The temptation game

Banks lure buyers with attractive repo rate-linked home loans

Image: Shutterstock [br]

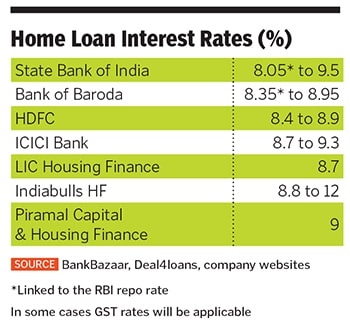

Banks are locked in a battle to offer attractive home loan rates to a sector plagued by slugging demand. In June, the State Bank of India said it was linking its home loan interest rate to the Reserve Bank of India’s (RBI) repo rate, offering a unique product at a tempting rate of 8.05 percent. Its rival, Bank of Baroda, in August launched a similarly structured product, starting at 8.35 percent.“Home loans linked to repo rates will have faster transmission of reduction in repo rates than the MCLR (marginal cost of funds based lending rate)-based ones. Repo rate-linked home loans will ensure higher transparency,” says Naveen Kukreja, CEO and co-founder of fintech firm PaisaBazaar.com.

“It’s a no-brainer, considering that the chances for further rate cuts are high,” says investment advisor Harsh Roongta on why the repo-linked loan is a better option. More banks are expected to announce similar products, but experts say some may have been arm-twisted by the RBI.For repo rate-linked products, the same can work against borrowers. “Home loans linked to them will witness swifter increase in their rates in case of policy rate increases by the RBI. Hence, borrowers should opt for loans linked to repo rates only if they are comfortable with frequent changes,” says Kukreja.

Anuj Puri, chairman of Anarock Property Consultants, says: “It’s attractive and will help improve the sentiment for the property market.”

First Published: Aug 26, 2019, 11:30

Subscribe Now