Jitu Virwani: The workspace meister

In the last two decades, Jitu Virwani has emerged as India's largest premier office space landlord. The Bengaluru-based billionaire now plans to expand his presence in the residential space, and enter

On Bengaluru’s eastern flank, not far from the old Hindustan Aeronautics Limited airport, stands Jitu Virwani’s finest creation. Spread across 60 acres, Embassy GolfLinks business park provides 4.5 million square feet of office space for over 45,000 employees. Its tenants include the who’s who of Indian and global corporations—the likes of Tata Consultancy Services, Cognizant, Target, Cisco, Goldman Sachs, Rolls-Royce. The complex comes equipped with food plazas, ample parking slots and, most important to clients, power back-up. Last year, it added a Hilton hotel that allows visiting managers to stay close to their offices. There are even plans to open a crèche for working mothers.

Running such a large office park can be a bit of a logistical nightmare. Getting it right is both an art and a science. Over the last decade and a half, it is this art and science that Virwani, 50, chairman and managing director of the Embassy Group, has worked hard at perfecting. The result: “Most of our tenants have done multiple deals with us and we’ve emerged as one of their preferred partners,” says Mike Holland, CEO of Embassy Office Parks.

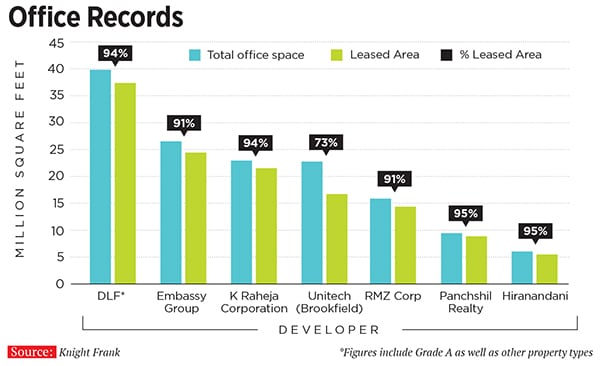

Having started as a small developer in Bengaluru in the 1980s, Virwani has, in the last two decades, built the largest stock of premier (Grade A, representing the highest quality of buildings) office space in the country—24 million square feet. (DLF, with 37 million square feet, has the most office space overall. With 3-4 million sq ft projected to be constructed by Embassy annually, it is expected to narrow down the lead substantially.) Other parts of the group include a residential portfolio that caters to premium customers, a services company that provides housekeeping and maintenance services, a fledgling hotel arm as well as plans to enter industrial parks and warehousing.

Virwani’s journey is a textbook case study in how to systematically build a business step by step. He eschews leverage. “Unless leverage is backed by an identifiable cash flow, I am not comfortable with it,” he says. In an email interview, Tuhin Parikh, a senior managing director at Blackstone, who looks after the firm’s real estate operations in India, lauds Virwani’s understanding of risk. “He understands risk well and knows how much risk he should be taking,” says Parikh.

As the business has grown, Virwani, who is a regular on the Forbes India Rich List and was ranked 68 in 2015 with $1.6 billion in wealth, has delegated effortlessly while still remaining accessible to his customers. In the last three years, he has hired heads for each of the key verticals (offices, residential, services, industrial parks) and given them complete freedom in day-to-day operations. By his own admission, much of his own time is spent on focusing on larger trends and maintaining relationships with all his stakeholders—tenants, land partners and financiers. It’s been his formula for winning repeat business.

Most significantly, Virwani’s is also the story of a smart entrepreneur who, spurred by the increase in offshoring and outsourcing by western corporations, spotted an opportunity in office parks and has methodically worked to cash in on it. “I’m so bullish about the demand for office space in the next ten years that I see us adding another 3-4 million sq ft a year,” he says.

“Virwani is a prolific dealmaker and is able to see inherent patterns in businesses, which enables him to see value where others can’t, thereby giving him the first mover advantage,” says Parikh.

While the residential market in India has had to contend with oversupply and declining prices, office developers are seeing buoyant demand. The stagnating rentals of the post-Lehman era are a thing of the past and the last six months have seen rentals edge up even as supply remains restrained. With an average of 34 million sq ft leased every year, the market is on track to soak in at least another 300-odd million sq ft in the next 10 years. In addition, office space is a rental yielding asset—yields are at 8-9 percent compared to residential yields of 2 percent—which makes holding such properties for the rental returns alone a viable proposition. This has resulted in developers like Embassy building large office parks and reaping the benefits of steady income while peers in the pure residential play struggle for survival.In addition to Embassy’s dominance in the office space market, it is also making moves in the residential and warehousing space, which will prop it as among the country’s largest real estate companies.

The year 1993 is not one that Virwani can forget in a hurry. The then 28-year-old was a bystander to a dispute between his father, Mohan Virwani, and his partner, who ran a real estate business together, called Embassy, in Bengaluru. As a fallout, his father had decided to stop developing more properties. A distressed Virwani, who had intended to join the family business, recalls telling his father that his partner had other businesses to fall back on. “We had only real estate as our bread and butter.” To his surprise, his father bought his argument: He agreed to let Virwani continue developing using the Embassy brand name but without any financial backing from the family.

The re-energised Virwani set out and bought his first land parcel from Anandbhai, a Gujarati landowner, on Infantry Road—now a bustling street but then a place where auto rickshaws would refuse to go—and started developing his first office block, Embassy Point. As luck would have it, he sold one floor to Kirloskar Oil Engines, then run by Vikram Kirloskar. At Rs 825 per square feet, Vikram liked the price but needed approval from his grandfather Vijay Kirloskar, who sat in Pune. After a meeting in Pune, Virwani sold another two floors to Kirloskar Pneumatic. Even before he had completed the project, Virwani had made money and also started an association with Vikram Kirloskar, one that would traverse the next two decades.

It was what Virwani did next that distinguished him from his peers and showed that he was not about to operate his real estate business the way it was traditionally done in the country. After having received money from Kirloskar for the office space, he could have easily paid Anandbhai. Instead, Virwani chose to take him along and renegotiated the deal to share half the built-up area with him. A sceptical Anandbhai initially refused, thinking that Virwani would be unable to sell the office space. “At that moment, I told him I had already sold two floors and we became partners,” he says. This freed up Rs 2 crore for Virwani to invest in his next venture. This move was unlike the norm at the time, when the association between the developer and landowner was more transactional—buy-sell.

And that was to become Virwani’s operating style over the next two decades. His modus operandi was simple. Take capital from investors, develop property, share the proceeds and move to the next thing. The 1990s saw him develop several office buildings in Bengaluru and nurture his initial relationships with clients.

By the end of the decade, two trends spurred Virwani on to take his big bet on office parks. First, he noticed companies were taking tentative steps towards expanding the scope of their operations by significantly increasing their staff strength. For instance, Microsoft went from 1,000 to 5,000 employees in a year. This dramatically increased the amount of office space they would need. At 100 square feet per employee, it amounted to 500,000 sq ft of office space. Until then, few companies had gone higher than 100,000 sq ft at one go.

Second, Virwani realised that once the ‘floorplate’, or the area of the floor, increased from say 10,000 sq ft to 100,000 sq ft, it dramatically increased the efficiency of seating employees. Both these factors resulted in companies upping their office requirements.

In the early 2000s, a key confirmation of Virwani’s belief came from large Indian IT companies that were setting up their own office parks for work outsourced initially from the US and later western Europe. Insulated from the hustle and bustle of Bengaluru, they offered landscaped surroundings for their employees to work in. They came equipped with round-the-clock power supply and employees had the option of eating in food plazas and going to the campus gymnasium or yoga classes.

The last mix in the cocktail was the emergence of western companies using India as an offshoring base. Among the most prominent examples of this is Accenture, which employs 150,000 people in India and has a global headcount of 373,000. Other examples include Microsoft, Fidelity Investments and Swiss Re. But global policies prevented them from purchasing office space in India. They had no option but to lease. If Embassy had to cater to this, they’d have to add an office park to their offering.

The growth in demand from global companies also led to the emergence of what is referred to in the industry as Grade A office space. These are buildings that are leased out, have one owner and one property manager—which can be the same, like in the case of Embassy that uses a group company for managing the parks. Tenants have all their maintenance needs taken care of. They simply move in and start work. This clearly is not a business where the developer can sell and disappear. It owns the asset and is responsible for its upkeep. It is also not a play many developers have proved themselves adept at. They’d rather construct and sell.

This game has, over the last decade and a half, separated the men from the boys. It has led to the emergence of half-a-dozen companies—Embassy, DLF, GIC, Brookfield, RMZ, Prestige, DivyaSree—that have large portfolios and are keen on growing them. Together, they would make up 60 percent of the 200 million sq ft of Grade A office space in India.

The last two years have seen a veritable boom in this market. Indian annual leasing averages about 34 million sq ft, according to Colliers International. Foreign clients, who make up 70 percent of the demand for Grade A office space in the country, have been expanding their physical presence meanwhile, Indian clients who prefer a mix of leasing and owning office space have been slowing down on increasing their staffing numbers. “The demand for the office market that we play in is directly related to the health of the US economy,” says a leading office parks developer on condition of anonymity.

It was this trend that Virwani caught on to early and capitalised on. In 2002, he set up Embassy GolfLinks in partnership with KJ George, who is currently the minister for all subjects pertaining to Bengaluru city. The site started as a 5-acre project, with ANZ Infotech signing on for 41,187 sq ft at a monthly rental of Rs 25 per sq ft. It was at the bhoomi pujan (ground-breaking ceremony), when IBM signed on for 700,000 sq ft, that Virwani got further validation of his analysis that the office market would explode. He quickly bought more land and gradually Embassy GolfLinks became a 60-acre, 4.5 million sq ft facility.

He also found a willing backer in HDFC. Virwani was stunned by the speed with which chairman Deepak Parekh approved a Rs 40 crore loan. Parekh had been briefed by his Bengaluru head RVS Rao that Virwani was an upcoming developer who must be supported. A quick meeting in Mumbai was all it took for the loan to get approved. Parekh also told his team that the project must not suffer for lack of funds. His relationship with HDFC has continued till this day. Virwani says that whenever he’s gone to other banks, HDFC has stepped in and upped his credit limits.

Virwani’s skill in forming partnerships was to also help him in managing tenants. He goes the extra mile to accommodate their requests. He’s even set up a separate company, unlike other developers who usually outsource them. Embassy Services, headed by Pradeep Lala, takes care of all their needs inside Embassy’s parks—from housekeeping to maintenance to organising buses to running crèches. It is now an independent Rs 500-crore company that provides these services to other developers as well.

A significant problem that clients faced was accommodation for their visiting employees. Virwani set up Embassy Hospitality to take care of this. “We plan to set up a hotel in each of our properties that will be open to both park tenants as well as the public,” says Sartaj S Singh, president, Embassy Hospitality.

Over the last five years, Virwani has moved to cement his position in the Bengaluru market. Through Embassy GolfLinks, Manyata Tech Park and Embassy TechVillage, they offer 20 million sq ft in the city alone, apart from Tech Zone in Pune. “We have clients coming to us directly for their needs without going through property consultants,” says Holland.

As a result, the company, after many years, has been able to push its rentals up. Average rentals have moved up by a third from Rs 54 to Rs 67 per sq ft per month in the last year, according to Holland, who is confident that supply will not exceed demand significantly over the next couple of years. Reason: Experts say the existing rentals do not justify the construction of significant amount of office stock in the foreseeable future. Office space is also taking longer to construct. Earlier, it was possible to have a building up in 12 months, says Virwani, but since the implementation of the Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA, which guarantees hundred days of wage employment in a year to rural households), labour is harder to get and so buildings can take up to 24 months to construct and fit out.

Therefore, with developers staying restrained on construction, there is little danger of a glut, unlike in the residential space, which, interestingly, is a direction where Embassy is also now headed.

With his leadership position in the Bengaluru office market unchallenged, Virwani, in 2012, decided to get back to the residential space. In the late 1990s and early 2000s, Embassy had constructed a few residential buildings in Bengaluru. When they restarted work, “we took a conscious decision to stick to the premium housing space”, says Reeza Sebastian Karimpanal, vice-president, residential sales and marketing at Embassy. Embassy’s new foray, spread across six projects in Bengaluru and Chennai, retails at an average ticket size of Rs 2 crore. Most of these apartments will be delivered in 2016. Among the projects in progress is Embassy One, an ambitious mixed-use development, which will feature a Four Seasons Hotel as well as apartments serviced by the hotel chain, apart from office and commercial space.

In May, Virwani will make another big bet by launching Embassy Springs, a 300-acre township in north Bengaluru. This is land Virwani had acquired for Rs 200 crore in the late 1990s. He then spent 10 years between 2005 and 2015 acquiring parcels in the area, where the landowners had initially held out, to finally reach 300 acres. “Sometimes I wish I could get five years of my youth back. Acquiring these large land parcels is just not possible anymore,” rues Virwani.

He’s confident of selling both these plots and the apartments on this land even in a sluggish market. And when he is done with this, he still nurses a desire to launch apartments in the Rs 50-60 lakh price bracket. “The buyer [in this price range] is getting shortchanged. I think we can give a much better product in this price bracket,” he says.

You would think Virwani has his plate full, but then you would have to think again. The self-confessed workaholic’s appetite is never satiated.

Next up, Virwani is confident of a REIT (Real Estate Investment Trust) listing that will allow a broader set of investors to come into the company. The context for this venture lies in his association with Blackstone. Virwani believes the recent clarifications on issues such as withholding tax are sufficient to make investors list REITs.

In 2012, Virwani stitched up a 50-50 joint venture with Blackstone to form Embassy Office Parks. He had been talking with Parikh for many years without any deal materialising. In 2010, they did put together a residential project but it was in 2012 that the big Embassy office parks deal took place that took care of a lot of the company’s financing needs. At present, the existing Rs 1,000 crore received from their four parks as rentals (shared by Embassy and Blackstone) is more than enough to take care of interest costs. Virwani is confident of the privately held Embassy being able to fulfill its funding requirements to expand office space.

A sneak peak into the next stage of Embassy’s growth can be found in a new industrial park venture that the company recently incubated in partnership with Warburg Pincus. “Just as with office parks ten years ago, there is a shortage of Grade A warehousing and industrial parks in India. We plan to change that,” says Anshul Singhal, chief executive of Embassy Industrial Parks.

Embassy has acquired 52 acres in Pune and 198 acres at Sriperumbudur near Chennai for two industrial parks that will come equipped with basic infrastructure and links to ports and airports. Companies will set up factories for their manufacturing needs. About 60 percent of the space will be reserved for warehouses. Plans are afoot to acquire more land parcels near Delhi at the start of the Delhi Mumbai Industrial Corridor. Expect this to be a billion-dollar business a decade from now.

Still a young 50, Virwani is already looking to the next generation to take over. Son Karan (24) is his executive assistant who shadows his father, while second son Aditya (21) is expected to join the business soon. Virwani has taken on an active role to mentor them. “I didn’t have my father to mentor me but I make sure I do that with Karan,” he says. Though it is hard to imagine Virwani taking a backseat, he does insist that he could step back in the next 4-5 years.

In that event, ever focussed on relationships, he’s concerned about what he’ll do with his team that has been there for the last 20 years with him. “Maybe I’ll take them with me and start something new,” he says. That could well be an adventure to watch out for.

First Published: May 09, 2016, 06:39

Subscribe Now