Should bleeding startups sponsor the IPL?

Two-thirds of the companies sponsoring the IPL this year are startups. Does it make economic sense for a bleeding business to do so?

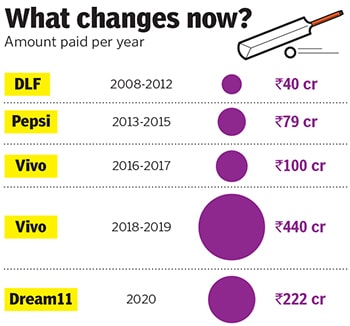

Gaming unicorn Dream11 swooped in on the title sponsorship of the Indian Premier League (IPL) for a bargain ₹222 crore, half of what Chinese smartphone maker Vivo paid in 2019. Four of the six major sponsors for the tournament this year are startups

Gaming unicorn Dream11 swooped in on the title sponsorship of the Indian Premier League (IPL) for a bargain ₹222 crore, half of what Chinese smartphone maker Vivo paid in 2019. Four of the six major sponsors for the tournament this year are startups

Image: BCCI/ IPL[br]After unleashing his fifth consecutive six of the over, Rahul Tewatia walked down the middle of the crease and fist-pumped his teammate. As the uncannily composed Rajasthan Royals batsman chatted with the non-striker, the cameras closed in on him. His shiny pink and blue jersey didn’t just have the number seven printed on the back, but also the word “Niine”.

That an obscurely known Kanpur-based sanitary napkin brand should be “principal sponsor” of the Rajasthan Royals franchise in what is cricket’s most glitzy tournament—the Indian Premier League (IPL)—became a talking point. Not just because the two-year-old Niine occupied prominent space on the jersey, more so than biggies like Reliance Jio and cable company KEI—also principal sponsors of the team—but because a female hygiene product was being endorsed by male players. “We wanted to break the shame and stereotypes around periods by showcasing our brand on a man’s platform,” says Sharat Khemka, founder and CEO of Niine.

Early results on the bet have been encouraging. Distributors across India and Rajasthan, in particular, are eager to stock Niine’s products. Says Krishna Sharma, a sales manager, “Earlier I would have to work hard to convince distributors to buy stock worth ₹3 lakh and they would refuse, saying nobody will buy a local brand. Now those same distributors have approached me and are willing to invest up to ₹40 lakh to get our products.” Adds Khemka, “We would never get this kind of traction on any other platform. The IPL is one of its kind.” And this edition, in particular, is more so. Despite shifting to the United Arab Emirates this year because of India’s growing Covid-19 caseload and empty stadiums, the tournament has been off to a blistering start.

The opening week of the IPL, starting September 19, was watched by 269 million viewers, 11 million more per match compared to the corresponding period of last year"s edition, according to the Broadcast Audience Research Council India.

This year’s IPL is also unusual because four of the six major sponsors are startups. Gaming unicorn Dream11 swooped in on the title sponsorship for a bargain ₹222 crore—half of what Vivo paid in 2019—after the Chinese smartphone maker suspended its five-year deal which was to end in 2022 due to the border tensions between India and China in August. Edtech unicorn Unacademy and credit card payments company Cred signed up as “official partners”, shelling out ₹130 crore each for a three-year association. Paytm is the fourth major sponsor from the digital world while the other two in the central sponsorship pool include Tata Motors Altroz and Ceat Tyres.Aside from these six companies, more than 120 others are sponsoring the various franchise teams this year. Sixty-five percent of them are from the startup world, says Bhairav Shanth, co-founder and managing director of ITW Global, a consultancy that struck more than 16 deals, including that of Unacademy and Cred. The balance are traditional companies spanning the FMCG, auto, cola, finance and electronics space. “There’s a clear paradigm shift from previous years in terms of the kind of brands this year’s IPL has attracted,” adds Shanth.

It’s easy to assume that the reduced rates are responsible for the shift going by the Dream11 deal. But, in fact, that’s not the case. “There’s a misconception in the market. There were no distressed deals. The sponsorship rates this year are on par with those that were signed in earlier years. Startups have paid top dollar to associate with the IPL,” says Shanth. Even the Dream11 deal, he says, was a “market correction” from the high-stakes Vivo rates.

“Two years ago, Ceat and Paytm paid ₹100 to ₹110 crore [each for three years] for their IPL association. Unacademy and Cred–the official partners signed on this year—paid ₹130 crore for a three-year contract,” says Shanth. Even franchise sponsorship rates are on par with last year, give or take a 10 percent fluctuation, he says.

So if not the prices what has led so many startups to see value in IPL 2020? For one, a lack of other opportunities, says Satish Kannan, co-founder and CEO of MediBuddy-DocsApp—a five-year-old startup that is making health care accessible to all through video-based doctor consultations—that is the “digital health care partner” to the Royal Challengers Bangalore (RCB) team. “These are tough times for patients given the pandemic and in tough times you have to create more awareness. We were looking for large-scale media opportunities to do so but there were none. The IPL is the first in several months,” he says. The Bengaluru-based platform currently assists about 25,000 patients daily through the IPL, Kannan hopes to reach several more, especially in small towns.

Second, the absence of packed stadiums and cheering crowds don’t make much of a difference to startups where the product or delivery is online. Take, for instance, e-sports and mobile gaming platform Mobile Premier League (MPL), which signed on as principal sponsor of the Kolkata Knight Riders (KKR) and RCB. “While a match is going on, the chances of you downloading the app and playing a game are greater. Just like one’s chances of buying insurance before getting on to a flight are 95 percent. After the flight, it’s unlikely you will buy insurance. So a gaming app has a direct benefit from an IPL association,” says brand expert N Chandramoulli. Sure enough, in just 10 days since the start of the IPL, MPL says it has added three million new users despite being out of the Playstore.Other digital-first startups like Trell, a Sequoia-funded app that lets users create and share three-minute videos and is “digital sponsor” to CSK, have seen a spike in users and engagement. “Time spent on the platform has gone up by 25 percent to 40 minutes per session since the start of the IPL and downloads, too, are up 2x,” says Pulkit Agrawal, co-founder and CEO. As the IPL neared, he noticed users were creating and sharing cricketing videos. “So it made sense to associate with the IPL and get our users closer to the cricketers and vice versa,” he says. Besides, this will probably be CSK captain MS Dhoni’s last series since announcing his retirement from international cricket. “We wanted to help our users show him their love and gratitude for all that he has done,” says Agrawal on the reason for backing CSK. As part of the deal, CSK players connect with popular creators on Trell and also share behind-the-scenes videos on practice sessions, locker-room chatter and other fun clips. Customer acquisition costs have gone down by almost 50 percent since before the IPL, says Agrawal, adding that the platform currently has 25 million monthly active users. Cred too, which rewards users for timely credit card bill payments, aims to reach out to the "masses" by focusing “on digital throughout this campaign, by creating engagements beyond the usual that audiences can access while watching the matches on their phone,” says Trupthi Shetty, lead, growth and engagement, Cred. One such activity includes ‘Cred Power Play’ where those who pay their bills on time using Cred can win cash back offers as well as a chance to be on television during a live IPL match.

Even so does it make economic sense for loss-making startups to splurge on the IPL? “If you ask an economics professor, he’ll say it makes absolutely no sense. But if you ask a digital marketing professor, he’ll say it makes absolute sense,” says Prateek Shah, founder of e-learning platform Digital Defynd. Startups have access to funds from investors and they often push them to spend on such properties besides, he says, “this is not an act to increase the bottom line”. Instead, startups view the return on investment (ROI) differently from how a traditional cola, auto or FMCG sponsor would. If startups are able to gain users, increase downloads and boost their valuation, they would have got their monies worth. Moreover, metrics like number of users, downloads and traffic can be measured on a minute-by-minute basis, unlike traditional companies where results can take a quarter or more to show up. “For startups it’s more about return of mindshare on investment,” says Shah.

OkCredit, for example, an app that allows SMEs to digitally record and keep track of the loans they make to customers, has partnered with the Delhi Capitals (DC) as principal sponsor. “We’ve spent a significant portion of our marketing budget on this,” concedes Harsh Pokharna, co-founder and CEO of the Tiger Global- and Lightspeed Ventures-funded app. They’re measuring ROI in terms of the number of organic queries the platform gets as well as the re-engagement rates [people who are on the platform but not actively using it, coming on board again]. To enable this, OkCredit launched a campaign called Taiyaar Hai Hum featuring players from the DC team showing their gratitude to small business owners for their work through the pandemic.

OkCredit claims to have 15 to 20 million small merchants on the platform prior to the pandemic, but when the lockdown was announced, they saw a dip in users because shops were forced stay shut. Even when they were allowed to reopen, merchants didn’t give credit to customers with “as loose a hand”, says Pokharna, “but since the IPL started, we’re back to our former levels.” Customer acquisition costs are also down by almost 50 percent in some states. Similarly, digital ledger app Khatabook, associate sponsor for IPL streaming platform Disney+ Hotstar, is looking at ROI in terms of new acquisitions, and increase in engagement and retention, says Ravish Naresh, co-founder and CEO. “We’re an extremely ROI-driven organisation. We measure each and every penny and double down on the opportunities we have.”

Abhishek Madhavan, senior vice president, growth and marketing, MPL, says, “We have a clear path to monetisation, a large paying user base with best-in-class retention numbers and have grown 4x over the last six to eight months to get to a billion dollars in GMV (gross merchandise value), so associating with the IPL makes a lot of sense for us.” For them, ROI equates to increasing brand awareness and as a result of that, onboard more users. They’re currently at 60 million users and want to cross 80 million by the end of the IPL. Interestingly, MPL recently raised $90 million in Series-C funding led by Singapore-based SIG Global, tripling its valuation to $450 million. It’s unclear, however, whether MPL’s IPL association has anything to do with the fund raise.

The challenge, however, will be to retain the users these startups capture through the IPL. As they go about working on that, several startups are already in talks with the BCCI for sponsoring the 2021 and 2022 editions of the 20-20 league. Like Rajasthan Royals batsman Tewatia, India’s startups are also hitting big.

First Published: Oct 06, 2020, 17:30

Subscribe Now