Uniphore: Building deep-tech conversational AI for the world

Uniphore has the vision of becoming the horizontal AI layer running across every organisation and every single conversation, including—not in the too distant future—in-person conversations

When one of Uniphore’s conversational artificial intelligence (AI) products for contact centres was recently deployed at a large US customer for 18,000 concurrent users, it was a big win for founders Umesh Sachdev and Ravi Saraogi, validating 14 years of perseverance in building a deep software engineering-based company that started in India.

They could not name the customer, but “to the best of our knowledge, we believe it is one of the largest real-time conversational AI deployments," says Sachdev, CEO.

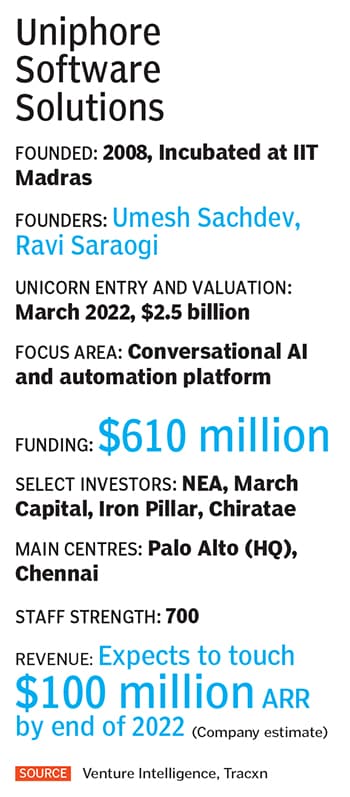

In February, Uniphore announced it had secured $400 million in series E funding, the company’s largest private investment round so far, bringing its total funding to $610 million—a long way from when investor after investor had turned them down in the early years of the company. Uniphore is now privately valued at $2.5 billion.

The money will also help Uniphore expand into adjacent AI opportunities, beyond the call centre solutions it is known for. And it has already made a few acquisitions, as it seeks to both widen and deepen its presence in voice AI, computer vision and tonal emotion.

“We believe that conversations are the key currency of any enterprise," says Sachdev. In the hybrid workplace that is emerging, these conversations are happening on multiple digital channels, even as, slowly, in-person meetings return.

But no matter how people meet, “quite simply, the big overarching vision is that we want to be that horizontal AI layer that’s running across every single conversation," says Sachdev. Not only contact centre agents, but salespersons talking to potential customers, or recruiters talking to potential candidates against job vacancies or finance executives, “we want to just turbo charge those conversations by helping them gain more insights, get real-time help in every single situation," he says.

Including, in the not too distant future, in-person conversations.

Over the last 12 months, Uniphore has been consolidating its products under its Uniphore X platform, a unified conversational AI and automation platform that combines speech recognition in over 100 languages, natural language processing, robotic process automation, voice biometrics, emotion AI, and computer vision and so on, with the kind of workflow automation that enterprises would need.

Uniphore’s established family of products are now folded into this platform and new ones will be added. The established ones include U-Self Serve, a chat or voice bot U-Assist, which customers such as telecom companies, banks, insurance companies or BPOs can use as a tool to give real time coaching and assistance to their contact centre agents U-Analyze, an analytics product, and U-Trust, a security related product. A newer addition is Q for Sales (from emotional quotient), which combines voice AI, tonal emotion and facial expression to help sales organisations and sellers who meet their customers online.

Uniphore’s established family of products are now folded into this platform and new ones will be added. The established ones include U-Self Serve, a chat or voice bot U-Assist, which customers such as telecom companies, banks, insurance companies or BPOs can use as a tool to give real time coaching and assistance to their contact centre agents U-Analyze, an analytics product, and U-Trust, a security related product. A newer addition is Q for Sales (from emotional quotient), which combines voice AI, tonal emotion and facial expression to help sales organisations and sellers who meet their customers online.

Today, including the US, Europe and Asia Pacific, Uniphore is present in about 17 countries. The company has about 700 employees serving large enterprise customers in telecom, financial services, health care, insurance and BPO. Among its customers are DHL, Arise and NTT Data in the BPO segment, Priceline, which is in ecommerce and India’s Tech Mahindra and Genpact.

In Asia, Uniphore works with FE Credit, TransUnion, and Accenture. Overall, Uniphore works with the who’s who of the global 500 companies, Sachdev says.

On a monthly basis, its AI platform is listening to more than 100 million interactions in real-time or offline, making it a hugely data-rich company.

The company recently helped a telecom service provider in North America save close to $40 million a year through some of the automations its products are capable of. Uniphore can also help enterprises increase their sales and revenue because of the real-time insights or analytics it can provide on how they can pitch or meet their customers in a better manner.

A third type of outcome is to improve customer satisfactions scores, customer experience and the employee experience. Contact centre staff have a better time doing their job and customers who call these lines get a better experience

In the case of the 18,000-seat deployment that this story started with, the preparation included working directly with major chip manufacturers who produce GPUs (graphical processing units) to make small adjustment to that GPU architecture, and make Uniphore’s AI and speech recognition software run more efficiently.

The idea was to ensure that the company would be able to sell this technology at an attractive price. And, “we have reached an efficiency where we can run thousands of concurrent users on a single GPU and we are the first in the world with this architecture, but we hope there’ll be several who will follow this reference point and come after us," says Sachdev.

Overall, Uniphore is beginning to demonstrate that its technologies can be deployed reliably at very large enterprises, he says.

To both add technologies it needs and expand its global talent footprint, Uniphore has begun to make acquisitions. In January 2021, the company announced that it had acquired Emotion Research Lab, a software developer that used AI and machine learning to identify emotion and engagement levels in real-time over video-based interactions.

To both add technologies it needs and expand its global talent footprint, Uniphore has begun to make acquisitions. In January 2021, the company announced that it had acquired Emotion Research Lab, a software developer that used AI and machine learning to identify emotion and engagement levels in real-time over video-based interactions.

This became a critical part of the Q for Sales product.

In October 2021, Uniphore completed the acquisition of Jacada, a no-code and low-code software specialist. In April this year, the company announced it had acquired Colabo, which specialised in extracting and using information from structured and unstructured documents in real time, using AI.

These acquisitions—and the ones that Uniphore will make in the coming days—will play their role in taking the company to its next big milestones. And Sachdev and Saraogi definitely have the billion-dollar revenue target on their mind.

Today, Uniphore is not too far from the $100 million in annual recurring revenue, and the founders expect to hit that rate by the end of this year.

The unicorn status was validation of the company’s hard work over the last 14 years—and to some extent it also showed them in favourable light with customers—but a billion dollars in revenue is the real deal, they say.

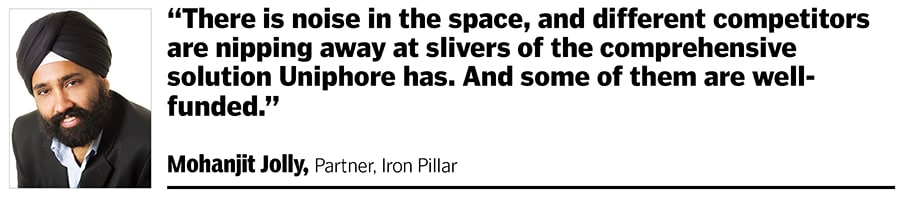

Now, with the company expanding its products beyond the customers service segment into enterprise intelligence, the opportunity is definitely there, says Mohanjit Jolly, a partner at Iron Pillar, a private equity company that invested in Uniphore, starting in 2019.

On the other hand, “we would be naive to think that we are the only ones. The flip side is that there is noise in the space, and different competitors are nipping away at slivers of the comprehensive solution Uniphore has. And some of them are well-funded," says Jolly.

“At Uniphore, they were very early to recognise the importance of conversational resources," says Dan Miller, founder and lead analyst at Opus Research. They grew out of speech analytics, which is the basic form of recognising that conversations between companies and their customers is an asset that applies to not just the contact centre, but delivers insights throughout a business organisation, he says.

Second, Uniphore also recognised—and coined something called ‘conversational services automation’—that their solutions could work to make both customer-facing tasks and an enterprise’s internal processes more efficient, Miller says.

Finally, the acquisitions they have made are filling gaps in areas that are forward-looking from the point of view of what will become increasingly important for Uniphore’s customers, he says.

The conversational AI market is so big that it won’t be a winner-takes-all scenario, says Sachdev. He expects a few ‘decacorns’ (companies privately valued at $10 billion or more), as well as a couple of leaders to emerge, who will take a large share of the market.

In the meantime, Uniphore is already preparing for an eventual initial public offering (IPO). While that may not be imminent, Sachdev is clear that he wants the company to function as though it were a public company. Uniphore has both added important members to its board of directors, as well as senior leadership as it moves toward this event.

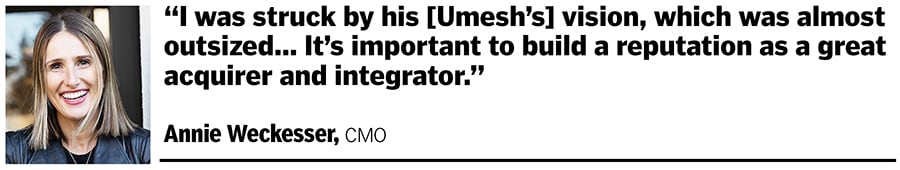

One of the first was chief marketing officer Annie Weckesser, in 2018, when Sachdev was just moving to the US. Weckesser had worked at Cisco Systems, and met Sachdev through John Chambers, who had invested in the company the previous year—the year Chambers had also stepped down as chairman of Cisco.

“I was struck by his [Umesh’s] vision, which was almost outsized," Weckesser says. She took Uniphore’s message to the US market, which up until then was better known in Asia.

Today, she also leads acquisitions and integration. And “it’s important to build a reputation as a great acquirer and integrator" of both technology and culture, she says.

The company recently appointed two former Google executives Balaji Raghavan and"¯Andrew Dahlkemper as chief technology officer and chief people officer, respectively, and Vinod Muthukrishnan, co-founder and CEO of technology startup CloudCherry, as senior vice president of developer platforms.

Other senior hires include chief revenue officer Ritesh Idnani, who joined from Tech Mahindra, Sylvain Tremblay and Curt Hill, both previously senior executives at Cisco, and Stephane Berthier, who was a partner at PwC before joining Uniphore as the chief financial officer. Moni Manor, the chief product officer, came from New Voice Media, which is part of Vonage, a cloud contact centre software company.

Dahlkemper, in addition to putting together processes needed to make sure that the company’s values don’t get lost as it becomes bigger, is also experimenting with technology in areas like diversity. A couple of months ago, his team started using an AI software to improve diversity in Uniphore’s recruitment.

With the company’s latest funding—which was led by New Enterprise Associates (NEA)—came the appointment of Hilarie Koplow-McAdams, a venture partner at the US-based VC firm, to Uniphore’s board. “Koplow-McAdams is a seasoned enterprise software and services executive who brings more than three decades of experience for both growth-stage and established companies," Uniphore said in the funding press release in February.

If the playbook sounds familiar, well, it is, now. Even five years ago, it probably wasn’t.

Sachdev and Saraogi founded Uniphore in 2008 and it was incubated at the Indian Institute of Technology Madras. They had to learn through multiple pivots—bootstrapping for several years, before a seed round in 2014 and series A in 2015—until they turned their business into a software-as-a-service (SaaS) operation, and eventually shifted base to the US to become a Silicon Valley-headquartered company.

Now, on the cusp of its next big phase of growth in the US, its most important market for a long time to come, Uniphore has also come full circle in some ways, with Saraogi leading its expansion in Asia. The company is adding engineering centres in Pune and Bengaluru.

“In hindsight, if the playbook was available, if I had a role model to follow, I would’ve loved to make the move to the US sooner than I did. That’s my learning. I don’t have any regrets, but I would say if I had the opportunity I would’ve done it sooner. I just did not," says Sachdev. “We had to prepare, we had to make our own moves, our own calls, we had to raise sufficient funding to be able to start investing in the US and it just took time."

First Published: May 13, 2022, 14:27

Subscribe Now