Why sovereign funds are lapping up tech IPOs

During 2021, three sovereign wealth funds—GIC, CPPIB and ADIA—made it to the top ten anchor investor list in India, a reflection of trends like internet penetration, the increasing size of IPOs and th

Presence of anchor investors—institutional investors who are allotted shares of a company just before the opening of the initial public offering (IPO) to the public—is a reflection of the large fund’s confidence in the company, like the anchoring of a ship

Presence of anchor investors—institutional investors who are allotted shares of a company just before the opening of the initial public offering (IPO) to the public—is a reflection of the large fund’s confidence in the company, like the anchoring of a ship

Image: Shutterstock

Anchor investors are walking on two different paths when it comes to investing in new age startup companies in India.

The presence of anchor investors—institutional investors who are allotted shares of a company just before the opening of the initial public offering (IPO) to the public—is a reflection of the large fund’s confidence in the company, like the anchoring of a ship. During 2021, sovereign wealth funds, global funds and domestic mutual funds deployed heavily in anchor books, especially of startup or tech stocks. But currently startup stocks are under tremendous pressure as most of them are trading either below or close to their listing prices (see chart) which has put domestic mutual funds on shaky ground as they have started selling down their exposure in some of these companies. Sovereigns, however, are sitting tight, for now.

Take the case of Paytm. During the largest initial public offering of 2021, payments firm Paytm (One97 Communications Ltd) raised Rs 8,235 crore from anchor investors as part of its initial public offering of Rs 18,300 crore. It was, of course, one of the largest capital market listings in India since Coal India Ltd. The anchor book was majorly led by global funds which include sovereign wealth and pension funds like Government of Singapore’s GIC, Canada Pension Plan Investment Board (CPPIB), Abu Dhabi Investment Authority (ADIA) and Pension Fund Association (a public pension located in Tokyo) among others. To be fair, Paytm had 122 anchor investors, but CPPIB alone cornered 11.4 percent of the anchor book with an allocation of Rs 937.83 crore. Government of Singapore acquired shares worth Rs 435.32 crore. In all this brouhaha, domestic mutual fund houses collectively bought in Rs 1,050 crore or nearly 12.75 percent stake in the company.

But what has transpired since November 18, when the company listed on the bourses with a discount of 9 percent, is a different story altogether. Paytm offered its share to investors in a price band of Rs 2,080-2,150 apiece and listed at Rs 1,950 per share. After one month, when the lock-in period for anchor investors was over, the share came under heavy pressure and on December 15, as 539887 shares changed hands, the share fell 13 percent (during intraday) though it recouped its losses by the end of the day and closed at Rs 1,380.05 per share.

A report on January 17 by Outlook India quotes HDFC Mutual Fund’s monthly portfolio data for end of December 2021. A look at the investor book shows that four HDFC MF funds had collectively invested Rs 150.06 crore. HDFC Mid Cap Opportunities Fund had invested Rs 65.31 crore in Paytm as part of the anchor book and have sold off their complete exposure. HDFC Balanced Advantage Fund, which had invested Rs 39.61 crore, has offloaded 91 percent stake in the firm. The other two strategies continue to hold their investment. The stock has seen excessive volume since January 5. Other mutual funds that hold the stock include nine strategies of Aditya Birla Sunlife and four strategies of Mirae Asset. There is no data available on block or large deals and one will have to wait for other mutual funds to disclose their exposure data over the coming month.

A report by Edelweiss Alternate Research (EAR) released on December 7, 2021 states that in CY21 (until December 7) 51 companies went public with 41 issuances’ anchor selling dates behind them and as many as 76 percent of those issuances experienced selling pressure on the anchor lock-in opening dates. The average decline value of these stocks has been 2.6 percent. Abhilash Paghariya, author of the report and head of EAR wrote that as many as 61 percent (25 out of 41, this does not include Paytm as it was unlocked on December 15) of the issues declined by 2.2 percent on the day after the anchor opening date and 61 percent of the issues traded down by 3.9 percent after five days of the anchor opening date. Which effectively means 10 out of 13 such newly-listed stocks have closed in the red with an average decline of 3 percent (on anchor opening date) wherein anchor allocations were above 10 percent of outstanding shares.

In the tech listed space, Easy Trip Planners was down 9.7 percent on the anchor lock-in opening date, Zomato was down 8.7 percent while CarTrade’s was impacted five days post lock-in when it fell by 7.7 percent. Nazara Tech continued to trade in the positive range.

The commotion also led to the markets regulator Securities and Exchange Board of India (Sebi) to come up with new regulations on December 28 regarding the lock-in period of anchor investors. Sebi has notified that the existing lock-in of 30 days shall continue for 50 percent of the portion allocated to the anchor investor and for the remaining portion, a lock-in of 90 days from the date of allotment shall be applicable for all the issues opening after April 1, 2022.

As on January 20, Paytm’s share closed at Rs 994.85 apiece on the Bombay Stock Exchange, which means foreign investors who had participated in the anchor book have lost 49 percent of their investment value when compared to its listing price, and 54 percent to its issue price. Post the upcoming quarter results it would be clear if foreign, especially sovereign shareholders, have sold any stake.

But Paytm isn’t the only buy that these sovereign funds have made.

Online marketplace for beauty and fashion Nykaa, which went public and raised Rs 5,349.72 crore from capital markets, managed to garner Rs 2,396 crore through anchor allocation. The anchor book was lapped up by sovereign funds like ADIA, Caisse de dépà´t et placement du Québec (CDPQ), CPPIB, Government of Singapore, Government Pension Fund Global and Monetary Authority of Singapore among others.

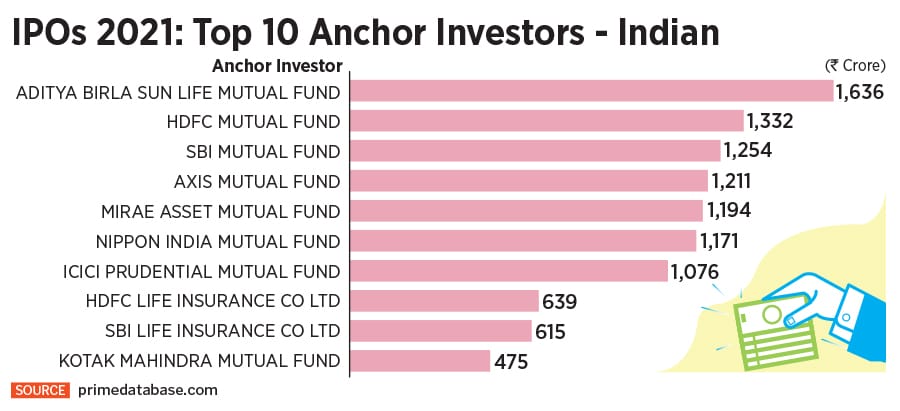

Eight tech-enabled company IPOs launched during 2021 and almost all of them managed to raise capital from different sovereign funds. According to data compiled by primedatabase.com for Forbes India, of the top 10 foreign anchor investors for CY2021 (including tech and non-tech IPOs), Government of Singapore tops the list with an investment of Rs 2,198 crore followed by Fidelity Group which deployed Rs 1,555 crore. The top 10 list consists of two other sovereign funds--CPPIB with investments of Rs 1,197 crore and ADIA with Rs 822 crore.

“Tech enabled IPOs appeal to sovereigns on their ability to provide non-linear returns on the back of macro trends such as internet penetration and adoption of various products which are fairly well understood and sovereigns are happy to back such stories which need a longer term view to pan out," says Mahesh Natarajan, senior vice president at ICICI Securities. The firm participated in 20 IPOs aggregating to Rs 64,256 crore in 2021 and is one of the largest domestic merchant banks. Natarajan explains that while sovereigns have varying return requirements net of forex impact, on the holding period front most of these sovereigns are looking at at least a 2-3 year horizon.

Sovereign Wealth Funds (SWFs) have always looked at India as one of the top destinations to play the emerging market story with a presence across private and public markets. Data compiled by Forbes India from EY data shows that GIC has been one of the top investors in India when it comes to private deals since 2015. GIC has deployed $1.56 billion in 2020, $2.46 billion in 2019 and $1.5 billion in 2018. Data indicates that ADIA actively started pumping private capital in India since 2018 when it deployed $680 million and in 2020 it deployed nearly $1.5 billion.

“One of the constraints used to be the size of the IPOs in India. With the average size of IPOs increasing and the portfolio weightage for India increasing for these sovereigns due to various geo-political factors, sovereigns have been aggressively deploying in India," Natarajan adds.

A thesis that CPPIB agrees with too. CPPIB has invested in Zomato, Nykaa, PolicyBazaar and Paytm.

“India is one of the key markets for us globally and a critical component of our goal to deploy up to one third of the fund in emerging markets by 2025. We have been investing in the country for over a decade and set up our Mumbai office in 2015," says Agus Tandiono, Asia Regional Head and Head of Fundamental Equities Asia, CPP Investments.

Tandiono adds, “We see domestic consumption, technology and the increasing demand for infrastructure to underpin many of the themes and opportunities for us in India."

With over $30 trillion in assets under management, some of the world’s largest sovereign wealth funds, government pension funds, central bank reserve funds, state-owned enterprises, and other sovereign capital-enabled entities have emerged to become the most influential capital markets players and have directed their capital towards startups and tech companies across the globe.

Sovereigns also have the benefit of having moved first on various other tech IPOs globally and benefit from those experiences in evaluating Indian tech IPOs in their ability to quickly grasp the potential of the story. Tiger Global, which usually invests in the private markets, participated in Zomato’s anchor book and invested Rs 162.46 crore.

“India is the third largest digital economy in the world after the US and China, so it’s natural for the sovereign funds and public pensions, who are hunting tech unicorns in the global markets, to actively invest in Indian tech companies at pre-IPO financings or IPO listings. These investors are long-term investors, and they are betting on the long-term growth of India’s mobile internet economy, similar to their active investments in the China market years ago to capture China’s mobile economy boom," says Winston Ma, managing partner of CloudTree Ventures and author of The Hunt for Tech Unicorns–How Sovereign Funds Are Reshaping Investment in the Digital Economy.

Ma, who was previously the managing director and head of North America for China Investment Corporation (CIC), the sovereign wealth fund responsible for managing part of the People’s Republic of China’s foreign exchange reserves, added that like tech unicorns in China, Indian tech startups similarly enjoy a large internet user market and a high growth potential, which partly explains their high valuation.

To be fair, valuations across startup companies in India and other geographies in Asia have found more favour in the recent years. The question always boils down to the size of the market, if the candidate is the leader in the space and how much more potential the segment has to offer in the next ten years.

As Manisha Girotra, chief executive officer at Moelis India candidly says, “Earlier, I remember they used to make us do extensive models on how the EBITDA is going to play out, etc. But now, a lot of these businesses, it"s a leap of faith, right? Because it"s all in the future."

But on a serious note, Girotra explains why sovereign funds, which earlier invested in consistent but low-growth sectors, want to be in a direct strategy with large cheques. This means investors are now comfortable with the India story and there will be more cheques which will be written directly in these kind of deals.

Girotra says, “They (sovereigns) pivoted their strategy and not just for India, they pivoted the strategy in other markets too. And they have specific funds which are targeted to the sector (tech investments) just because of the kind of returns that you’re seeing in the segment and more importantly, because they feel that especially in emerging markets like India, tech is the way to play the economy. It is a clean sector where governance is high. Most of the time, by the time the sovereigns come in, it already has VC/PEs in the firm which means basic hygiene has already been checked in terms of corporate governance, a strong board and other credentials. The promoters don’t have disproportionately large stakes."

While the stock market performance of tech companies in India continues to remain under pressure, it is yet not reflected in the private space. For CY2021, venture capital and private equity funds deployed record $77 billion, 62 percent higher than CY2020. According to an EY-IVCA report, investments in startups was a defining feature of 2021 and during the year India overtook UK as the third largest ecosystem for startups with 2021 witnessing 44 unicorns. While most sectors recorded an increase in investments, e-commerce and technology were the top sectors, each witnessing record investments of $15 billion and $14.3 billion respectively. With an increasing amount of capital moving towards the tech-enabled ecosystem, experts believe that sovereigns will continue to back first-movers disrupting and creating long-term value, the way they backed the traditional sectors in their early days of investments in India.

First Published: Jan 21, 2022, 16:17

Subscribe Now