But it is not just the investments that have caught the attention of fund managers. What has set the ball rolling is the ability to return capital from India, which was, till five years ago, a sticky subject of conversation for foreign capital providers.

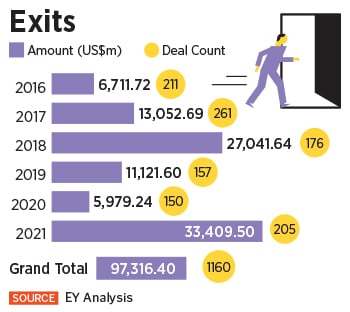

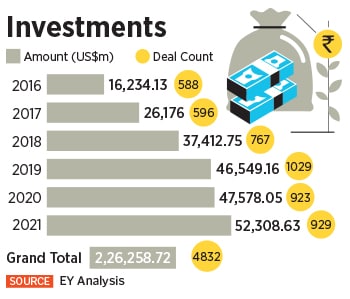

Investments in India are at a record high with $65.6 billion worth of capital being deployed by fund managers across 1,056 deals and exits are the ripple effects of the same. However, one cannot overlook the fact that even in the pandemic year of CY20, they deployed $47.58 billion across 923 deals exits stood at mere $5.98 billion across 150 deals. Even during CY19, when capital was flushed in the Indian subcontinent with general partners (GPs) deploying $46.55 billion across 1,029 deals, exits stood at $11.12 billion via 157 deals. GPs are fund managers of PE and VC funds who deploy capital.

“The quantum of exits that is happening in India is a telling sign of maturity in the deal environment. Funds who were earlier reluctant to sell have realised that the hyper growth phase of startups is stretching and in some cases, it is exceeding the fund life of one fund… there is acceptance now that you can sell and exit," says Vivek Soni, partner and national leader for PE services at EY.

![]() Exits through strategics during 2021 (January to September) stood at $16.69 billion, thanks to the likes of large corporates like Tata Group and Reliance Industries acquiring PE/VC-backed companies secondaries, too, have hit an all-time high in India. Secondaries are transactions where a PE/VC fund manager sells their stake to another fund. Since January, secondaries stood at $12.9 billion. Exits in October were dominated by secondary deals worth $4.9 billion. In fact, in its best year in 2018, exits through secondary sales were recorded at $5 billion.

Exits through strategics during 2021 (January to September) stood at $16.69 billion, thanks to the likes of large corporates like Tata Group and Reliance Industries acquiring PE/VC-backed companies secondaries, too, have hit an all-time high in India. Secondaries are transactions where a PE/VC fund manager sells their stake to another fund. Since January, secondaries stood at $12.9 billion. Exits in October were dominated by secondary deals worth $4.9 billion. In fact, in its best year in 2018, exits through secondary sales were recorded at $5 billion.

October also recorded the two largest secondaries in the Indian ecosystem which includes Carlyle’s buyout of IT services firm Hexawae from Baring Asia PE for $3 billion. The other big deal was Blackstone Group’s buyout of 75 percent stake in visa processing firm VFS Global Services for $1.9 billion from EQT Partners.

“Secondaries as an exit strategy has been consistently gaining prominence over the last few years. We have done close to 10 large exits in private secondaries this year. The later-stage investors are now comfortable giving exits to early investors because they see an IPO (initial public offering) as a viable liquidity option for themselves," says Pankaj Naik, executive director and co-head, digital & technology, Avendus Capital. He adds that the maturity of the business models is helping traditional PE and growth investee firms to take a longer call on digital-first companies. “We are also seeing that buyout funds have started playing into the majority acquisition of digital companies," he explains.

Post Covid, digital-first businesses have taken centre stage and a huge share of the market share away from brick-and-mortar-first businesses. General liquidity available in global markets and the inability to chase China are also helping Indian markets. However, it is not just the large transactions—even during early series rounds, some of the funds are exiting their investments.

“Almost every growth stage fund raise has a secondary component today and for the first time, these are being driven by buying investors than selling investors, because of the certainty that they will be able to exit in the future. And this trend is across the board," says Kashyap Chanchani, co-founder, The RainMaker Group, a tech-focused investment banking firm.

Kashyap elaborates, “Right from angel syndicates buying shares from founders or even requesting the employees of the firms to offload their shares to sovereign funds or bulge bracket PE firms wanting to get a bite of the startups that are a step away from an IPO."

The access to easy global liquidity has been driving capital deployment across shores and a loose monetary policy has created a confluence of low discount rates in the global ecosystem.

In India, exits are happening across spectrums—the first being the likes of Blackstone and Carlyle or the so-called bulge-bracket firms acquiring large assets from other PE firms, which signals deepening of the ecosystem as the funds believe there is still a definite headroom for growth to offload these assets in five to seven years.

![]() But the other category belongs to VC firms who had deployed capital as early-stage investors and are finally able to clock returns. In some cases, vintage funds are also able to mark exits and return money to their LPs.

But the other category belongs to VC firms who had deployed capital as early-stage investors and are finally able to clock returns. In some cases, vintage funds are also able to mark exits and return money to their LPs.

In June and July, fund managers exited $4 billion worth of capital and most of it was led by early-stage VC funds. Funds like Matrix Partners, Tiger Global, Helion Ventures and Kalaari Capital have exited multiple investments this year by selling their stakes in Ola, Simplilearn and Toppr, among others. This is in stark contrast to what was happening in 2018 when most of the early-stage VC funds were on the road looking for secondary firms to sell their vintage investments at a discounted value and provide exits to their LPs.

In July, Blackstone acquired a controlling stake in edtech company Simplilearn Solutions by picking up a 60 percent stake in the firm for $250 million, and in the process, provided an exit to existing investors like Mayfield, Kalaari Capital and Helion Ventures.

An email sent to Kalaari Capital went unanswered.

While large PE firms who had traditionally shied away from this asset class or did few deals previously are clearly asking for riskier bets and are open to buying into companies which are yet to break even and make money. PE firms had traditionally distinguished themselves as firms who undertake select investments and nurture them through the lifecycle of the deal while VC funds believed in the concept of spraying capital across deals in the hope of a few winners. It is not just the large PE firms, but now late-stage VC companies such as SoftBank India, Steadview Capital and Tiger Global, among others are also writing bigger cheques while providing an exit to early backers.

As a lot of investments are being exited by vintage funds which earlier found it difficult to liquidate their position, one question that props up often in the circles is are we going to see more such examples. Naik explains that vintage funds can exit if liquidity is available. “This is available now because of increased confidence and many new funds are being raised for India alone. The cycle of fear and greed repeats itself even if we expect investors to mature and learn from past experiences. However, in general, VCs are far more disciplined in this cycle to take reasonable liquidity. This is also because many of them find themselves at the fag end of their first funds and hence need to return capital," he says.

Suffice to say, most of the funds have at least a few multi baggers and thus on an overall fund level, most of the VC funds have met their internal rate of return targets and sent back cheques to the fund’s investors. But things weren’t this great until 2018, when a bunch of VC funds had to sell off portfolio companies to other funds and exit those investments or write down investments from their vintage funds.

In late 2018, New Quest Capital Partners, the Hong Kong-based secondary specialist, had acquired the India portfolio of US-based New Enterprises Associates (NEA). And the NEA team moved on to launch a new fund. Two years prior to that, in May 2016, Draper Fisher Jurvetson sold a bunch of its India portfolio to New Quest Capital Partners for a discounted valuation the numbers were not made public. Thus the ability of early-stage VC funds to return capital allows them the window to raise further capital for their new funds.

As tech-enabled companies hit the capital markets, Soni of EY adds that successful listings of VC-backed companies which are not profitable is a paradigm shift in the Indian markets. While lot of people did not understand the dynamics earlier and only focused on profitability, they are now open to these ideas. “Domestic mutual funds, insurance companies and family offices are now participating in these listings as they understand that the metrics are different and these companies need capital to corner market share before delving into profitability."

Until September end, PE and VC funds have exited $2.6 billion through exits via IPO. Blackstone exited Rs5,250 crore from Sona BLW Precision Forgings, Temasek and Highdell, and others exited CarTrade Tech for Rs2,999 crore. General Atlantic exited Krishna Institute of National Sciences for Rs1,320 crore. As part of the largest IPO in the country, One97 Communications, which owns Paytm, raised Rs18,300 crore from its IPO while Rs8,300 crore was fresh issuance. Existing investors like Alibaba’s Ant Group, SoftBank and others have offloaded shares worth Rs10,000 crore through offer for sale.

But in the midst of all the IPO frenzy and easy exits by large institutional investors, the markets regulator, Securities and Exchange Board of India (Sebi), has now proposed to tweak rules governing these IPOs to bring more accountability.

As most of these tech-enabled companies are yet to become profitable and retail investors are lapping up such issuances, Sebi on November 16 put out a consultation paper on review of certain aspects of the public issue framework.

When it comes to exit through IPOs, it has proposed that companies where there are no identifiable promoters, divestment of stake by shareholders holding over 20 percent be capped at say 50 percent of their pre-issue holding. Further, for such significant shareholders who are selling through offer for sale in IPO, their remaining post issue shareholding can be locked-in for a period of six months from the date of allotment in IPO. It has also proposed to increase the lock-in period for anchor investors from 30 days to 90 days.

One of the key points of the proposal also includes clear identification of use case of proceeds under ‘funding of inorganic growth initiatives’ objective. Companies are currently raising capital without clearly identifying the target acquisition or specific investments proposed to be deployed out of issue proceeds, at the time of filing the offer document. According to Sebi, raising funds for unidentified acquisition leads to some amount of ambiguity and thus it has proposed to prescribe a combined limit of up to 35 percent of the fresh issue size for deployment on such objects of inorganic growth activities.

Exits through strategics during 2021 (January to September) stood at $16.69 billion, thanks to the likes of large corporates like

Exits through strategics during 2021 (January to September) stood at $16.69 billion, thanks to the likes of large corporates like  But the other category belongs to VC firms who had deployed capital as early-stage investors and are finally able to clock returns. In some cases, vintage funds are also able to mark exits and return money to their LPs.

But the other category belongs to VC firms who had deployed capital as early-stage investors and are finally able to clock returns. In some cases, vintage funds are also able to mark exits and return money to their LPs.