How Venkat Viswanathan built LatentView Analytics into India's IPO blockbuster

The 15-year-old data analytics company has taken the conventional road to growth and profitability by focussing on global clients and Indian talent

Venkat Viswanathan, Founder and Chairman, LatentView Analytics

Venkat Viswanathan, Founder and Chairman, LatentView Analytics

Venkat Viswanathan has always had a knack for staying ahead of his time.

Long before the internet and emails went mainstream in India, Venkat, as the job placement representative for his batchmates at IIM Calcutta in the early 1990s, set up an email address for placements.

“My colleague and I set up the first email address for the placement office so that people could digitally contact us," says Venkat, speaking from San Francisco. “They didn"t need to send faxes or letters by post, which was how it used to be in the early ’90s." He had used the institute’s internal network (intranet) to set up the email address. It was only in 1995, the year Venkat graduated from IIM Calcutta, that India’s first publicly available internet service was launched by state-owned Videsh Sanchar Nigam Limited (VSNL).

Incidentally, earlier in 2021 when his company LatentView Analytics was invited by IIM Calcutta to participate in their placement programme, the first thing he checked was the email address of the placement office. “That email address is still there," he says.

Perhaps this ability to understand the potential of what the future holds is what propelled him into the books of India’s richest businessmen, after a blockbuster debut at the bourses recently. LatentView Analytics received record bids worth Rs 113,000 crore, the highest ever in the history of the Indian primary market, during its Rs 600-crore initial public offer (IPO) in November. It was more than five times the demand for India"s largest-ever IPO from Paytm. The issue, which was priced at Rs 190-197 per share, was oversubscribed 338 times, and came just two days after the Paytm debacle.

The company is worth Rs 12,300 crore, and Venkat’s stake in it is nearly 60 percent, which makes his net worth around Rs 7,300 crore (almost $1 billion). “We"ve been building this business for 15 years now," says Venkat, chairman of LatentView. “I keep joking, how overnight success usually takes about 15 years."

Chennai-headquartered LatentView helps customers with data analytics services, consulting, and data engineering solutions across sectors as diverse as banking, technology, industrial, and retail. It was set up in 2006, and had remained largely bootstrapped until it decided to go public. Its clients include Adobe and Uber, and it is focussed on the US market, which contributes over 90 percent of its revenues.

“If you see the last few IPOs, there is a private equity investor or somebody else who will be looking for an exit and transferring risk capital from the large player to institutional investors and retail," Venkat says. “The company itself is not getting much. Our thought process is somewhat traditional, very conservative. So much so, that even in the 15 years we have never paid any dividend to the promoters. We are a good, old-fashioned, profitable growth company."

This means the proceeds from the IPO have now gone into the company’s coffers, adding Rs 474 crore to its balance sheet. “It"s always been about how to ensure more money is in the company so that it is well funded 80 percent of the issue has actually gone into the company," Venkat adds.

Much of this cautious approach perhaps comes from his middle-class upbringing.

Venkat was brought up in Chennai, the son of an accountant and a housewife, until his family shifted to New Delhi, where his father worked in the Comptroller and Auditor General’s office. “Delhi has a very different cosmopolitan culture compared to Chennai and I had to fend for myself and find my feet."

Soon after he joined IIT Madras, where he studied civil engineering. “I think our generation probably got pushed in that direction to do a professional degree, and in some sense, it was a way out of the lower middle-class kind of scenario," Venkat says. While many of his friends and classmates decided to study further and go abroad, Venkat chose to stay in India and study management. It was also partly because he didn’t want to study engineering further, and the Indian economy had just opened up.

“Some of us could feel that India was changing and there was opportunity here," Venkat says. “I did try my hand at being an engineer, but realised there are better-paying jobs if you do a business degree." That took him to IIM Calcutta, where he also met the current CEO of LatentView, Rajan Sethuraman. Venkat also met his wife, Pramad Jandhyala, a co-founder at LatentView, at IIM Calcutta.

By the time Venkat graduated from IIM Calcutta, he had already been placed at ICRA, the credit rating agency, where he worked as a senior consultant before moving in Cognizant a few years later. India was then in the midst of an information technology boom, and Venkat was among the first few MBAs that the IT services company had hired. “They told me, don"t learn any programming because we already have too many people who know how to code," Venkat says, “We don"t have anyone who knows how to talk to customers."

By the time Venkat graduated from IIM Calcutta, he had already been placed at ICRA, the credit rating agency, where he worked as a senior consultant before moving in Cognizant a few years later. India was then in the midst of an information technology boom, and Venkat was among the first few MBAs that the IT services company had hired. “They told me, don"t learn any programming because we already have too many people who know how to code," Venkat says, “We don"t have anyone who knows how to talk to customers."

Over the next few years, as India’s IT sector grew into one of the world’s most sought after, Venkat travelled the world, meeting customers across the US and the UK, before the entrepreneurship bug finally bit him. It led him to start LatentView, with a focus on business analytics solutions for global clients. The gamble was firmly based on the belief that if his business flopped, he would go back to his corporate life after a few years. “From day one our focus has been on business analytics," Venkat says. “If you look at the company name, it had analytics in it in 2005."

It helped that Indian companies had laid out the playbook when it came to tapping global markets. “It"s not as if we were the first people to attempt this. In some sense, IT services businesses, including Cognizant, had paved the way in terms of how to sell in international markets, while using India as a talent sourcing hub," Venkat says. “The only change we did was to focus on business customers and marketing heads, heads of risk management rather than CEOs."

By 2008, the company had its first international client, although the global financial crisis soon played spoilsport. But spending more time in the US and connecting with former friends from the IITs meant that the opportunity was still immense. “2010 was a defining year for us within a matter of six weeks when we won two large American contracts," Venkat says. By 2014, the founders made way for professionals to step in and run the show, and brought in Gopi Koteeswaran, Venkat’s batch mate at IIM Calcutta, as CEO. In 2019, Koteeswaran left LatentView and Rajan Sethuraman, another IIM Calcutta batch mate, took over.

Today, the company’s business includes a pureplay consulting service, business analytics, data engineering, which helps build data and digital solutions that automate business processes and predict trends. “Entrepreneurship by definition is what I call the series of high highs and low lows," Venkat says. “We all go through highs and lows in life, but entrepreneurship changes the amplitude, so suddenly that you feel like a king one day, and then weeks later, you"re asking why you are doing this."

LatentView works with customers in retail, consumer goods, finance, and other sectors to develop analytics solutions that give them meaningful insights from their data, in order to make smarter choices.

“We are more akin to business consulting, solving ill-defined problems, and we work mostly with the functional heads of organisations," Venkat says. “In many instances, we actually help bring more clarity to the problem itself, and help them figure out their analytics strategy, and the road map or initiatives that they can pursue." That’s a line of business that has found much steam in the past few years, as companies look to digitise their businesses on the back of the Covid-19 pandemic.

Global IT spending is expected to recover from the flat growth in 2020 and reach $4 trillion by 2024, according to market consultancy firm Zinnov. India, meanwhile, remains the top outsourcing destination for analytics, according to Zinnov, and Indian companies including the likes of TCS, Wipro, Tech Mahindra, and pure-play analytics firms such as MuSigma, Fractal Analytics, and LatentView have a share of about 40 percent of the market. The market for data and analytics stood at $174 billion in 2020 and is expected to grow at 18 percent to $333 billion by 2024, according to the report.

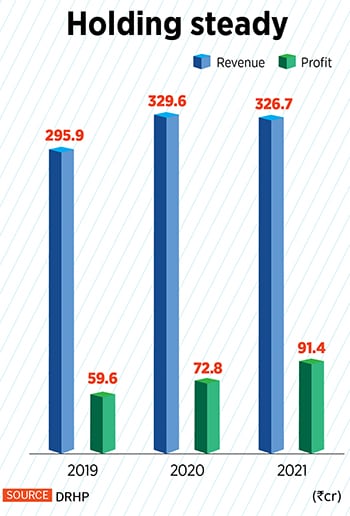

“Indian service providers address the demand from across the globe and the market is dominated by multi-Service IT providers driving $10-11 billion of services revenue, followed by pure-play analytics firms contributing $1.5-2 billion," the Zinnov report says. Last year, the company had posted a net profit of Rs 91 crore as against a profit of Rs 78 crore in the year-ago period last year sales stood at Rs 326 crore.

“The company’s business model is supported by stable and recurring revenues, significant operating leverage, and low capital requirements that contribute to a healthy, free cash flow," said Sameer Pardikar, research analyst at ICICI Securities, in a November report. “Their high levels of client retention and shift towards multiyear engagement contracts result in a high degree of revenue visibility."

The company has over 900 employees, spread largely across India. “As organisations want to take an integrated approach, budgets are getting bigger, and the nature, scope, and ambition are also changing," Venkat says.

Much of the gamble by LatentView to go public is also because of planned expansions and acquisitions.

This was also the first time that the company was diluting its equity capital, especially since the company hadn’t raised any equity funding in the past and had relied on debt capital. “If we can bring in more talent and take bolder risks, which are out of the ordinary, the market will be hungry for a sector like ours," Venkat says.

On the bourses, the company’s stock also made a bumper debut, listing at over 48 percent from its issue price of Rs 197. As of December 7, its stock price was Rs 624.65. “When we started looking at the big canvas, we could clearly see that the opportunity is really big and we have only scratched the surface," says Sethuraman. “We are still a small, sub-$100 million business, and clearly if we can raise the visibility, if we can bring in talent, there is massive opportunity."

Sethuraman reckons that the company already has an upper hand when it comes to facing competition, both from India and outside. “Competition is approaching from multiple perspectives," he says. “Given that we work with large companies, most of them will have an ecosystem of service providers and partners. They will be having large strategy consulting firms and will work with systems integrators, and technology services firms in addition to niche product companies. But the unique combination of the business and technology being focussed on problem-solving is a niche that we figured out early on, and have been building capabilities on."

That means as the sector sees more uptick in the wake of digitisation, the company is also likely to enter newer areas of operation, especially since its line of business has been largely focussed on a few sectors and geographies. “The company’s revenues are highly dependent on a limited number of industry verticals, and any decline in demand for outsourced services in these industry verticals could reduce its revenues and materially adversely affect its business, financial condition, and results of operations," the ICICI Securities report adds.

So, what does it mean to join the list of some of India’s top billionaires? “I don’t like this B-tag," Venkat jokes. “The financial risk of the business was entirely on us from the early days. I didn’t want others to feel the pain of not getting the salary. I could absorb that, and that’s why the shareholding was concentrated. Who knew this will grow in value as this much."

Clearly, Venkat and his team are only getting started to embrace the big data revolution underway.

First Published: Dec 07, 2021, 14:00

Subscribe Now