BharatPe redefined India's payment ecosystem. The unicorn now wants to challenge

In just three years, Ashneer Grover-led BharatPe has become one of India's biggest fintech startups. And it's only getting started

(From Left) Ashneer Grover, MD & Co-Founder Suhail Sameer, CEO Shashvat Nakrani, Co-Founder BharatPe.

(From Left) Ashneer Grover, MD & Co-Founder Suhail Sameer, CEO Shashvat Nakrani, Co-Founder BharatPe.

Image: Madhu Kaparath

Ashneer Grover has one fundamental rule in life. “If you have to do something, do it big," the 39-year-old co-founder of BharatPe says. “Because, if you must do something smaller, it takes an equal amount of effort."

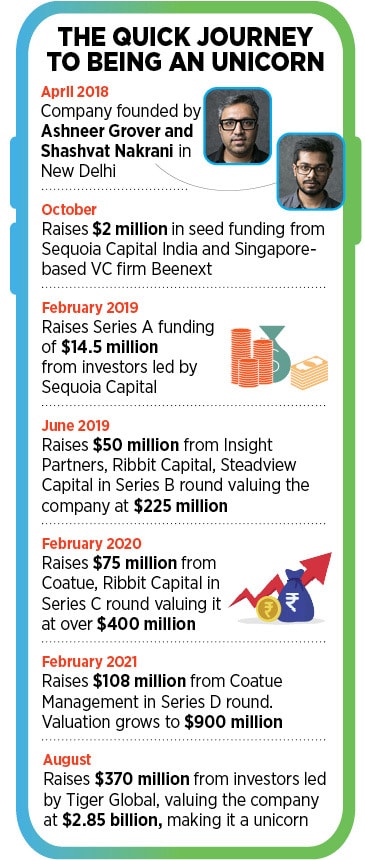

There is a certain merit in that argument, particularly since Grover and BharatPe have made it a habit of making it big. In just three years, Grover has built BharatPe, founded in April 2018, into one of India’s biggest fintech startups, commanding a staggering valuation of $2.85 billion after its latest round of funding. This August, BharatPe raised $370 million from investors including Tiger Global, Sequoia Growth, and Dragoneer Investment Group, among others.

In June, the company’s joint venture with Mumbai-based Centrum Group received an in-principal approval from the Reserve Bank of India (RBI) to take over the troubled cooperative lender PMC Bank and re-launch it as a small finance bank. The consortium will become the first small finance bank in nearly six years to be permitted by the RBI to do this.

“Even today, I don"t care about these valuations," Grover says nonchalantly in a video interview. “I absolutely don’t give a damn about it. For me, the question is whether I am a leader or not. If I’m the leader, money will follow. If I’m not, then I will be following the money. I am in no mood to follow the money."

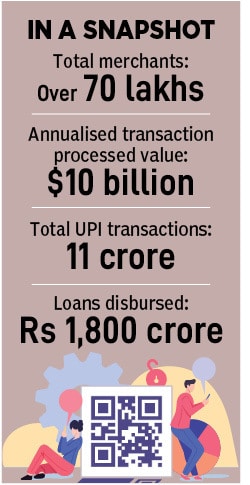

BharatPe, the financial services platform that Grover founded along with Shashvat Nakrani, an IIT-Delhi dropout, processes payments and provides credit or loans to merchants and shopkeepers across the country after building up India’s first UPI interoperable QR code. The company is also India’s first zero MDR payment acceptance service with over 70 lakh merchants across 140 cities, processing some 12 crore UPI transactions per month with an annualised transaction value of $10 billion. MDR is the cost paid by a merchant to a bank for accepting payment from their customers via digital means.

BharatPe also operates what Grover calls India’s largest peer-to-peer lending service, mostly offering to merchants. “To me, it was clear from the beginning that the business to do in India is not commerce, it’s lending," Grover, the managing director and co-founder of BharatPe, says. “You have a much better chance of being successful if you try to be an Uday Kotak as against a Kishore Biyani. If we look back, Kotak has created more value in the last 25 years even though he and Biyani would have started at the same point in time."

In many ways, Grover is the quintessential middle-class boy, what Indian parents want their children to grow up to be.

Out and out a Delhi boy (in his own words), and the son of a schoolteacher mother and a chartered accountant father, Grover studied in the same school all his life. He then went to the illustrious IIT-Delhi, before cracking the Common Admission Test (CAT) and made it to IIM-Ahmedabad. Grover had scored a 99.7 percentile in his CAT exams.

At IIT, where he studied civil engineering, he had a departmental rank No. 2 and was rather “infamous" since he had hit an SGPA (Semester Grade Point Average) of 10 in the last semester. Quite often, studies take a backseat in the final semester, with students having secured a job or found acceptance to the IIMs. But Grover, the nerd, didn’t want any of that. “I don’t come from a business family at all," Grover says. “I was always high on academics and liked engineering a lot."

His contemporaries at the IIT-Delhi back then included the likes of Sachin Bansal, the co-founder of Flipkart, Deepinder Goyal, the co-founder of Zomato, Albinder Dhindsa, the co-founder of Grofers, and Sujeet Kumar, the co-founder of Udaan.

After graduating from IIM, Grover joined Kotak Bank in its investment banking division, where he worked under Falguni Nayar, who went on to become the founder and CEO of Nykaa. At Kotak, much of Grover’s work involved activities including early-stage funding, helping with IPOs, loan offerings, and restructuring assets. “I was very keen on doing a lot more of bits and pieces rather than specialising in just one product," Grover says. “That"s how you learn a lot more. I did some 10-odd deals worth $3 billion, was consistently the highest-rated guy, and doing extremely well."

Doing well also meant that Grover would have had to subsequently move to Mumbai. “The Bombay life did not attract me at all," Grover says. “So, after seven years, when it became inevitable that I had to either go to Bombay or go out, I decided to go out."

Staying back in Delhi, Grover then moved to American Express, where he was director for corporate development—the role involved studying payment companies and investing in them on behalf of Amex. That meant meeting over 100 founders in the two years that he spent there, providing him with an insight into India’s payment industry, particularly as the fintech revolution in India began to take shape. Of course, much of India’s fintech revolution came after 2016 when the Narendra Modi government decided to demonetise the country’s high-value currencies, giving a fillip to cashless transactions in the country.

By 2015, Albinder Dhindsa, the co-founder of Grofers and his classmate at IIT-Delhi, who had previously worked at Zomato, approached Grover to join him at the online grocery delivery service. “Albinder said he was raising funds and wanted my help," Grover says. “In fact, Grofers’ business plan was created in the Amex office. And before we knew it, we had received $10 million from Tiger and Sequoia."

At Grofers, Grover became the CFO, helping it raise money from SoftBank and, in the process, helping grow the business from 30 orders to 30,000 orders a day. “I was in the thick of things and literally the third co-founder there," Grover says.

In many ways, the experience at Grofers also gave Grover an insight into building a business from scratch especially since he looked after everything from commercial to finance and compliance. By 2017, as the competition within the online retail industry began to grow and BigBasket began to cement its leadership position, Grover also realised that a merger was the best way out.

Around the same time, Paytm Mall, which was struggling, was also in talks to invest in BigBasket, which had in many ways scuttled Grofers’ prospects. “Once the deal fell through, I had a tough call to take on whether to stick around or to move on," Grover says. “Unfortunately, as I was not made good for my promise of equity, the decision to move on became easier. So, I stepped away."

While Grover later dabbled with the prospect of building a gold loan business for PC Lal Jewellers, he knew the enormous potential awaiting in the small merchant business. “One of the things I realised was that you could not sell the shopkeepers any service," Grover says. “Because these guys have a 15 percent margin and after their cost and everything, they take home between 6 and 8 percent. So, they have no willingness to pay even a single percent out of that."

Around the same time, he met Shashvat Nakrani, a student at IIT-Delhi, over a decade younger than him. Nakrani had figured out the architecture of the Unified Payments Interface (UPI), a government-owned system that enables real-time payment and instantly transferring the funds between the two bank accounts. “They realised that architecturally there"s no difference between a person paying a person or person paying the merchant," Grover says.“

At that time, incumbent players such as Paytm and PhonePe were using closed-loop QR codes, although UPI allowed them to be interoperable. Closed-loop QR codes only allowed transactions between one platform.

“That meant two things," Grover says. “We could build a pure merchant-side business. We did not have to be on both sides. To me, what that meant was that payments in India are now, therefore, going to go to zero. We realised that if this becomes big, then nobody is going to pay for paying another person. Over time, the merchant will also not pay for receiving those payments."

The company set up its first interoperate QR code in August 2018. BharatPe’s interoperable QR codes meant that offline businesses could register and receive UPI payments directly into their bank account without any charges. Before this, companies charged around 0.6 percent from merchants on every transaction. In October 2020, the RBI said payments companies would have to shift to interoperable QR codes by March 31, 2022.

“We said we are not here to make money on payments and the larger industry hates me for it because they think I"m the person who has driven economics of MDR to zero in India," Grover says. “But if it was not me, there would be another Ashneer doing it," Grover says. “There are enough smart people who would have figured out that. There"s no money to be made in payments anymore."

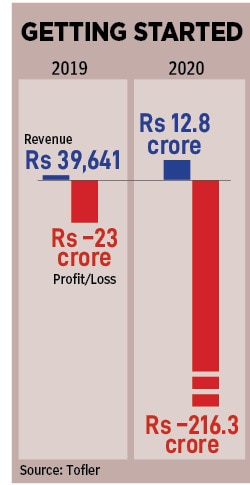

Over the next few months, the company actively pursued adding more merchants to its platforms, who were willing to use their service since they did not have to pay any transaction fee. “For the first six months that we were doing this business, everyone said these guys will die."

But in those six months, Grover says, BharatPe just took the market away from everyone to the extent that incumbents, including PhonePe and Paytm, were also forced to offer payments free. Soon, the government, which was looking to ramp up digital transactions in India, realised that the high MDR costs were hindering adoption and removed MDR charges.

“From January 2020, my biggest cost item became zero," Grover says. Until then, the company was absorbing the costs, and paying the transaction cost, seeing it as a customer acquisition opportunity. “I did not have to even pay the banks anything, and we had already acquired a whole bunch of customers. It was a bold call back then and I don"t know how many more months I could have survived bearing that cost."

With a sizeable merchant base under its belt, the wily Grover sensed the next big opportunity prompting him to start lending on the platform. “Nobody lends to this segment," Grover says. Much of that is because the lender has no access to the size of the business that the shopkeeper has. India has an estimated 70 million shopkeepers across the country, who control almost 90 percent of India’s retail trade, with limited access to capital.

“We were in the money flow and knew about the transactions," Grover says. The company soon tied up with LenDenClub and Liquiloans, where BharatPe was the originators of the liability and began lending on the platform at an interest rate of two percent per month. The company would ease the payment process by charging the merchant when he received a payment, making it a rather easy affair.

Starting lending on the platform also meant an opportunity to build a peer-to-peer lending platform, especially for cash-rich merchants looking to lend money to those in urgent need. “The merchant who is saving money with us can earn up to 12 percent, and that money is allocated to a borrower who"s paying the 24 percent." The company claims to run the largest peer-to-peer lending in the country. So far, the company has also disbursed some Rs 1,900 crore.

Last year, the New Delhi-headquartered company also decided to foray into the card swiping business with Bharat Swipe, the country’s first zero rental and zero merchant discount rate (MDR) PoS machine. The company sells PoS (point of sales) machines to its customers, who do not have to pay rentals, as is the practice now, and doesn’t charge an MDR. “We did not want to charge an MDR for swiping of cards," Grover explains. “When the customer swipes, the merchant can see the whole balance. If they take it within 15 days, they must pay me 1 percent. If they take it out after 15 days, they don’t have to pay anything."

With the company now joining the coveted unicorn club, BharatPe and Grover are only getting started.

And much of that, Grover attributes to the steadfast focus on lending that it has initially started out to do. “Three years ago, I did envision that I would be doing the lending business on the back of payments," Grover says. “The core business plan has never changed. In my first deck to Sequoia, I said I’m going to do payments for free, and I’m going to make money on lending. Three years on, I’m still doing exactly what I had for me right from the first day, which is a matter of pride."

It only helps that the company’s banking aspirations are taking shape now, a plan that had been in the works for a long time. “I want to give more and more loans, and my play is against the organised e-commerce trade," Grover says. “What if I became the bank account for these merchants. Then I can do tonnes of things because not only am I the pipe through which the money flows, I"m also the container in which the money goes and sits."

While Grover hasn’t given a timeline on when the small finance bank will begin operations, he reckons the lack of innovation in the sector, especially in the past few decades, will give him an opportunity to offer new products. India’s market for digital lending is poised to grow from $110 billion in 2019 to $350 billion in 2023, according to PwC. “This will increase the share of digital lending in India’s overall lending market from 23 percent in 2018 to 48 percent by 2023, making digital lending a sector with the highest penetration by digital channels in the country," a PwC report says.

“If you look at the last 25 years in India in terms of banking innovation, other than UPI and faster moving of money, there"s no new product," Grover says. “It"s going to get redefined when five folks like me meaningfully jump and give competition to Uday, to HDFC, ICICI, Axis. When we compete against each other is only when the customer is going to see a new product and a new level of banking."

It also helps that BharatPe’s partner Centrum, too, is looking to expand aggressively. “Since our larger objective was to scale, this was a wholesome complement to what we were planning to do," Jaspal Bindra, the executive chairman of Centrum Group, had told Forbes India earlier. “The eventual plan is to go the full distance. Directionally, a small finance bank is still a logical [step forward]." That means, over the next few months, the new bank will be in direct competition with larger players such as AU Small Finance Bank led by new billionaire Sanjay Agarwal, Ujjivan Small Finance Bank led by Nitin Chugh, and Equitas Small Finance Bank led by PN Vasudevan.

Then, there is the massive opportunity in the UPI segment that has begun to pick up lately. In August 2021, the total number of transactions on the UPI platform across 249 banks stood at 3.5 billion transactions, valued at some Rs 6.3 lakh crore. Just a year ago, that number stood at 1.6 billion transactions worth Rs 2.9 lakh crore.

“I think the next wave is all about credit on UPI," Grover adds. “How fast can any of these players transform from being a pure debit play to a credit play will determine you whether you can make money or not."

BharatPe, meanwhile, will likely launch consumer-focussed programmes on its platform over the next month. “We"ve so far been underwriting merchants, but we see the full transaction," says Suhail Sameer, the CEO of BharatPe. “I think the first product will be simple in the form of buy now, pay later. It will be done disruptively as compared to what other people do." Sameer took over as the CEO in August this year, as Grover turns his attention to strategy.

The company has also launched secure lending on its platform, providing loans in exchange for a collateral. “We have just launched our first secured lending product in the form of gold loan," Sameer says. “Over a period, we will launch more and more products like auto loans, loan against property and so on. Therefore, the focus is to launch and scale a series of merchant-focussed lending products for the business."

All that means that the Indian fintech revolution will see investors making a beeline, particularly for companies like BharatPe. “We’ve seen global investors taking an interest in the Indian digital payment space in the past few years and expect it to continue attracting investments in the coming years," consultancy firm PwC said in a report last year. “In the first six months of 2020, India’s fintech sector attracted $1.47 billion in investments, which is almost 60 percent higher than that received in the corresponding period last year. In 2019, total investments in the Indian fintech space were worth $ 3.7 billion compared to $1.9 billion in 2018."

For now, Grover and BharatPe have their hands full. If the interoperable QR code revolution that BharatPe had brought is any indication, it’s only a matter of time before he gives India’s banks a run for their money.

First Published: Sep 09, 2021, 10:15

Subscribe Now