It is a very significant challenge and a once-in-a-century event. Most of us have not encountered a situation like this, where a tiny virus has completely disrupted the way humans live. It was easy to get into the lockdown, but it has a huge economic cost, and it is very difficult to get out it. We are coming to a situation where the world is moving towards a different place and assumptions we made of the world have changed today. The government and the Prime Minister are realising that.

Q. You speak about moving towards a different place…which businesses are getting reset?

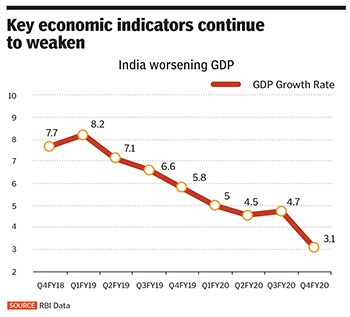

This is a core theme we, at CII, are working on. Our secretariat and the national council of 180 members had meetings on June 3. We usually announce a GDP forecast and sectoral growth trends this time we have said that it is not possible, for anyone, to have a correct prediction of GDP for the current year. In fact, we should monitor it granularly, month-by-month. We have a theme—lives, livelihood and growth.

Q. We are growing at the slowest pace in 11 years. You speak about the need for the government, business and financial sector to work together to revive the economy. Could you spell out what corporates and lenders need to do?

There will be significant loss and pain in the system. The first category is individuals and businesses. There will be a lot of inter-business negotiations that will happen—between a lessor and a lessee, and between an employer and employee, regarding who will bear the pain. The next part is the government, which has given a stimulus, but there is a significant drop in its revenue.

![key economic indicators key economic indicators]()

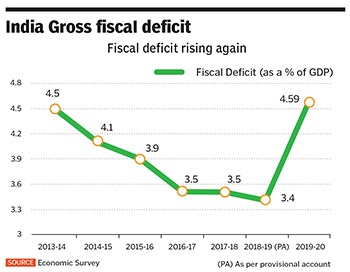

After the support package from the government and the drop in revenues, the fiscal deficit of the centre and state governments combined will be 11-12 percent of GDP, against the 6.5 percent that economists projected in February. In an economy of our size [$2.9 trillion], the five percentage-point difference is a hit of Rs 10 lakh crore…the government is taking that shock. The rest of the shock falls on the financial sector. All the three segments need to figure out how the pain is going to be distributed.

Q. Should we write off the first half of FY21 and think that demand and labour would come back only in the second half?

April was a complete standstill in business activity in May, we saw gradual stirring. If we were a 100 percent economy and you saw a sharp shock during the lockdown in April and May, the most dangerous thing to do is to predict the year 2020 on averages. We should focus on objective parameters such as electricity consumption, goods and services tax (GST) collections, road traffic, passenger car sales, freight movement month-on-month, to tell us how the economy is faring. We have to look at this year as a year in transition—a deep shock—and then decide how we take things forward.

Q. Some of the RBI"s MPC members fear it will take years for India to repair its economy. Is recession inevitable then?

It is very hard to predict at this point the likely trajectory of the economy. Certainly, I do not expect a near-term recovery but at the same time, I do not expect a protracted recession. I would expect a gradual recovery over the coming year, so that starting in 2021-22, company earnings and overall GDP is likely to start growing at a faster rate. This is consistent with the market expectation as well.

Q. The government measures targeting migrant labourers, low income and small businesses are well intended. But the fresh fiscal impact through the five-tranche package announced by FM Nirmala Sitharaman is only Rs 1.5 lakh crore—is this adequate?

Whether you spend or you have reduced revenues the net impact is that the fiscal deficit bloats. We are already seeing a gap of Rs 10 lakh crore, to that extent the shock is being taken by the centre and states. More needs to be done but how do we balance the need for doing more with the reality that we don’t have a global currency. We have to be careful about doing more but not overreaching in terms of the size of our fiscal deficit where we have sharp shocks to our external accounts. The good news is that our external accounts are fine but the domestic finances need to be handled with care.

Q. But the government has addressed the supply side of the economy, there is no trigger to boost demand. How can this be resolved?

There are many demand boosting measures in the government’s package such as the cash transfers to the underprivileged people and the credit guarantee to MSMEs. However, the immediate spending by the government is limited due to the government’s already extended fiscal position. I believe more will be done as and when required but we should be careful to not trigger financial instability by sharply increasing the fiscal deficit and public debt.

Q. Considering that the governments hands are tied and there is only this much there can do, some of the hardest hit sectors by the Covid19—hospitality, airlines, tourism (which faces potential job losses of 41 million)—have been left ignored by the government. Would you seek a bailout for these sectors?

![india gross fiscal deficit india gross fiscal deficit]()

We need to prioritise on sectors—first protect lives and livelihood (jobs). The government should be thinking about a backstop: it should create a social security net for the low-income (salaries below Rs 25,000 per month). We have neglected healthcare, with just 1.3 percent of GDP invested in health. We need to strengthen our sanitisation, hospital facilities trained medical staff and e-medicine systems from here onwards. Germany could withstand Covid-19 better due to cutting-edge healthcare systems. We need to focus more on education and not take the environment for granted.

As far as the bailout is concerned, it is not in the hands of the government. It depends on what the consumer wants in the future. If you decide not to go to a movie hall for six months, that’s the choice you’ve made. There will be a limitation to the amount of resources the country will have after the losses it suffers. We have to ensure that what we are doing is structurally right for the new world and be careful not succumb to lobbies or people who are making the loudest noise, whether justifiable or not and gets something.

Q. With the moratorium on repayment of loans being extended, it means potentially a longer level of indebtedness in the system, which is never good…

It is a fair concern that investors have voiced, whether it runs the risk of moral hazard—where borrowers get used to not paying. We need to have a proper credit culture. I understand that the RBI has to balance things due to the economic impact of the virus. But going forward, we will have to take a call on which entities are credit worthy and which are not. In that context, I am appreciative of the government’s recent MSME (micro, small and medium enterprises) guarantee system. [Through this scheme, banks will provide Rs3 trillion as automatic collateral-free loans to standard MSMEs. The government will also provide credit guarantee to banks and non-banking finance companies (NBFCs) for both principal and interest till 31 October].

Q. But the fear is that that come Sept 1, people will say they cannot pay as they would have seen a cut in salary or lost a job. How bad will retail NPA get? There is a real concern that the highest delinquencies might be in the unsecured personal loans space.

There will certainly be pain, and it is always difficult to predict a number. But if I had to look within the financial system, the segment that will see significant amount of pain will be the unsecured consumer, particularly the urban consumer [loans]. The MSME sector has been well buffeted by the government and a lot of the large businesses which are not highly leveraged should sustain.

My simple principle is to apply Finance 101: When you are lending, first look at sensitive sectors and how they will sustain in a post-Covid-19 era, then look at businesses with high fixed operating costs—they will also face pain. And then look at companies with high debt: Equity ratios on how businesses fare.

And I do believe that interest charge during the moratorium should stay, which is the RBI’s view too. Banks and financial companies get money from depositors and lend it to borrowers. You cannot have a situation where the borrower is not allowed to pay and the depositor, obviously, must be paid. That would create a discontinuous situation. If you see the crux of the Banking Regulation Act, it is protection of the depositors’ money which is most important.

Q. The suspension of the IBC for a year—while offering relief to weak companies— means that banks have to sit on a bad asset for a longer period of time. How does it help?

At least a six-month window was required. But the year starts from March 25, 2020 [the ordinance just passed thus says no case of corporate insolvency can take place till September 24, which can be extended to March 24, 2021].

Q. How would you explain the complete disconnect between the surge in the stock prices and the state of the economy?

One of the two scenarios is right I do not know which one. On a serious note: Think of any company facing turbulence ahead due to the virus outbreak and seeing an uptick in the stock markets. Why not go raise capital? Several companies have already done it. If my real economy need is to have more risk capital, I should go out and take it. If I am in a boat in the high seas and there is a thunderstorm, and if there is another stronger boat that is bigger and stronger (and that is what capital does), why not take advantage of the situation?

Q. How many banks are at risk of falling away, with weakened balance sheets, poor asset quality, low profitability and little sign of recapitalisation for public sector banks?

Sector after sector will see consolidation: Companies that will survive will also grow in scale—as seen with the telecom sector in earlier years—and weaker players must raise risk capital. The markets as you rightly said, have a disconnect, so corporates need to use that to raise capital.

Q. Can Indian corporates take advantage of the anti-China wave or create new supply chains? Or is this just a political statement?

I relate to the Prime Minister’s statement and use it in a broader context. A self-reliant India (Atma Nirbhar Bharat) also includes our self-sufficiency on our healthcare and education system, reverse migration, how to create balanced regional growth in rural India. It is upon us to bring about a transition where we create a well-balanced India with strong broadband connectivity. There is great opportunity to reset what India means.

Q. And where does one start—it just cannot be like a Skill India or Make in India campaign?

A. Look at the personal protective equipment (PPEs)—India could manufacture these and make them available. We must get the investment mindset back…we cannot be cowed down by Covid-19.