At least 7-8 companies have lined up plans to launch mutual fund schemes soon, in a market already crowded by nearly 1,500 schemes across debt, equity, hybrid, ETFs and ELSS segments from 45 asset management firms.

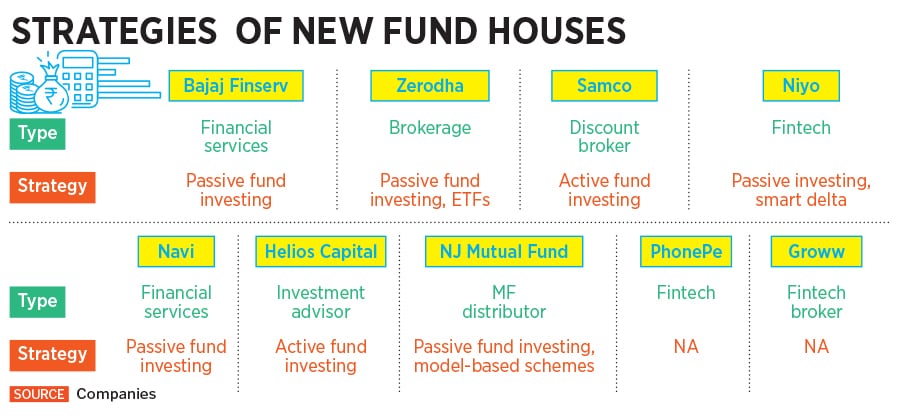

Zerodha, Navi Technologies, Samco and Bajaj Finserv are planning to launch their own schemes in coming months. NJ Mutual Fund comes from India’s largest mutual fund distributor NJ India Invest and has announced the launch of a balanced advantage fund for October. Fintech firms Niyo, Groww and PhonePe have all firmed up plans to apply for a mutual fund licence with the Securities and Exchange Board of India (SEBI) by the year end.

The entry of new mutual funds has been welcomed. “It will not only bring in more choice for investors, but will also bring costs down. India is not a saturated market at all, so the entry of more players can expand the market, even for existing players," says Kaustubh Belapurkar, director-manager research at Morningstar India.

The passive route

Several of the newest mutual funds, including Flipkart Founder Sachin Bansal’s Navi Mutual Fund digital fintech Niyo and brokerage Zerodha, will use passive investing as their business strategy. Passive fund investing, where the scheme tracks a market index, is an easy-to-understand product for investors new to mutual funds, besides lowering expenses for the originator of these schemes.

The interesting part is that in recent times, exchange traded funds (ETF) and index funds have been hiking up their total expense ratio, which investors need to pay. For passive funds, Sebi allows a maximum expense ratio of one percent. Navi MF has been offering far lower expense ratios to its investors on some of its schemes, but it remains to be seen if other fund houses will do the same.

The need to invest beyond traditional savings products has grown as returns on these have only dipped in recent years. On the personal investment front, demat account openings have jumped to 26 lakhs per month in FY22 from 4 lakh in FY20. Investing in systematic investment plans (SIPs) have also risen: While around 51-53 lakh SIPs were added in the last two financial years, this rose to around 59 lakh during the first five months of this fiscal, Sebi data shows.

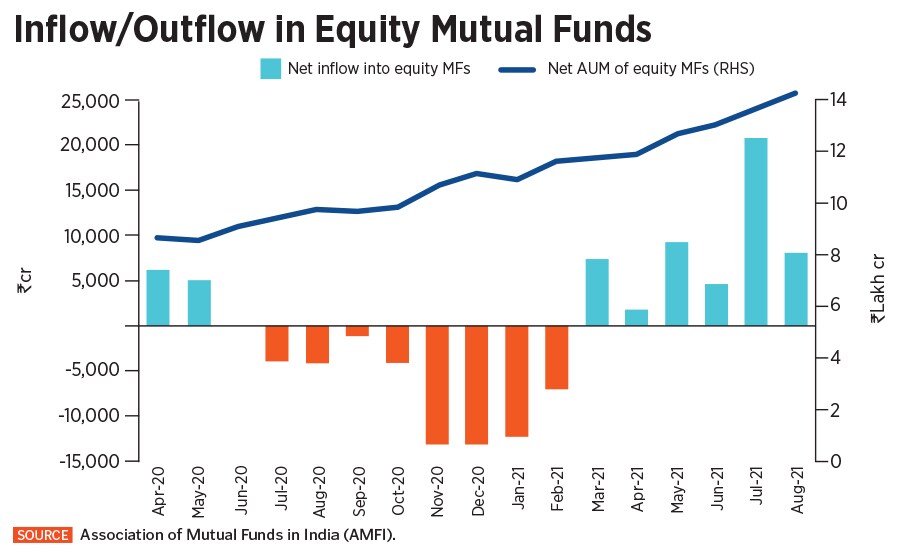

Additional liquidity in the financial markets, support from global central banks across nations during the pandemic and an easing of fear post vaccination to tackle Covid-19 have all led to a boost for equities. Since April 2020, the Nifty 50 index has surged 119 percent to a record 17,735.15 points on September 17, while the Sensex 30 has jumped 116 percent to a high of 59,515.81 in the same period.

Assets under management (AUM) of Indian mutual fund industry stood at Rs36.59 lakh crore, as on August 31. Yet the securities market penetration for adults in India is just 6.5 percent, compared to around 55 percent in the US in 2020, according to Statista data.

“We are in a time when investors have seen significant market movements in a very short period of time. Investors are now more aware of the risk associated with short-term market movements and understand the benefit of staying invested for the long-term," says Saurabh Jain, managing director and CEO of Navi MF.

This was seen last year when, retail investors chose to stay invested in equities, including SIPs, despite indices falling by a third of their value in late February and March 2020 when the pandemic broke. “Investors are starting to think more long-term when it comes to equity investing and not necessarily staying out completely even at elevated market levels," says Morningstar India’s Belapurkar.

“Passive investing will grow faster than active in the next few years. The simplicity of passive products coupled with their low cost of management make them an ideal product for the retail investor base," says Jain. Navi MF wants to grab a share of the 35 percent passive funds space by 2030, when the size of passively managed funds is expected to be over 7 lakh crores.

Alphas might have shrunk, but have not gone away completely, so in the long term there is a definite case for active fund management. Private sector banks and financial institutions are going to continue with active investing, unfazed by phases of underperformance and outperformance depending on the market cycle.

“Investors tend to chase performance, so they often come in too late in the cycle, and lose patience too soon when the cycle is not in favor. For example, in recent years, investors sold value biased managers and moved most money in pure growth managers," Belapurkar says.

Many of these switches were made when a large part of the strong outperformance of growth strategies had already played out and value was beginning to rise. Such behavioral biases can lead to sub-optimal results in portfolios. “Having a blend of styles is the way to go when picking active managers. This is where passive fund management can play a huge role rather than being overwhelmed when it comes to picking active managers and sitting out of the market altogether, buying a passive fund where it simply tracks the market indices," Belapurkar says.

Different strategies

India’s stock markets are expensive at the moment, with the BSE 30 share Sensex trading at a trailing P/E multiple of 31.5x. The ‘bubble’ word continues to come up every few weeks as analysts are unable to find rationality in the rising stock prices and valuations.

Mid- and small-caps continue to outperform the Sensex, with the BSE Mid-Cap up 38 -percent for the year, trading at a P/E of 36.4x and the Small-Cap index up 53 percent in 2021, trading at a P/E of 41.2x. The challenge in active fund investing will be to find investment opportunities, particularly value stocks, after the growth potential appears to have already played out over the past 12-15 months.

![]()

One of the new mutual funds is Samco, which is part of the broader Samco Group with an interest in real estate, corporate tax advisory and a non-banking financial company. The discount broker Samco with 2.5 lakh customers, which also runs RankMF, a research backed mutual fund recommendation product, will launch its new first offer (NFO) by the end of the year.

Most of the new MFs argue with a simplistic formula that a longer-term horizon to equity investing will reduce the concerns of investing at record highs. Umeshkumar Mehta, CEO of Samco AMC says, “Our business is built on a model portfolio basis. The fear of investing is there but if investors are keeping a ten-year horizon, there should be no concerns."

Harsh Roongta, founder of Fee-Only Investment Advisors, a boutique firm that services 50 high net-worth clients says passive will strip off every risk, other than the underlying market risk. “Asset allocation accounts for 90 percent of your ultimate experienced return on investment and securities invested in accounts for the balance 10 percent."

Niyo, a digital fintech, plans to use its technology focus to sell mutual fund schemes. It already provides banking services through NiyoX to six lakh customers, in a tie-up with Equitas Small Finance Bank. Another one lakh customers, including HNIs and global travelers, are serviced with its wealth management services. Post restructuring within the company, Niyo plans to launch its mutual fund schemes in 2022 after applying for a licence by 2021 year-end.

“The mutual fund will focus on selling products through passive and smart beta schemes," says Swapnil Bhaskar, business head at Niyo. The company, which has raised $65 million (about Rs480 crore) over the past four years through existing investors Prime Ventures, Horizons Ventures, Tencent and JS Capital, is well-capitalised.

Zerodha and Bajaj Finserv have the advantage of a large customer base to whom they can sell mutual fund products. Both plan to launch passive index-linked funds, but declined to talk about their strategies or scheme details.

The jury is out on which new fund house will finally succeed in its strategy. In recent years, passive fund investing has started to become popular only because it is easy to sell and is a tested formula seen in the developed markets. Considering that most of the new mutual funds are technology-focussed players, the medium-term aim will be to boost valuations, even though they may not emerge as profitable in the near-term.

For investors, it could be a different story. “Investment lectures do not teach investors much. Once they start investing and fail or lose one’s own money, they will learn faster," said Dhirendra Kumar, CEO of mutual fund advisory firm Value research.

At least seven to eight companies have lined up plans to launch mutual fund schemes soon

At least seven to eight companies have lined up plans to launch mutual fund schemes soon