State-run Hudco seen to be in sweet spot, focussed on financing govt. projects

To becomes first state-run company to tap the market in past five years

(Image: for illustrative purposes only)

A quiet buzz appears to be building around the initial public offering (IPO) from the Housing and Urban Development Corporation Ltd (Hudco). The government fully owns Hudco and this will be the first offering from a public sector undertaking to hit the capital markets after a gap of five years the last being National Buildings Construction Corporation (NBCC) in 2012.

The government plans to sell 10.2 percent of its stake in Hudco, to raise Rs 1,224 crore through the offering, which opens on May 8. This will be an offer for sale, which means that the company will not receive any proceeds from the offering and there will be no sales of new shares. The IPO’s price band is Rs 56 to Rs 60 per share of face value of Rs 10 each.

The Hudco offering is of 204 million shares and this disinvestment from the government forms part of its broader disinvestment plan which was announced in the FY17-18 Union Budget on January 31.

Hudco is one of the government’s ‘mini-ratnas’ and was established in 1970 to provide loans for housing and urban infrastructure projects.

What is making Hudco an attractive bet?

Hudco operates in the housing finance space which is crowded by several large private players, which include several companies such as HDFC, Indiabulls Housing Finance, LIC Housing Finance, Dewan Housing Finance Corporation and a string of smaller firms.

But what stands out for Hudco is that it is focussed on financing long-gestation government projects.

This is a segment in which several banks – themselves struggling with stressed assets – have preferred to stay away from in recent years. NBFCs are also largely absent and thus gives Hudco a firm advantage.

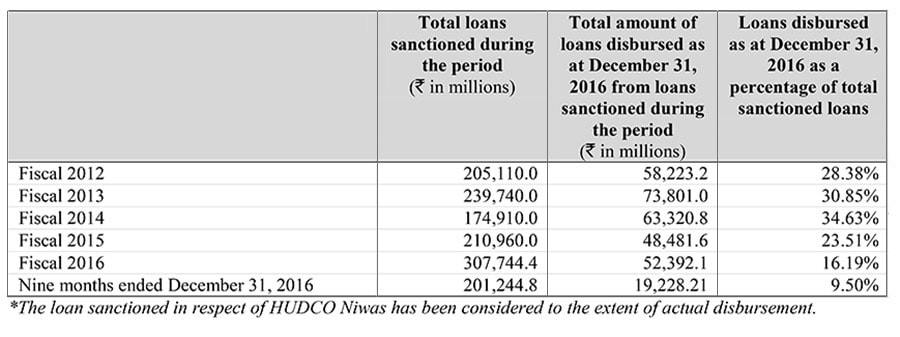

Hudco’s total outstanding loan portfolio is Rs 36,385 crore (as on December 2016) and the majority, 89.93 percent is towards state governments and their agencies. About 30.86 percent of Hudco’s loan portfolio is towards housing finance loans and the balance 69.12 percent is towards urban infrastructure finance loans and project linked bonds, the company has said in an investor presentation.

Total loans disbursed in the nine months ending December 2016, were Rs 37,482 crore.

“Hudco has decent visibility its financing is towards government projects, where the incremental risks are low” says Siddharth Purohit, senior research analyst at Angel Broking.

Hudco’s high NPAs but not so much a concern

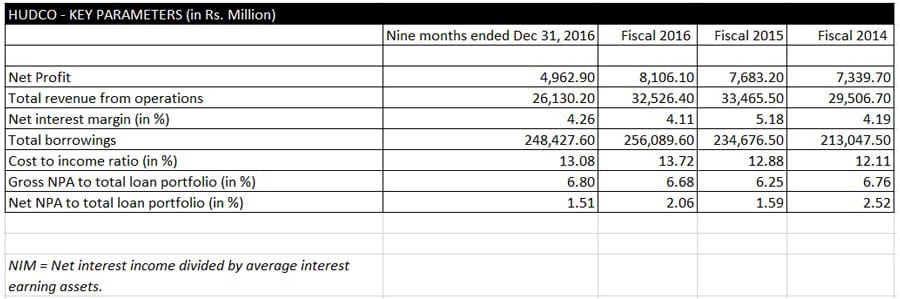

Hudco’s financials do reveal that it has a high level of non-performing assets, at 6.8 percent of total assets, (see table). This, analysts say, is due to loans which were towards private sector projects.

“The Gross NPA ratio for loans made to state governments and related agencies is very low, at 0.75 percent,” say IIFL analysts Franklin Moraes and Rajiv Mehta, in a note to clients.

Further, the data from the company also shows that Hudco has decided to stop financing private sector projects, also the gross NPAs for housing finance loans have been historically lower at 3.08 percent, compared to gross NPAs for urban infrastructure loans, which are estimated at 8.4 percent.Analysts say that going forward, with the focus towards housing finance and more so government linked projects, there would be less asset quality pain.

Housing thrust from government

Rising mortgage penetration, increased urbanization, a shortage of housing across urban and rural India and the need for housing credit are all compelling drivers of growth for Hudco. India faces a shortfall in housing needs, estimated to be 19 million in urban housing between FY12 to FY17 and 44 million in the same period towards rural housing, the Hudco presentation showed.

The Narendra Modi-led government has embarked on an ambitious “Housing for all by 2022” two years ago, with a focus on 500 Class I cities.

All this reveals that from a housing perspective, state governments will continue to play a critical role to help finance housing needs for the low income and economically weaker sections of society and families in rural India. These have become important growth drivers for a company like Hudco.

According to ICRA, the housing finance sector will register a growth of around 18 to 20 percent in fiscal 2017, compared to a five-year CAGR of 18 percent in fiscal 2011 to 2016. The growth is likely to be supported by some pick-up in primary sales, new launches and a healthy growth in the affordable housing segment, ICRA has said.

Timing the market right

Hudco comes to the market, attempting to ride on the strong wave seen for Indian equities – at a time when both the BSE and the National Stock Exchange benchmark indices have hit record highs in recent days-- and investor appetite for IPOs appears to be favourable.

“The timing could not have been better,” Hudco’s chairman and managing director M. Ravi Kanth told the media late last month.

India’s IPO market has started to see a spurt in activity between January and March 2017, with offerings from Shankara Building Products and Avenue Supermarts DMart IPOs in March. Backed by noted investor Radhakishan Damani, the DMart IPO raised Rs 1,870 crore in early March and was listed at an over 100 percent premium to its issue price of Rs 299 in its trading debut at the markets.

In April, textbook publishers S Chand & Co.’s Rs 728.5 crore IPO was oversubscribed nearly 60 during its three day subscription, based on data at the stock exchanges.

First Published: May 06, 2017, 07:30

Subscribe Now