Yogi's consumer pivot begins to pay off

Many years ago ITC made a bold bet on building a consumer business from scratch. In the next decade it may finally begin to pay off

How does one judge YC Deveshwar? - a man whose list of achievements as chairman of Indian Tobacco Company or ITC are formidable. An ITC lifer (except between 1991 and 1994 when he was chairman of Air India) he’s spent the last 19 years as chairman of India’s largest tobacco company.

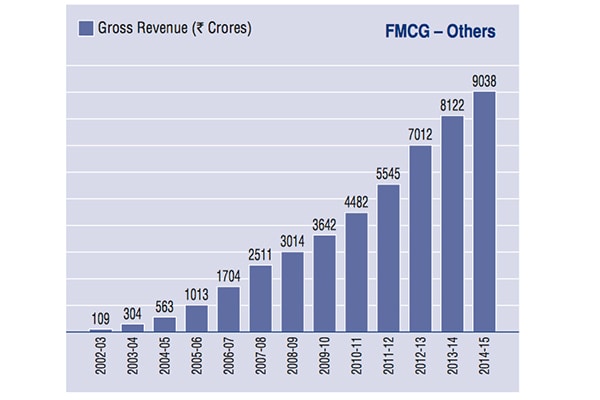

He’s widened and deepened the company’s tobacco business moat. Over the years the cash flows of this business have allowed ITC to incubate a series of businesses from hotels to paperboards and agri-businesses to information technology. But it is the company’s strategic pivot towards consumer goods that has been the most keenly watched. Rightly or wrongly for Yogi, as Deveshwar is known, this is the most viewed metric on which industry watchers, analysts and shareholders have judged him. On Tuesday, Deveshwar announced that he would let go of his executive role in February 2017 while staying on as non-executive chairman till 2020.As the chart shows ITC has recorded an impressive increase in its revenues from consumer goods. In 2014-15 they stood at Rs9038 crore larger than venerable Indian consumer companies like Marico and D abur. Sure the business lost a lot of money till as late as 2010-11 but Deveshwar showed he had the patience to persist. The strong profits that the tobacco business was churning out till 2013-14 played no small part in this.

As the cigarette business has come under pressure from increased taxes and stronger regulation (everything from an advertising ban on packets to a ban on surrogate advertising) the consumer business has proved to be an effective counterweight. While ITC doesn’t break out segment wise numbers its fair to assume that even as the consumer businesses inch up to a quarter of the top line the consumer business profits are miniscule as a percentage (probably no more than 7-8 percent) of the Rs10,061 crore the company earned in 2015-16.

Still, Deveshwar’s achievement stands tall when compared to the criticism he’s had to endure and the fact that even British American Tobacco or BAT, a large shareholder hasn’t been able to pull this off. As the government continues to tighten the screws on tobacco companies shareholders will increasingly look to the consumer business. Deveshwar wont be around to see that but shareholders will know whom to thank.

First Published: Jun 23, 2016, 17:45

Subscribe Now