Pocket FM wants to be the Netflix of long-form audio

The all-at-one-go bingeable release model, championed by Netflix among video streaming services, has helped Pocket FM drive engagement, increase listeners and clock higher revenues

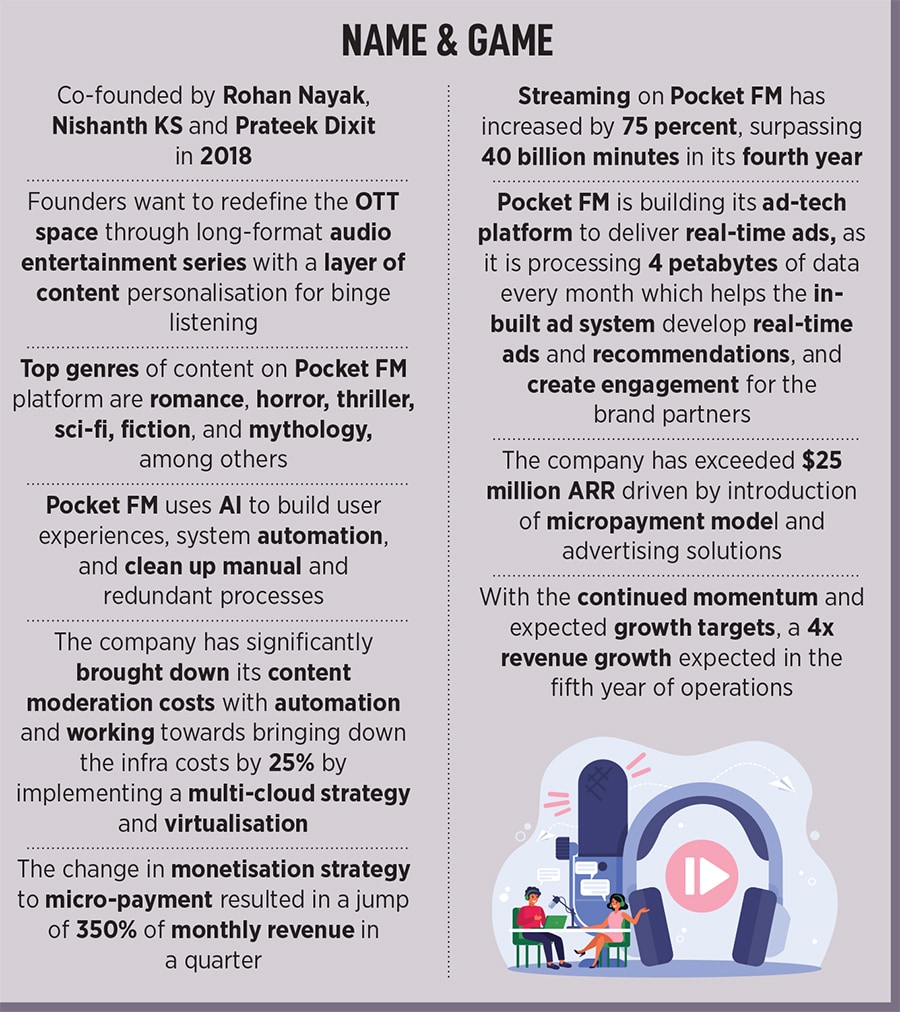

In the cacophony of social media and short videos, with people speaking over each other, three young engineers ventured out to offer long format audio series in India, an idea that appeared to not work from the get-go given people’s shrinking attention spans. But the idea of a long-format audio series hit the right chord and is today generating $25 million ARR (annualised revenue run-rate), an achievement, Pocket FM boasts, it has clinched in its fourth year of launch.

“We want to make Pocket FM the Netflix of audio OTT platforms, releasing bingeable long-format series to keep listeners hooked," says Rohan Nayak, CEO and co-founder, Pocket FM. The all-at-one-go bingeable release model, championed by Netflix among video streaming services, has helped Pocket FM drive engagement, increase listeners and clock higher revenue.

Along with his collegemate from IIT-Kharagpur, Nishanth KS, and techie friend Prateek Dixit, Nayak founded Pocket FM. The audio series platform has diversified genres in multiple languages. The idea was born during Nayak’s long commutes at work and his desire to listen to something entertaining other than music. “During my long travel time to office, I realised the need of audio storytelling in Indian languages. The only relief during these long drives was FM stations and music apps. However, the content was repetitive, sometimes irrelevant, and lacked the entertainment booster," Nayak recalls.

With experience of building and scaling mobile-based content products during their past stints with Paytm, JioSaavn, Flipkart and Grofers, the founding team of Nayak, Nishanth and Dixit wanted to create a niche segment in audio entertainment beyond music.

Boosted by its unique micro-payment model, which the company calls “freemium", Pocket FM breached the $25 million annualised revenue run-rate (ARR) in October. It is a significant jump from $2 million in September 2021, and aims to hit $100 million ARR by next year. ARR is a financial indictor that predicts the annual performance of the company.

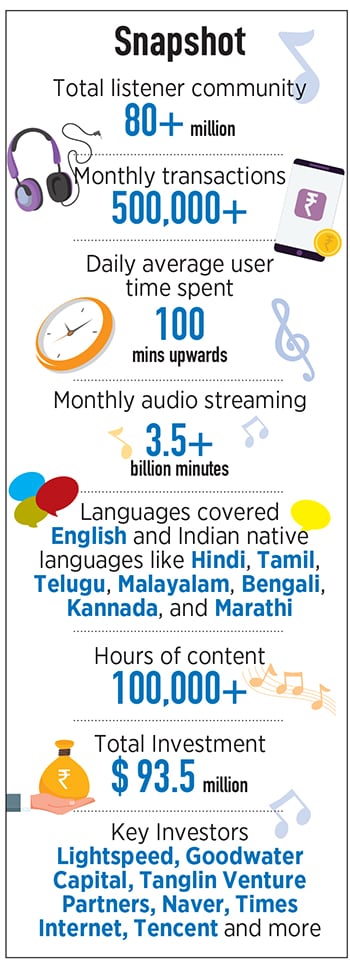

“Pocket FM has seen a hockey-stick growth trajectory over the past few months, not only limited to listeners’ and creator growth, but also an exponential rise in revenue. Currently, listeners are spending an average of over 100 minutes every day, while the total monthly audio streaming on the app counts to over four billion minutes," Nishanth (also COO) says. He adds that with the introduction of micro-payment, the platform has registered a 10 times revenue growth during the fourth year of operations, with over 500,000 monthly transactions.

Behind the revenue growth is the strategic role of artificial intelligence (AI) and machine learning (ML) to personalise content, create/produce content and customise discounts using micro-payments. “Technology has been the core of Pocket FM’s growth," says Dixit, also the CTO.

“Our AI and ML enabled technologies, which are unique for Pocket FM, have helped us to understand listeners’ data insights and simplify things, helping us cut expenses elsewhere. It has accentuated advanced, personalised content recommendation engines to drive higher user engagement and retention," Dixit adds.

Pocket FM is building generative AI capabilities across natural language processing (NLP), text2speech and image, which will drive faster production and content testing. It is also ramping up its AI capabilities for automated content moderation and quality testing. According to Dixit, AI-enabled strategies have resulted in 16 percent rise in transacting users and 10-12 percent rise in revenue from April 2022.

Available in Hindi, English, Tamil, Telugu, Kannada, Malayalam, Marathi and Bengali, Pocket FM offers content mostly in genres like romance, horror, fantasy and sci-fi, mythology, suspense and thriller in episodes ranging from 10-15 minutes to 25-30 minutes. Its Tamil series Vaseegara recorded over 1,700 episodes. Some of its hit titles in the audio series segment include Ye Rishta Kaisa Hai (405 million listens), Love Contract (200 million), Yakshini (195 million), Shoorveer (129 million) and Secret Affair (120 million).

Over 80 percent of its listeners belong to the 15-35 age group, with Bengaluru, Mumbai, Delhi, Pune and Hyderabad being the top five cities. Audio series on Pocket FM are also popular in small towns and hinterlands, the company claims. On an average, listeners spend 100 minutes on the platform daily.

Audio series, the long-form storytelling category, has an audience following of over 50 million listeners, of which 26 percent binge on romantic content, while 20 percent thrive on thrillers.

Currently, Pocket FM has 733 audio series, besides audio books. It has clocked over 120,000 audiobook sales every month after it launched this segment in March partnering with Indian and international publishers like Harper Collins, Juggernaut and Manjul Publishing. It has over 500 bestsellers, and the library is expected to surpass 1000 by 2022-end.

Pocket FM rolled out its online reading platform ‘Pocket Novel’ last October. In about a year, the property has seen over 100,000 novels uploaded by the writer community, with over 100 minutes average user time spent daily. It has recorded over 400 million reads during the period, while top-performing novels are converted into audio series.

The company has raised a total of $93.5 million so far with $65 million capital infusion in March led by Goodwater Capital, Tanglin Venture Partners and Naver. Other key investors include Lightspeed, Tencent and Times Internet.

What struck a chord with investors is user traction and engagement on the platform of Pocket FM, especially after it expanded to the US markets.

“What really excites us about Pocket FM is the team’s DNA of data-driven experimentation and decision-making, and their strong focus on sustainable unit economics. We have been investing with deep conviction in the team’s ability to execute and build a massive business in this category," says Sankalp Gupta, partner, Tanglin Venture Partners.

Gupta adds that Pocket FM created a playbook in India and leveraged that to launch in the US. “Their great initial traction in the US demonstrates that there is a global appeal for the product," Gupta reiterates. He sees Pocket Studios, Pocket FM’s creator platform, becoming an IP powerhouse not just for audio content, but also licensing out IP for other formats like videos and movies.

While audio IP, content licensing and syndication are the next leg of expansion Nayak sees for the company, he also nurtures ambitions to see Pocket FM getting listed in stock markets via the IPO route.

With growing internet and smartphone penetration, the audio OTT industry in India is dominated by players like Apple Music, Spotify, Amazon Music, Gaana, Wynk, Audible and JioSaavn, which are producing and distributing mostly music and an emerging genre-podcast. The rise of audio OTT platforms has provided the Indian audience with a new medium, transforming the country from a traditional audio-visual market to one with an audience for digital platforms.

In 2021, many companies had started to experiment with podcasts, generating millions of listeners per month with genres like comedy, business, news, religion, and storytelling. “Monetisation of this content, though in its infancy, commenced at a platform level for a bouquet of podcasts. New formats around social audio also became popular. Since the launch of Clubhouse, platforms started to experiment with their own versions of audio apps," says EY-FICCI in the report ‘Tuning into Consumer: Indian M&E rebounds with a customer-centric approach’, released in March.

With hiccups along the road to growth, Pocket FM founders aim to make its content accessible across platforms enabling a seamless experience across wearable devices, IOS, web, mobile, fire sticks and home speakers like Alexa for those hours of the day when ‘ears are free and eyes are busy’.

Despite the steep road ahead to profitability, Nayak says, the company enjoys high gross margins and low customer acquisition cost (CAC) payback period. CAC payback is the number of months it takes for a company to recover the cost of acquiring a customer a shorter CAC payback indicates faster growth. Currently, Pocket FM’s payback period is less than 12 months.

“The company’s focus is on sustainable and profitable growth with strong unit economics. Micropayments for content monetisation models have spiked revenue significantly and we want to continue investing in expanding and nurturing our content creator community. With this current growth rate, we are on the path to profitability," Nayak says.

First Published: Nov 25, 2022, 11:01

Subscribe Now