Spinning a greener yarn: Sustainable fabrics' day in the sun

Plant-based sustainable fabrics are gaining ground in the textile and fabric industries, as increasing economies of scale hold the hope of greater affordability

Sustainably grown forest

Sustainably grown forest

Image: Lenzing AG

In the 1990s, when Spanish garment retailer Zara opened shop in New York, it claimed to be able to produce a garment—from the design stage to being sold in stores—in only 15 days, thus giving rise to the term ‘fast fashion’. Since then, the term has gone on to define mass-produced, inexpensive, poor quality and disposable garments and footwear that move quickly from fashion catwalks to stores in order to cash in on current trends.

According to the European Parliament, the average number of collections released by European apparel companies per year has gone from two in 2,000 to five in 2011, with, for instance, Zara offering 24 new clothing collections each year, and H&M between 12 and 16. This has led to consumers seeing cheap clothing items increasingly as perishable goods that are ‘nearly disposable’. According to British clothes waste charity Traid, the average garment is worn 10 times before it is thrown away. Of the discarded garments and footwear, about 85 percent end up in landfills, while less than 1 percent is recycled.

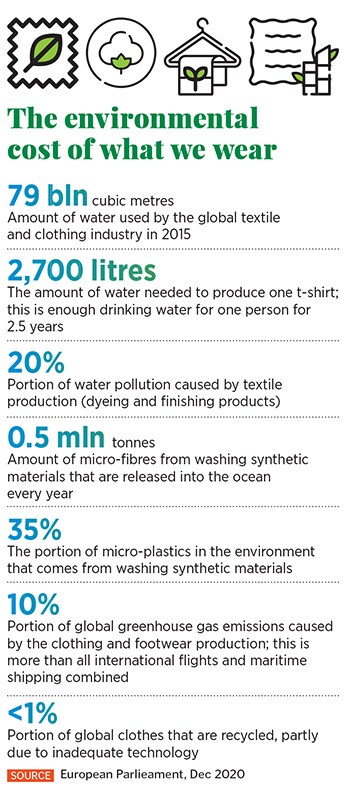

The global textile and fashion industries have also grown to be one of the most natural resource guzzling and polluting sectors. For instance, the amount of greenhouse gases these sectors produce is more than emissions of the global aviation and maritime shipping industries combined (see ‘The environmental impact of what we wear’).

It is expected that the global textile market will expand at a CAGR of 4.4 percent from 2021 to 2028, by which time it would be worth $1,412.5 billion, according to a March 2021 report by Grand View Research Inc. The India and US-based market research and consulting company pegs this growth on factors such as rising consumer awareness, fast-paced changing trends in the fashion industry, and the rise in the ecommerce platforms.

Austria-based Lenzing Group innovates on technology to create regenerated fabrics like Tencel by extracting cellulose from wood pulp drawn from sustainably grown forests

Austria-based Lenzing Group innovates on technology to create regenerated fabrics like Tencel by extracting cellulose from wood pulp drawn from sustainably grown forests

Image: Lenzing AG

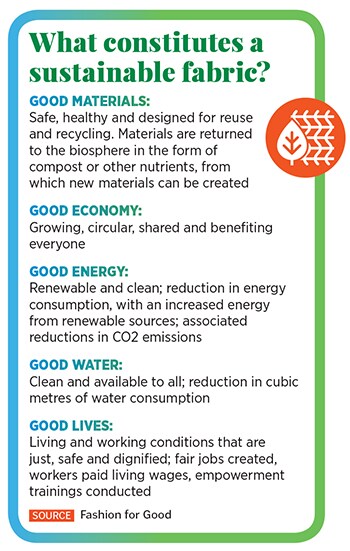

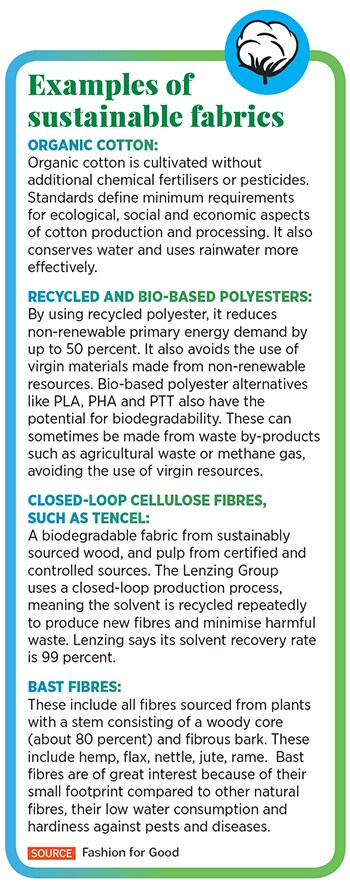

To counter the severe environmental impact of this massive growth in the manufacture and use of conventional textiles, what has been slowly gathering pace is the rise of sustainable fabrics. These have significantly lower impact on the environment, whether it is during the manufacturing process, their use, or in their end-of-life impact. For instance, use of recycled polyester reduces the dependence on non-renewable energy by 50 percent, while also avoiding the use of virgin materials made from non-renewable natural resources. Fabrics like Tencel are sourced from sustainable forests, and manufactured in a closed-loop process in which up to 99 percent of chemical solvents are recovered and recycled repeatedly, thus minimising wastage and pollution (see ‘Examples of sustainable fabrics’).

The growth of plant-based sustainable fabrics

The growth of plant-based sustainable fabrics

Among the innovations that have taken place in the space of sustainable fabrics is the technology to create regenerated fabrics by dissolving cellulose from tree wood in chemical solvents and forming fibres from the extracted cellulose. What makes the process sustainable is the fact that the wood pulp comes from sustainably grown forests—of trees such as eucalyptus, spruce and beech, usually—and the closed-loop process, in which the chemical solvents are almost entirely recovered and reused. Different types of regenerated fabrics include lyocell, linen, modal, alginate and crabyon.

One of the major manufacturers of such cellulose-based fibres is the Austria-based Lenzing Group. The company partners with global textile and non-woven manufacturers, and its fibres form the basis of a variety of textile applications ranging from women’s wear and denims to high-performance sports clothing. The cellulose-based fibre brands that it manufactures are Tencel (for lyocell and modal), and Lenzing Ecovero (for eco-viscose) it also makes Tencel fibres with Refibra technology, which focusses on circularity and uses cotton waste from the garment industry, which is then recycled and blended with lyocell. “The fibres that we make are 100 percent biodegradable and do not release any waste, such as microfibres, into the environment, or into the water," says Avinash Mane, commercial head, South Asia, Lenzing AG.

The total fibre capacity of the Lenzing Group in 2020 was 1 million tonnes, of which about 65 percent is contributed by specialty fibres. The majority of these consists of Tencel-branded fibres, followed by Lenzing Ecovero fibres. As a market, India (including South Asia) now accounts for 20 percent of the global volume consumed.

Mane recalls the time when the Lenzing Group entered India in 2007, and went through the process of convincing textile and garment manufacturers to try the cellulose-based fibres, because the industry is dominated by cotton products. He had to demonstrate to the established players in the Indian textile sector, accustomed to fibres such as cotton, silk and petroleum-based polyester, that Tencel’s lyocell and modal are as easy to weave, dye, cut and stitch as conventional fabrics. “One of the earliest orders we got was from Jockey, makers of innerwear," he remembers.

Mane recalls the time when the Lenzing Group entered India in 2007, and went through the process of convincing textile and garment manufacturers to try the cellulose-based fibres, because the industry is dominated by cotton products. He had to demonstrate to the established players in the Indian textile sector, accustomed to fibres such as cotton, silk and petroleum-based polyester, that Tencel’s lyocell and modal are as easy to weave, dye, cut and stitch as conventional fabrics. “One of the earliest orders we got was from Jockey, makers of innerwear," he remembers.

Thirteen years later, Lenzing counts designers such as Anita Dongre, Ritu Kumar, Abraham & Thakore and Rajesh Pratap Singh as collaboration partners among mainstream brands it has brands such as Levi’s India, Arvind Ltd, and D’décor as clients. These clients have not only included the fabric in their portfolios but have also agreed to co-brand the product (along with Tencel or Ecovero) in order to raise more awareness about the sustainable nature of the clothes. “In the last few years, we are also seeing smaller startups and designers who are focusing on sustainability as clients," adds Mane.

Kriti Tula, creative director and co-founder of sustainable fashion label Doodlage, says she is mostly exploring alternative, recycled material at the moment as that is what her brand stands for—made from waste. Among such materials are recycled PET, cotton and econyl. Doodlage has collaborated with Tencel as well, and has created a collection with their waste. “We upcycled 900 MT of waste in the process," says Tula.

“We constantly research new-age material, and every material has a different nature and is sustainable in its own way," she adds. “But something that would be common between all sustainable fabrics versus conventional natural fabric would be that, besides being biodegradable, these materials have low environmental impact in the production process and are more often than not produced ethically."

“We constantly research new-age material, and every material has a different nature and is sustainable in its own way," she adds. “But something that would be common between all sustainable fabrics versus conventional natural fabric would be that, besides being biodegradable, these materials have low environmental impact in the production process and are more often than not produced ethically."

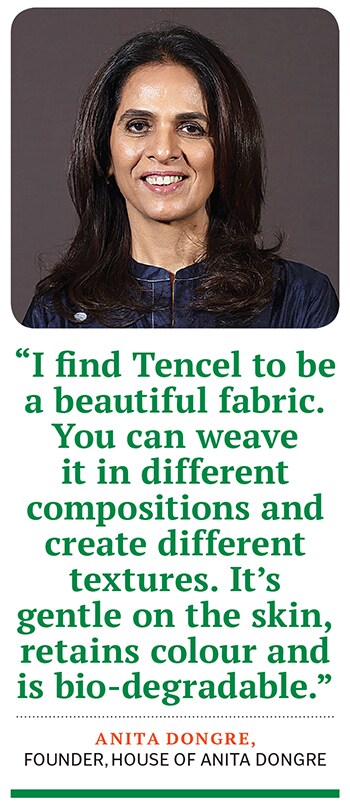

This April, fashion designer Anita Dongre collaborated with the Lenzing Group to launch her new Spring Summer 2021 collection, Sounds of the Forest, using Tencel fibres, with which she has been working for four to five years. “As a company we are always trying to source fibres that are produced in a sustainable manner. So many fibres and components go into the making of one garment, and my sustainability team and I are always thinking of how we can slowly move towards working with companies that are producing fabrics in a responsible manner," she says.

Dongre finds Tencel to be a versatile fabric, and it is possible to create many options with it. “As a creative person, I find it to be a beautiful fabric to use and work with, to create different textures. Tencel is only a fibre, and you can weave it in different compositions and create different textures, and then you can print on it, dye it, and embroider it. Tencel is gentle on the skin and a very soft fabric it is breathable, it retains colour, and it is bio-degradable. So for me it ticks all the right boxes," she adds.

And it is not just high-end designers who are collaborating and working with sustainable fibres. Mainstream Indian brands such as Fabindia and Cottonworld, known for their use of natural fibres, have made fabrics such as Tencel and lyocell a part of their apparel range.

Last October, ecommerce platform Myntra tied up with the Lenzing Group to launch a range of festive clothing made of Lenzing and Ecovero fibres. The reasonably-priced apparels provided a wide range of fashion choices, and were offered by top brands like Roadster, Dressberry, Mast & Harbour, and House of Pataudi. “As one of the leading fashion retailers in the country, we are curiously conscious and committed to working towards serving the evolving fashion preferences of our customers with holistic offerings. This collaboration will further enhance Myntra’s commitment towards the ecosystem," Amar Nagaram, CEO of Myntra, had said at the time of announcing the partnership.

Sustanable fashion label Doodlage explores alternative, recycled material like PET, cotton and econyl and Tencel as well, which have low environmental impact on the production process

Sustanable fashion label Doodlage explores alternative, recycled material like PET, cotton and econyl and Tencel as well, which have low environmental impact on the production process

In 2020, textile and garment major Arvind Ltd also tied up with the Lenzing Group to launch shirts and suiting material made from Tencel. “From innovation in fibre to sustainability in fashion, Arvind has been revolutionising the fashion industry and powering high-fashion brands across the world with continuous innovative offerings. There it was only natural for us to partner with the Tencel brand. Staying true to Tencel’s core promise, each garment is light and breathable, with added performance features, and at the same time is high on sustainability," said Pravan Dave, CMO of Arvind Ltd, while announcing the collaboration.

Challenges of using sustainable fibres

Despite the rising acceptance of plant-based, sustainable fabrics in the textile and fashion industries, mass-scale adoption is still a distance away.

“Most new technologies are often limited in quantity and come with a high price tag," says Georgia Parker, innovation manager at Fashion for Good, a global platform for sustainable fashion innovation. “Economies of scale help bring prices down over time. Bio-fabricated materials, in almost all instances, will sell at a premium for the foreseeable future. As a result, brands at the mass or lower end of the market will likely have to wait a little while longer before bringing these materials to market."

Tula of Doodlage says, “The cost of these [sustainable] fabrics is often much higher when compared to conventional material.

Responsible production and economies of scale both impact this cost." She adds that the extent to which sustainable fabrics can increase the cost of the final product “completely depends on the material you are buying. Responsibly made recycled material on handlooms costs about three to four times more than the price of a conventional material. In the case of medium- to low-grade leather versus its alternatives like Pià±atex [a natural leather alternative made from cellulose fibres extracted from pineapple leaves], the cost could be 20 times more."

Dongre says working with sustainable fabrics is more about doing the right thing as a manufacturer and designer, rather than meeting consumer demand. “It’s a very, very small percentage of consumers who are actually concerned with issues such as sustainability, but that has not deterred people like us who want to do the right thing. The percentage of people who buy garments because they are environmentally friendly is negligible," she says. “I am doing this because I want to do it, not because the consumer is asking for it."

She adds that today every designer has a responsibility, and if they are supporting any manufacturer or process that is better than someone else who is cutting corners and making it cheaper, they have to pay that 10 to 20 percent more to support the right causes.

“Anything that you want to do right today will cost you a little more. Responsibility comes with a little more expense, but in the long run it is better to support that than to just support something because it is cheaper," she says. Although adapting to sustainable fabrics is a slow process, Dongre wants to work 100 percent with only environmental friendly fibres over the next three or four years currently, Tencel forms 50 to 60 percent of her ready-to-wear line.

Mane from the Lenzing Group draws a parallel with organic groceries. “When organic vegetables were introduced in the market, they were far more costly than regular vegetables. But today, the cost is hardly 5 to 10 percent more. In the same way, when Tencel and Ecovero products were at the introduction stage, there weren’t many mills available to weave these fabrics, and the cost of manufacture was on the higher side. But now, with volumes going up, the costs have come down significantly, and at present it is on a par with mid- to good-quality cotton."

Mane adds that plant-based products also provide price stability in the textile markets. “The price of cotton is dependent on the global cotton index, while the price of polyester depends on global petroleum prices. The production capacities of our cellulose-based fibres are increased in a planned and phased manner. We cannot either increase or decrease our production in a dramatic way, and this stabilises the supply chain and makes retailers happy."

Parker says new fibres have to compete with highly commoditised prices of the current alternatives, such as cotton and PET, which together make up about 75 percent of the fibre market. “For anything to truly take off and start displacing those fibres, they must be price-competitive, while performing on par or better versus the displaced fibres. That’s, of course, not an easy task, but it also takes time."

Years of development, testing, certifications and safety standards need to be met before new materials can be made available for use. For example, cellulose was discovered in 1838, but made into a consumer product, as viscose, in the 1880s it has continued to evolve to this day. Likewise, Lycra took decades to develop before becoming commercially available.

Parker points to the fact that many innovative fibre categories started out as more expensive niche fibres, and after costs came down, took over more and more of the market. “There is no reason to assume the innovative fibres we are working on do not require such a route to scale."

First Published: May 28, 2021, 12:56

Subscribe Now