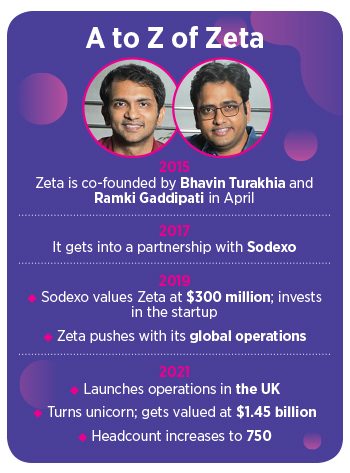

Then why now with Zeta? What has changed? Turakhia reckons it’s the global opportunity, and aspiration to take a bigger, bolder bet. Banks across the globe, he maintains, spend roughly $200 billion in IP spend. “Our goal is to try and get Zeta to address a significant chunk of that," he says. Zeta has over 750 employees across its offices in the US, UK, Middle East and Asia “We have extremely ambitious plans to scale up," he adds.

The investors are backing the vision. Banking software is a $300 billion industry globally, says Munish Varma, managing partner at SoftBank Investment Advisers. Most banks still employ technology which is significantly older than their customers, impacting user experience and engagement. Zeta’s modern Omni Stack will drive banking software upgrades catering to the digital consumer, and innovations in financial services globally, he adds.

![]()

What has also whetted Turakhia’s global appetite is the massive tailwind over the last year. The pandemic, he explains, has made almost the entire economy, including banks, think digital first. “Our product lineup was just fit for their needs," he claims. What made banks come out of their comfort zone was a bunch of pluses for them. A cloud-native SaaS (software as a system) that requires minimal capital investment, minimal IT infrastructure and training is something the banks couldn’t resist in their pursuit of a digital-first product strategy, he adds. Moreover, most financial institutions are looking to accelerate digital transformation and have realised the benefits of a cloud-native modern stack that can enable them to launch new-age banking products. “We saw a massive interest and uptake during this pandemic," he says, declining to share the financials of Zeta. “We haven"t provided any guidance around revenue numbers," he says, adding that Zeta counts among its customers over 10 banks and 25 fintech firms across eight countries.

Industry watchers are not surprised with Zeta’s brisk growth. “Anyone who has used a banking website or app will see the need for a player like Zeta instantly," reckons Srikrishna Ramamoorthy, partner at venture capital fund Unitus Ventures. He explains what’s wrong with the banks. The user experience is not the best in fact, at times it’s broken and traditional banking technology hasn’t kept up with the times. Such issues have fuelled the rise of neo-banks and fintechs across the globe. Customers now want the ecommerce-like experience or the app store experience in banking which old banks can’t provide. “Zeta helps traditional banks reduce the ‘technology debt’ that most of them have carried for decades," he says. By doing so, he adds, Zeta helps the bank upsell and cross-sell better.

What has also worked for Zeta is morphing into a one-stop solution for banks. The fintech startup, Ramamoorthy lets on, has managed to ‘productise’ requirements of the banks, which might have earlier been managed by the bank using a dozen different vendors. As banking needs and processes are fairly similar across the world, it now makes sense for Zeta to cater to the wider global market. “That’s the bold bet now," he says.

Back in 2015, a bunch of Zeta’s domestic bets didn’t pay off. Turakhia calls them experiments. For a few months, the co-founders started to build the payments business, and piloted a wallet in Mumbai and Bengaluru. The idea was to design an effective payment mechanism for everybody, including autorickshaws, shops, and merchants. Unfortunately, the venture couldn’t scale. “But it had a lot of learning," he recalls.

The young startup then took a stab at solving the pain-point of cafeterias. The plan was to automate payments. Cafeterias, Turakhia recalls, are one of the most stressful places to collect payments. A typical lunch break lasts for an hour, and the entire campus or company descends on a restaurant. The scene gets all the more chaotic if hungry people get angry with poor services. “It"s quite challenging as compared to any other payment problem," he says. The experiment again couldn’t scale.

Gaddipati, Zeta’s co-founder, points out another memorable mistake. “Bhavin and I got very excited about a product called Collect Card," he recounts. “In fact, we felt it was a magical innovation," he laughs. The logic behind the card flipped the notion of how payment cards work. Most card solutions, he explains, are about customers carrying a card, taking to a card machine and then the merchant swiping it. Zeta did exactly the opposite. While making the payment, the merchant would swipe his card, and the customer just needed to enter a PIN for the transaction to complete. The co-founders were delighted with the idea, which simply meant that merchants would not have to worry about getting a new payment terminal or sticking a certain QR code or anything. “We thought this would dramatically solve the mobile-based payment problem across the country," he says. The product and the experiment were discontinued after a few months. Excitement, he lets on, at times doesn’t translate into success.

Turakhia, though, views the imposters—success and failure—from a different lens. “We don"t tend to think of success as an objective and failure as an outcome," says the man who turned entrepreneur when he was a teenager. In 1998, Turakhia and his younger brother founded Directi as a web-hosting business from their parents’ house in Mumbai. The duo took a loan of Rs 21,000 from their father, and within four years, their fledgling business posted a revenue of $1 million. Over the next few years, the revenues leapfrogged to $10 million. Entrepreneurship, Turakhia maintains, is like a journey towards mastery. “There is no binary outcome. There is no final outcome. It"s a lifetime journey," he says. The serial entrepreneur views success and failure too from the same philosophical lens. “You learn from failures and you celebrate successes," he says. The goal, though, is to become a better version of oneself.

![]()

For somebody who turned founder at 17, is he not scared of failure? Having an almost 100 percent strike rate in all ventures so far, does the thought of missing the bull’s eye play on his mind? Turakhia smiles. “I believe that it’s our moral obligation to make an impact that is proportionate to our potential," he says. Having a fearless mindset is something that he learnt from his father. Turakhia recalls the words of wisdom: You can achieve anything if you set your mind to it. “That"s what my father used to tell us all time," he says. What he is scared of at times, though, is something that most might find amusing. “It"s okay to fail, but the thing that scares me the most is not giving my best shot," he says.

Turakhia now wants Zeta to become best in the world. The target over the next 24 months is to be present in pretty much every country across the world. “Our goal is to make Zeta the default model platform for banks," he says.

Back in India, it has been raining goals of a different kind: Startups getting the prized tag of unicorns, privately-held companies with a valuation of $1 billion or more. Turakhia tries to decode why India is witnessing a flurry of $1 billion-plus companies. When any ecosystem reaches a level of maturity, he explains, the impact that the same people can make becomes much bigger. Eighteen years ago, the impact that a startup in India could have made was small. Reason: The domestic market was not big ability to scale globally was missing and opportunities were limited. Though things have changed massively in India for startups over the last few years, for entrepreneurs, the focus must be on value, and not valuation, he insists.

Though Zeta’s offering makes it unique, is there something that differentiates it from a sea of fintech startups that have emerged over the last few years? Turakhia names just one factor. “Focus," he says. Back in 2014, when he was brainstorming about disrupting the financial ecosystem, there were three ready options. First, start a bank. Second, become a fintech player. And lastly, turn into a technology service provider. The temptation to do all was hard to resist. After all, the precedent was there. Taxi cab operators add fintech products fintech players add ecommerce businesses and ecommerce businesses add travel services, Turakhia wrote in his blog in 2019. Capital tempts into buying and juggling more balls. But one needs to learn how to catch one before adding five more. “Your probability of success," he concludes, “is directly proportional to focus and inversely proportional to the number of balls you juggle."

*****

Zeta’s Tech Factor

How chief technology officer Ramki Gaddipati turned out to be the X-factor of Zeta

Ramki Gaddipati knows only one thing: Product engineering. In 2008, he joined Directi as a project lead, and closely worked with the Turakhia brothers to build various platforms and multiple messaging services. Take, for instance, Flock. Started in 2014, the enterprise and a real-time team messaging and collaboration platform focussed on simplifying communication and boosting productivity. “We shared mutual trust and transparency," says Bhavin Turakhia. Back in 2014, the duo often discussed and expressed frustration around payments. Banking, both believed, was one of the last industries where customer experience had stayed stagnant. “Even space travel got disrupted before banking," exclaims Gaddipati, who exited Directi in 2014 as senior director at software engineering. After a year, he co-founded Zeta with Turakhia.

In 2015, Zeta was staring at a huge problem, and an opportunity. The co-founders set a goal of building a modern platform to enable banks to offer state-of-the-art experience that can be deployed rapidly. The task, though, was not easy. Banks were used to multiple vendors offering disconnected solutions. It"s almost impossible for a bank to work with all of them in unison to create new experiences for customers. “Banking software systems are relics of legacy," says Gaddipati. While the world moved away from licensed software to SaaS, banks were still running mainframes for critical applications. Consequently, failures of the systems became a norm.

Gaddipati devised a solution to disrupt the banking structure. He built Tachyon, a banking and payments platform, that replaced traditional core banking systems and mainframe based payment systems and switches with a cloud-native technology. The product was offered as a SaaS, liberating banks from running IT infrastructure and software upgrades. “This is a first-of-its-kind in the $300 billion banking IT industry," says Gaddipati. Six out of the top 10 private sector banks in India have adopted Tachyon for various use cases, within a year of launch, claims the chief technology officer at Zeta. The platform, he adds, has now been launched in the US as well.

Turakhia acknowledges the tech heavy lifting done by Gaddipati. “Ramki’s work paves the way for banks to embrace and excel in the fintech revolution," he says. Banks now can work with each fintech as a digital branch of the bank, in lieu of the traditional brick-and-mortar branches. Over 21 fintech firms have built their business using the embeddable banking solution from Zeta and half a dozen banks have adopted it to partner with fintech, he says.