Turakhia brothers: Getting it right, time after time

Serial entrepreneurs and internet services barons, brothers Bhavin and Divyank Turakhia, have managed to replicate their success with every new business they have built

Divyank focuses his energies on one thing at a time

Divyank focuses his energies on one thing at a time

What is common between MotoGP champion Valentino Rossi and Formula 1 legend Michael Schumacher? Both were introduced to racing at an early age, and went on to become world champions. Rossi was five when he drove his first kart before shifting gears to motorcycles. Schumacher was greeted to his first kart at four. The early-age mantra has been a part of so many champions’ stories that it can easily be called a ‘recipe for success’ in the world of racing.

It also appears to apply to coding. It’s not a cakewalk to build a million-dollar business in the first outing. And the odds are stacked even higher when the business is in a nascent industry with only about 100,000 takers in the country.

But Directi founder—brothers Bhavin, 38, and Divyank Turakhia, 36—beat all odds with their web-hosting and domain name registry business that they set up in 1998, when the internet was relatively new in India. The brothers were 16 and 14 then. And while building a company may have been a first for the duo, computer tech was not new to them. Their chartered accountant father bought them their first coding book when they were eight. They devoured programming books like candy since then.

Early Success

Directi became the fastest growing domain registrar in Asia three years after it was started, they claim, and one of the fastest growing in the world at the time. It closed its first fiscal (FY1999) with $5,000 in revenues. The first million was made within five years of operations—in FY03, it posted $2 million in revenues. It rose 5x to $10 million in the next two years.

The brothers had made their first million before they were 20 they were worth $300 million in their mid-20s, and are billionaires before turning 40.

Bhavin and Divyank Turakhia are No 97 on the 2018 Forbes India Rich List with their net worth at $1.55 billion. They first found their place on the list in 2016 (No 95 with $1.3 billion).

Success Spinners

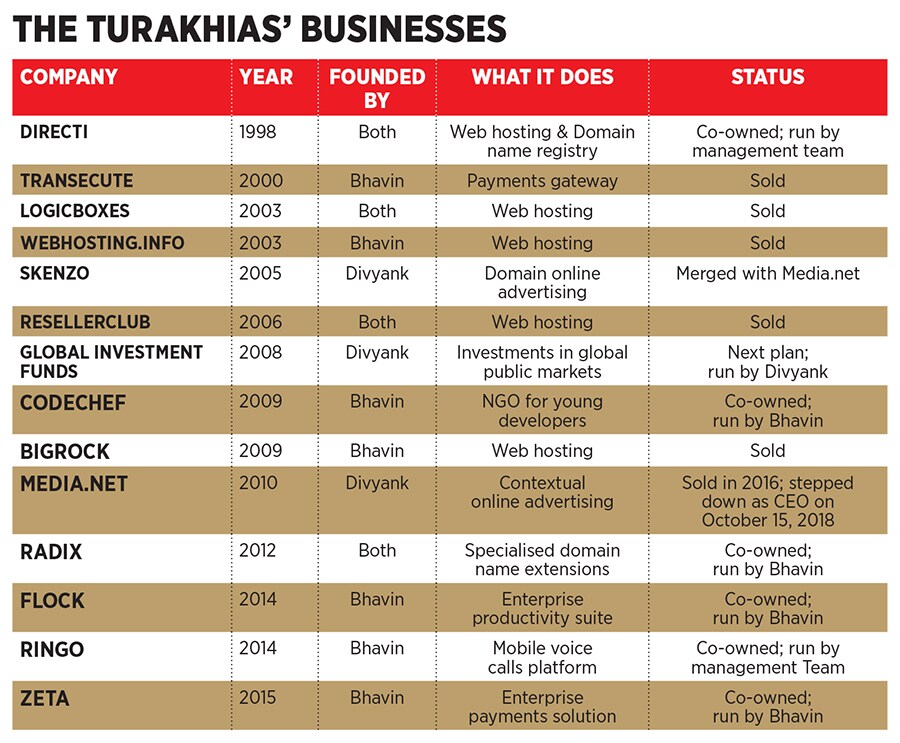

In the 22 years since they started their first business, the brothers have founded over 12 ventures, individually or together. And they co-own all the companies they have founded. “We didn’t have anything much when we were growing up. So we decided to share everything in life,” says Divyank. “We may not interfere or help each other but we both reap the gains out of our individual companies doing well.”

Despite sharing five homes across the world, the brothers don’t cross paths often. This is set to change as Divyank plans to move to London—where Bhavin spends much of his time—after stepping down as CEO of online ad-tech giant Media.net on October 15. The brothers sold Media.net in 2016 to a consortium of buyers for a whopping $900 million though Divyank stayed on as CEO. The deal was one of the largest ad-tech deals in the world at the time, and turned them into billionaires.

Multi-Million Dollar Deals

The Media.net deal may have been their largest sale, but it wasn’t their first multi-million dollar deal. The brothers have replicated their success again and again, reducing the time taken to bring their company to size with every new venture they have established. Until 2005, they were running two web-hosting and domain registry businesses—LogicBoxes, and Webhosting.info. They launched ResellerClub in 2006 and BigRock in 2009 and the four were sold to Nasdaq-listed web hosting firm Endurance Group for $160 million in 2014. It was their first successful exit.

While Bhavin started running the two businesses on his own in 2005, Divyank moved away from the web hosting businesses to launch Skenzo in the same year. It was his first tryst with online advertising and it set the stage for Media.net.

After a one-page plan and going back to the basics, Divyank zeroed in on domain advertising. “I knew nothing about online advertising, but knew about domain names more than anyone else,” he says. Domain advertising shows relevant ads to users when a non-existent website URL is entered by a user, by recognising the intent of the search. Bhavin Turakhia is a multitasker, juggling five to six companies at onceDivyank worked on things from a technological standpoint that had not been attempted earlier. Skenzo scaled rapidly and he also built lasting relationships with internet bigwigs like Google and Yahoo.

Bhavin Turakhia is a multitasker, juggling five to six companies at onceDivyank worked on things from a technological standpoint that had not been attempted earlier. Skenzo scaled rapidly and he also built lasting relationships with internet bigwigs like Google and Yahoo.

Skenzo was churning out million dollar profits a month, closing 2006 with $12 million in profits, he claims. The profits doubled to $2 million a month in 2007. “Skenzo was generating 10x the profit that the previous businesses generated as a combined total in the past eight years, in its first full year of operation,” says Divyank.

In just two and a half years, the company was valued at $240 million by PEs. In 2008, they made $200 million by selling a significant minority stake to UK-based Ashmore Group. The stake was later bought back by the Turakhia brothers.

Long-term Strategy

By 2008, Divyank had devised his long-term strategy. The plan was to find a niche and grow in it. Use that position to go mainstream. Once you have grown large in the mainstream, build vertically and horizontally across the industry segment to capture more value. “This can be practically applied to any business you want to grow,” he says.

Media.net was launched in 2010 to take a leap from niche to mainstream. To go mainstream, Divyank picked contextual online advertising. Contextual ads allow automated programs to read the text of a user-preferred webpage and show ads related to the content. At the time, Google AdSense was the only program doing this worldwide. Yahoo Publishing Network had made two failed attempts between 2005 and 2010 in contextual advertising.

“I leveraged my relationship with Yahoo to launch a co-branded contextual advertising program

with it in 2012,” Divyank says. The brothers lost money in the first two years, but the tide changed once the co-branded program went live. “From that day on, we grew like crazy.” Soon, Skenzo was merged with Media.net as domain advertising started becoming irrelevant. “This time, it took me six years to build my company to size,” says Divyank. It was sold in 2016. In the last three years, Divyank, who had stayed on as CEO, built the company vertically and horizontally across adtech. “We now have products in Search, Display, Video, Logo, and in different languages,” he adds. In Q3 2018, Media.net posted its highest-ever quarterly revenues and is on the path for FY18 to be its highest revenue year ever.

To view the full India"s 100 Richest 2018 list, click here

The Multi-Tasker

While Divyank was building an online adtech empire, Bhavin was handling four web hosting businesses. He also launched Radix, a specialised domain name registry, in 2012.

“Radix was set up to give customers a choice in the creation of their online identity and to move away from mundane extensions like .com or .net,” says Bhavin. They own ten of the largest extensions in the world like .store, .press, .online, .website, and .tech. For example, any online store in the world can buy the .store extension. “There is Amazon.store, Virgin.store,” he says. While it’s too early for any real revenue, Bhavin claims Radix is profitable.

As soon as Bhavin sold the web hosting businesses in 2014, he set up an Enterprise Productivity Suite, Flock, and communications business Ringo. Next year, he set up a payments solution platform called Zeta. “Bhavin loves building beautiful things he will keep doing it for the rest of his life because it’s the process of building that gives him happiness,” says Divyank.

A stickler for productivity and efficiency, Bhavin launched Flock to tackle enterprise collaboration logjams. “Built to rival Office 365 and the GSuite”, Flock has an instant messaging platform at its core. In its current avatar, it directly competes with enterprise collaboration tool US-based Slack. Flock will soon expand to become a suite of productivity products and services, says Bhavin.

Flock recently started monetising its product and is adding one new paid team every day, while 2,000-3,000 new companies try it out every month. It has more than 100,000 active users, and 15,000-18,000 companies use its services. About 50 percent of its users are in the US, while the other half is divided between India and the UK.

While Ringo is currently at a pause, Zeta, co-founded with close friend and associate, chief technology officer (CTO) Ramki Gaddipati, to eliminate all paper trail within organisational transactions and make them faster, has 13,000 corporate clients in India, including Accenture, Amazon, IBM, Life Insurance Corporation, Tata Motors and Mahindra. “These companies have 5 million employees, and 1.5 million are on our platform. They get benefits worth $700-800 million to spend every year on Zeta,” Bhavin says. It helps employees claim all benefits from their employers and for corporate gifting, and plans are afoot to launch an expense management program.

“Both the brothers are productivity freaks, humble, and always open to feedback from anyone,” says Gaddipati, who has known them since their Directi days and for over ten years now. “Bhavin and Divyank bring hard work, perseverance, and energy to every venture as if it’s their first and is going to be the most impactful yet.”

The Right Slot Machine

Despite being in business together for over two decades, there is a fundamental difference between the brothers: Divyank loves to focus all his energies on one thing at a time, while elder brother Bhavin is a multitasker, juggling five-six companies at once. “When someone close to you does things differently, it adds value. Bhavin likes building things, I like managing risk,” Divyank says.

Divyank credits his success to constantly managing risks to minimise failure. “I may be an acrobatic flyer and land helicopters on bridges [Divyank is an avid flyer], but I’m not adventurous. I’m actually risk averse. By training with the best flyers in the world, I leverage my potential risk and increase my chances of success,” he says. He brings the same philosophy to his businesses.

I’m constantly calculating my risks, he says. “I didn’t get lucky with $100 million because I put a dollar in a slot machine. It’s really about how I picked dollars and put them across several slot machines to mathematically get the maximum returns with the minimum risk.”

The Next Decade

Problem-solving, passion for efficiency and a personal moral obligation are the things that drive Bhavin. “I believe it is our moral obligation to make an impact that’s proportionate to our potential. All my businesses till today have been in the areas I believed I could make the most impact in,” he says. “I believe, if I can improve the productivity and efficiency of every person on the planet by 30 percent, I would have made a meaningful impact in the world.”

He plans to focus on his startups—Flock and Zeta—for the next two to three years to “build them into companies that will make an impact 20 times larger than anything I have created so far in my life.” In the near-term, Zeta is likely to expand its geographical footprint to the US, UK, Brazil and a Southeast Asian country.

undefinedThe brothers made their first million before turning 20 are billionaires before 40[/bq]

Bhavin is also passionate about education, health care and a couple of other initiatives.

Divyank is focusing solely on his $1 billion global investment fund that he has been running passively since 2008. He will remain hands-on till 2018-end and later, as an advisor with Media.net, he tells Forbes India. CTO Vaibhav Arya will be the new CEO.

In an almost fatherly farewell letter to his 1,300-plus employees, Divyank said, “I am excited to see where all of you take Media.net from here! I will be cheering you on!… In our industry, only the most innovative companies will thrive. The rest will disappear. To stay relevant, you must continue to build revolutionary products and not get comfortable. We are always in version 1.0 for everything.”

His global funds corpus is mostly invested in public capital markets so far, especially the US. He says he has done more debt than equity. “I plan to reverse that in the next decade.” In the near-term, he plans to spend the next two years learning everything he can about investing, and to restructure his funds such that they remain “forever funds”, he adds.The risk-averse Turakhia remains conservative about investing in startups. Early-stage investments are a no-no for him he prefers late-stage where he can add strategic value.

“Success comes from being boring and adding fundamental objectives to everything, and not by being a cowboy,” he says.

First Published: Nov 06, 2018, 08:00

Subscribe Now