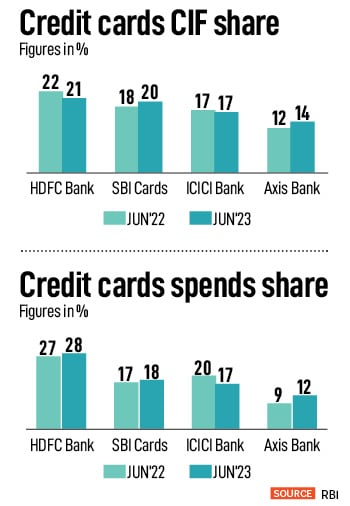

But the bank has a clear perspective on how it wants to engage with its customers. In the post Citi-acquisition of its consumer banking business—including credit cards, its reach and customer base of cardholders has grown. But it now needs to climb up the ranks in terms of share in card spends (see chart), which is why the restructuring of rewards and points had to take place, analysts say.

Some of the measures for the Axis Bank Flipkart co-branded card will start to kick in from August 12 while others for the Axis Bank Magnus card will come into effect on September 1, 2023.

In the case of the Axis Bank-Flipkart card, one can earn a cashback of 1.5 percent by using the card to pay for travel-related expenses on Flipkart. But one cannot earn a cashback on fuel purchases, gift card purchases made on Flipkart and Myntra and EMI transactions from this date onwards.

In the case of some of the features on the Axis Bank Magnus card, the bank also saw “very high usage" which got the bank to think that this accelerator burn would be difficult to sustain for a long term. And hence it introduced some changes.

Not out of line

Banks altering reward points and benefits is not something not seen earlier. In May, SBI Cards and Payment Services had said it was discontinuing the [5 percent] cashback on services like jewelry, utilities, school and educational services, and insurance besides other outlets.

In Axis Bank’s case, while obviously these actions have impacted customer sentiment, it is also the change in the terms and conditions relating to reward points on Axis Bank’s Magnus credit card, which has irked customers the most.

From September 1, 2023 onwards, on the Axis Bank Magnus card, the monthly milestone benefits of 25,000 EDGE reward points on monthly spend of Rs 1 lakh will be discontinued. This card earlier offered 25,000 EDGE reward points worth Rs 5,000 on monthly spends of Rs 1 lakh.

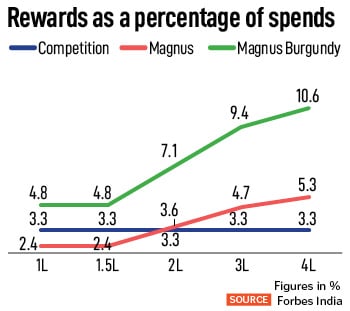

Customers will essentially need to keep spending more to start to avail the reward points. From September 1 onwards, Axis Bank Magnus credit card customers can earn 12 EDGE reward points for every Rs 200 on cumulative spending up to Rs 1.5 lakh. They can earn 35 EDGE reward points for every Rs 200 on monthly spending above Rs 1.5 lakh. This, the bank argues, is the highest earn ratio in the industry (see chart).

![]() “Magnus continues to be a market-winning proposition. If anything, with the higher earn ratio (35 points per 200 beyond Rs 1.5 lakh of spends), it becomes even more rewarding for customers spending more," Moghe says. Spends done in August will be eligible for monthly milestones and the bank has said that reward points for eligible customers will be posted within 90 days as per the normal time frame.

“Magnus continues to be a market-winning proposition. If anything, with the higher earn ratio (35 points per 200 beyond Rs 1.5 lakh of spends), it becomes even more rewarding for customers spending more," Moghe says. Spends done in August will be eligible for monthly milestones and the bank has said that reward points for eligible customers will be posted within 90 days as per the normal time frame.

Also, from September 1, the transfer ratio to convert reward points to airlines and hotel loyalty programmes for Axis Magnus cardholders will be 5:2, compared to a previous 5:4 ratio. This means for 50,000 reward points, you could now get 20,000 air miles, compared to 40,000 miles earlier.

Deepen the banking engagement

The hook here for customers is that they could still avail of the earlier 5:4 feature on points if they consolidate their banking operations with Axis Bank. Also, the rewards as a percentage of spends (see chart) double if the customer becomes a Magnus Burgundy one.

A Burgundy programme with Axis Bank entails maintaining a minimum balance of Rs 10 lakh in the savings account or a total relationship value of Rs 30 lakh or receiving a net salary account credit of Rs 3 lakh each month, besides other conditions.

![]() So at a broader level, the key message being sent out to existing and new Axis Magnus card holders—which the bank maintains is still a premier product—is that if you want same acceleration (earn) then deepen your relationship with the bank. Moghe said that in the bank’s card portfolio, customers were already spending significantly beyond Rs 2 to 3 lakh per month. “It becomes more powerful for them."

So at a broader level, the key message being sent out to existing and new Axis Magnus card holders—which the bank maintains is still a premier product—is that if you want same acceleration (earn) then deepen your relationship with the bank. Moghe said that in the bank’s card portfolio, customers were already spending significantly beyond Rs 2 to 3 lakh per month. “It becomes more powerful for them."

Additionally, Axis Bank has taken action to ascertain the authenticity of some transactions on the Magnus card. “A small section of customers was trying to exploit the rewards programme to achieve the Rs 1 lakh spends threshold by making large, frequent, commercial transactions or peer-to-peer transactions, which are not permitted as per our card’s terms and conditions," Moghe says.

The bank did not disclose the number of transactions but said it was negligible out of the total portfolio. The cards remain active, but the reward points are blocked.

With the acquisition of Citi’s consumer banking business, Axis Bank’s cards portfolio is now of 1.2 crore. Through the acquisition the bank has now been able to deepen its presence in the top eight cities in India, while Axis was anyway quite strong nationwide. Axis was strong in the mass affluent and emerging affluent market segments, while Citi’s customers are in the affluent and super affluent segments.

The bank is now well positioned across the entire customer segment pyramid.

Need to drive up card spends

The bank’s changes in the rewards points are focussed towards the high spender. The product benefits have got diluted but if the customer is willing to spend more, then the rewards are decent.

“Axis is inviting customers to spend more and more to cross the threshold. RBI data shows that spends for Axis Bank remains comparatively lower to other banks, so the strategy is to increase spends and cross-selling of other products," says Nitin Aggarwal, head of BFSI at Motilal Oswal Financial Services.

Axis portfolio spends have grown by 56 percent in FY23 as compared to FY22. Its growth in the credit card segment is good and its reach has also improved after the Citi acquisition. But it figures lower in the spends share, where it will need to catch up with the leaders such as HDFC Bank and SBI Cards.

The true test of how loyal Axis Bank’s card customers are—after the July devaluations—will be seen in the coming months, starting with the upcoming festive season. The bank promises there will be attractive features in its cards’ product line for all customers. But they will, in all probability, need to keep spending more to see benefits. After all the maths involving the reward points, one content creator tweeted on July 21: “Itna complications nahi chaiye life mey. [Don’t want so many complications in life]. Axis you can keep your points, I will keep my sanity."

“Magnus continues to be a market-winning proposition. If anything, with the higher earn ratio (35 points per 200 beyond Rs 1.5 lakh of spends), it becomes even more rewarding for customers spending more," Moghe says. Spends done in August will be eligible for monthly milestones and the bank has said that reward points for eligible customers will be posted within 90 days as per the normal time frame.

“Magnus continues to be a market-winning proposition. If anything, with the higher earn ratio (35 points per 200 beyond Rs 1.5 lakh of spends), it becomes even more rewarding for customers spending more," Moghe says. Spends done in August will be eligible for monthly milestones and the bank has said that reward points for eligible customers will be posted within 90 days as per the normal time frame. So at a broader level, the key message being sent out to existing and new Axis Magnus card holders—which the bank maintains is still a premier product—is that if you want same acceleration (earn) then deepen your relationship with the bank. Moghe said that in the bank’s card portfolio, customers were already spending significantly beyond Rs 2 to 3 lakh per month. “It becomes more powerful for them."

So at a broader level, the key message being sent out to existing and new Axis Magnus card holders—which the bank maintains is still a premier product—is that if you want same acceleration (earn) then deepen your relationship with the bank. Moghe said that in the bank’s card portfolio, customers were already spending significantly beyond Rs 2 to 3 lakh per month. “It becomes more powerful for them."