It has raised the possibility that Jio will lock horns with its India rival Bharti Airtel in Africa too, where the latter provides telecom and mobile services. But, at least for now, this will not be the case. While the turf will be the same—and Airtel already operates in 14 African countries—Radisys with NGIC offers a telecom infrastructure and vendor service, which is different from Airtel’s telecom and mobile money service.

Africa contributed about 25 percent to Airtel’s consolidated FY24 revenues and, after a tough period of initiation where it had to raise debt to keep the business running and profitability became a concern, it managed to turn the business around. Costs were lowered and it focussed on providing 4G technology. It is the second largest telecoms operator in Africa, after South Africa’s MTN, with 38 million Airtel Money customers.

NGIC will work with local mobile network operators (MNOs) AT Ghana and Telecel Ghana, besides Radisys, Nokia and Tech Mahindra, the latter being a managed service provider (MSP) for Microsoft Core Network. “NGIC aims to expand beyond Ghana, leveraging cloud and Open RAN (radio access networks) technologies to create borderless networks," says Harkirit Singh, CEO of Ascend Digital Solutions, which specialises in helping telcos build fixed and wireless network solutions.

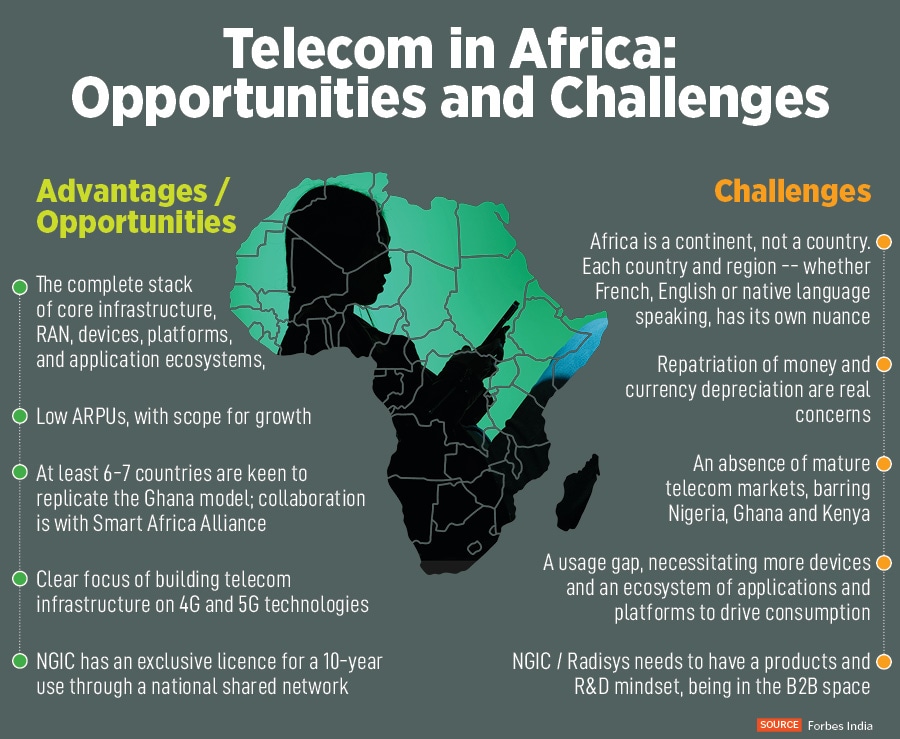

The various partners provide the complete stack of core infrastructure, RAN, devices, platforms, and application ecosystems, enabling us to replicate the successful template established in India by Jio. “Our plan is to bring this proven model to Africa," Singh told Forbes India.

An Open RAN infrastructure allows inter-operation between cellular network equipment provided by different vendors. They can enter the market and offer telecom connectivity to the Ghana region.

NGIC has begun roadshows to raise $200 million from potential investors across the US, Middle East, Asia, and Europe. The capital will be utilised over a three-year period, with the first round of funding expected to close in August this year.

“The venture will provide 4G and 5G infrastructure—it means wireless equipment, base stations, radios and antennas. The objective is to expand coverage and capacity so that all mobile network operators benefit from it," Arun Bhikshesvaran, CEO of Radisys, told Forbes India. For 5G technology, NGIC has an exclusive licence for a 10-year use through a national shared network.

As in India, Radisys and its partners are betting big on 5G technology for the African market. “We are taking a modern approach: At this age if you’re going to invest in infrastructure you have to do it in a way where you get the best of what is available today in terms of lifecycle management cost, flexibility in the network and separation of software and hardware."

“And make it useful for people—the devices need to be offered at the right affordability structure. We are not trying to build 5G networks to power iPhones to watch YouTube videos. It has a strong social purpose," Bhikshesvaran says.

Radisys, founded in the United States 38 years ago, specialises in three segments—communication services sector fixed broadband and mobility (wireless network). In India, Radisys operates in all three areas. “In communication services our software and hardware is installed in 200 operating networks across the world and is part of all modern VoLTE networks. We are connected with 2 billion subscribers on a daily basis," Bhikshesvaran says.

So when you make a call a ring-back tone, announcements and conferencing, the software is powered by Radisys.

In the fixed broadband, Radisys offers fiber to home, fiber to building technology where the hardware and software is used by Reliance Jio. It is involved in major FTTX projects with other customers globally, for example Deutsche Telekom in Germany.

Radisys in India, which is unlisted, clocked a 139 percent year-on-year jump in net profit at Rs 63.14 crore in FY23, on revenues from operation of Rs 848.64 crore, which rose over 50 percent for the corresponding period in the previous year.

![]()

Africa: The usage gap

This venture appears to be a well thought out one. The journey spanned over two years, driven by a strategy and vision to democratise mobility through meaningful connectivity. “We defined three key imperatives: The availability of cloud-based and Open RAN technology to build a hyperscale telco cloud, collaboration with technology partners who share our vision of creating high-skilled technology jobs, and the provision of affordable devices alongside platforms and services/applications," Singh told Forbes India.

“The key challenge in the market is the usage gap, necessitating more devices and an ecosystem of applications and platforms to drive consumption," he says.

Airtel, which went into Africa as a telecom service provider, found the early years a massive struggle. It emerged profitable in Africa only in 2018, eight years after it had bought out Kuwait-operator Zain’s mobile operations in Africa for nearly $9 billion.

Airtel insiders will tell you that Africa offers huge opportunities, but this does not mean that it is an easy market to monetise business. “Africa always comes with nuances of its own—repatriation of money is a concern, dealing with forex and currency depreciation is a concern," says an industry source who formerly worked at Airtel. “Africa is a continent, not a country, the French speaking region and market is different from the English speaking or the African speaking one. It is still a Third World market, barring the matured markets of Nigeria and Kenya," he told Forbes India on condition of anonymity.

Bhikshesvaran does not agree. “If you enter a market after it is mature then you will be late. You’ve got to be part of the change to make things happen for society," he says. NGIC will start in a phased manner, looking to roll out 4G and 5G networks in Ghana’s capital Accra, besides fixed wireless network.

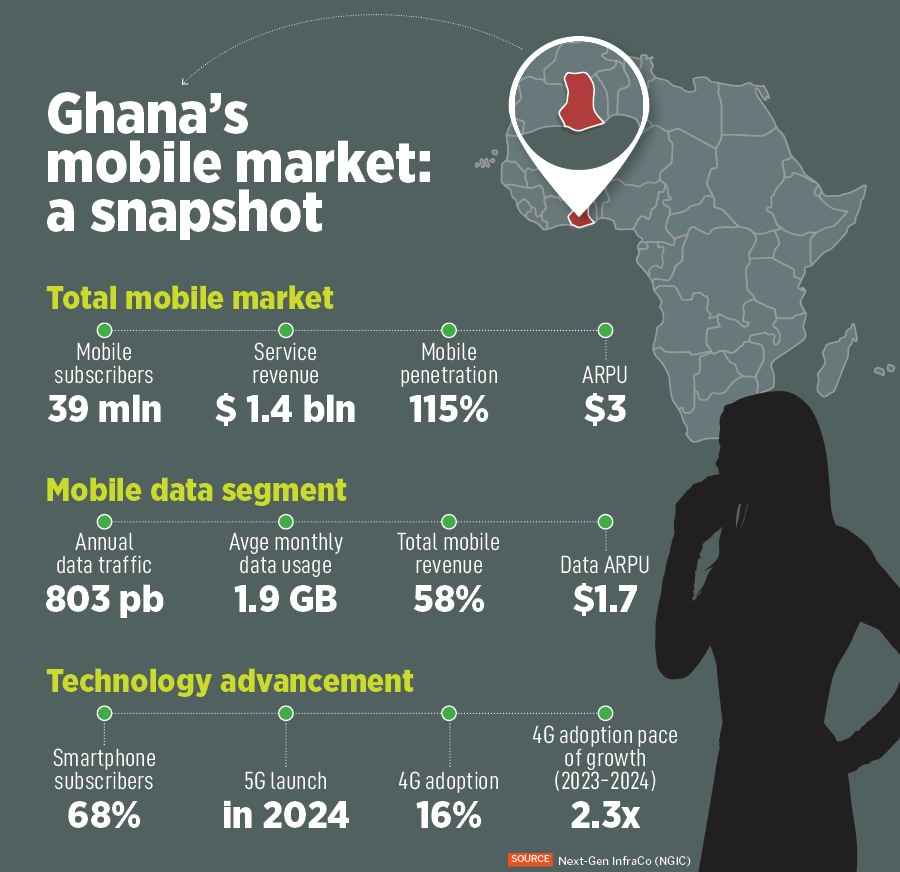

Despite high mobile penetration rates (see Ghana snapshot table), the growth of 4G and 5G in Ghana is hindered by a lack of market competition. The NGIC aims to address this imbalance through a Network-as-a-Service (NaaS) model.

NGIC will be collaborating with the Smart Africa Alliance, which includes 38 African countries and representation from the International Telecommunication Union (ITU), African Union, World Bank, and others. “We believe that the Ghana model will become a playbook for all member states, with at least 6-7 countries eager to replicate it," Singh says.

![]()

Monetisation and beyond

Capex towards 5G technology has meant that the need for MNOs to monetise on this technology has only risen. In India, the hype for 5G technology grew faster than its usage. The technology is obviously useful—and has helped telcos such as Jio and Airtel to debottleneck their 4G networks—but there are very few use cases to test the capabilities of 5G.

The 5G expansion into Africa will mean there will be a real challenge to monetise on this technology. Bhikshesvaran presents a realistic picture. “The question is is there a demand which can be captured and served well? The answer is yes. The demand is for broadband application, experiences and services. That is unquestionable.

What is the most effective way to deliver capacity to meet the demand?" Bhikshesvaran asks. “It is a combination of spectrum which is available, price point for the devices and best underlying technology which you use to deliver this package. In 2024, it is not efficient to build it on 2G or 3G technology, it has to be built on 4G and 5G."

“There is no one solution which fits all. In some frequency bands the ecosystem is different. In other frequency bands, the ecosystem is better suited for 5G. It is building the underlying broadband infrastructure as a utility at the optimum price per gigabyte possible, for both capex and operating expenses," he says.

There is no doubting Jio and NGIC’s strategy of building a shared telecom infrastructure ecosystem. If executed well, it will encourage competition amongst MNOs and serve as a catalyst for digital entrepreneurs to develop local content. Their ability to plan R&D, products and think as a B2B player will also determine their success. Ultimately, of course, the test will be in whether the venture emerges profitable.

Disclaimer: Network18, the publisher of Forbes India, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.