Fusion Microfinance: The newest kid on the block

With consistent growth and new business lines, Fusion Microfinance adds to the list of investible companies in the sector

A little over half-way through my interview, Devesh Sachdev makes an off-the-cuff remark that speaks wonders for the confidence he has in his business. “Any of my employees would be willing to sign the balance sheet," says the managing director of Fusion Microfinance. In a finance company this confidence is significant. Over the last decade, there have been numerous instances of fudged numbers by companies, auditors signing off and then resigning, and independent directors resigning when they are uncomfortable with the numbers reported.

In a business with few hard assets, cooking the books is easy, and Sachdev is clear that is a problem Fusion will never face. “I wanted to build a good company. Not [necessarily] a large company," he says.

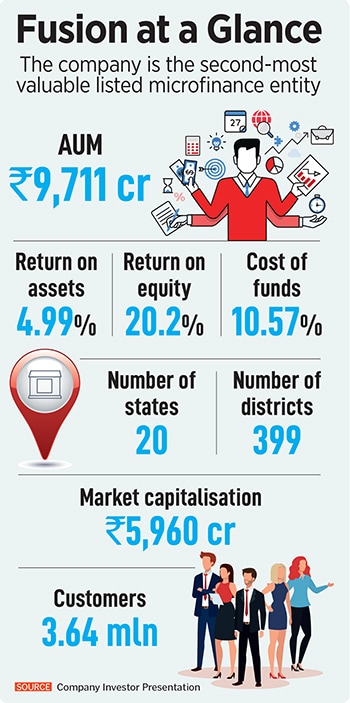

It is with this endeavour that Fusion Microfinance has emerged as the second-largest listed company in India in the microfinance space. After a successful listing in November 2022, the stock has been on a tear. It is up 63 percent from its listing price to Rs 599 a share, taking its market cap to Rs 5,960 crore the stock trades at 2.6 times book value. In comparison, CreditAccess Grameen, which has a market cap of Rs 22,963 crore trades at 4.6 times book value. As the market sees more quarters of its performance, Fusion’s stock may re-rate further.

The company has put in place strong growth levers. Its recent Q1FY24 numbers saw asset under management (AUM) grow to Rs 9,711 crore, up 31 percent in the last year. At Rs 120 crore for the quarter, profit after tax was up 60 percent. The business had a return on equity of 20. 1 percent and a return on assets of 4.9 percent.

The company is also trying to show that microfinance investments can make for consistent compounding. The sector hasn’t been a happy hunting ground for investors and there is still a lot of scepticism on whether companies can perform through cycles. They stumbled during demonetisation and then during the Covid-19 pandemic. But still, the largest CreditAccess has compounded at 29 percent a year since its August 2018 listing and now with Fusion’s performance (although over a much smaller time period) investors may be getting some confidence in the sector.

"We always believed we were doing a deep discount IPO but we did it because microfinance as an area needs to get more evangalised before it gets mainstream," says Narendra Ostawal, managing director at Warburg Pincus, an investor in Fusion Microfinance. “Until you have three to five listed players with a good history of performance it will not create a strong market for these companies."

Fusion’s performance also comes against the backdrop of low asset quality stress in the microfinance sector. What remains to be seen is whether the cycle, where borrowers default on their loans during hard times, repeats. For now, after losses during the pandemic, where lenders saw gross non-performing assets (NPAs) rise to as high as 7 percent of their AUM, asset quality in the sector has improved dramatically. Net NPAs at Fusion are down to 0.78 percent in Q1FY24 results. What remains to be seen is how the portfolio performs in another downcycle. On its part, Fusion says it is putting in place systems to ensure early warnings of stress. More on that later.

In the early part of the last decade, the Indian countryside was ripe for microfinance companies. Five years of rural employment guarantee had pushed up incomes and entrepreneurs were willing to start small businesses. Finance was an issue, but Bandhan and SKS Microfinance had shown it was possible to lend to such borrowers and set up a viable business. Undivided Andhra Pradesh had become a success story as far as microfinance was concerned. (Problems would surface later and microfinance activity was banned in Andhra Pradesh and Telangana. The ban was lifted in February 2023.)

It was against this backdrop that Fusion Microfinance—it was named Fusion as a portmanteau of the words financial and social—started operating in 2010 in states where no one had ventured till then. “The first thing we did right was start our operations from Uttar Pradesh and Bihar," says Sachdev. There were naysayers who thought his strategy of bring diversified across north India with rural branches was a cocktail for disaster.

It was against this backdrop that Fusion Microfinance—it was named Fusion as a portmanteau of the words financial and social—started operating in 2010 in states where no one had ventured till then. “The first thing we did right was start our operations from Uttar Pradesh and Bihar," says Sachdev. There were naysayers who thought his strategy of bring diversified across north India with rural branches was a cocktail for disaster.

But Fusion persisted by working carefully on the joint liability group model, where members are jointly liable for each other’s loans and managed to grow organically. Importantly, they showed that it is possible to have a presence in Uttar Pradesh and Bihar and still have a good portfolio. Another recent listing, Utkarsh Small Finance Bank, also started in Varanasi in Uttar Pradesh and has grown consistently. Utkarsh listed in July 2023 and was up 92 percent on listing day.

As the business grew, Fusion realised that managing risk was as important as growth. Sachdev put levers in place to ensure that a down cycle doesn’t take down the company. For starters, he diversified the portfolio. The company now operates in 20 states and has made sure it keeps a lean portfolio in states like Assam and West Bengal where microfinance lenders have had problems with collections. For instance, in Assam their loan book is just Rs 36 crore.

In addition, Fusion has instituted district caps. Time and again lenders get excited when a business in a particular geography is growing rapidly and then suffer during a down cycle. At Fusion no district accounts for more than 3 percent of loans, along with caps on the number of customers in a village. At the top, five states make up 65 percent of the portfolio.

In April 2022, the Reserve Bank of India (RBI) announced new guidelines for microfinance companies, which have further taken risk off the table. Now, loans of up to Rs 300,000 for a household can be classified as microfinance loans. This has increased their addressable market. In addition, companies can lend 25 percent of their portfolio for non-microfinance activities. This has made it easier for companies like Fusion, and Sachdev has been clear he doesn’t want to grow the business by increasing the portfolio size of Rs 25,000 per customer.

Still, analysts say that this lending could also entail risks. “While microfinance companies can now lend up to 25 percent of their portfolio for non-micro finance activities, the risk levels for this kind of lending remain if you are serving the same borrower," says Jindal Haria, director, India Ratings.

At present, Fusion has 1,103 branches across 20 states and 3.64 million active clients. This has enabled the company to grow rapidly with compounded sales and profit growth in the last five years of 46 percent and 64 percent respectively. Sachdev prides himself on the fact that his team—the chief finance officer and compliance officer—have stayed with him for a long time. This was also a point that Warburg noticed when they invested in the company.

"Scale is a factor of how strong your middle management is. Top management is focussed on the big picture and front-line staff has high attrition anyway," says Ostawal. “But it is the cluster managers and area managers that really drive the scalability of your business and the way they were conducting their business meant that Fusion was a fabulous platform in the making."

The cyclicality of the microfinance sector has often vexed investors who want growth but with dollops of predictability. This is something Sachdev is keenly aware of saying “[The] market has become smarter and the market wants to see consistency. They look at guidance, portfolio quality and profitability together," he says.

One way in which Fusion can achieve this is by putting in place an early warning system. After 12 years on the field, the company has collected data on its borrowers. A large number of borrowers also have credit scores. This allows them to segregate borrowers and states as per risk. Assam, West Bengal and Haryana are tagged as high-risk states, while Uttar Pradesh, Madhya Pradesh, Bihar and Tamil Nadu are low-risk Chhattisgarh and Odisha fall under medium-risk.

Fusion has run these models to see what would have been default rates if they had been able to use these models in 2021-22. As a result, they are confident of weathering the next downturn better. The data now provides information on when they need to focus on a particular customer or a particular district and step up monitoring efforts. It also allows them to see when a loan enquiry is made from competition.

And lastly, there is the diversification to lending to micro, small and medium enterprises (MSMEs). This has been touted as a new sunrise sector and lenders are now able to triangulate information from credit scores (for companies) and their GST returns, as well as data from account aggregation services to assess creditworthiness of companies. Fusion has created a Rs 350 crore book since 2019 across 12,000 SMEs.

Sachdev says that if customers want a bigger loan the company moves them to MSME lending as he doesn’t want to take loan sizes in the micro finance portfolio higher than the current Rs 25,0000. “That way we are not losing a market opportunity but they can do more adjacencies," says Sachdev. He has also made sure that these small business loan branches are different from microfinance branches.

An industry analyst who declined to be named cautioned against scaling up this business too fast. While there is no doubt the opportunity is huge, the company has to give itself time to understand these new customers. The company has already had one round of learning and is pivoting its portfolio towards secured loans.

As Fusion scales up, it would be interesting to watch if it manages to keep its portfolio quality in check. A successful showing on that front would make the sector investible to a broad set of investors who are looking for consistent growth. After all, as Ostawal of Warburg Pincus explains, it was only after a clutch of housing companies—Aavas, Optus, Home First—got listed and showed a consistent record of performance that the sector attracted a flurry of investors from both India and overseas. It is possible that microfinance could also offer such an opportunity in the next few years.

First Published: Aug 08, 2023, 13:02

Subscribe Now