Covishield, manufactured by Serum Institute of India (SII) in partnership with AstraZeneca, accounted for some 80 percent of doses. Covaxin, manufactured by Hyderabad-based Bharat Biotech, accounted for a significant part of the rest followed by Biological E’s, Corbevax, and Russia’s Sputnik V.

Recent Covid-19 cases in India have not spiked to earlier levels, with an average of 16,000 cases in a seven-day period. Although the possibility of a new virus variant remains, people’s lives have almost swung back to normal, with attention fading from the pandemic.

This is why Gennova Biopharmaceuticals’ mRNA vaccine may just be a tad late to India’s vaccine party. The vaccine is the first mRNA vaccine developed by an Indian company, and is similar to globally administered vaccines by Pfizer-BioNTech and Moderna, thus marking a milestone in India’s vaccine journey.

Unlike vaccines that use a weakened or inactivated virus, mRNA vaccines use lab-made mRNA to create a protein, or even a piece of it, to trigger an immune response. “Developing an unprecedented, storage-stable mRNA vaccine for India took time, as rolling out the liquid vaccine would not have been relevant for India or our efforts to democratise the mRNA vaccine globally," says Samit Mehta, chief operating officer, Gennova Biopharmaceuticals. “Thus, it took the time it did."

The Pune-based company’s vaccine, Gemcovac-19, is based on freeze-drying technology that enables storage at 2 to 8 degrees Celsius, compared to other mRNA vaccines that require sub-zero temperatures. “This makes it unique in its deployability in countries like India," adds Mehta. “However, we don’t think we are late, given the continued threat posed by Covid-19 and its different variants. The versatility of the mRNA platform will allow us to develop a vaccine to combat different dominant strains in a very short time."

Gemcovac-19 uses a self-amplifying mRNA platform, which gives it the advantage of a low-dosing regimen, says Gennova it has to be administered intramuscularly in two doses, 28 days apart. The mRNA technology means it can be tweaked for emerging variants, similar to the DNA-based vaccine by Zydus Lifesciences.

![]()

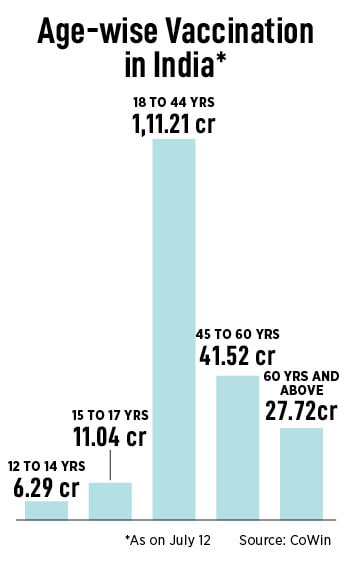

“In the domestic market, the opportunity will be for the Omicron-specific booster dose as well as paediatric vaccination, since immunisation so far has been low," Mehta says. “There is huge potential in several emerging markets."

India’s National Technical Advisory Group on Immunisation’s (NTAGI) Covid working group is expected to study data related to Gemcovac-19 after it received approvals for restricted use in emergency situations for 18-year-olds and above from the Drugs Controller General of India (DCGI). Gennova submitted their trial data in April.

“Well, they are certainly late compared to vaccines approved in 2020-21," says Satyajit Rath, emeritus professor, Indian Institute of Science Education and Research (IISER). “However, there is certainly room for new Covid-19 vaccines, including as ‘cross-booster’ doses. Also, next-generation vaccines are quite possibly needed, and mRNA vaccines can be tweaked for this purpose quite rapidly, as well generate high levels of antibodies. And, of course, ordinary refrigeration storage is an advantage."

![]() How Gennova upped its game

How Gennova upped its game

Gennova Pharmaceuticals was set up in 2002, as a subsidiary of Pune-headquartered biotechnology company, Emcure Pharmaceuticals.

Founded in 1981 by Satish Mehta, the son of a pharma distributor, Emcure started as a contract manufacturer for multinationals. After more than a decade, Mehta began marketing and distributing his own branded generics. Today, the company manufactures over 350 brands, and operates five research and development (R&D) centres and 14 manufacturing facilities across India it has a presence in about 70 countries.

A bulk of Emcure’s operations centre around chronic and sub-chronic therapies, which contribute nearly 65 percent of its revenues. Its focus areas include gynaecology, dermatology, anti-infectives, anti-retroviral, gastrointestinal, respiratory, oncology, cardiovascular, pain and vitamins. Last year, Emcure posted revenues of Rs 6,054 crore.

In 2012, Gennova established its vaccine formulation and research centre, which was partly funded by Seattle-based non-profit global health organisation Path’s Malaria Vaccine Initiative (MVI), which in turn was funded by the Bill and Melinda Gates Foundation. Gennova"s vaccine development includes an antigen development programme and an adjuvant development programme, in collaboration with the likes of USFDA and Johns Hopkins University.

With the Covid-19 outbreak, Gennova turned to its established mRNA platform to develop a vaccine, even as other pharma companies moved quickly to either contract manufacture or develop their own vaccines using other technologies. While SII, India’s largest vaccine maker, partnered with UK-based AstraZeneca to manufacture Covishield, Bharat Biotech developed a vaccine using a whole-virion inactivated vero cell (dead coronaviruses).

“Gennova is the first Indian company to develop an indigenous mRNA platform, and we have been working on this platform for over four years," Mehta says. “It is a pandemic-ready, disease-agnostic, rapid-development platform technology." Gennova"s work was partly funded by the Department of Biotechnology (DBT) in June 2020, under the Mission Covid Suraksha, a vaccine development programme allocated Rs 900 crore.

“At the onset of Covid-19, the DBT provided part of the seed funding of Rs 25 crore for developing our vaccine manufacturing platform," says Mehta. “Our internal accruals provided the rest of the funding." After its phase 1 clinical trials, Gennova received another Rs 100 crore under Mission Covid Suraksha.

![]() Gennova is yet to disclose its vaccine’s efficacy data, although it claims it’s similar to already approved vaccines in IndiaImage: Shutterstock

Gennova is yet to disclose its vaccine’s efficacy data, although it claims it’s similar to already approved vaccines in IndiaImage: Shutterstock

The mRNA vaccine

While Gennova is yet to price its vaccine, it says the pricing will be far more competitive than its peers on a similar platform.

One shot of the US-based Pfizer-BioNTech vaccine costs $23.15 in the European Union, while one shot of Moderna’s vaccine costs $25.50, according to revised supply contracts. Both vaccines have an efficacy level of more than 94 percent. “This [pricing] can be decided only after a discussion with the government," Mehta adds.

Gennova is yet to disclose its vaccine’s efficacy data, although it claims it’s similar to already approved vaccines in India. “The immune response study was thorough and, in addition to measuring antibody levels, also assessed the neutralisation of the SARS-CoV-2 virus. Both the humoral and cellular responses were compared. Based on the trial outcome, we can conclude that the immunogenicity of Gemcovac-19 was determined to be comparable."

“The EUA for the mRNA vaccine involved several firsts," explains Mehta. “The first time the group was making a new entity, and it was the first time a product on the mRNA platform was being studied in India. Such firsts usually face their own set of challenges."

Even as Gennova began developing its vaccine, it faced hiccups, including an US embargo on raw materials at the peak of the pandemic. This meant turning to Emcure for raw materials, including enzymes required for making mRNA API.

Gennova has the capacity to manufacture between 40 lakh and 50 lakh vaccines a month, which can be quickly ramped up. “Gennova"s API capacity is close to 500 million [50 crore] doses a year, which can be doubled in a short time. The fill-finish capacity is 200 million doses [20 crore] annually and this too can be ramped up at short notice. One of our plants in Pune has been repurposed for manufacturing the Covid-19 vaccine," says Mehta.

Can it work in India though?

Although Gennova might be a late starter, Mehta says its platform will help prepare for future pandemics, which could include mutations of the virus. “The creation of such an unprecedented disease agnostic mRNA-technology-based facility empowers the world to be ready for future pandemics," he says.

“The mRNA vaccine is quite significant in terms of biotech industrial capacity," says Rath of IISER. “mRNA vaccines are quicker to tweak for next-generation vaccine development, and they generate quite high levels of antibodies, though it is not clear how they compare with other vaccine platforms in terms of duration of responses. Therefore, mRNA vaccines are going to be visible in the years to come for a number of other illnesses."

There is also the possibility that Gemcovac-19 could play a role among booster doses, although it is yet to receive required approvals. Booster dose penetration is significantly low, at less than 5 percent, according to GlobalData, a London-based consultancy firm.

![]() “While most of India’s eligible population have taken their initial doses of Covid-19 vaccines, the mRNA platform is likely to be an option in the medium to long term as a booster dose," said Neha Myneni, pharma analyst, GlobalData, in a July 11 report. “Gemcovac-19 has not received approvals for use as a booster dose in India. Hence, we expect low market penetration as the proportion of the eligible population yet to receive a Covid-19 vaccine is comparatively small."

“While most of India’s eligible population have taken their initial doses of Covid-19 vaccines, the mRNA platform is likely to be an option in the medium to long term as a booster dose," said Neha Myneni, pharma analyst, GlobalData, in a July 11 report. “Gemcovac-19 has not received approvals for use as a booster dose in India. Hence, we expect low market penetration as the proportion of the eligible population yet to receive a Covid-19 vaccine is comparatively small."

“Gemcovac-19’s approval surely paves the way for further development of home-grown mRNA vaccines for other diseases in India," Myneni adds. “However, its success will likely depend on the government’s decision to procure and deploy it, as most of the vaccinations in India are driven by the government."

Government procurement is significant, as was obvious from the lack of takers for Zydus’s ZyCov-D and Sputnik V, who were early movers but have struggled since. Currently, as many as 40,530 vaccination sites are run by the government in comparison to 1,396 sites run by private institutions. Together, the market penetration of ZyCov-D and Sputnik V stand at less than 2 percent.

Then there is the potential that Gemcovac-19 has in export markets, particularly lower and middle-income countries where vaccine penetration continues to be low. “In such cases, there may be unmet need for primary vaccination and Gemcovac-19 can emerge as the leading option, provided the vaccine’s clinical results are made available," says Myneni.

For Gennova, the journey has been a bit long. But it knows well that the battle is a long-drawn one and it has everything to play for.

How Gennova upped its game

How Gennova upped its game

“While most of India’s eligible population have taken their initial doses of Covid-19 vaccines, the mRNA platform is likely to be an option in the medium to long term as a booster dose," said Neha Myneni, pharma analyst, GlobalData, in a July 11 report. “Gemcovac-19 has not received approvals for use as a booster dose in India. Hence, we expect low market penetration as the proportion of the eligible population yet to receive a Covid-19 vaccine is comparatively small."

“While most of India’s eligible population have taken their initial doses of Covid-19 vaccines, the mRNA platform is likely to be an option in the medium to long term as a booster dose," said Neha Myneni, pharma analyst, GlobalData, in a July 11 report. “Gemcovac-19 has not received approvals for use as a booster dose in India. Hence, we expect low market penetration as the proportion of the eligible population yet to receive a Covid-19 vaccine is comparatively small."