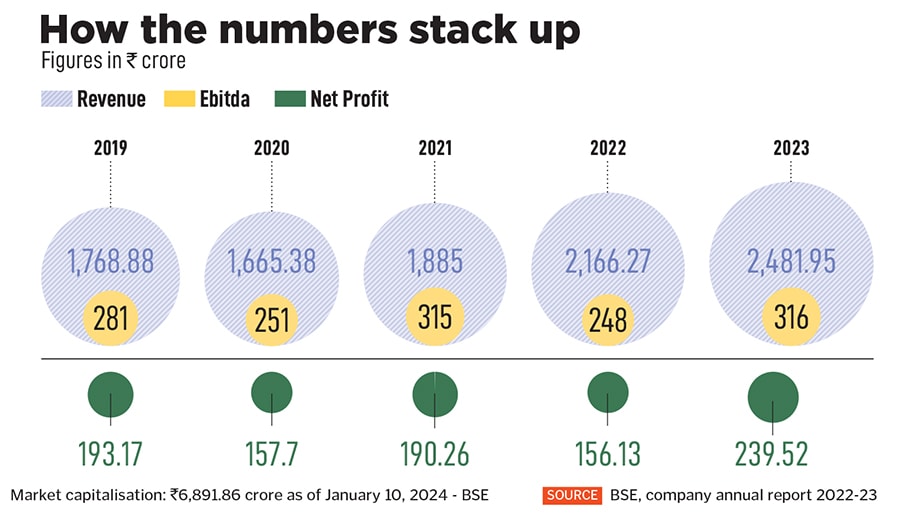

When she took over, the revenue of the company was close to ₹1,700 crore. As of year-ended March 2023, it has grown close to ₹2,500 crore under her leadership. Net profit, as per Bombay Stock Exchange (BSE) data, was at ₹239.52 in FY23, recording an increase of more than 50 percent from the previous year.

Jyothy, 45, has now set her eyes on the ₹5,000 crore revenue goal, which the company has harboured for a few years now. Jyothy Labs was founded when she was five years old. As a little girl, she remembers how her father, who came from a middle-class family in Thrissur, Kerala, painstakingly built it “brick-by-brick". Seeing an unmet demand for fabric whiteners, he had launched the company with a single product Ujala, which remains a cash cow till date.

The fabric whitening liquid was her father’s own formulation, for which he had even ideated the concept and designed the packaging, Jyothy says. She remembers how he worked late, seven days a week, and did everything himself, from overseeing the loading and unloading of products to writing print advertisement jingles.

![]()

In the early days, Ujala was sold door-to-door by a team of six-odd women, a practice that would shape the company’s distribution in the years to come. Ramachandran, as per a July 2011 profile by Forbes India, also took advantage of tax breaks to set up manufacturing plants, which fuelled growth.

Now, as the company completes 40 years in business, Jyothy says that while her father did the hard work of building the company, she wants to “take it to the next level", guide it towards more growth. She wants to “think bigger, do better and make my father proud". And she has set in motion a plan to achieve that goal.

![]()

Finding her feet

Sitting behind a desk in her sprawling yet minimalist office in Mumbai, just a few days after Christmas, the second-generation entrepreneur reflects on the year gone by as one that was marked with a steep increase in raw material prices, inflationary pressures and muted rural demand.

“High input costs and a lot of other factors made it difficult to do business in the FMCG industry. But we are in the growth stage and under no circumstances can we pull the plug. We will keep laying our tracks, see how we can balance cost considerations along the way, and when things start looking up in the industry, we will benefit," she says, referring to her decision to stick to the deeper distribution, geographical expansions, product innovations and advertising plans, even in a challenging market that cut into margins.

One of the reasons the company was able to stay on its growth trajectory was that it streamlined costs wherever possible, she says. Sanjay Agarwal, chief financial officer, Jyothy Labs, explains that Jyothy has never shied away from “good costs" like investments in people, technology, distribution and A&P (advertising and promotions). The focus, instead, according to him, has been on making financial metrics more efficient. “For example, our working capital, a few years ago, was at 30-35 days. Now we are down to five days [which improves efficiency in supply chain and operations]. Be it that or moving from a debt to a net cash situation, [it] was done by building robust processes in the organistion," he says.

![]() Right now, Jyothy Labs is a market leader in fabric whiteners, with more than 80 percent share led by its flagship product Ujala. It also ranks second by value in the dishwashing segment with its products Exo and Pril. It is also second by volume in the household insecticide segment, with its Maxo brand of mosquito repellent coils.

Right now, Jyothy Labs is a market leader in fabric whiteners, with more than 80 percent share led by its flagship product Ujala. It also ranks second by value in the dishwashing segment with its products Exo and Pril. It is also second by volume in the household insecticide segment, with its Maxo brand of mosquito repellent coils.

In a market that is dominated by multinationals like Hindustan Unilever (HUL) and Procter & Gamble (P&G), and heavyweights like ITC, Dabur and Britannia, Jyothy Labs has been a challenger brand in all the categories in which it operates, minus fabric care, where it is the clear market leader by a mile. Jyothy takes this status in her stride, saying that it is only when you are a challenger brand that you “get a kick when you gain market share". She adds, “And the market has a lot more room for growth."

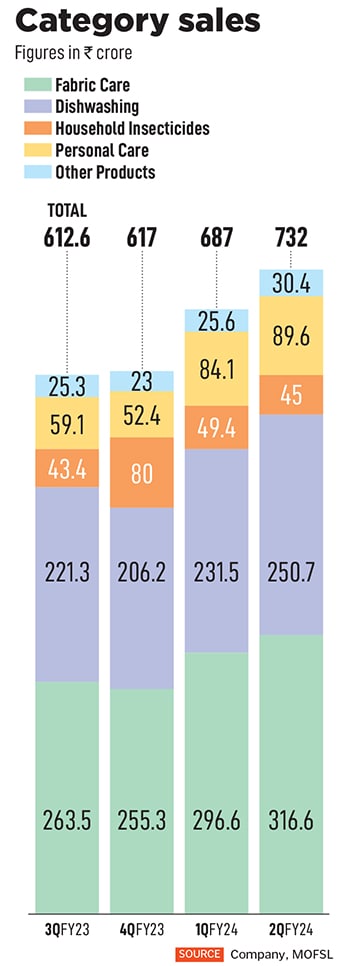

One of the ways Jyothy is chasing growth is to rebalance the product portfolio, which, at present, is dependent on fabric care and dishwashing products. She is focussed on growing the personal care segment, which is represented by the Margo soap. In 2023, the company launched three new variants of Margo. There are also plans to expand to other categories within personal care, which could be by launching a different brand at a different price point.

Sneha Poddar, AVP, retail research, broking and distribution at Motilal Oswal Financial Services (MOFSL) says product innovation and premiumisation is the need of the hour for Jyothy Labs. According to her, the markets in which the company’s products are present are highly penetrated. There is huge competition, even from regional and unorganised players, and the slow pace of innovation at the company has affected its growth.

“Though we saw a short-term gain in Q2FY24, with increase in market share and good volume growth, the long-term outlook is lackluster. They operate in highly penetrated categories, and the volume growth is likely to be limited to single digits unless they come up with a new category or new products," she says. “They would also have to shift the focus from mass products to premiumisation."

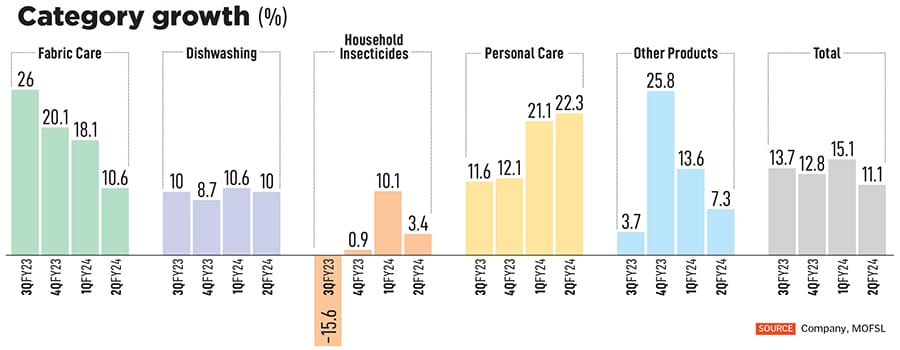

During Q2FY24, Jyothy Labs gained market share across its portfolio, with a 9 volume growth and a 2 percent growth in value. A November 2023 MOFSL research report added that although margin expansion exceceded expectations in that quarter, expansion beyond 17 percent is “constrained by a focus on mass and rural segments."

Taking a view of the past 10 years, the report says the stock has been an underperformer for several reasons, including the higher penetration and regional dependence on its largest brand Ujala, limited success in achieving profitable growth in other categories/geographies outside South India.

In 2011, Jyothy Labs had acquired the India business of German multinational Henkel, which gave it access to the latter’s portfolio of brands, Henko (detergent), Pril (dishwasher) and Margo (soap). At the time of the sale, Jyothy Labs had offered Henkel the first right of refusal to pick up a 26 percent stake in the company in 2016, which the latter chose not to exercise. “The expiration of the Henkel option, which had the potential to expand its portfolio by adding more brands, has also been a setback," the MOFSL report says, in the section assessing the stock’s performance over the past decade.

![]() The Jyothy Labs manufacturing unit in Roorkee

The Jyothy Labs manufacturing unit in Roorkee

CFO Agarwal says that while product innovation is certainly a focus, Jyothy believes in “relevant innovations". By relevant, he means the products have to be differentiated and solve a pain point for the consumer. “This would make sure there’s no unnecessary pressure on the system. A lot of people—factory, sales, supply, marketing—work overtime to make a product launch happen. So the success ratio should be far better," he says.

While Jyothy is extremely driven and ambitious about growth, her approach is methodical and process-driven, says Anil Sarma, head of sales at Jyothy Labs. “There is no short-term objective. There is a heavy focus on profitable growth, right down to the SKU (stock-keeping unit) level. We ask, ‘You can sell anything, but at what cost?’ That mindset is seeded in the company," he says.

Jyothy agrees that there is a tall task ahead of her but is not one to shy away from a challenge. This company has been with her all her life, and she has wanted to be part of it ever since she was in Class 9.

She recollects that when after she joined the company in 2005, though she was with marketing, she often travelled with her father to various meetings, and met distributors, retailers and other stakeholders across the country.

More processes and professionalisation was put in place at Jyothy Labs after the Henkel acquisition in 2011. “We got in a CEO in 2012 for a period of four years. Just to see acquisition and processes are done well. We had acquired something as big as us. Most acquisitions go wrong if not executed well," she explains.

Jyothy believed that she would take over the reins much later in life, but had to do so earlier than expected because there was an urgent need. “Between 2016 and 2020, things were not in shape at the company. In terms of sales and other lapses, the system had a setback," she says. “We were stagnant for four years, with a 3-4 percent CAGR [compound annual growth rate]. Things needed to move faster, quicker."

![]() Even as she took over, it was in the early months of the Covid-19 pandemic, and with it came uncertainty and setbacks. Her father remained hands-off, she says. Jyothy Labs was her ship to steer. She was sure of one thing. One could not sit around and wait for things to fall in place, and that she needed to walk the talk herself. In retrospect, she thinks it all worked out for the best. “What I would have taken five years or more to learn, I learnt in three years," she says.

Even as she took over, it was in the early months of the Covid-19 pandemic, and with it came uncertainty and setbacks. Her father remained hands-off, she says. Jyothy Labs was her ship to steer. She was sure of one thing. One could not sit around and wait for things to fall in place, and that she needed to walk the talk herself. In retrospect, she thinks it all worked out for the best. “What I would have taken five years or more to learn, I learnt in three years," she says.

Over time, Jyothy has observed the value her father placed on people, and wants to take that mindset forward. As per the company’s 2022-23 annual report, 73 percent of the 6,700+ workforce has a tenure of over five years, while 39 percent employees stay with the company for more than 15 years.

As far as leadership style goes, she says she has brought in some changes “to be in tune with the changing times". This has meant a more flexible, decentralised approach to operations, innovations and experimentation. It has also meant introducing new technologies (like using real-time data to analyse gaps in the system) and automating processes for greater efficiency. Sarma adds that Jyothy has an “open door culture", where she is always accessible to discuss ideas and strategies.

Jyothy reiterates that when she took over, it had a revenue of close to ₹1,700 crore. In close to four years, she has significantly increased both the revenue and the market cap. “We need to think big and do better," she says. “The plane is about to take off. It’s time to fly."

Right now, Jyothy Labs is a market leader in fabric whiteners, with more than 80 percent share led by its flagship product Ujala. It also ranks second by value in the dishwashing segment with its products Exo and Pril. It is also second by volume in the household insecticide segment, with its Maxo brand of mosquito repellent coils.

Right now, Jyothy Labs is a market leader in fabric whiteners, with more than 80 percent share led by its flagship product Ujala. It also ranks second by value in the dishwashing segment with its products Exo and Pril. It is also second by volume in the household insecticide segment, with its Maxo brand of mosquito repellent coils.

Even as she took over, it was in the early months of the Covid-19 pandemic, and with it came uncertainty and setbacks. Her father remained hands-off, she says. Jyothy Labs was her ship to steer. She was sure of one thing. One could not sit around and wait for things to fall in place, and that she needed to walk the talk herself. In retrospect, she thinks it all worked out for the best. “What I would have taken five years or more to learn, I learnt in three years," she says.

Even as she took over, it was in the early months of the Covid-19 pandemic, and with it came uncertainty and setbacks. Her father remained hands-off, she says. Jyothy Labs was her ship to steer. She was sure of one thing. One could not sit around and wait for things to fall in place, and that she needed to walk the talk herself. In retrospect, she thinks it all worked out for the best. “What I would have taken five years or more to learn, I learnt in three years," she says.