How 'pirates' are rocking the boAt

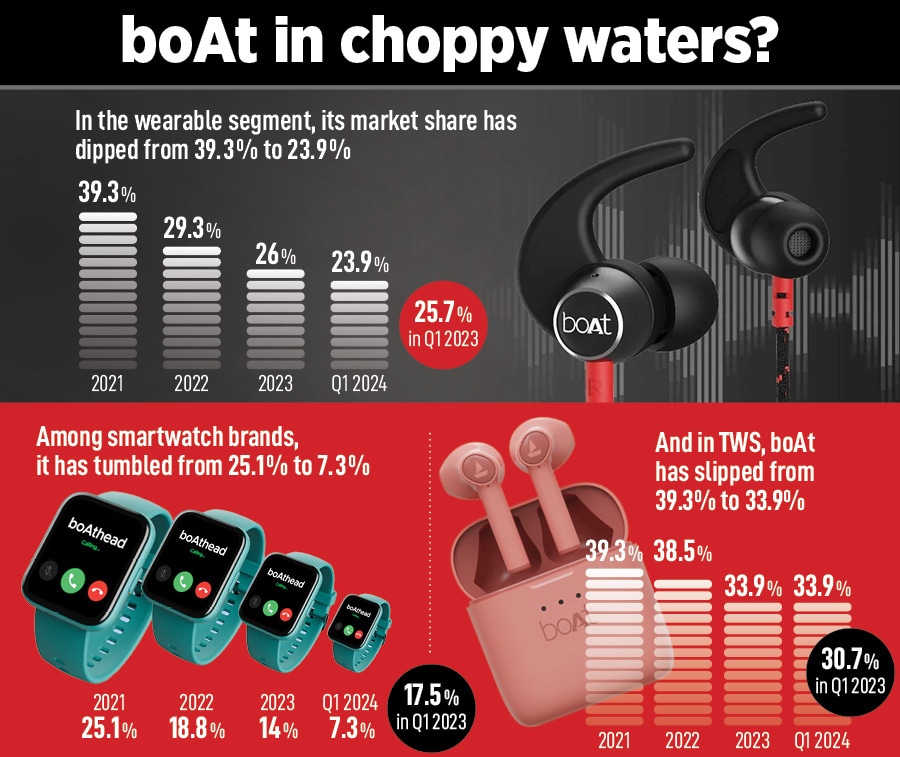

Battered by the onslaught of a sea of clones, knockoffs, and price warriors, homegrown wearable and audio biggie boAt finds itself in choppy waters. Can the leader arrest an alarming slide in its mark

“Have you seen Pirates of the Caribbean," the seasoned tech analyst posed an intriguing counter-question. “How do you explain the mayhem in the wearable and hearable market in India," was the original query with which I started the conversation. Can Pirates of the Caribbean, I wondered, explain the dramatic crash—over 50 percent—in the prices of smartwatches, truly wireless stereo (TWS), and wearable segments over the last twelve months or so? The analyst, who has been closely tracking the Indian smartphone, smartwatches, and hearables and wearables markets for over a decade, takes us back to 2019.

Look at the market share of the three established brands. Apple topped the chart with a thumping 27 percent share in the hearable segment, JBL came third with eight percent, and South Korean giant Samsung was fourth on the ladder with seven percent. “The market grew furiously, the leadership stacking was settled, and the Indian market was poised to explode," underlines the expert, requesting anonymity as his job profile with a top-tier consulting firm prevents him from commenting on individual brands. ‘The market was set to explode," he says.

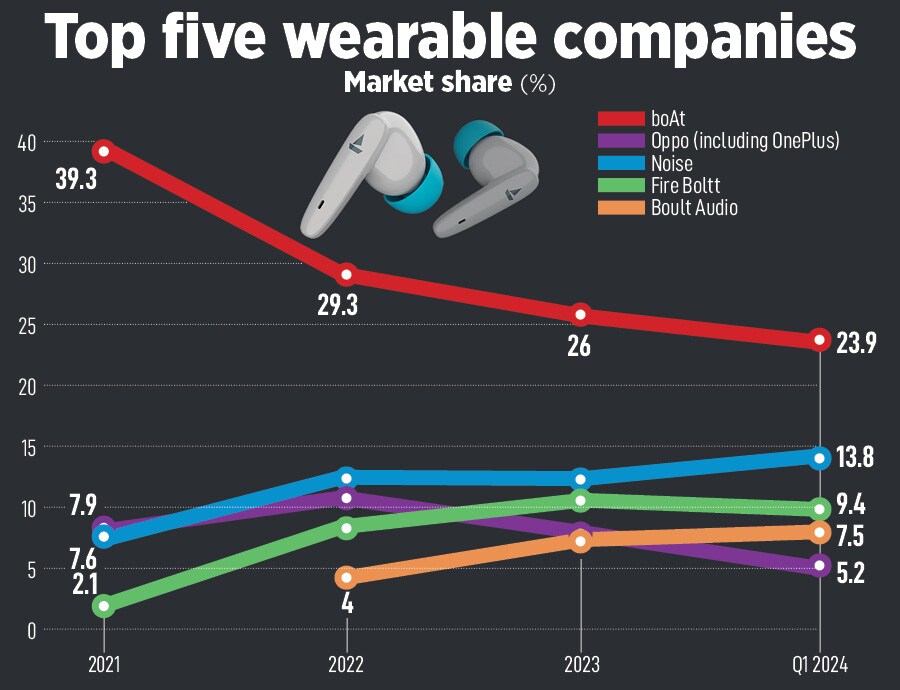

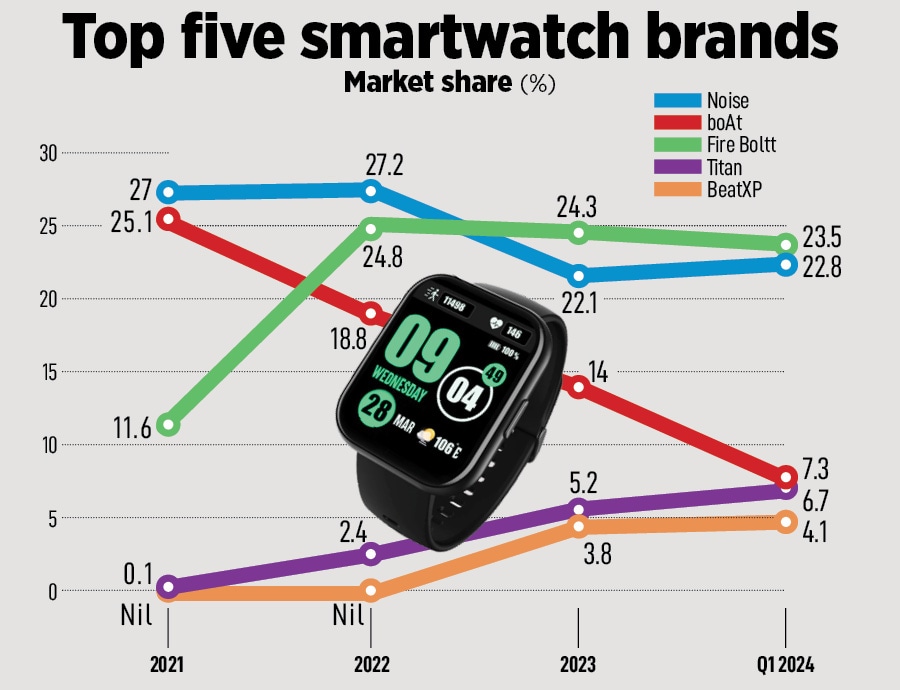

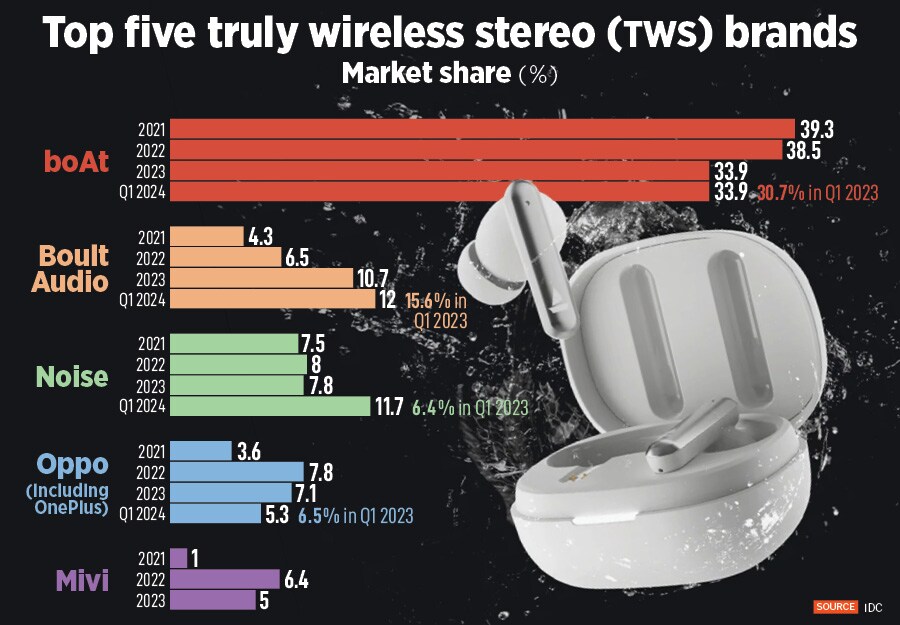

And the markets did explode over the next four years. In 2023, the wearable market posted a record growth: 134.2 million units, and a hefty 34 percent growth. Apple lost the crown and doesn’t even have a double-digit market share, JBL slipped out of the reckoning, and Samsung is not a force to reckon with. So, what went wrong for the global brands? “Blame it on the ‘pirates’," reckons the analyst mentioned above. In 2019, he talks about an upstart that raced ahead of JBL and Samsung to become the second biggest after Apple, and India saw the emergence of a bunch of pirates. “Noise came second with a 12 percent market share," he says, adding that a clutch of homegrown players such as boAt and Noise had stormed the market as price warriors, democratised the segment by making smartwatches, wearables and hearables’ affordable, and quickly displaced the market leaders. “The aggressive new Indian players acted like pirates," he adds.

Fast forward four years. Noise is still the second biggest with a 13.8 percent share in the wearable market (see box). The other four among the top five are boAt, Fire-Boltt, Oppo, and Boult Audio. “But now we have a bunch of new and unknown pirates such as Promate, CMF, Hammer, Hapipola, and Nu Republic," says the analyst mentioned above. These insignificant players—most have under one percent market share but form a huge chunk when counted together—are doing what once boAt, Noise and others did to Samsung, Apple, JBL, and Sony.

The playbook remains the same. Import from China or Taiwan, load the product with basic features—health tracker, calling, music control, voice assistant—and position it as a fashion accessory. The smartwatch, hearables, and wearbles’ market has become a commodity where the cheapest takes the crown. What is turning out to be the bane of the market is a ridiculously low-entry barrier where smartwatches, smart bands, and earbuds are available as low as Rs201.

If one wants to buy a smartwatch under Rs1,000, Flipkart offers over 3,363 products. Forget the ASP (average selling price) of a smartwatch, which has tumbled from $42.5 (Rs3,548) to $26.1 (Rs2,179) during the first quarter of this year. Online marketplaces like Flipkart have smartwatches for as low as Rs201, and brands such as Isa Creators, Tarido, Braton, and MVS. No wonder, the share of ‘others’—brands under single digit or between 1 percent and 5 percent share—has bloated to over 40% (see box).

The fall, though, is steepest in smartwatches: From 25.1 percent in 2021 to 14 percent in 2023, and a new low of 7.3 percent in the first quarter of 2024. The corresponding quarterly number stood at 17.5 percent in 2023.

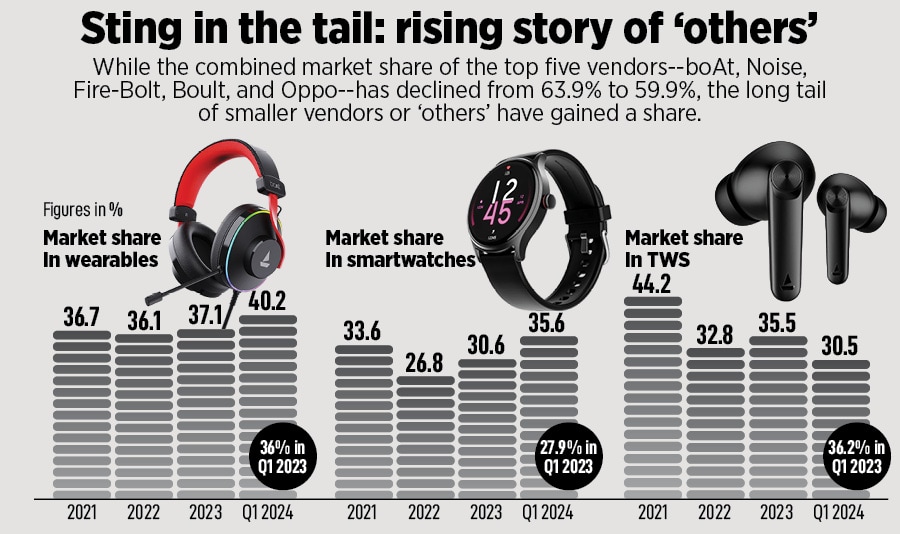

Experts blame the long tail. “The growing popularity of non-branded watches is impacting the incumbents," underlines Anand Priya Singh, market analyst (wearable devices) at IDC India. They (non-branded products) offer cheap alternatives to popular models, and are bundled with multiple watch straps, explains Singh. The collective share of the top five players—boAt, Noise, Fire-Bolt, Boult, and Oppo—has declined from 63.9 percent to 59.9 percent, and the long tail of smaller vendors has gained share.

The overall market, registering a double and triple-digit growth over the last couple of years, remained flat in the first quarter of 2024. Consumers, says Anshika Jain of Counterpoint, are not warming up to buy a new smartwatch or replace an existing one due to low differentiation in terms of features and limited innovation in the market. “The combined market share of the top three players have fallen 77 percent in Q1 2023 to 66 percent in Q1 2024," points out Jain.

Jain explains why boAt is feeling the heat. Its market share in smartwatches has dipped due to aggressive competition at lower price points, and frequent product upgrades done by other brands. There is also a slowdown in consumer demand due to limited differentiation and falling replacement rates leading to inventory issues and price cuts. “Market is slowly getting saturated with players realigning their strategies towards other product categories," she says, adding that while consumers perceive smartwatches as a fashion accessory, hearables are still perceived as a consumer tech product.

The market leader is gearing up to face the threat. “boAt has repivoted its strategy and playbook towards wearables," underlines Gaurav Nayyar, chief operating officer of boAt. “Unlike other players, we don’t want to play the price and heavy discount game to retain market share," he reckons, adding that the Indian wearables’ market has witnessed a massive price crash over the last year. Most of the players, claims Nayyar, are burning money to acquire consumers, which is unsustainable. “We are reassessing our playbook and strategy and overhauling our approach to wearables," he says.

Nayyar outlines boAt’s strategy. “Our focus is to build a software-led ecosystem for smartwatches and provide differentiated experiences and features," he says. The brand is transitioning towards a consumer segment that values superior experiences over price considerations, prioritising premium hardware and advanced algorithms to cater to their discerning preferences. “It is a transitory loss in market share. Over the next couple of quarters, the market will stabilise," he adds.

Can boAt navigate the choppy waters? Well, it all depends on how fierce the ‘pirates’ are, and how proactive the market leader is in facing the threat.

First Published: Jun 24, 2024, 16:02

Subscribe Now