A Boltt vs Boult battle is underway in India's booming wearable and audio market

Two young brands, Fire Boltt and Boult Audio, are locked in a high-pitched battle for dominance. Do they have enough firepower to outpace market leaders boAt and Noise?

Greater Noida, May 12, 2023

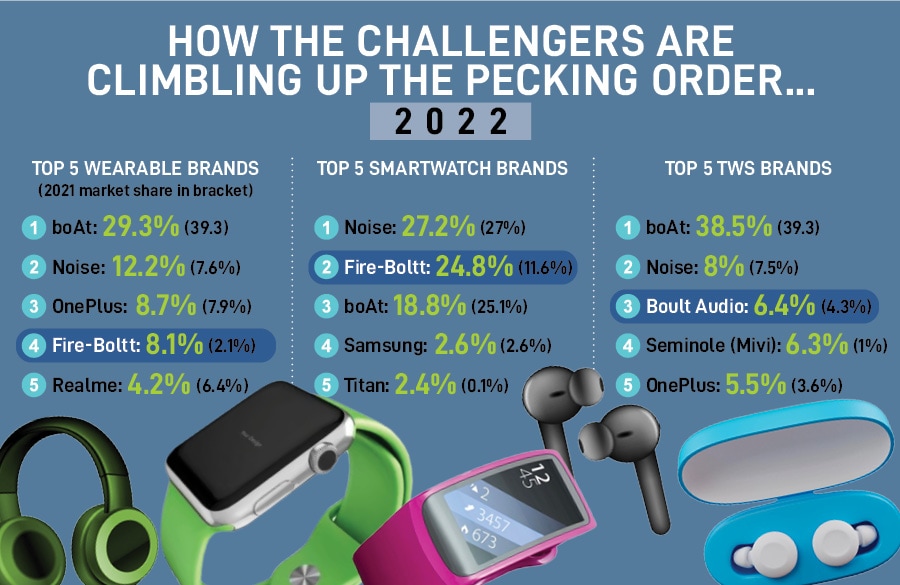

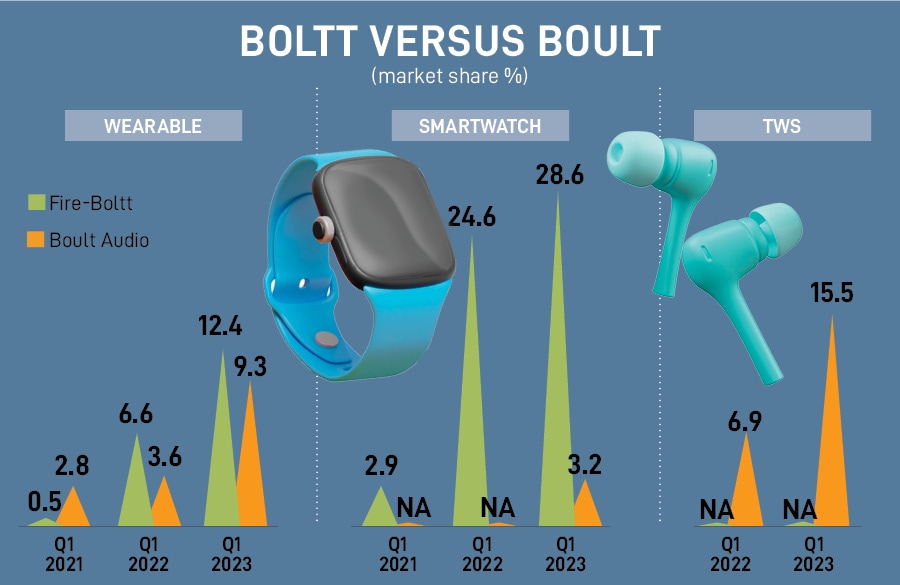

It was indeed a bolt from the blue for many, including top dogs Noise and boAt. An unassuming rival sprinted at an electrifying speed and cornered a staggering market share in smartwatches. From a paltry 0.3 percent in 2020, this little-known bootstrapped brand from Delhi-NCR had grabbed a meaty 11.6 percent market, making it the third-biggest in the pecking order after Noise and boAt in 2021. “We spread like wildfire," smiles Arnav Kishore, who co-founded Fire-Boltt along with his sister Aayushi in 2015.

For the next five years, the siblings did nothing startling with their wearable brand. Fire-Boltt comfortably remained under the radar, and a largely anonymous life suited the co-founders. Then something changed in 2022. “Last year, many did label us as a ‘boltt’ from the blue," 29-year-old Kishore breaks into a loud guffaw on a Zoom call from Maldives where the second-generation entrepreneur has been camping for over a week to celebrate his birthday. Last year, the challenger brand notched up 24.8 percent market share, pipping boAt, and was just one step away from the crown. “We knew the party would start soon," he says, alluding to the aspiration of becoming the biggest in the segment.

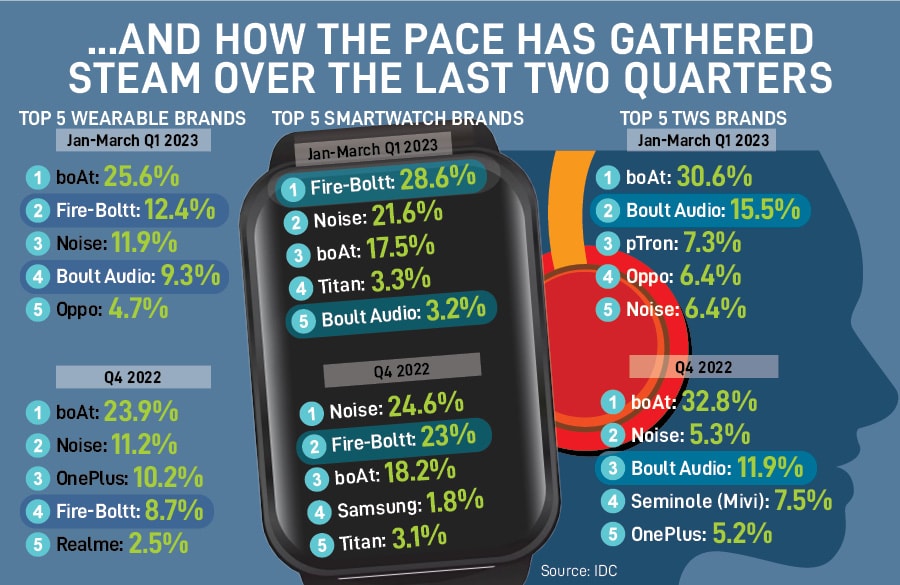

Early this month, the party did start on a big-bang note. In its latest quarterly wearable ranking released by IDC India, Fire-Boltt toppled Noise to become the biggest smartwatch brand in the first quarter of this year. Kishore, though, points out one more and a bigger reason for wild celebrations. In the overall wearable category—which includes smartwatches, TWS (true wireless stereo), wristbands—Fire-Boltt has become second biggest by logging a 12.4 percent market share.

What, though, is startling is the year-on-year leap. Fire-Boltt was 6.6 percent in the first quarter of 2022. “You can call the jump as a helicopter shot," says the young founder, alluding to the trademark shot of MS Dhoni, a brand ambassador for Fire-Boltt.

But when contrasted with the performance of others in the top five wearable brand charts in the first quarter—which includes boAt, Noise and Oppo—there is another unpretentious brand that draws attention for two reasons. First is its name, which sounds similar to Boltt. And second is its game. It is the fourth biggest wearable brand, fifth-biggest smartwatch player, and second-biggest TWS brand.

Yes, we are talking about Boult Audio, a consumer electronic brand rolled out by siblings Varun and Tarun Gupta in 2017. Just like its homophone rival Boltt, Boult Audio too had a less than modest beginning, and started its innings by launching products in the true wireless segment (TWS). Even after two years of toil, the newbie didn’t have sufficient numbers to make noise. In 2019, Apple continued to lead the TWS with a 43.1 percent market share.

A year later, though, Boult started creating a buzz in the market. In the fourth quarter of 2020, the Delhi-NCR-based brand notched up a 4.3 percent share in TWS, making it fourth biggest after boAt, Realme and pTron. Over the next few months, its performance got amplified. Last year, Boult emerged as the third biggest TWS brand. And more recently, in the first quarter of this year—January-March 2023—Boult toppled Oppo to emerge as the fourth biggest wearable brand with a 9.3 percent market share. In the TWS segment, where it started its journey, it was second biggest. In smartwatches, Boult ranked fifth after Titan. (See BOX)

“Boult is the second largest audio company in India selling a headphone every 7 seconds," claims co-founder Varun Gupta. The company, he lets on, has sold over 8 million units so far in the country, had actor Vicky Kaushal as an endorser for three years, and has now has roped in actor Saif Ali Khan and cricketer Surya Kumar Yadav as brand ambassadors. “We are bootstrapped, and yes, very much profitable," he says, grinning.

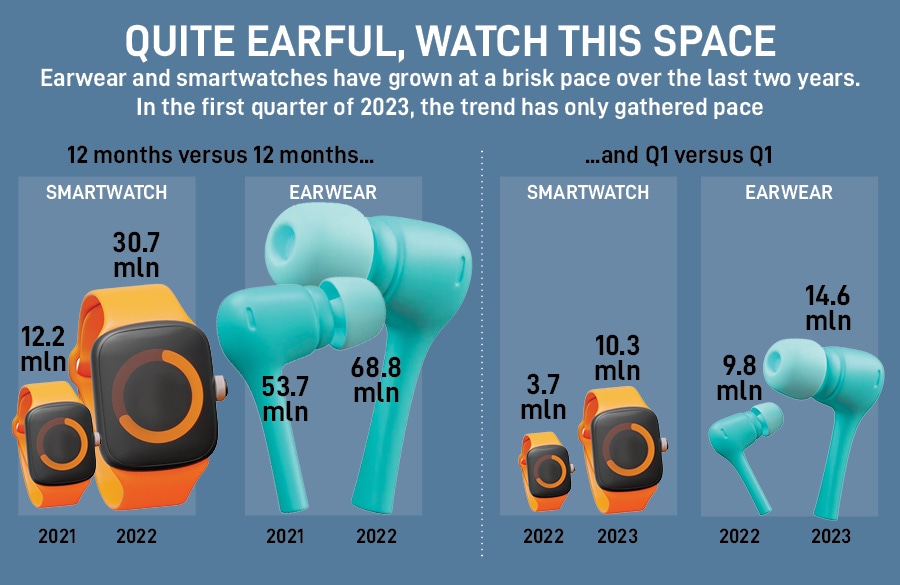

It’s not hard to decode Gupta’s delight. Thanks to the pandemic, India is in the midst of an explosive growth in the wearables’ market. From just 14.9 million units in 2019, the market ballooned to 100 million units last year. And a chunk of the growth is driven by the earwear segment, which saw a massive 68.8 million shipped in India in 2022. The corresponding number for 2021 was 53.7 million. The second biggest item in the wearable was smartwatches with 30.7 million last year as compared to 12.2 million in 2021.

But this monstrous expansion in the wearable market is not just because of the pandemic. Had it been so, smartphones would not have registered a pedestrian growth during the same period. In fact, the mobile market dipped last year. From 152.5 million smartphones in 2019, the market swelled to 161 million in 2021, and then fell to 144 million last year. So, what explains the hockey-stick growth of wearables?

A boom in wearables has money behind it. Let’s start with smartwatches. Their average selling price (ASP) has continuously crashed from a high of $122.1 (around Rs10,035) in 2020 to $61.2 (Rs5,034) in 2021, and $42.5 (Rs3,495) in 2022. In fact, in the first quarter of 2023, when smartwatches were the fastest growing wearable category and shipped 10.4 million, the ASP dipped to $29.2 (Rs2,401). Among smartwatches, the share of basic smartwatches—unlike Apple and Samsung, basic smartwatches don’t support third-party apps, and carry a price tag of as low as Rs 999—has grown to a staggering 98 percent. This explains why brands like Apple and Samsung are conspicuously missing from the top pecking order.

A boom in wearables has money behind it. Let’s start with smartwatches. Their average selling price (ASP) has continuously crashed from a high of $122.1 (around Rs10,035) in 2020 to $61.2 (Rs5,034) in 2021, and $42.5 (Rs3,495) in 2022. In fact, in the first quarter of 2023, when smartwatches were the fastest growing wearable category and shipped 10.4 million, the ASP dipped to $29.2 (Rs2,401). Among smartwatches, the share of basic smartwatches—unlike Apple and Samsung, basic smartwatches don’t support third-party apps, and carry a price tag of as low as Rs 999—has grown to a staggering 98 percent. This explains why brands like Apple and Samsung are conspicuously missing from the top pecking order.

Analysts explain how Indian brands are fuelling the growth of wearables. Improved supplies, leaner inventory, multiple new launches, faster portfolio refresh, and affordable products are the magic ingredients behind the eye-popping growth story, they reckon.

Brands, analyst Upasana Joshi points out in IDC India’s latest quarterly update, are bringing a variety of smartwatch models with metal straps and casing, circular dials, rugged finish, and premium designs. Clubbed with advanced communication features like LTE (it helps you receive calls and messages without being connected to a phone), digital payment options, and more accurate sensors and algorithms, brands are attracting new smartwatch consumers as well as fuelling refresh buying. “In 2023, smartwatch market will cross 50 million units," Joshi predicts. Earwear too has a similar story to narrate. The average selling price in TWS nosedived from $43.6 (Rs3,586) in 2020 to $20.4 (Rs1,678) in the first quarter of this year.

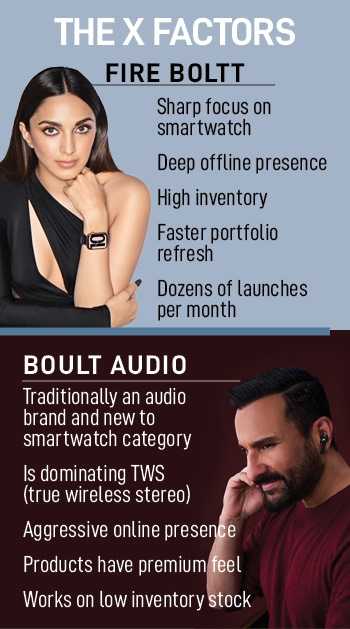

Meanwhile, Fire-Boltt and Boult are on an upswing. Navkendar Singh, associate vice president (devices research) at IDC, explains what works for both the brands. He starts with Fire-Boltt. It has sharply focused on smartwatches, has an expansive and deep offline presence, keeps a high inventory, has a much faster portfolio refresh as compared to rivals, and specialises in dozens of launches per month. “It has rolled out over 40 models till April," he says. Add aggressive marketing, strong promotions and competitive pricing, and you get the biggest smartwatch brand, and the second biggest wearable brand in India.

Then comes Boult Audio. Though it started with audio (TWS) products and is relatively new to the smartwatch party, it has grown at a rapid clip to corner 3.2 percent market share and become fifth biggest in smartwatches and fourth biggest in wearables. What’s helping Boult, Singh explains, is its dominant position in TWS, a vigorous online play, low-inventory model, rapid portfolio refresh and rolling out affordable products that have a premium feel and look. “They (Boltt and Boult) are mavericks and price warriors. They have identified the gaps in the market, are aggressive and nimble," he reckons.

They are mavericks, price warriors, aggressive and got big names to endorse their products. But are they brands? Or are they merely playing their cards well in a market that has been commoditised beyond recognition? Or are they beneficiaries of a trend in the wearable market that has an insanely low-entry barrier, and where anybody loading rich features and selling it cheap can become a volume killer? Yunus Khan, Ravi Yadav and Kusum Gupta in Greater Noida, Uttar Pradesh, perhaps have an answer to how consumers are behaving and deciding who the king would be.

A security guard at one of the gated housing societies in Greater Noida (west), Khan earns around Rs10,000 per month. The 26-year-old recently swapped his analog watch for a maiden smartwatch. There were three reasons. First, his friends bought one. So he too had to buy one. Second, he wanted to keep track of his steps, blood pressure and fitness. So, a smartwatch made sense. And lastly, it came cheap. “I bought one for Rs999 from Flipkart," he says, adding that the watch came at a discount of 85 percent. “Which brand is it," I ask? Khan didn’t expect this question. “I was looking for the cheapest watch. This looked good and is working well," he says, flaunting his watch, which happens to be one of the top five brands.

Nineteen year old Yadav too went for the lowest price model. Preparing for his engineering examination, he was looking for an affordable wireless headphone. Though there were many under Rs300 as well, Yadav settled for a slightly higher priced one at Rs900. “I wanted something that looked classy as well," he says. So, which brand is it? He too doesn’t remember the name. However, he is quite certain that he will soon buy another one. “Use it for a few months and then go for a new one. It won’t burn a hole in your pocket," he adds. Gupta too didn’t look for a brand. The 36-year-old chef runs a small kitchen, and makes over Rs35,000 every month. “Every smartwatch looks the same from outside," she says. “So why spend more on buying brand."

Marketing and branding experts explain this curse of the wearable market. “It’s a white label market. And everybody looks the same," reckons Harish Bijoor, who runs an eponymous brand consulting firm. A white-label market, he underlines, is one where products are made by a third-party, and the companies just have their branding.

Over a decade back, he lets on, the smartphone market in India mirrored a similar picture. An army of home-grown Indian brands cropped up, bought phones from China, assembled them in India and sold them under their respective branding. Maxx, Supermax, Micromax and all me-toos looked the same. “The same trend is getting repeated in audio and wearables," he says, adding that white labels have wiped out quality brands such as Bose, JBL, Harman out of the market.

Bijoor underscores the curse of the white-label market: Absence of brands. “What you see in the market today and ruling the charts are labels. They are not brands," he says, adding that on one hand customer stickiness is missing, and on the other there is no brand love and aspiration. “The cheapest survive, and flourish," he says.

For Fire Boltt and Boult Audio, manoeuvring the white-label market is going to be their biggest trial by fire. Faisal Kawoosa, founder of techARC, explains. “If brand A has got X, Y and Z, then brand B also has X, Y and Z. There is no differentiation," reckons the analyst. And if price is the only factor, then tomorrow anybody can enter into the market, bring down the price, and gain volumes. A very low-entry barrier in the wearable and audio market also makes it very challenging for the incumbents to focus on brand building.

For Fire Boltt and Boult Audio, manoeuvring the white-label market is going to be their biggest trial by fire. Faisal Kawoosa, founder of techARC, explains. “If brand A has got X, Y and Z, then brand B also has X, Y and Z. There is no differentiation," reckons the analyst. And if price is the only factor, then tomorrow anybody can enter into the market, bring down the price, and gain volumes. A very low-entry barrier in the wearable and audio market also makes it very challenging for the incumbents to focus on brand building.

Kishore and Gupta, meanwhile, reckon that they are not in the business of selling products. “Fire-Boltt is a brand that has consumers love," says Kishore. If selling cheap was the only trick, he underlines, then the brand would have become the biggest from the first year, and not in its eighth year. One of the biggest drivers of our growth, Kishore points out, is the ability of the brand to foresee gaps in the market and capture those segments by innovating on first-in-segment wearables. “We have been constantly introducing newer categories in the budget segment. This gives a personalised experience to the users," he says, adding that the company recently introduced the luxe category that targets fashion-conscious customers who see smartwatches as more than just a tech product. “We will remain at the top of our game," he says.

First Published: May 15, 2023, 10:35

Subscribe Now