How quant investing is helping investors beat the market

The total AUM of domestic quant funds rose nearly 180 times in five years. Can eliminating human emotions of greed and fear help fund managers consistently outperform the market?

In 1987, the Oracle of Omaha, Warren Buffet, wasn’t enthused about the emergence of high-tech stock picking. In a letter to Berkshire Hathaway investors, he wrote, “In my opinion, investment success will not be produced by arcane formulae, computer programs or signals flashed by the price behaviour of stocks and markets. An investor will succeed by coupling good business judgment with an ability to insulate his thoughts and behaviour from the super-contagious emotions that swirl about the marketplace."

For context, this was the time when early quantitative or tech-powered strategies were being tested by US money managers. In contrast, over thirty years later, around 35 percent of the total US market capitalisation of over $25 trillion is owned by quant-driven funds, and active and passive funds roughly comprise 15 percent and 50 percent respectively.

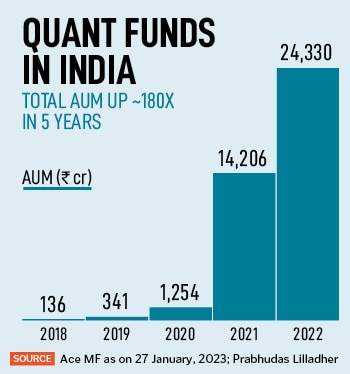

The story in India is strikingly different. In 2007, the AUM of quant funds was Rs163 crore, and this increased to Rs260 crore in 2017. In 2018, the corpus of quant funds leaped from Rs136 crore to Rs24,330 crore in 2022. The massive increase of 180x in five years is due to the interplay between several key developments.

“Quantitative (or quant) investing uses algorithms to analyse massive amounts of data (such as valuations, quality, liquidity, yields and the speed of price changes) and then systematically makes trades based on this analysis. By definition, this means that trades are grounded in historical data," explains Morgan Stanley’s global head of quantitative research, Vishy Tirupattur.

In the early ‘90s, Punita Kumar Sinha, co-founder of Pacific Paradigm Advisors and ParadigmARQ Advisors, witnessed the evolution of quant methods in the US first hand when she worked with one of the pioneers in the field of quantitative investing—Legg Mason at Boston- based investment firm Batterymarch. A first of its kind, the Batterymarch Emerging Markets Fund deployed several multi-factor quant models in the mid-90s.

“But we found there was not enough quality data in emerging markets and in India, in those days, and a lot of fundamental work was required, but now there is much better-quality data available and much more liquidity and depth in the markets and the derivative markets as well. The reporting practices of companies has improved and we can model financial data to uncover patterns and relationships which you can then exploit in a portfolio context," Sinha says.

In 2012, Sinha set up Pacific Paradigm Advisors, an investment management firm mainly focussed on fundamental strategies in Asia. Now, Sinha feels the stage is set for quantitative methods to meaningfully pick up in India. In line with this, along with Ray Prasad, a veteran quantitative investor who was the head of emerging market investments at Batterymarch, Sinha co-founded ParadigmARQ Advisors, a boutique quantitative investment firm, last year.

Although domestic funds have been late entrants in this domain, Siddharth Vora, head of quant investment strategies and fund manager—PMS, Prabhudas Lilladher believes quant investing is the future of investing.

“Better talent, technology and availability of data are the starting point for the quant ecosystem to explode. This coupled with underperformance of actively managed funds and more awareness of the consistency, predictability, and sophistication of quant investment strategies compared to actively managed strategies will pave the way for quantitative investing to become mainstream in India," asserts Vora.

“Better talent, technology and availability of data are the starting point for the quant ecosystem to explode. This coupled with underperformance of actively managed funds and more awareness of the consistency, predictability, and sophistication of quant investment strategies compared to actively managed strategies will pave the way for quantitative investing to become mainstream in India," asserts Vora.

Sankaranarayanan Krishnan, quant fund manager, PMS and AIF schemes, Motilal Oswal AMC says many fund houses have started incorporating quantitative methods. “They have a quant desk or one or two people who are working on quant strategies. There is an incremental interest as to how it evolves and no one wants to be left behind. There are a few firms that have done more than others but others are trying to catch up," explains Krishnan.

To be sure, the total AUM of mutual funds is to the tune of Rs40 lakh crore and quant funds comprise less than a percent in India. Quant funds are available to HNIs and small retail investors across several asset management segments including PMS, AIF, and factor-based index funds.

Unlike active or fundamental investing which relies on the skill and judgement of a fund manager at each stage of the investment process, quant investing is driven by tech-enabled investment models and minutely defined rules that are rigorously tested to generate alpha or superior risk adjusted returns. These strategies can also be powered by AI/ML models to predict outcomes using extensive historical data patterns.

“Active investing is like cooking without a recipe. You will have to rely on your art or experience to cook a dish with a possibility that the taste might differ every time. But quant investing is like cooking with a recipe we collect data and follow rules to work on that data. The rules or processes ensure consistency in investment returns," says Vora.

Once the extensive range of data is synthesised and the model is designed to achieve a stated objective, the ‘output’ or buying and selling decisions, is put to test across market and economic cycles to gauge the effectiveness of the model in terms of risk and return, for instance, and is finetuned. The risk and return are primarily driven by macro factors such as interest rates, inflation, GDP growth, and equity factors like a company’s m-cap, volatility, value, and momentum.

Vora says quant investing is a better strategy in relation to fundamental investing as it is enabled by a consistent and predictable model, based on vast data processing, which leads to faster and accurate investment decisions that can be reliably back-tested in different market conditions. “It is not emotional and does not base decisions on greed or fear. The disciplined and unbiased exits thereby reduce downside risks," he adds.

Prasad believes ParadigmARQ is a pioneer in utilising some of the latest techniques and tools in quant investing. He is reluctant to divulge details. “We put a lot of effort to have clean data and how you construct the model can make a huge difference in how your quant strategy will operate and give returns. Our models add alpha on the long side, stock selection on the short side, as well as on selecting the stocks and asset classes," Sinha says.

A more preferred ‘quantamental’ strategy is based on human judgement to develop rules and frame the model, and, in effect, combines fundamental, technical, and quantitative methods. Another example of a quant strategy is math and statistics-based models which hinge on an in-depth understanding of data science versus financial markets. Likewise, AI/ML strategies depend on complex algorithms and fundamental data for stock picking.

Sinha believes active, passive, and quant investing styles will co-exist, but quant strategies will have an edge.

“As there are more companies, which have much more data, it is not possible for a fundamental manager to cover 5,000-6,000 companies. As India market becomes more and more deep, and the cost of hiring people goes up, you will have to use quantitative methods," Sinha observes. Vora agrees: “With this, there lies a sweet spot between low-cost passive quant and high-cost active strategies, what we call active quant strategies."

At present, according to industry data, there are less than fifty quant schemes available to retail investors in India. Quant Money Managers has the largest quant AUM of over Rs14,000 crore, which is roughly 0.1 percent of its total AUM. It has over a dozen quant schemes.

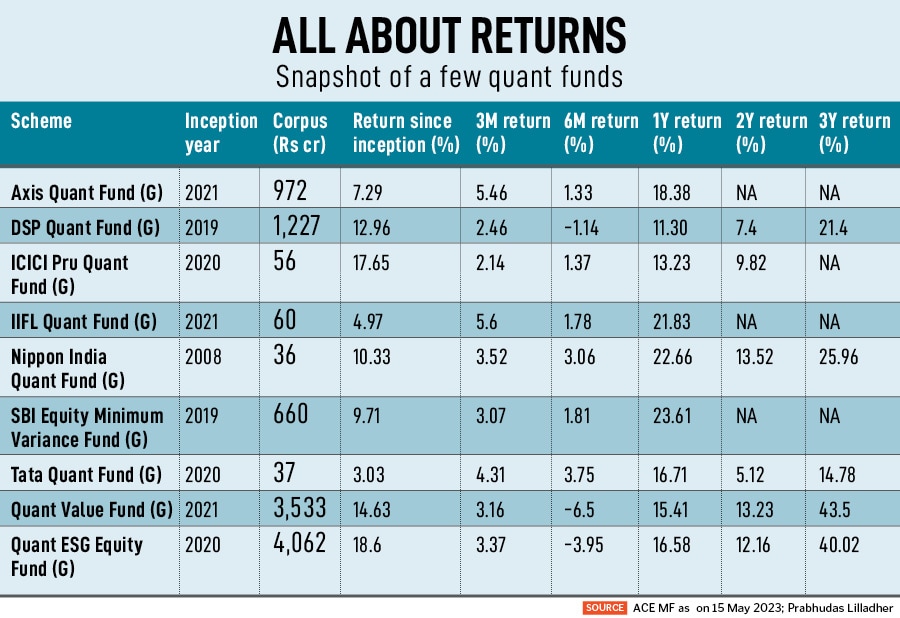

In fact, the Quant Value Fund launched in 2021 returned 14.63 percent since inception and outperformed the benchmark by a wide margin with a three-year return of 43.5 percent (see table). The Quant ESG Equity Fund has among the lowest expense ratio in the industry at 0.5. It was launched in 2020 and returned over 40 percent to investors over a three-year period. Nippon India Quant Fund, one of the earliest domestic quant funds, was launched in 2008 and has returned over 10 percent since its inception.

In general, Morgan Stanley’s quantitative strategists believe markets will continue to be driven by macro themes in 2023 as the global economy transitions from rising policy rates to one in which inflationary pressure recedes and global growth slows. Against this backdrop, value stocks offer better investing opportunities.

“As long as the environment continues to be favourable for value investing, with market volatility remaining high, investors should concentrate on undervalued stocks of high quality—crossing value filters with quality filters, in quant speak. Value-investing benefits extend to fixed-income value strategies as well," Tirupattur notes.

The world of quant investing has a dark side too. “The strategies based on AI/ML are usually black box optimisation techniques or models where it’s difficult to attribute the final stock selection to any particular factor," says Vora. What this means is that AI/ML based quant models can wreak havoc as fund managers do not have full control over the strategy because it is challenging to pinpoint the factors affecting the trade outcome.

In fact, there are instances of AI-based investing going wrong. For example, recently, two fund houses bore the brunt when markets corrected, and lost 45-50 percent due to optimisation models, an industry insider tells Forbes India in an off-the-record conversation.

Though quantitative investing cuts out human bias to refine outcomes, the success of a quant model critically depends on human judgment at the stage of constructing the investment model and the experience of a fund manager in sorting through data and eliminating distortions. "A big risk for quant managers is that it"s easy to get blindsided by data and historical tests, which look interesting and meaningful but are actually traps," says Krishnan.

Another big hurdle, which partly explains why quant techniques are often shrouded in secrecy, is that as more and more investors implement a strategy it effectively loses its edge in the marketplace. “Let"s say one quant investing strategy, for example momentum, becomes very popular and everybody adopts it. Over time, that strategy will become crowded and it will stop working. My job as an investor is not just to try to find the best strategy, but also to know how to tactically pivot," says Sonam Srivastava, smallcase manager & founder, Wright Research.

Importantly, the model is inherently based on volumes of historical data. This data is not indicative of black swan events or unforeseen catastrophic calamities. Obviously, the occurrence of such events can throw the model out of gear and lead to unfavourable outcomes and returns. Besides, active fund managers have their ears to the ground and are quick to respond to market intelligence and qualitative information which cannot be readily built into quant models on a here-and-now basis.

“The model’s robustness may go down if the quality and timeliness of data isn’t optimal and the model may also be irrelevant if it is not tested for different market cycles," cautions Vora.

A case in point, in the US, actively manged funds backed by humans profited from tech stocks amid an avalanche of liquidity that fuelled growth stocks even as most quant-driven funds were among the top losers as they succumbed to the chaos of an unprecedented pandemic and leading funds such as Renaissance and AQR lost over 30 and 20 percent each.

Once again, in 2009, Buffet wrote in a letter to investors: “Investors should be sceptical of history-based models. Constructed by a nerdy-sounding priesthood using esoteric terms such as beta, gamma, sigma and the like, these models tend to look impressive. Too often, though, investors forget to examine the assumptions behind the symbols. Our advice: Beware of geeks bearing formulas."

And, for the record, despite decades of heft and clout of quant funds among US investors, it was the Oracle of Omaha’s wisdom and keen understanding of perpetually true investment principles that withstood the testing times of extreme uncertainty and volatility induced by the pandemic in 2020.

First Published: May 17, 2023, 11:35

Subscribe Now