India's trillion-dollar opportunity

India has set itself out to be a manufacturing exporting powerhouse and with a reorientation in exports, over the next few years a bulk of the growth in export numbers could come from sectors like ele

At an ABB India factory in Faridabad employees regularly walk over to take a look at a low voltage motor kept on the shop floor. The unit of the Swedish-Swiss multinational makes motors for exports and its employees have been tasked with making sure they get the quality and specifications right. It’s a test they’ve passed and the product, which is now 100 percent localised, is sent to ABB customers across the globe.

And it’s not just motors. Take for instance its factory that makes relays in Vadodara. A large part of that production is dedicated to exports. Or its recent expansion in Nashik announced in February. Expect products from there to be exported too. While ABB India doesn’t break out export numbers for specific products it’s fair to say that 12-15 percent of its Rs8500 crore turnover comprises of exports. It’s an area the company expects to focus on in the years ahead.

“China +1, like elsewhere is a topic at ABB," says TK Sridhar, chief financial officer at ABB. He points to how the Group is actively looking at increasing exports from India complemented by the efforts of local talent to upskill themselves in a global environment, work on product customisation, and to increase localisation standards.

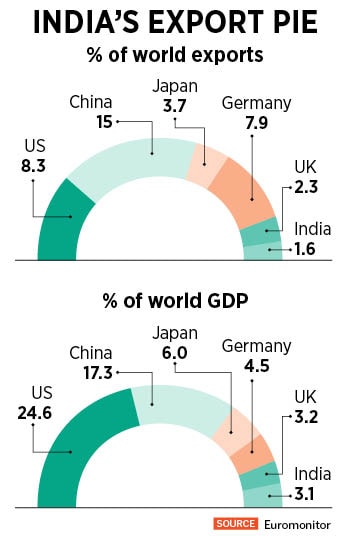

Importantly, the products that companies like ABB export are not areas where India has had a competitive advantage. Our traditional export areas have comprised petroleum products, gems and jewellery, textiles, cotton, minerals (mainly iron ore), tea, coffee and buffalo meat. “These are clearly not going to get us to the trillion dollar mark," says Jayant Dasgupta, who represented India at the World Trade Organization. As a percentage of world exports India’s share accounts for a measly 1.6 percent even though its economy is 3.1 percent of world GDP.

According to Dasgupta, this shift in the reorientation of Indian exports is crucial to us getting to a trillion dollars. It is also significant as it would help us to move up the value chain and leave our export numbers less exposed to the vagaries of commodity prices. (The increase in exports last fiscal from $422 billion to $445 billion was almost entirely on account of the rise in prices of petroleum products. Services exports were $322 billion in FY23).

According to Dasgupta, this shift in the reorientation of Indian exports is crucial to us getting to a trillion dollars. It is also significant as it would help us to move up the value chain and leave our export numbers less exposed to the vagaries of commodity prices. (The increase in exports last fiscal from $422 billion to $445 billion was almost entirely on account of the rise in prices of petroleum products. Services exports were $322 billion in FY23).

This is where efforts in boardrooms across India point to the slow but steady strides India has been making in positioning itself as a manufacturing powerhouse. While estimates on the timelines vary, this much is certain: India has set itself a $1 trillion merchandise export target by the end of this decade. Getting there will be a tall task but equally it is not a target that can be taken lightly. To get to a trillion over the next seven years India needs to compound at 12 percent in dollar terms or 15-16 percent in rupee terms.

Skeptics argue that Indian exports have never grown this fast. Between 2010 and 2023 they rose 6 percent a year in dollar terms. India has also multiple times missed the export-led growth spurt that powered countries across Asia from Japan in the 1960s to South Korea in the 1970s and Taiwan in the 1980s to China and the Asian tiger economies in the 1990s. India now finds itself in a position to take some business away from them for three reasons.

The first is geopolitical. “Political blocs are increasingly becoming trade blocs," says Abheek Barua, chief economist at HDFC Bank. He points to this being a large opportunity for India as we are seen to be in the bloc that comprises of countries not allied to China or Russia. While it remains to be seen how India exploits this it is clear that countries would willingly import from us if there is an option.

Second, the imposition of environmental rules in China from 2016 onwards has left large swathes of products for the taking. Specialty chemicals, textiles and active pharmaceutical ingredients are three areas where India has a competitive edge and has companies that are able and willing to work on products for the West.

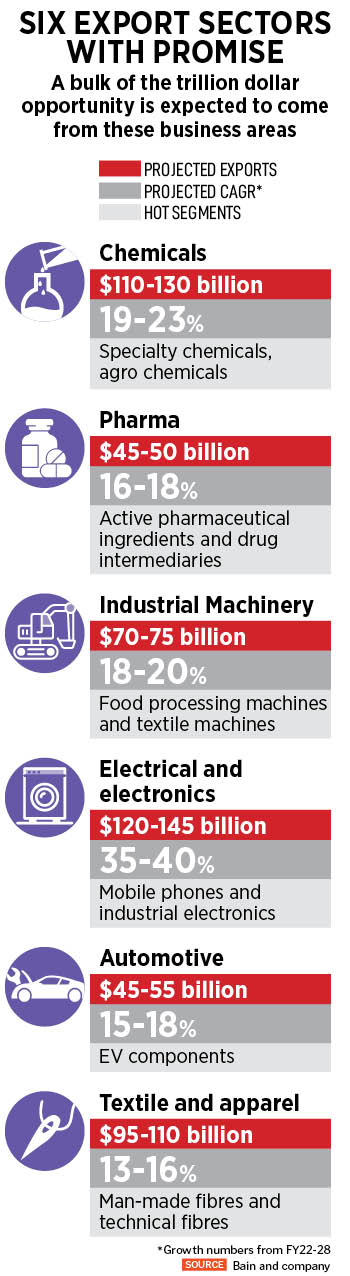

Third, the adoption of the production linked incentive or PLI scheme in 14 sectors has meant that companies are now willing to put down capacities. In this fiscal 2023-24 an allocation of Rs197,000 crore was made in the Budget. In the next three years expect a bulk of the growth in export numbers to come from textiles, automobiles and auto components, chemicals, pharma, industrial machinery and electronics.

It’s still early days in India’s aim of shifting its export basket from petroleum products and commodities to more value-added areas but the initial signs are promising. “Our investment in new technologies and new areas where hitherto we were not very strong exporters opens up a lot of strong possibilities," says Dasgupta.

The government has decided to adopt a two-fold approach in getting businesses to set up export facing operations. The first and most publicised is the production linked incentive scheme that gives a rebate of 4-6 percent on incremental sales when compared to the first year of production. This means that businesses in effect can save up to 5 percent of the cost of production. The incentives have a five-year sunset clause.

The government has decided to adopt a two-fold approach in getting businesses to set up export facing operations. The first and most publicised is the production linked incentive scheme that gives a rebate of 4-6 percent on incremental sales when compared to the first year of production. This means that businesses in effect can save up to 5 percent of the cost of production. The incentives have a five-year sunset clause.

While a bulk of the sectors where approvals have come in are yet to start exporting, capital investment plans have been announced and the advantage of incremental exports should start accruing from FY24. Mobile phones is one area where the numbers have already started to show an uptick.

While a bulk of the sectors where approvals have come in are yet to start exporting, capital investment plans have been announced and the advantage of incremental exports should start accruing from FY24. Mobile phones is one area where the numbers have already started to show an uptick.

In the year ended March 2023 provisional numbers point to Rs90,000 crore ($11 billion) of mobile phone exports, according to the India Cellular and Electronics Association, an industry body. In the previous year this number stood at Rs45,000 crore. Some portion of this has come as companies like Apple and their suppliers Foxconn and Wistron, which exported $5.5 billion worth of products from India in FY23, want to develop India as a hedge against China. Barua expects this number for electronics to rise steadily and for India to become the second largest manufacturer in Asia after China.

Expect a bulk of the output in sectors like solar panels, specialty chemicals, advanced cell batteries for EVs to account for $200 billion in incremental exports. Unlike textiles and auto parts, where India faces stiff competition from Bangladesh, Vietnam and Thailand, companies here face less competition as manufacturers also intend to use some of their production for India’s large domestic market.

Vinati Organics, which makes a host of specialty chemical products, says it is seeing a lot of interest from consumers overseas as they look to diversify their sources of supply from China. The company is investing Rs580 crore in capacity expansion and is on the lookout for new projects. “Clients are now willing to give Indian suppliers a chance," says Vinati Saraf Muthreja, the managing director of the company, while cautioning that Indian companies only get a look in once their quality specifications are up to scratch. In the chemical business, the effects of capacity expansion should be visible in the next 18 months.

Just like in the 1980s Maruti’s entry gave rise to an Indian auto component system, semi-conductor manufacturing, if it takes off, can position India as a hub for manufacturing electronics, satellites, automobiles, mobile phones, laptops and defence equipment. Dasgupta says that this would be a key monitorable as a successful semi-conductor industry would make it easier for India to reach the $1trillion export mark.

Just like in the 1980s Maruti’s entry gave rise to an Indian auto component system, semi-conductor manufacturing, if it takes off, can position India as a hub for manufacturing electronics, satellites, automobiles, mobile phones, laptops and defence equipment. Dasgupta says that this would be a key monitorable as a successful semi-conductor industry would make it easier for India to reach the $1trillion export mark.

Even outside of government incentives companies are upping their investments in India. Back at ABB India a Rs1000 crore expansion plan was announced in early 2023 across its 27 factories. The bet seems to be on using Indian facilities for both the domestic market and exports, and initial signs are that it could be paying off. Over the last year sales rose 24 percent to Rs8500 crore while profits zoomed 77 percent to Rs1016 crore giving it plenty of cash to redeploy in the India business.

First Published: Apr 28, 2023, 13:45

Subscribe Now