Inside ThoughtSpot's $150 million plan to expand in India

After overhauling itself into a SaaS company, ThoughtSpot is making its India team central to its growth plans

One could say, ThoughtSpot made its own transition to the cloud in the nick of time. Not because there was some path-breaking technological shift—about three years ago, when the Sunnyvale, California-based data analytics company began its switch—but because the Covid pandemic happened.

When, after some initial uncertainty, businesses around the world significantly stepped up their move to the internet, ThoughtSpot had not only saved itself, but found itself in the right place at the right time, offering the right solutions.

Heading into 2023, memories of a layoff in 2020 that resulted from the shift to the cloud should be fading. With the caveat that we don’t know what more might be in store for the entire tech sector this year, which has already seen Microsoft, Google, Amazon and Salesforce together layoff about 50,000 people.

Anyway, today the software-as-a-service (SaaS) model is responsible for the bulk of ThoughtSpot’s revenue. In November 2021, Forbes reported ThoughtSpot was on track to hit $100 million in annual recurring revenue in the next 12 months, but the company declined to share financial numbers for this story. That projection, it’s worth pointing out, was also well before the current slowdown.

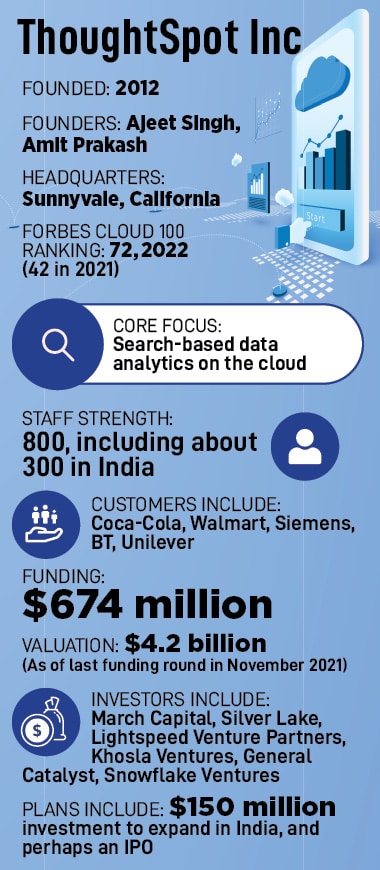

That said, as recently as September 2022, ThoughtSpot was clearly in growth mode, announcing a $150 million plan to expand the company’s operations in India.

“Our core product value proposition, making it easy for people to access data, has remained the same. What has changed significantly in the last two-and-a-half years is our distribution model," Co-founder and Executive Chairman Ajeet Singh says. Ten years ago, the cloud infrastructure wasn’t there to run a search engine for business data analytics on it, he says.

“There was no Snowflake, no Google BigQuery," he says. So ThoughtSpot Analytics, the company’s flagship product, was born as an on-premises product.

Today customers can start with a cloud-based subscription at $95 a month—compared with an average on-premises deal size of about $270,000, two-and-a-half years ago, CEO Sudheesh Nair told TechTarget in May 2022—and as a result, customers include not just some of the biggest corporations in the world, but also scrappy startups with five-member teams.

Another aspect of ThoughtSpot’s evolution is that developers can bring ThoughtSpot’s tech into their own SaaS products—using APIs, of course (increasingly, APIs or application programming interfaces, are how different software talk to each other).

“If someone is building an HR app, a sales app, a marketing app, whatever they might be building, they can inject insights and analytics through what we call ThoughtSpot Everywhere with our very easy-to-use APIs," Singh says.

Some of the world’s biggest companies use ThoughtSpot’s products, including Walmart, Coca-Cola, BT, Siemens, Daimler, Medtronic, Hulu, Royal Bank of Canada, Nasdaq, OpenTable, Metromile, Workato, and Nationwide Building Society, according to the company’s website.

The cloud products have grown upwards of 100 percent year-on-year, Singh says.

The germ of an idea for what would become ThoughtSpot probably came to Singh when he noticed that people"s ability to store data was really improving. He was working at a company called Aster Data Systems. There were such companies as Aster, and Hadoop (an open-source collection of software to use networks of computers to process very large volumes of data) was starting to gain traction, he recalls.

On the other hand, how that data was delivered to the end users, who were often business users, and not software professionals, was still very manual, he recalls. One would need analysts and data experts to build dashboards and “people had to wait weeks to get those answers", Singh says.

“We said why can"t this be as simple as Google? Why can"t people go to a search bar and just ask the question they have and get an instant answer, and make a business decision and move on."

ThoughtSpot has competitors, of course, and some of those products are backed by technology’s biggest names—Power BI from Microsoft, Tableau, acquired by Salesforce, Looker, bought by Google, Amazon QuickSight from AWS. Other independent providers include Qlik, Sisense and Domo.

Singh argues that ThoughtSpot is more user-friendly, with the rivals such as Power BI or Tableau requiring more training. Reviews on G2.com, a large marketplace for software, popular with developers and other software professionals, had given an average rating of 4.4 on 5 for ThoughtSpot, 4.3 for Tableau and 4.4 for Power BI, as of today.

Another aspect of why companies such as ThoughtSpot see a large opportunity is that “when it comes to data, the biggest thing that is happening is this creation of what is known as modern data stack," Singh says.

What this means is that “data is now being managed as software… and the role of ‘data engineer’ is becoming powerful," he says. A new generation of companies such as Snowflake, which has also invested in ThoughtSpot, and Databricks, is emerging that is helping businesses tap a cloud-based data management model called data-as-a-service.

What this means is that “data is now being managed as software… and the role of ‘data engineer’ is becoming powerful," he says. A new generation of companies such as Snowflake, which has also invested in ThoughtSpot, and Databricks, is emerging that is helping businesses tap a cloud-based data management model called data-as-a-service.

Today, the software development lifecycle is being applied to management of data, Singh says. Data engineers can define data pipelines, how data moves from one location to another, and monitor it. They can define the changes they want to see in the data using software code.

“Unlike the traditional model of using an ETL tool, here you can use something like dbt, where you can write the transformations, execute them inside the cloud data platform, and your data will be ready for analytics," he explains.

ETL, which is about half a century old as a concept, refers to ‘extract, transform and load’ (data) and dbt refers to ‘data build tool’–an open-source tool that helps software developers transform data to make it more useful, developed by dbt Labs–gaining popularity in the recent five years or so.

The end users could be merchandisers who are trying to decide which products to promote on their websites, insurance agents, wealth advisors or teachers trying to decide how they should approach different students, Singh explains, with some examples. This is why a simple search-bar-based analytics tool is attractive.

The end users need not be data experts, but they still need reliable information, quickly, that can help them make decisions every day. And whether it’s an insurance giant or a school, in giving the end users the information they need, there is also the need for security. “It"s a very exciting time to be in the data industry. It"s become the most important part of an enterprise and it"s become a cliché," Singh says.

As ThoughtSpot charts its next phase of growth, in addition to its flagship ThoughtSpot Analytics, it’s investing in products including SpotIQ, which provides AI-based insights very quickly, and ThoughtSpot Monitor and a mobile app.

“We want the system to become smart enough that it can come to the users and tell them what is happening in their business, what is changing and why that change is happening. Just like Google weather app can tell us it"s going to rain tomorrow so we can better prepared."

For example, ThoughtSpot Monitor can show a business that its churn for a particular customer segment in a particular geography has increased, and point out some of the reasons.

Analytics will become more proactive over time as opposed to people having to go to a tool, ask a question and get an answer, he says. And that is one important plan for the next four or five years – to build much more of that predictive capability into ThoughtSpot’s products.

Singh expects the company’s India-based teams to play an increasingly central role in executing the growth plan. Today, ThoughtSpot has about 800 employees worldwide, with about 300 of them in India, which the company entered in 2017, setting up an India-based R&D team.

Now ThoughtSpot has two more centres in India, one in Hyderabad and another in Thiruvananthapuram, which is a more recent one, as a result of ThoughtSpot acquiring a company called Diyotta. While based in India, these teams interface with everyone, including customers in the US, according to Kumar Gaurav, India country head and VP of engineering. The teams in India comprise not only engineers, but also product managers and designers. Over the next few years, Gaurav expects to as much as double the headcount. It will increase by between 80 percent and 100 percent, he says.

Certain products, like ThoughtSpot Everywhere, and product areas like ThoughtSpot’s integration with DBT and cloud technologies are all being done from India, according to Singh. The idea for ThoughSpot Everywhere came out a hackathon at the company’s India centre some two-and-a-half years ago, Gaurav says.

There will be further investments in sales and marketing for both the Indian market and to use India as a base to sell in the US and elsewhere. Another area of investment is to both deepen and expand relationships with India’s IT giants, including TCS, HCL Tech and Wipro, who will be important systems integrators around ThoughtSpot’s products.

In December, ThoughtSpot named Rajesh Dhiman, to specifically oversee this aspect of its growth, as senior director for global system integrators. Dhiman, who has an engineering degree in IT and an MBA, has, over the last 16 years, worked at companies including Fujitsu, Dell, and most recently, NetApp.

He is part of a roster of senior executives ThoughtSpot has attracted over the last 18 months as it looks to grow faster, having mostly finished the transition to becoming a SaaS company. Others include Gaurav, and Kuntal Vahalia, a former Salesforce executive, who came onboard as senior VP of channels and alliances in April 2022.

CEO Nair himself joined in late 2018, from Nutanix, a cloud infrastructure provider. He mapped out the plan to turn ThoughtSpot into a cloud company, and oversaw the implementation of that plan, Forbes reported in November 2021.

Founder Ajeet Singh has the distinction of being counted among those entrepreneurs who co-founded not one, but two billion-dollar businesses. He started out with the classic Indian high-achiever combination of IIT-IIM, with a chemical engineering degree from the Indian Institute of Technology, Kanpur and an MBA in finance and information systems from Indian Institute of Management, Calcutta.

After about a year with multinational accounting firm PwC, Singh switched to tech and worked at companies including Honeywell and Oracle before turning entrepreneur himself. In 2009, he helped found Nutanix with Dheeraj Pandey and Mohit Aron, where he was chief product officer. Nutanix is a Nasdaq-listed company, currently valued at $6.2 billion.

In 2012, Singh left to start ThoughtSpot with Amit Prakash, who is currently also the CTO, and “technical co-founders" Abhishek Rai, Priyendra Deshwal, Sanjay Agrawal, Shashank Gupta and Vijay Ganesan. Rai, Deshwal, Ganesan, Agrawal and Gupta have gone on to starting their own companies.

At its last funding round, a $100 million financing announced in November 2021, ThoughtSpot was privately valued at $4.2 billion, more than doubling its value from 2019. So far, the company has raised about $674 million in funding. Investors include March Capital, Silver Lake, Lightspeed Venture Partners, Snowflake, Fidelity and General Catalyst.

There’s been some talk of an initial public offering (IPO), but considering the current market conditions, a timeline is not immediately clear. ThoughtSpot is hiring for a variety of roles in India, from people with specialist knowledge or those finishing college with a keen interest in software and analytics. The company is especially paying attention to hiring talented fresh graduates in India, with country head Gaurav, adding “I’m a big fan of working with young college graduates."

First Published: Jan 23, 2023, 12:48

Subscribe Now