M&A in India: Deals see a resurgence in 2024

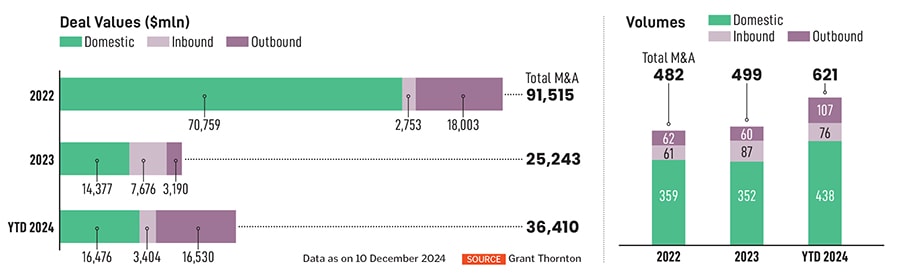

Deal values have touched $36.14 billion from $25.24 billion in 2023—marking a 43.2 percent increase; volumes too saw a 24.4 percent increase in 2024. Manufacturing saw 18 deals, followed by pharma and

The Indian M&A landscape in 2024 has seen a marked resurgence, bouncing back from the slowdown in 2023. Until November 2024, the deal values had touched $36.14 billion from $25.24 billion in 2023, marking a 43.2 percent increase. Deal volumes also saw a 24.4 percent increase in 2024, as per data provided by Grant Thornton Bharat.

Domestic deals have been at the forefront of this revival, with Indian companies increasingly active in both acquiring and merging, supported by rising foreign direct investment (FDI) inflows.

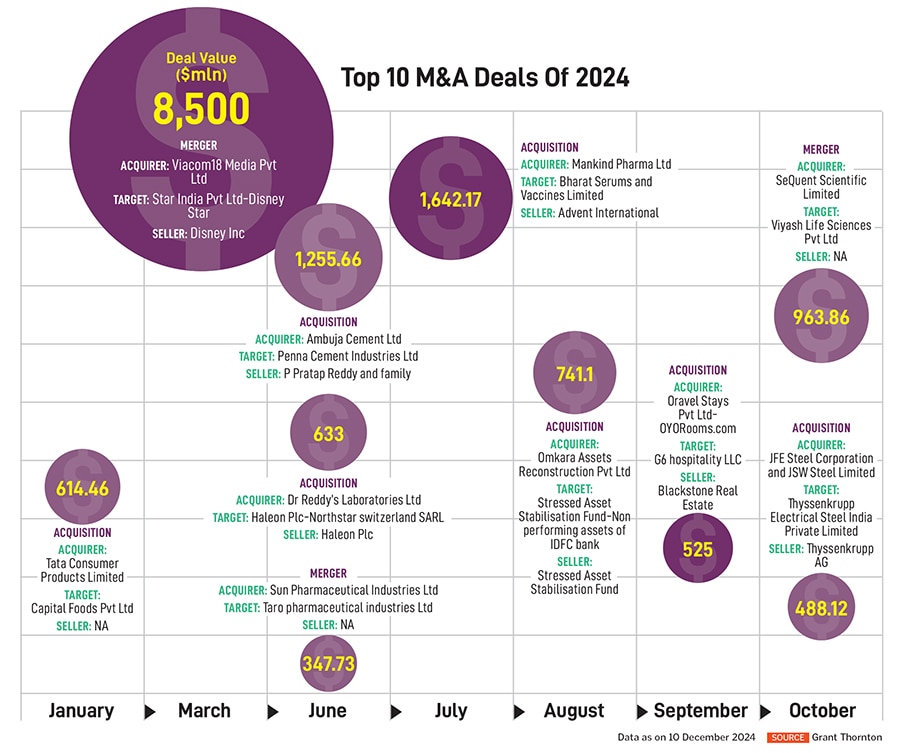

The biggest deal in terms of value was the merger of RIL’s Viacom18 and Star India for $8.5 billion, to create India’s largest media and entertainment company. Outside of this deal, the sector remained fairly muted.

Manufacturing has been the most active in terms of sectors with 18 deals such as Ambuja Cement Ltd acquiring Penna Cement Industries Ltd in a $1,255 million-deal. A close second was pharma and health care with 15 deals, including Mankind Pharma acquiring Bharat Serums and Vaccines Limited in a $1,642 million-deal and Dr Reddy’s’ acquisition of Haleon Plc’s arm Northstar Switzerland SARL in a $633 million-deal.

Manufacturing has been the most active in terms of sectors with 18 deals such as Ambuja Cement Ltd acquiring Penna Cement Industries Ltd in a $1,255 million-deal. A close second was pharma and health care with 15 deals, including Mankind Pharma acquiring Bharat Serums and Vaccines Limited in a $1,642 million-deal and Dr Reddy’s’ acquisition of Haleon Plc’s arm Northstar Switzerland SARL in a $633 million-deal.

“The consumer goods sector, including FMCG and retail, and the financial services sector, including banking, insurance, and asset management, is witnessing M&A activity driven by the need for consolidation, digital transformation, and regulatory changes," says Rohit Berry, president–strategy, risk and transactions, Deloitte India.

This uptick is a reflection of India’s growing stature as a key destination for capital and strategic investment. “India ticks all the boxes for it to be the most attractive investment destination, be it strong growth prospects on a large base, stable political environment and regulatory regime, easing inflation, deep capital markets, relative ease in accessing good talent, low-cost advantage, large domestic consumer base, technology and innovation," says Bhavin Shah, private equity leader, PwC India.

The optimism around Indian M&A activity is abundant, characterised by strong domestic deal activity, strategic cross-border investments in high-growth sectors, and a thriving IPO market. “The availability of abundant dry powder in the Indian market—capital raised by PE funds that remains uninvested—further supports the optimism around Indian M&A activity. This large pool of capital, combined with the ongoing success of IPOs, is driving valuations to new heights, contributing to the “hockey-curve" effect, where valuation growth accelerates at a steep rate," notes Iqbal Khan, partner and national corporate lead, JSA.

The emphasis on technology and digital transformation has intensified, with companies prioritising acquisitions that can enhance their technological capabilities. Additionally, while consolidation has been a trend in previous years, it has become even more pronounced in 2024, as companies seek to gain scale and market dominance.

India’s FDI inflow rose to $88 billion in 2024, a 10 percent increase from 2023, with M&A friendly policies driving a large share, as per data shared by Deloitte India.

Certain changes, such as relaxed FDI caps in sectors like defence, retail, and aviation have attracted foreign investment, while ongoing ease-of-doing-business reforms have simplified regulations and reduced compliance burdens. “Tax cuts and the introduction of the production-linked incentive [PLI] scheme have boosted investor confidence, particularly in manufacturing and tech sectors. The government’s push for consolidation in the banking sector and improvements to the Insolvency and Bankruptcy Code (IBC) have further stimulated strategic acquisitions and distressed asset deals," explains Khan.

Additionally, changes to the Goods and Services Tax (GST) and customs policies have made cross-border transactions smoother, creating a more favourable environment for M&A across various sectors.

So far the interest from foreign investors has been in sectors such as technology, banking, pharma and health care, and renewable energy among others. However, says Vishal Agarwal, partner, Grant Thornton Bharat, “Everybody felt that the valuation multiple is very high, so deals have taken longer to close. But interesting deals have taken place where the scalability of the business is convincing or the promoters have been willing to take some cut on the valuation."

On the other end, geopolitical uncertainties and global economic shifts are having a significant impact on M&A activity in India. According to Deloitte, over 45 percent of cross-border M&A deals in 2024 were influenced by geopolitical and supply chain factors.

“Many companies are adopting a China-plus-one strategy, seeking to diversify their manufacturing and sourcing beyond China. India is seen as a potential alternative, which could lead to increased M&A activity as companies acquire Indian businesses or set up manufacturing facilities in the country," says Berry of Deloitte.

Supply chain disruptions caused by geopolitical events such as the ongoing conflict in Ukraine have highlighted the need for greater supply chain resilience. “There is a clear decoupling of supply chains taking place leading to M&A activity being along similar lines," says Shravan Shetty, managing director, Primus Partners. Companies are seeking to acquire businesses that can help them improve their supply chain visibility, agility, and resilience.

“MNCs don’t seem too keen to set up plants in India—however, working with Indian contract manufacturers seems to be fairly active. That’s one of the reasons you’ll see a lot of activity in terms of manufacturing M&A —they are growing fairly rapidly and CapEx is getting added there," says Agarwal.

M&A activity in India is likely to remain strong, aided by the positive shift in global markets. Growing sectors such as technology, health care, manufacturing and renewable energy will remain a key focus.

In the next couple of years, Agarwal says, “In small quantums, but sectors such as aerospace, defence, agritech will continue to garner investments—not the bulge bracket, but they will remain exciting sectors. Additionally, there are certain regulatory changes that are expected on the insurance regulatory framework, in terms of FDI policy. If those changes come through, that could trigger a bunch of consolidation action there—so insurance should be an interesting space."

On the policy and regulatory front, Khan says, “We expect the government to keep up the growth-oriented approach of recent years and the sustained push on fast infrastructure development to continue," — bolstering the overall outlook on the Indian economy in general and on M&A activity in particular.

First Published: Dec 30, 2024, 11:53

Subscribe Now