No extraordinary gain in 2024 as investors weather stormy markets

Investors were vulnerable to shocks in most parts of 2024 as stocks waded through disruptions and uncertainties

For stock markets, 2024 was a year of stark contrasts. Betting on stocks for any investor almost seemed like playing the old puzzle video game Minesweeper—if a player opens a mined cell, it is game over.

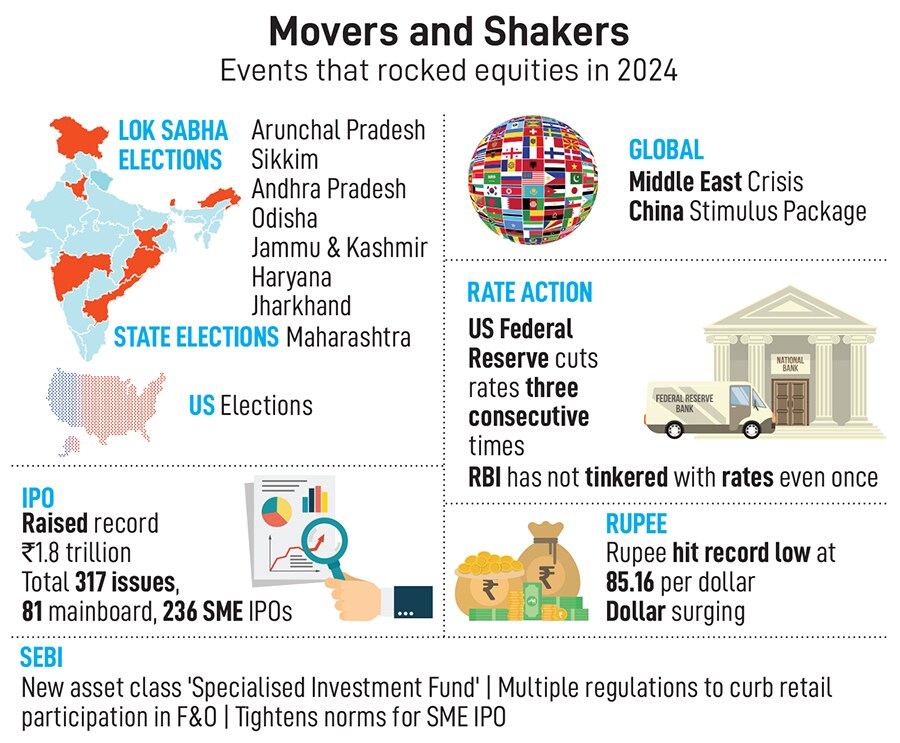

Investors in stock markets showed resilience, no doubt, but returns were pale compared to previous years. Markets weathered plenty of challenges as the world was normalising following Covid-led pangs. Sequence of events such as elections in India (both Lok Sabha and in a few key states) and in the US, high interest rates, rising bond yields, fluctuating foreign flows, strong dollar and geopolitical crisis, tested the patience of Indian investors throughout the year.

Adding to the overall concerns and nervousness was the slowdown in economic growth and the unimpressive corporate earnings in India. Where could an investor in Indian stocks hide? They were getting more vulnerable to shocks as the year progressed. Some of them re-balanced portfolios to protect some profit at least.

Though Indian equities started the year with optimism, benchmark indices Sensex and Nifty are ending the year with just about eight percent gains. This compares to around 20 percent surged in 2023.

“In 2024, we witnessed the Indian market turning more volatile than before. The Nifty and BSE Sensex peaked in September before sharply correcting in October and November," says Shripal Shah, MD and CEO, Kotak Securities. Sell-off of Indian shares by foreign institutional investors (FIIs) added pressure to the already-tense markets sentiment.

The Sensex made a record high at 85,978.25, while the Nifty, too, hit a lifetime-high of 26,277.35 in September. Both the benchmark indices surged over 20 percent by the first nine months of 2024 as election-related euphoria pumped investors to keep allocating more money into stocks. However, weaker-than-anticipated corporate earnings in the September quarter and heavy sell-off by FIIs in October led to massive corrections in Indian equity. Eventually, Sensex and Nifty have declined nearly 10 percent from their respective life highs. The stimulus package announced by China in November also took the shine off the Indian markets as investors started reconsidering China as an alternative to India in their investment portfolio.

The Sensex made a record high at 85,978.25, while the Nifty, too, hit a lifetime-high of 26,277.35 in September. Both the benchmark indices surged over 20 percent by the first nine months of 2024 as election-related euphoria pumped investors to keep allocating more money into stocks. However, weaker-than-anticipated corporate earnings in the September quarter and heavy sell-off by FIIs in October led to massive corrections in Indian equity. Eventually, Sensex and Nifty have declined nearly 10 percent from their respective life highs. The stimulus package announced by China in November also took the shine off the Indian markets as investors started reconsidering China as an alternative to India in their investment portfolio.

Gautam Duggad, head of research, institutional equities, Motilal Oswal Financial Services, finds a silver lining in these corrections. He explains that, for the first time in 10 years, mid and smallcap indices have fallen less than largecaps. Historically, in the case of an over-10 percent correction in Nifty, midcap and smallcap indices have seen a sharper correction of two-to-four times.

“Relentless FII selling has led to a significant decline in largecaps, whereas strong retail and DII flows have resulted in midcaps and smallcaps outperforming by a wide margin during the recent market correction," explains Duggad.

BSE Midcap and BSE Smallcap has risen around 25-30 percent in 2024, while both the indices have slipped nearly seven percent from their respective record highs touched in September. In 2023, both BSE Midcap and BSE Smallcap had surged by whopping 45-47 percent.

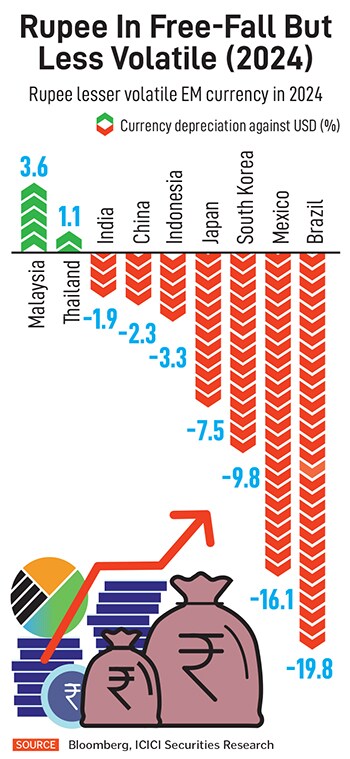

Globally, markets have also been volatile this year while a strong US dollar helped equities there. In 2024, MSCI World has risen over 20 percent while MSCI EM is up over 10 percent.

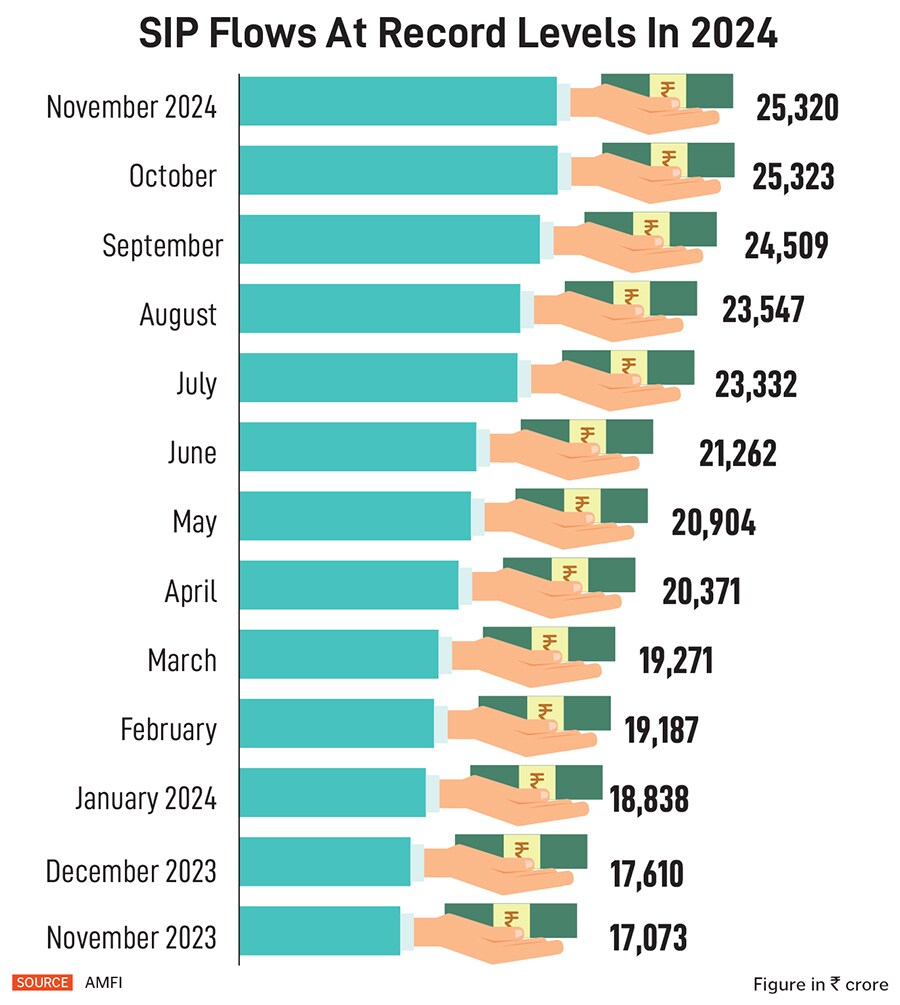

Riding on a strong US dollar and higher US treasury yields, FIIs have been mostly fleeing Indian stocks in 2024. What led to the liquidity support of Indian stocks was money from local shores through domestic institutional investors (DIIs) and retail. The DIIs have consistently been net buyers, providing substantial support to the market.

FIIs have bought Indian shares worth net $394.5 million in 2024 so far. In contrast, DII investments have pumped around Rs511124.5 lakh crore.

The monthly flow of money through systematic investment plan (SIP) has been growing, hitting a record at Rs25,323 crore in October. Monthly SIPs have been rising above Rs15,000 crore per month since July 2023.

2024 has been a blockbuster year for the Indian primary market, with Rs1.8 lakh crore raised through more than 317 IPOs to date—an all-time high that surpasses the previous record of Rs1.3 lakh crore in 2021. The contribution of new listings through IPOs to the Indian market capitalisation saw an uptick of 2.9 percent versus 1.4 percent in 2023.

Domestically, while India’s strong long-term structural growth story remains intact, growth has been cyclically slowing and impacting profits, which led Goldman Sachs to downgrade its view on India equities in October.

“The macro environment has become more challenging for emerging markets equities, including India," says Sunil Koul, emerging market equity strategist, Goldman Sachs. However, Koul thinks Indian equities should be relatively insulated from the macro headwinds of a stronger dollar, shallower emerging markets easing cycles and likely higher US tariffs on China.

Koul feels valuations of Indian stock markets are still steep despite a correction he, therefore, expects equities to be in a range.

Meanwhile, Chetan Seth, Asia Pacific equity strategist, Nomura, remains structurally overweight on India although there could be some more near-term risk of healthy valuation de-rating amid a slowing macro and earnings cycle. “Elevated geopolitical and trade tensions amid looming tariffs, monetary policies that are less supportive than hitherto and China’s restraint on fiscal stimulus dictates a cautious stance at the start of 2025," says Seth.

First Published: Dec 24, 2024, 12:29

Subscribe Now