ONDC is India's next big bet after UPI

The open network is re-inventing ecommerce to level the playing field between online and offline players and loosen the grip of Big Tech. The opportunity is massive but so are the obstacles

When Rosbin PB, a 32-year-old shopkeeper, joined hands with the owner of a 450 square-foot local convenience store in Bengaluru’s Indiranagar, it had a small but dependable customer base. IT workers who lived in the neighbourhood bought their groceries and daily supplies from the shop. But Rosbin wanted more.

He borrowed money, expanded the shop, and registered on Dunzo. Orders routed through the hyperlocal delivery service shot up to 700 per day in a matter of months.

Then, Dunzo decided to open its own dark store in the neighbourhood. Rosbin says the number of orders slashed to 80 per day. “They give preference to their own store, naturally," he says. “We have to accept whatever these companies decide. We have no choice."

That’s changing now. Rosbin has registered on the Open Network for Digital Commerce or ONDC—a network that enables his little shop to be visible to online buyers shopping on any app, so long as that app is aligned with ONDC.

So when a customer opens his favourite shopping app—Paytm, for example, which is part of the network—and clicks on the ONDC icon, he will be able to find products from all sellers who are part of the network, not just sellers registered with Paytm. So far, 36,000 sellers across 236 cities have registered on ONDC including large ones like HUL and ITC, as well as smaller setups like Rosbin’s Green Mart.

“It’s only been a few weeks since we registered but we already get 40-50 orders per day from ONDC from Monday to Thursday. On weekends we get 100+ orders per day," says Rosbin. “We don’t have to depend on Dunzo anymore. We now have other options to grow online."

And that is the point of ONDC: To give offline retailers like Rosbin, who have been left out by the ecommerce wave sweeping through the country, a chance at levelling up.

“We’re not trying to be a Swiggy or Zomato-killer or an Amazon or Flipkart-killer," says Shireesh Joshi, chief business officer of ONDC, a government-backed, not-for-profit entity, whose funders include Quality Council of India, Small Industries Development Bank of India (SIDBI), National Bank for Agriculture and Rural Development (NABARD) and a number of financial institutions including State Bank of India, ICICI Bank and Kotak Bank.

“Our aim is not to take away 10 or 15 percent market share from Swiggy or Zomato," Joshi continues, referring to the buzz on social media in the recent past on the price differences between these giants of food delivery and ONDC. A cold coffee from McDonalds, for example, was available for Rs208 on Swiggy, Rs226 on Zomato, and Rs108 on ONDC on May 8.

Customers are currently being offered discounts of up to Rs50 per order if they shop through ONDC. While restaurants are being charged commissions of two to five percent versus the 25 to 30 percent charged by Swiggy and Zomato. “The incentives are just triggers to jumpstart the network," says T Koshy, the chief executive of ONDC who previously set up and ran the National Security Deposit Council (NSDL) for over a decade. "We don’t believe that the network will scale based on such incentives - it isn’t a long term strategy," he clarifies.

Instead, the long-term strategy is to bring into the digital fold people like Rosbin and still others who have never sold anything online. After all, ecommerce penetration in India is a mere five to seven percent. The remaining 93 to 95 percent of India has never purchased anything online even as Amazon and Walmart-owned Flipkart have ploughed through the country, investing billions to bring people into the ecommerce fold.

“It’s this undigitised population we are going after," says Joshi, which will result in ecommerce penetration rising to 25 percent in two years. The logic being that ONDC will create a vastly larger pool of sellers and consumers and result in lower costs. This in turn will turbocharge ecommerce growth. Besides, while India is home to the third-largest online shopper base of 140 million, behind only China and the US, according to McKinsey, the market is still largely untapped given India’s Internet-user base of about 750 million.

ONDC team: (From left) Rahul Handa, VP-Strategic Initiative T. Koshy, MD & CEO Shireesh Joshi, CBO & President-Network Expansion Vibhor Jain - COO & President-Network Governance Nitin Mishra - CTO & President-Network Enablement. Established by Indian Government, Open Network for Digital Commerce (ONDC) is a private non-profit initiative aimed at promoting open networks for all aspects of exchange of goods and services over digital or electronic networks, based on open-sourced methodology, independent of any specific platform.Image: Madhu Kapparath

ONDC team: (From left) Rahul Handa, VP-Strategic Initiative T. Koshy, MD & CEO Shireesh Joshi, CBO & President-Network Expansion Vibhor Jain - COO & President-Network Governance Nitin Mishra - CTO & President-Network Enablement. Established by Indian Government, Open Network for Digital Commerce (ONDC) is a private non-profit initiative aimed at promoting open networks for all aspects of exchange of goods and services over digital or electronic networks, based on open-sourced methodology, independent of any specific platform.Image: Madhu Kapparath

The launch of ONDC in November 2022 came as India was aggressively pursuing anti-trust cases against large US tech companies including Amazon, Google and Meta. It may have been purely coincidental but the message it rang out was loud: India was going to build and leverage it eye-watering Internet-user base in a fair, inclusive and democratic manner.

“ONDC has been built to address the fundamental problems of platform-centric models that lead to market concentration leading to a few gatekeepers with practices not in the best interest of the larger merchant ecosystem. It’s a problem all over the world," says Koshy.

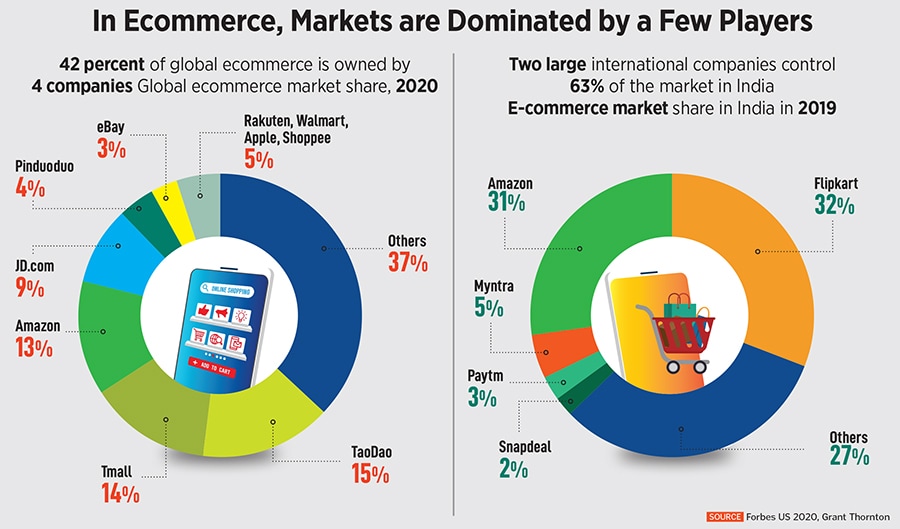

Consider this: 42 percent of global ecommerce is owned by four companies—Amazon with a 13 percent share of the market, Chinese companies TaoDao (15 percent), TMall (14 percent) and JD.com (nine percent), according to data compiled by Forbes USA in 2020. In India, foreign companies Amazon and Walmart-owned Flipkart control 63 percent of the market. Each claim a near equal 31.5 percent market share as of 2021, followed by Myntra (4.7 percent), Paytm (3.3 percent) and Snapdeal (1.9 percent), as per Grant Thornton.

"While governments in the US and Europe are trying to loosen tech giants" grip through laws and regulations, India has chosen a tech-based solution supported by markets and enabling regulation," says Koshy. ONDC is a “network-centric" ecommerce model built atop digital public goods. So unlike Amazon, which is a closed private platform where everything from seller onboarding to customer acquisition, fulfilling deliveries and solving grievances is controlled by the tech giant, here the entire chain of services is broken up or “unbundled." Seller apps help to onboard sellers like Rosbin on to ONDC, helping them with registration, cataloguing, building an online store front and inventory management. Buyer apps, like Paytm and MagicPin, bring buyers on to the network through their platforms. Logistics companies like Shiprocket and Shadowfax fulfil deliveries if the customer choses so and multiple payment partners help complete the transaction.

“It’s just like the physical world where different building blocks of the value chain are built by different players. Think of the auto industry. Does a single automaker manufacture everything from tyres to engines to seats?" says Koshy. “They don’t. They outsource the components and then assemble everything together. That’s exactly what we are doing for ecommerce."

ONDC’s ambition is to bring 30 million sellers and 300 million shoppers on to its network by the end of 2024. Presently, there are 36,000 sellers are on the network who process around 15,000 transactions daily. Roughly, 11,000 of these are in the food and grocery vertical, the balance includes mobility, fashion, apparel, electronics and agri products like seeds and saplings. The plan is to expand into all manner of goods and services in the months to come.

“The scale is miniscule at present," says Swapnil Potdukhe, assistant vice president, JM Financial. Swiggy, for example, delivers 1.5 million orders per day, while Amazon India fulfils a 1.6 million orders per day. Even so, Nandan Nilekani, who built the Aadhaar digital ID system, calls ONDC “the most exciting business transformation happening in the country."

That’s not just because ONDC will promote fair competition for the millions of small retailers like Rosbin. Or give them a fighting chance like the roadside chole-batura seller in Gurugram’s Iffco Chowk area, who has seen a spike in orders ever since registering on ONDC through Magicpin.

But also because it will foster innovation. Magicpin, a hyperlocal discovery startup, for example, shifted its focus to helping sellers get on to ONDC when the opportunity sprung up. It has helped onboard 44,000 sellers so far with the number doubling every month, says Anshoo Sharma, co-founder and CEO. It doesn’t charge sellers an upfront fee but takes a cut from the sellers’ earnings through ONDC. Presently, the “bulk" of ONDC’s 15,000-odd daily orders pass through Magicpin, says Sharma. Similarly other seller side apps like one called SellerApp are focussed on “digitally enabling" the vast pool of retailers who have never sold online, says Dilip Vamanan, co-founder and CEO. SellerApp onboards 10 sellers per day, up from two-five sellers a few months ago.

“ONDC could be India’s next unicorn catalyst," says Susmit Patodia, capital director at Antler India, a Bengaluru-based venture capital firm. Just like startups built on and innovated using the UPI [unified payments interface] protocol built by the government—think GooglePay, PhonePe and the numerous other startups that used the UPI rails to build atop—the opportunity for startups to build on and innovate for ONDC is massive, he says.

According to some estimates, ONDC could add $60 billion to $80 billion to India’s economy by 2030. That’s because unbundling services will allow niche players to spring up and build specialised apps. Think of selling furniture online, for example. Items can be clunky to transport from seller to buyer. Shipping a chair is different from shipping large wardrobes or glass table tops. “That’s why penetration of furniture ecommerce is extremely low," says Patodia. ONDC can encourage startups to build and thrive in such niche areas.

Moreover, as data on buyer behaviour is made available to sellers through ONDC, unlike in the case of Amazon, Flipkart or Swiggy, which hold on to customer data, sellers will be able to better cater to their customers. “Data masking is a big issue. Today restaurants who serve customers through Swiggy or Zomato have no clue who their customers are, so how can they better serve them and improve their margins? This is one big advantage of ONDC over the marketplaces that are merely looking to maximise their profits," says Varun Khera, a restauranteur and Noida chapter head of the National Restaurant Association of India.

But sceptics worry that just like UPI gave rise to the oligopoly of Google Pay and PhonePe, which together process nearly 80 percent of all digital payments, ONDC won’t so much democratise commerce but monopolise it in a few hands.

Yet there are other challenges.

First, there’s the “cold start" problem, as Patodia puts it. For ONDC to succeed, the participation of all players is key, which in turn will result in scale. At present, Paytm and Snapdeal are the only large buyer side apps that have aligned with the network. Amazon and Flipkart have noticably stayed away. “They’ve invested billions of dollars into building their platforms and systems. Joining ONDC will cannibalise their business so it’s natural for them to stay away," says Magicpin’s Sharma.

Again, Koshy is umflapped. “They will all join at their own time," he says. If you look at the way disruptions are adopted, you will see leaders and laggards. We experienced this with UPI adoption. Eventually, the market compulsion is what will drive adoption That’s the beauty of a network-centric approach."

For others to come onboard they need to overcome the “intellectual challenge" that ONDC poses, says Joshi. “Most people—buyers and sellers—are unable to get their heads around an open, interoperable network. Getting them to understand how it works is our biggest challenge. Once they understand it, they will join."

Second, ensuring a seamless user experience is imperative. One user who ordered food via ONDC over the last week, for example, took to Twitter to complain about the speed of delivery: “Food is cheaper but also cold," he tweeted.

“Customers are habituated to use Amazon or Flipkart. They offer a sophisticated user experience which has come after years of money, time and effort spent. ONDC will have to play catch up here not just in ensuring quick deliveries but also timely refunds, exchanges etc. This will take time," says Lloyd Mathias, a business strategist.

Third, closed platforms like Amazon or Flipkart can control or prohibit the sale of certain items. As an open network, ONDC might not be able to do so, says Prateek Waghre, policy director, Internet Freedom Foundation. “Take the sale of acid, for example. How will ONDC control who is selling what on the network? And where does the buck stop if acid is indeed sold?"

Fourth, discovery is an issue. If sellers aren’t paying advertising dollars like they do on Amazon, for example, to feature atop a search query, how will ONDC’s algorithm’s decide what search results show up first? According to Mathias, items will mostly likely be listed on the basis on geographical proximity and popularity, that is, how many times have they been bought by other customers.

All said, everything centres on the buyer. The sellers will follow them. As Rosbin, the shopkeeper, says, “Five years ago we started accepting payments through UPI because our customers demanded it. Now as they switch to ONDC, they’ll see that we are already there. You have to change with the times."

First Published: May 22, 2023, 14:35

Subscribe Now