The Tata Group has built an electric vehicle universe. Can it help its global am

The Mumbai-headquartered group's plan assumes significance as global automakers, including Tesla, are firming up plans to set up operations in India

From languishing at the bottom as a fleet taxi operator, ignored by personal car buyers, Tata Motors has staged an exceptional turnaround that only mirrors a similar story by another homegrown automotive giant, the Mahindra Group, in recent years.

With a renewed product portfolio, cost optimisation, better distribution network, affordability, and a host of features alongside impeccable safety offerings, the automaker has once again caught the fancy of private car buyers, propelling it to India’s third-largest carmaker, almost neck-and-neck with South Korean behemoth, Hyundai Motors.

Between April 2020 and July 2023, the automakers’ market capitalisation surged a staggering 821 percent, while the benchmark Sensex only grew 142 percent. During that time, the company’s market share also grew from around 5 percent to 13.5 percent, with sales of nearly 40,000 vehicles a month.

Now, the Mumbai-headquartered automaker is gunning for more. This time around, with its headstart in the electric vehicle ecosystem—Tata Motors has emerged as India’s largest electric car maker, cornering over 80 percent of the market—the company is setting up an ecosystem that will build everything from batteries to charging stations to financing vehicles and finally putting them on the road.

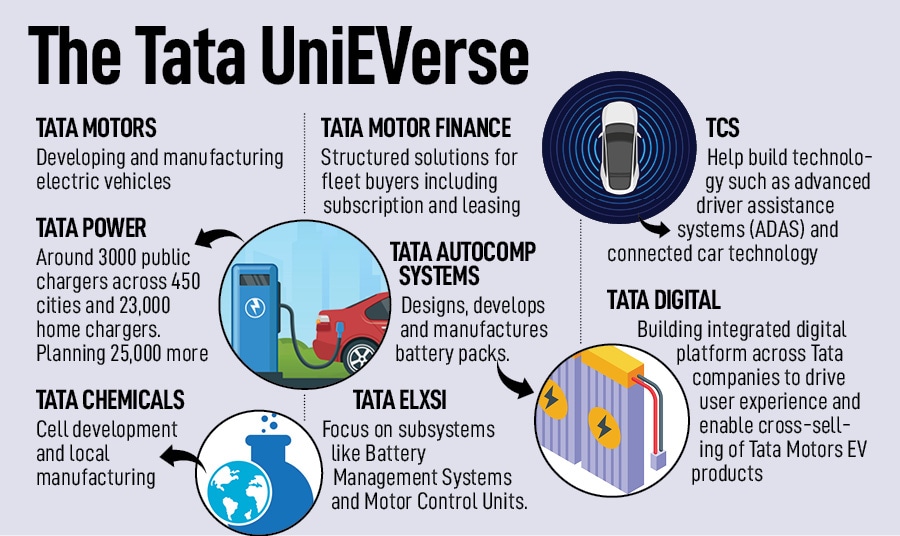

No other automaker in India can currently counter that proposition from the automaker. That project, known as Tata UniEVerse, is an ecosystem that will leverage group synergies, from companies such as Tata Power, Tata Chemicals, Tata Autocomp, Tata Consultancy Services (TCS), Tata Digital, Tata Elxsi and Tata Motors Finance.

“Tata UniEVerse could potentially play a pivotal role in the wider scheme of EV plans at Tata Motors and JLR," says Harshvardhan Sharma, head of auto retail practice at Nomura Research Institute. “It provides a comprehensive ecosystem that addresses the key pain points for consumers, such as the lack of charging infrastructure and the high cost of EVs. By providing a one-stop shop for all things EV, Tata UniEVerse makes it easier for consumers to adopt EVs."

The move is significant, especially since homegrown automakers are ramping up their efforts on the electrification journey. Globally, automakers ranging from GM to BMW and Ford are expected to spend over $500 billion in developing all-electric vehicles from gasoline models over the next several years. GM had, in 2021, said the company would switch to an all-electric fleet by 2035 while Ford had announced plans to go all-electric in Europe by 2030. But, not all of them can boast an ecosystem as the one put together by the Tata Group.

By 2030, about 40 to 45 percent of all two-wheelers and 15 to 20 percent of all four-wheelers (passenger vehicles) sold in India will be electric, according to a report by Bain & Co, while the government wants EV penetration to hit 40 percent for buses, 30 percent for private cars, 70 percent for commercial vehicles, and 80 percent for two-wheelers.

In simple words, the Tata UniEVerse involves bringing together various companies of the 155-year-old Tata group to the table to build up a large EV ecosystem.

“While Maruti Suzuki might be a leader in India, it will need to depend on a lot of other companies as we move into the next phase of automobiles," adds Gupta. “The Tata group, with all its expertise in house, will be a step ahead. Many of their group companies have global clients, and that helps in building up their electric play with the vast knowledge that they have."

That means, to start with, Tata Motors will develop the cars, while Tata Power will venture out into setting up a charging ecosystem in the country. Already, some 3,000 public chargers have been established by the company in addition to over 23,000 home chargers. The company is also planning to set up 25,000 public charging stations by 2028, and has partnered with Hyundai, Tata Motors, MG Motors, and Jaguar Land Rover (India) to provide charging infrastructure.

The 94-year-old Tata Chemicals will develop battery cells while another group subsidiary, Agratas Energy Storage Solutions, has signed a memorandum of understanding with the government of Gujarat to set up a 20 gigawatt-capacity lithium-ion cell manufacturing factory at an investment of Rs 13,000 crore. “Tata Chemicals has expertise in the development of lithium-ion batteries," adds Sharma. “The company will work to develop battery cells and battery packs for EVs, and it will also explore opportunities in battery recycling."

Then, there is Tata AutoComp which makes EV powertrain components and operates a battery assembly plant for Nexon and Tiago. Tata AutoComp had designed the battery pack for the Nexon EV, to meet the Indian driving requirements. Another arm, Tata Elxsi, a design and technology company, with expertise in developing software for electric vehicles will build solutions, such as telematics and infotainment systems, that are crucial in electric vehicles. Elxsi has also partnered with Renesas, a Japanese semiconductor manufacturer, to set up an electric vehicle innovation centre to focus on subsystems like Battery Management Systems and Motor Control Units.

There is also Tata Technologies, an arm of Tata Motors that focuses on electric vehicle engineering solutions, product benchmarking, embedded systems, as well as connected and autonomous vehicle solutions.

TCS, the group’s crown jewel, will help build technology such as advanced driver assistance systems (ADAS) and connected car technology while Tata Digital is a partner for building an integrated digital platform across Tata companies to enable cross-selling of EVs. All this will be backed by Tata Motors Finance, offering structured financing solutions for fleet buyers and dealers.

“Overall, Tata UniEVerse is a critical enabler of Tata Motors and JLR"s EV plans," says Sharma of Nomura. “It provides a comprehensive ecosystem that addresses the key pain points for consumers and helps to create a positive environment for the adoption of EVs in India."

Last month, the automaker announced a plan to build an electric vehicle battery plant in Britain to supply its Jaguar Land Rover factories, worth some £4 billion. The 40-gigawatt battery cell factory will be used to develop electric mobility and renewable energy storage solutions for customers in the UK and Europe. JLR and Tata Motors will be the anchor customers, with supplies commencing in 2026.

“The ecosystem could help Tata Motors to enter new markets and expand its presence in existing markets," says Sharma. “For example, Tata Power is already working on developing charging infrastructure in Europe, and Tata Chemicals is exploring opportunities in battery recycling in the US."

Separately, the Tata UniEVerse will also comprise the group’s electric vehicle arm, which was carved out in 2021. Tata Passenger Electric Mobility has already received funding of $1 billion from TPG and Abu Dhabi state holding company ADQ valuing it at $9.1 billion. Tata Motors has pledged to invest more than $2 billion in its EV business over five years. “Overall, Tata Motors has done a good job of maintaining its leadership position in the domestic EV market," says Sharma. “However, the market is still in its early stages of development, and Tata Motors will need to continue to innovate and invest in the EV ecosystem to stay ahead of the competition."

Over the next few years, Tata Motors is readying newer models including an electric variant of the Tata Harrier in addition to launching vehicles such as Curvv, Avinya, and the Sierra. The company’s current offerings include Tata Nexon, Tiago, and Tigor. Then, at JLR, the company is looking to launch the first all-electric Range Rover by 2025.

Globally, a sudden surge in pursuing electric vehicles has meant that battery prices haven’t seen a gradual decline as was expected in 2022, prices for lithium-ion batteries rose by 7 percent, according to Bloomberg NEF. Automotive lithium-ion (Li-ion) battery demand increased by about 65 percent to 550 GWh in 2022, from about 330 GWh in 2021, according to the International Energy Agency. That, despite a 180 percent growth in lithium production compared to 2017.

The Tata group’s plan to set up an ecosystem assumes significance, especially at a time when global automakers, including Tesla, are firming up plans to set up operations in India. Tesla is already considering a sub-Rs 20 lakh vehicle for the Indian market, with plans to export them. That means, Tata Motors, with its headstart, and market dominance will need to double down on its domestic play.

That’s where the ecosystem with expertise in different areas of EV technology, such as battery cells, battery management systems, and electric motors, comes into play. “This could help Tata Motors to develop new and innovative EV technologies that could give it a competitive advantage in the global market," adds Sharma. “It could help Tata Motors to expand its global reach and enter new markets and expand its presence in existing markets. For example, Tata Power is already working on developing charging infrastructure in Europe, and Tata Chemicals is exploring opportunities in battery recycling in the US."

At the same time, as incumbents and global players set out for their play in the world’s third largest automobile market, the company will also need to rework its product innovation, pricing, and marketing to succeed, which the combined might of the group companies can help with. This year, the company tied up with Uber to sell 25,000 units of its XPRES–T EVs.

“Today, the Indian passenger vehicle market would be 3.5 million units a year," Shailesh Chandra, the managing director of the passenger vehicle division at Tata Motors, had told Forbes India in an interview. “If you fast forward to 2030, this will double to nearly seven million. If you take a 30 percent penetration, it would mean two million EVs. There is an opportunity on the EV side to grow from zero to two million."

Still, affordability remains a key constraint when it comes to mass adoption in a market that’s well-known for being price sensitive. Currently, electric vehicles from Kia, Mercedes, BMW and Hyundai, among others, position themselves at a higher price point, making them less accessible to a broader consumer base. “The technology is still evolving. The EV technology is still evolving, and there is still a lot of uncertainty about the future of the market," says Sharma. “Tata Motors will need to be able to adapt to changes in the market in order to remain competitive."

It"s a long game. And if anything, the group is making all the right moves to fight it out.

First Published: Jul 26, 2023, 10:31

Subscribe Now