But Gadkari claims to be a taskmaster who believes in overcoming challenges to unlock opportunities rather than using problems as a crutch for failure. When he took office in 2014, he says, there were 406 stalled projects worth 3.85 lakh crore that would have slipped into NPAs for banks. After months of negotiations and a strategic overhaul his ministry set the ball rolling. He proudly points out that India has the second largest road network in the world now. The total length of national highways in the country increased around 50 percent in the last nine years to over 1.45 lakh kms as per latest estimates.

“Before 2014, the work order was given before land acquisition, environment and forest clearance. After that there was a lot of delay due to courts, environment ministry, NGOs. And because of delays the total contract will collapse, because the interest meter does not stop and that was the reason there were losses to the companies… a big company made a lot of losses and had to go to NCLT. But now majority, about 90 percent of the companies, I have been able to help them with the law and now the majority of companies are out of problem and they are doing an excellent job. Now we are not working only on BOT. We are working on BOT, hybrid annuity, TOT, EPC model," Gadkari says in an exclusive interview on Forbes India Pathbreakers Season 2.

BoT or build-operate-transfer was the main model used by the government for the construction of road infrastructure before 2014. Many companies went belly-up due to legal disputes and policy inertia. The average construction of roads was 3-5 km/day. Analysts say the strategic implementation of the hybrid annuity model (HAM)—along with toll-operate-transfer (ToT), engineering, procurement and construction (EPC) models, and Infrastructure Investment Trusts (InvITs)—energised the sector and attracted private players to participate in road building projects.

“The InvIT model is the best model. Now I don’t have any problem at all as far as investment is concerned. People are coming to me and we have ample money available. Now the idea is we are taking money from the small (investors). Presently when they deposit their money in the banks, they are getting 4.5 percent to 5.5 percent. But now I"m offering them 8.05 percent interest. Now there is a provision that they will get interest monthly. Presently, our toll income is Rs 42,000 crore and at the end of 2024 it will go up to Rs 1,40,000 crore. There is no risk," he explains.

Media reports indicate National Highways Authority of India (NHAI) was looking to launch Series 3 and Series 4 of InvIT to raise over Rs 20,000 crore in FY24. Gadkari tells Forbes India this is in process but they are not in a hurry to launch it.

“There was some problem with GST and that was the problem why the (InvIT) scheme was stuck… We have a Rs 2.8 lakh crore budget. And the InvIT model is also there. The problem is we need to increase the expenditure. Then suppose if we get the money from the InvIT model, we have to give them interest, but at the same time, there will be no investment. We have to deposit that money somewhere in the bank. We will receive less interest. So that is the reason we are waiting. We need to increase the road construction speed by which we will require more money," he explains.

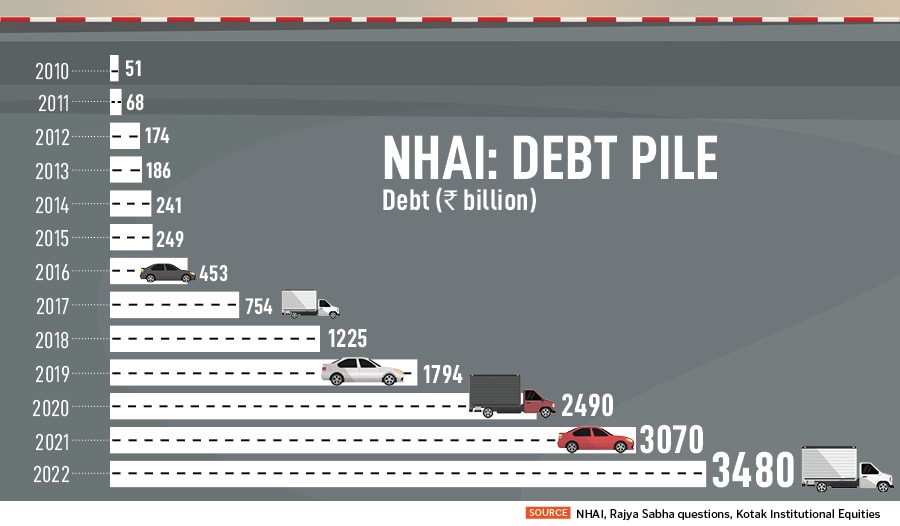

Over the past nine years, the debt on the balance sheet of NHAI has ballooned from Rs 24,000 crore to around Rs 3.43 lakh crore. Apart from funds allocated in the budget, toll income and proceeds from the monetisation of assets are among the main income sources for the government-owned organisation. In fact, NHAI has identified 46 assets (2612 km) for monetisation in FY24 to reportedly raise funds to the tune of Rs 60,000 crore. Also, Gadkari is betting on a steady increase in toll income and does not agree with the market view that the balance sheet of NHAI is stretched.

![]()

“When the loan quantum is going to increase, at the same time, the assets are also going to increase. And within 12 years, with the interest, we will get our money back, but the toll is continuing. So, it is totally a profitable work which I am doing. It is win-win for all the stakeholders… my toll income is constantly increasing. So that is not a problem for us," he says.

But the relatively slow pace of project completion is a major roadblock for generating toll income, launching InvIT, and monetising assets. The escalation of project costs is also a concern. Gadkari says his team is on the front foot to address inefficiency.

“We need to increase the speed of construction. And we are doing that, we are trying for that, but the way in which the system is working… I"m talking like a professional. I"m transparent, corruption-free, quality conscious. But taking decisions, I always tell my officers and engineers that I like people who can get things done. My only worry is how to increase the speed of taking construction decision and to start the work," he adds. “Land acquisition is a big problem. The tender process is a problem. Getting environment and forest clearance is a problem. There is a very lengthy procedure by which we have to take the permit. These are the things and we need to improve the system by which we can give more orders for construction and increase the pace of construction. We don"t have a resources problem, but we have problems where we need to increase the speed. That is there."

He further highlights, “Project to project the reasons are different. Somewhere the reason is the financial organisation where we need… Suppose they want final performance guarantee, the bank is giving performance guarantee for a year, so we start insurance bonds. So, the problems are there."

Against this challenging backdrop coupled with macroeconomic woes, Gadkari has managed to transform India’s highway network and grow highway construction by 7 percent CAGR in the last 10 years. The Ministry of Road Transport and Highways (MoRTH) wants to increase this to 14 percent YoY in FY24. The rate of road construction is close to 36 km/day and the government wants to achieve a run rate of 40 km/day.

“I always believe that there are some people who convert problems into opportunities and there are some people who convert opportunities into the problem. So let us accept problem as a challenge and convert it into an opportunity. That is an important philosophy. I feel on the basis of that we are resolving the problem and to resolve the problem is the duty of the minister. It"s my duty to resolve and make the speed faster."

The challenges

Many investors are concerned about the high debt on the books of NHAI. Bharatmala Phase-1 is expected to be pushed to FY27 at a cost escalation of Rs 10.63 lakh crore versus Rs 5.35 lakh crore earlier. A large chunk of the budget outlay of Rs 2.7 lakh crore is likely to be used for completing Bharatmala Phase-1 (34,800 km) during FY24 and for new projects under Bharatmala Phase-2- for which MoRTH is awaiting government approvals. The awarding of projects was mainly impacted due to delays in land acquisition which led to delays in completion of projects, delay in annuity receipt, and delay in monetisation of projects as the roads could not be fully opened to traffic.

Harshad Borawake, head equity research & fund manager, Mirae Asset Investment Managers, says the delay in financial closure, land acquisition, environmental and forest clearance, unseasonal rains, and the effects of the pandemic led to cost over-runs, but some of the issues were addressed with the government taking the start of construction date after 80-90 percent of land acquisition.

“In order to increase awarding from current levels and also to maintain debt, NHAI will have to increase the proportion of BOT projects in overall awarding as well as ramp up monetisation. Players and bankers are showing interest toward BOT projects provided bids are reasonable," analysts at Kotak Institutional Equities said in a note to investors.

Analysts believe that if NHAI has to increase awarding from the average levels of 4,500-5,500 kms per year, with debt at current levels, it will either have to reduce project expenditure—

which forms nearly 46 percent of total NHAI expenditure—or it will have to ramp up monetisation from current levels. “High debt level of NHAI is limiting increase in ordering from NHAI. Although the government has increased the overall budgetary allocation for FY2024BE, overall debt servicing liability also stands high at nearly 20 percent of total allocation," Kotak’s analysts note.

![]()

Between April 2022 and April 2023, the government monetised road assets worth Rs 47,000 crore. But analysts believe NHAI needs to scale up the sale process to lower its debt-servicing costs. It achieved 75 percent or Rs 22,400 crore of its asset monetisation target in FY22 and 53 percent or Rs 17,300 crore in FY23, Borawake points out. But he expects toll collection to remain healthy. “The implementation of the FASTag system for toll collection in India has been a resounding success with a consistent growth trajectory. In FY24, toll collections will stay buoyant, however now not on the scale witnessed in FY23, which grew from a low base in FY22."

There are concerns in the industry that the recent changes to HAM and BOT to provide concessions and attract private players into the highway sector may allow weaker players to enter. The bidding and operation and maintenance costs have been delinked for HAM projects at the time of tendering. Also, the lock-in period has been brought down to one year from two years earlier.

“The dilution in criteria—due to Covid—has resulted in key listed players losing ground in terms of inflows in FY22 and FY23 with their share in NHAI awards at 24-25 percent due to undesirable bids and high competition from smaller players. This has resulted in lower-than-expected inflows in FY23. While most of the regional and small players order backlog has been bloated in the last couple of years—due to strong inflows and high market share in NHAI awards—we expect the competitive intensity to ease off in FY24 and benefit the larger players in terms of consistent inflows. The worrisome situation is likely to recede in HAM," Borawake explains.

Kotak’s analysts say, “Several players have put in aggressive bids for HAM as well as EPC projects. In HAM projects, the aggression was quite high in the O&M portion of bids, which was kept at very low levels to get the projects. Such projects are facing issues in terms of monetisation."

Importantly, phase-3 of NHAI InvIT (635 km) is looking to garner approximately Rs 8,000 crore and another Rs 11,000 crore via the project-based financing route for the Delhi-Mumbai Expressway. “These funds coupled with an additional Rs 5,000-10,000 crore from ToTs can provide an additional support of Rs 25,000-30,000 crore to NHAI which can further increase ordering by 15 percent," they add.

Borawake says the Infra InvIT platform remains attractive. “The yields are better than any sovereign G-Sec rates and the NHAI InvIT is a success story and other public and private InvITs too have raised funds from global pension funds, debt funds, financial institutions and others," he adds.

(Coming soon—Forbes India Pathbreakers Season 2: Watch this space for interview snippets of the first episode featuring Nitin Gadkari, Minister of Road Transport and Highways)