Nokia: Dial 'N' for Nostalgia

Once a global giant, Nokia will have to up its smartphone game to claw its way back up

Image: Madhu KapparathIf Nokia participates in a 10-year challenge based on the market share, it wouldn’t be a good one. Once a global giant, its downfall started about a decade ago, when it began to cede ground to other Android smartphones and Apple: Its market share in 2019 slid to 4.9 percent from 56.2 percent in 2008.

But Nokia has made it to the list of Most Respected Consumer Tech Brands because of its brand value and people’s trust in it. The nostalgia it evokes has seen it grow in the feature phone segment in the country.

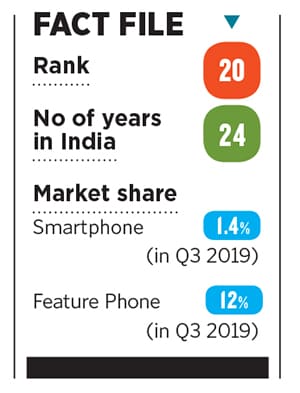

India is the world’s biggest feature phone market and Nokia, according to analysts at Counterpoint, ranks fourth in terms of market share in Q3 2019, after Samsung, Itel and Lava. Its market share grew from 8 percent in Q3 2018 to 12 percent in Q3 2019. Anshika Jain, research analyst at Counterpoint says, “Brands like Nokia and Samsung are seeing an increase in the feature phone market because of a decrease in Reliance Jio’s phones." While Nokia wanted to harness the nostalgia quotient by reinventing the Nokia 3310 and Nokia 8110 with 4G-enabled features, “they have not done that well [in 2019], while we saw Nokia 105 do really well", she adds.

While Nokia wanted to harness the nostalgia quotient by reinventing the Nokia 3310 and Nokia 8110 with 4G-enabled features, “they have not done that well [in 2019], while we saw Nokia 105 do really well", she adds.

But its success will be limited if Nokia, which was sold to HMD Global in 2016, doesn’t work the smartphone market. Ajey Mehta, vice president and region head, Apac and India, HMD Global, says, “In barely three years since inception, we’ve seen fast change even in this relatively short time." According to Counterpoint, Nokia’s share in the smartphone segment in Q3 2019 has come down to 1.4 percent from 1.9 percent in Q3 2018.

Also Read: How Nokia became the invisible force of Indian telecom

The company has also been slow to respond to competition. While other brands are spending big on marketing, using ecommerce platforms, festive offers and discounts, Nokia hasn’t kept pace.

“Xiaomi and RealMe are taking the lead in the ₹8,000-₹15,000 segment and although Nokia is offering better products in the mid-range level, players like Vivo, Xiaomi, Samsung and Oppo are ahead," says Jain. “The premium market segment sees Apple, Samsung and OnePlus as market leaders, so models like Nokia 8 and Nokia 9 PureView have not worked well."

However, Nokia has been updating its smartphone models with newer versions and better features. For instance, its first smartphone Nokia 6 was launched in Q2 of 2017, with its third upgrade Nokia 6.2 being launched this September.

Nokia is also equipping itself with 5G-ready smartphones. Mehta says, “5G will transform many industries, including smartphones. Together with our partners—Nokia, Qualcomm and Google—we will expedite our vision for 5G globally, offering a Nokia-grade experience at relatively lower price points." Nokia is also pushing the envelope with two-year software updates and three years of monthly security patches across smartphones. This has led Counterpoint to put the brand at the topmost position in terms of smartphone software and security updates.

First Published: Dec 18, 2019, 08:38

Subscribe Now Recall value: Ajey Mehta, VP and region head, Apac and India, HMD Global

Recall value: Ajey Mehta, VP and region head, Apac and India, HMD Global