The good, bad and ugly of stock trade training courses

The Indian stock market has witnessed an increase in traders becoming trainers, but there are both profits and pitfalls in the business

PR Sundar grew up in a middle-class household. After he moved to Gujarat for a teaching job, he found himself surrounded by stock market experts, and he too decided to invest in the stock market. Due to a lack of capital and knowledge, he was only active in the primary markets, applying for initial public offerings (IPOs) and selling them for a small profit. He received a fantastic offer to teach in Singapore when he was 29 years old, where his first month"s salary was roughly 20 times higher than in India.

Sundar returned to India at the age of 44 and decided to re-enter the capital markets, this time with more money saved. He decided to pursue a career in option selling, after dabbling in the cash and futures markets. “I trade based on probability because I am a mathematician. The winning probability in the cash and futures markets is 50 percent. It is much higher in option selling," he says.

Around the time Sundar arrived in India, a lot was going for options trading. Following the Lehman Brothers bankruptcy, people began to recognise the value of options, and the volume of options began to rise. This, combined with the Securities and Exchange Board of India"s (Sebi) lower taxation and the introduction of discount brokerage in India, made option selling a very profitable business. The National Stock Exchange (NSE) is now the world"s largest derivatives exchange, and Nifty Bank, which debuted around the same time, has grown to become the most traded index option.

Sundar"s passion for teaching resurfaced around 2013-14, when his broker recognised him as one of the few clients with consistent profits. Sundar went from being a trader to a trainer after he was approached by his broker to teach others. “My first few trainings were free, and the broker initially covered the basic costs associated with training. Eventually, I began to appear as an expert on a local television station, Sun TV," he says.

People began contacting him for workshops, for which he charged Rs 3,000 each. He has built a name for himself over the years, and his two-day workshop now costs Rs 60,000, while his mentorship costs Rs 20 lakh. His mentorship programme, which began in 2019, cost Rs 3 lakh-plus GST back then. Sundar recommends a capital of Rs 10 lakh and Rs 25 lakh for one-day and two-day workshops, respectively, and a minimum capital of Rs 2 crore for mentorship. “Mentorship is like a practical training programme where people come to my office and stay with me for a month or two to watch me trade." He typically attracts high net worth individuals (HNIs) as clients due to the high minimum capital requirements. His growth has been phenomenal over the last two years, both of his courses and his YouTube channel.

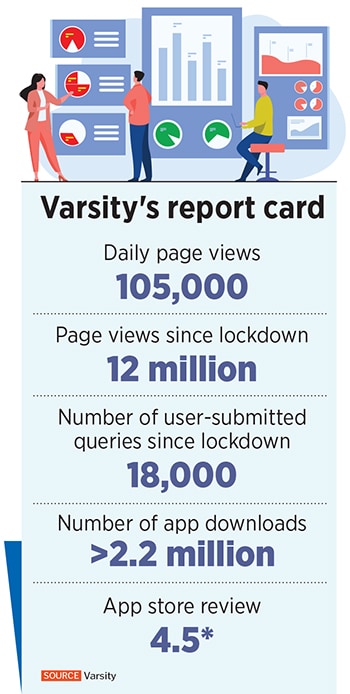

The Covid-19 pandemic lockdowns, which began in March 2020, saw a slew of new traders and investors enter the stock markets. Throughout the pandemic, all stock market-related businesses have experienced phenomenal growth, with educational businesses at the forefront. It not only increased every trainer"s income but also increased the number of trainers. People who were stuck at home looked to the capital markets as a source of income. Coupled with cheap and easily accessible mobile data and lower trading costs with discount brokerages, all that was required for trading was a smartphone. Zerodha, India"s first discount brokerage firm, saw an increase in users, as did Varsity, its educational portal.

In 2010, Zerodha was founded by Nithin and Nikhil Kamath. Three years later, they decided to start an educational platform, primarily for retail traders. “Nithin and I decided to start an educational initiative in 2013. Until then, all educational content was geared towards the US market," says Karthik Rangappa, vice president, Educational Services at Zerodha. “It was clear when we started this project that we wouldn"t do it for the sake of hitting revenue targets. We were doing this to help people." Varsity"s content is open to everyone, not just Zerodha customers, and does not require users to log in.

Varsity offers content on everything from the fundamentals of the stock market to analysing and trading various capital market instruments, personal finance, and even psychology. Varsity’s app has bite-sized content for easier consumption and gamification elements to make the content more interesting. The founders then translated their content into Hindi and are now working on converting the content into YouTube videos. Rangappa explains, “Right now, we"re juggling both web content and video content." Varsity has never charged for its educational content and has no plans to do so in the future.

Varsity offers content on everything from the fundamentals of the stock market to analysing and trading various capital market instruments, personal finance, and even psychology. Varsity’s app has bite-sized content for easier consumption and gamification elements to make the content more interesting. The founders then translated their content into Hindi and are now working on converting the content into YouTube videos. Rangappa explains, “Right now, we"re juggling both web content and video content." Varsity has never charged for its educational content and has no plans to do so in the future.

Varsity has seen an increase in retail traders since the lockdown. Its success has been measured by a different metric, according to Rangappa. For the past seven years, he has been answering user questions on the Varsity modules every day. “I used to spend an hour to an hour and a half on the portal. Since 2020, I"ve been working on it for nearly three hours every day," he says. This gives you a sense of Varsity’s progress over the last two years.

While the stock market training industry is currently fragmented and unorganised, some edtech companies are attempting to bring it together. Elearnmarkets, for example, is attempting to bring multiple trainers under its umbrella.

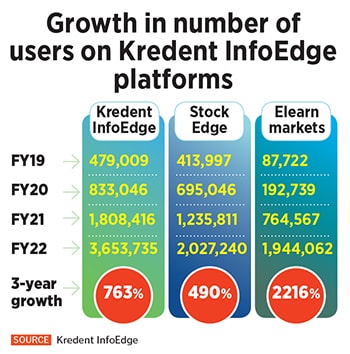

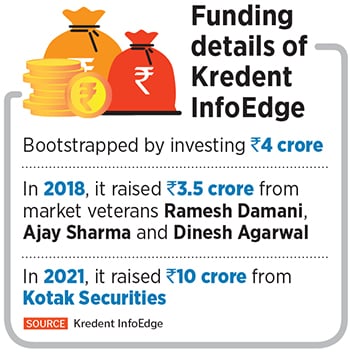

Founded by Vivek Bajaj and two other co-founders, Vineet Patawari and Vinay Pagaria, in 2014, Elearnmarkets is a marketplace for finance education, for certificate courses around NSE Academy, NCDEX, and MCX. Bajaj"s trading career began in 2006, when the 26-year-old established one of Kolkata"s largest commodity and currency trading desks. Until 2013, he was primarily concerned with developing the proprietary trading desk. Bajaj, the co-founder of Kredent InfoEdge, the parent company of Elearnmarkets, Kredent Academy and StockEdge, says, “I"ve since changed my goalpost to creating learning content for retail investors." They currently have over 200 experts on their platform.

In 2016, Kredent InfoEdge founded StockEdge to provide data and analytics to people who have learned the ropes of the capital markets. They recently launched StockEdge Social, a collaborative platform of like-minded communities with over 6,000 paid members. “We"re not just an education service provider," he says, “but a parallel ecosystem that provides everything needed to invest." Their most expensive course costs over Rs 1 lakh, even though they have several Rs 500 programmes on their platform as well. HNIs, contrary to popular belief, prefer the lower-cost, micro modules because of their small size. “People who are new to the markets tend to opt for the longer-term programmes," Bajaj adds.

Both Bajaj and Sundar use YouTube to provide free value in the hope of converting YouTube subscribers into course seekers. While their YouTube videos cover a wide range of topics on finance, their courses are more specific. Sundar agrees, “Our workshop count has increased since YouTube, and when we ask trainees how they found out about us, the primary source is again YouTube." Sundar had 897,000 YouTube subscribers as of April 13, while Bajaj"s YouTube page, Elearnmarkets by StockEdge, had 763,000 subscribers.

Soumita Mitra, from Kolkata, is one of the novice traders who found a mentorship course via YouTube. At the age of 32, Mitra decided to try her hand at the stock market after struggling with multiple career paths. Despite her family’s opposition, she began trading in June 2021 with a capital of about Rs 2 lakh. Her learning journey started by watching YouTube videos. “I learned about 40 percent of trading from YouTube, but I was still not confident. I needed some handholding," she explains. She decided to enrol in Elearnmarkets’s six-month mentorship programme in November 2021, which cost her around Rs 56,000 at the time it now costs Rs 82,600.

In the stock market training business, not everything that glitters is gold. Traders used to look for ways to diversify their businesses’ revenue until a few years ago. Portfolio management services and brokerage firms were the obvious choices. The majority of traders continued to work full-time and trade part-time. Offering courses and training new traders has become a popular diversification strategy today.

On December 1, Rangappa posted a video on Twitter showing how simple it is to create fake profit and loss screenshots on Zerodha"s trading platform. People on Twitter are constantly posting screenshots of their profit and loss statements, the veracity of which can always be questioned. These individuals offer their training or tipping services after demonstrating profits for a few days.

On December 1, Rangappa posted a video on Twitter showing how simple it is to create fake profit and loss screenshots on Zerodha"s trading platform. People on Twitter are constantly posting screenshots of their profit and loss statements, the veracity of which can always be questioned. These individuals offer their training or tipping services after demonstrating profits for a few days.

According to a well-known trainer who requested anonymity, there are some red flags that retail traders should be wary of. “When selecting a trainer, you should exercise and use common sense. It’s usually a red flag when trainers make a sales pitch and offer steep discounts on their courses. You don’t need to give 90 percent discounts if your product is good," he says. Before enrolling in a course, students must do their due diligence. A person who consistently makes money in a losing market is another red flag. It is impossible to time the market perfectly. Veteran investor Vijay Kedia famously said, “Only two people can buy at the bottom and sell at the top—One is God and the other is a liar."

Another red flag is someone who constantly brags about their profits and posts screenshots on social media. “Why would someone who is genuinely making money in the stock market want to show it to the entire world?" says the above-mentioned anonymous trainer. A student should do a background check on the trainer. Complaints made on websites like Quora can help them get real feedback on trainers and their courses. “I’ve seen videos of trainers calling their trainees on stage and having them talk and dance about the programme. It’s infuriating and I try to mind my own business and ignore these trainers."

Even though platforms like Elearnmarkets do their due diligence, they admit to making mistakes by inviting some black sheep on their flagship programme, Face2Face with Vivek Bajaj, on Elearnmarket’s YouTube channel. “Even though we look at a trainer’s profit and loss statement and do our due diligence to see if they are genuine or not, we too have made some mistakes," says Bajaj. To separate the wheat from the chaff for retail traders, he suggests looking at a trainer"s free content before paying for advanced content. “YouTube also has a premium content option. If you like the free content from a newbie provider, you can subscribe to their premium content," he adds.

Although both Bajaj and Rangappa consider Telegram to be a “shady" social platform, it has emerged as the market’s preferred platform for finance-related groups.

Following completion of training courses, newbie trainers are typically added to a Telegram group where the trainer suggests stocks to buy or sell. “These groups could be used to pump-and-dump stocks, which is when you find an illiquid stock and buy it before suggesting it to others. You can drive up the price of that stock even if 100 people buy it," says the anonymous trainer. The Telegram group operator then sells the stock at a higher price, accomplishing two goals. Firstly, they make money, and then they can share screenshots of their stock picks and how their group members made money, which helps them recruit more trainees.

Following completion of training courses, newbie trainers are typically added to a Telegram group where the trainer suggests stocks to buy or sell. “These groups could be used to pump-and-dump stocks, which is when you find an illiquid stock and buy it before suggesting it to others. You can drive up the price of that stock even if 100 people buy it," says the anonymous trainer. The Telegram group operator then sells the stock at a higher price, accomplishing two goals. Firstly, they make money, and then they can share screenshots of their stock picks and how their group members made money, which helps them recruit more trainees.

Forbes India questioned a well-known trainer who was accused of pumping and dumping in illiquid and microcap stocks via his Telegram group. “No, I never do this type of work because I am also a retail trader and know the pain of losing money in the market," he replied over email.

It is also up to Sebi to question these trainers and take appropriate action against them. The industry is still young, and the more well-known trainers in the industry are feeling the heat from Sebi’s lack of guidelines and protocols. “To get into the [training] business, you don"t need a licence or infrastructure. There are no barriers to entry, and if you have the knowledge, you can start training next week," Bajaj says. This has led to an influx of new trainers into the industry.

People who want to talk about a specific stock need a research advisory licence, according to Sebi"s rules, and trainers who are serious about the business generally get one. “We are a Sebi-registered platform as an organisation. It gives us credibility because we are regularly audited by Sebi," Bajaj says. Rangappa and his team at Zerodha are no longer active traders in the market to avoid being conflict of interest.

First Published: Apr 19, 2022, 12:13

Subscribe Now