How India became the world's third largest startup hub in 15 years

Flipkart's journey is symbolic of the changing global perception of India's startup ecosystem over the past fifteen years. Here's why

Bitten by the entrepreneurial bug, two IIT-graduates quit their jobs at Amazon to start an online retail business from an apartment in Bengaluru and an initial investment of ₹4 lakh. Two years later, in September 2009, the founders raised their first round of institutional funding of $1 million from US-based venture capital firm Accel. Within weeks, they opened offices in Delhi and Mumbai and hired over 150 people. This marked the beginning of the new-age startup’s meteoric growth and a critical turning point for the country’s budding startup ecosystem.

This is the story of ecommerce pioneers Sachin Bansal and Binny Bansal. Flipkart, the company they set up, changed the global perception of India’s startup ecosystem when Walmart, in the world’s largest ecommerce M&A deal, bought a 77 percent stake in the company for $16 billion in 2018. Nearly six years later, the loss-making Initial Public Offering (IPO)-bound company is valued at $35 billion and is preparing to foray into the quick commerce market.

In a way, Bansal’s and Flipkart’s journey is symbolic of the changing face of India’s startup ecosystem which gained momentum fifteen years ago. For instance, Mobikwik, Milk Mantra, CarTrade, among others, joined newly minted tech-startups such as Zomato (formerly FoodieBay), Policybazaar, and EaseMyTrip to disrupt India’s business landscape. In 2009, according to industry data, 75 startups were founded and venture capitalists (VCs) invested $475 million.

“Fundraising was far from easy because while the number of companies was far fewer, the venture investment ecosystem was close to non-existent because no one had seen success," Snapdeal and Titan Capital’s co-founder Kunal Bahl reminisces.

There’s been a sea change since then.

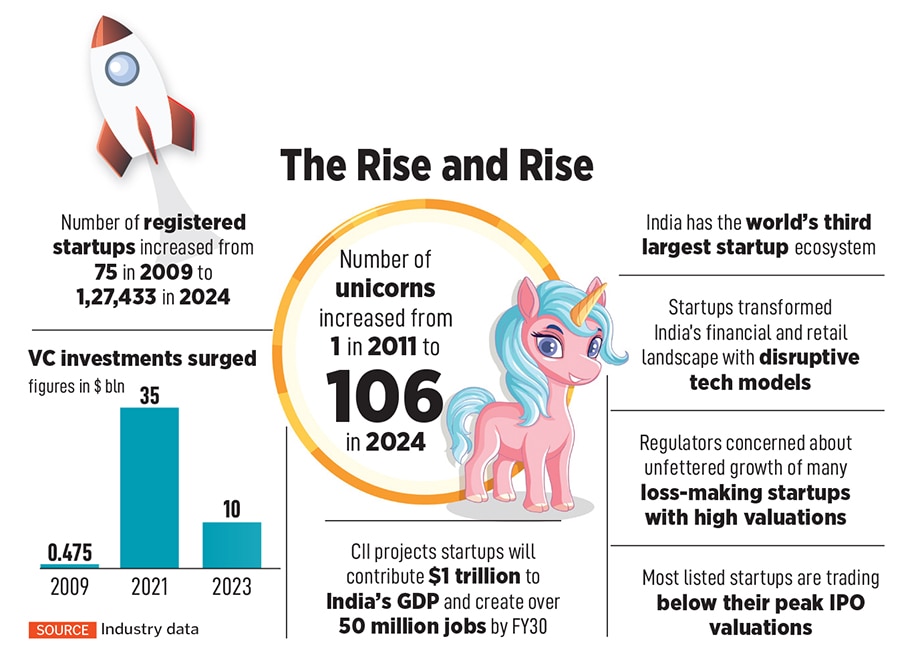

Consider this: In 2024, at last count, the number of registered startups has swelled to a staggering 1,27,433. The unprecedented surge in global liquidity played a significant role in shaping India’s startup ecosystem. VC investments into domestic startups hit a record-high of over $35 billion in 2021. This declined to around $25 billion in 2022 and $10 billion in 2023.

In 2011, InMobi became India’s first unicorn or startup to be valued at over $1 billion. By 2022, the number of domestic unicorns rose to 100. As per Venture Intelligence, as of March 2024, there are 106 unicorns. In fact, Hurun India Future Unicorn Index 2023 states that India’s future unicorns- gazelles and cheetahs- are worth a whopping $57 billion.

Undoubtedly, funding from VCs and PEs helped startups scale-up. But, over time, it also stoked massive concerns of frothy valuations and poor governance frameworks. The sole focus on growth, and the dynamics of venture capital investing, led many founders to stray into reckless price wars and freebies to garner new customers at the cost of unit economics. In chasing valuations, many founders lost sight of building a profitable and sustainable business. Over the last couple of years, several such loss-making startups debuted on Dalal Street. Billions of dollars of market cap were wiped out when growth rates tapered and the tech meltdown in the US, coupled with rising interest rates, forced companies and investors to focus on profitability.

“The customer’s money is better than the investor’s money. People didn’t regard this very highly because, before the funding environment tightened, there was an abundance of capital available and you had the option of fund-raising your way out of trouble," says Sanjeev Bikhchandani, co-founder and executive vice chairman, Info Edge.

Prime Minister Narendra Modi wants to make India the third largest global economy in his third term. At a Startup Mahakumbh event held in Delhi in March, Modi applauded India’s entrepreneurial spirit and urged the country’s youth to choose the path of being job creators rather than job seekers. India is seen as the world’s third largest ecosystem and has contributed to the nation’s progress in using technology to create impact and wealth.

First Published: May 23, 2024, 13:11

Subscribe Now