Akash Sinha: Banking on the digital wave

29-year-old Sinha's Cashfree has been incubated by PayPal, and by March 2020 was processing over $12 billion annualised payment volume on its platform

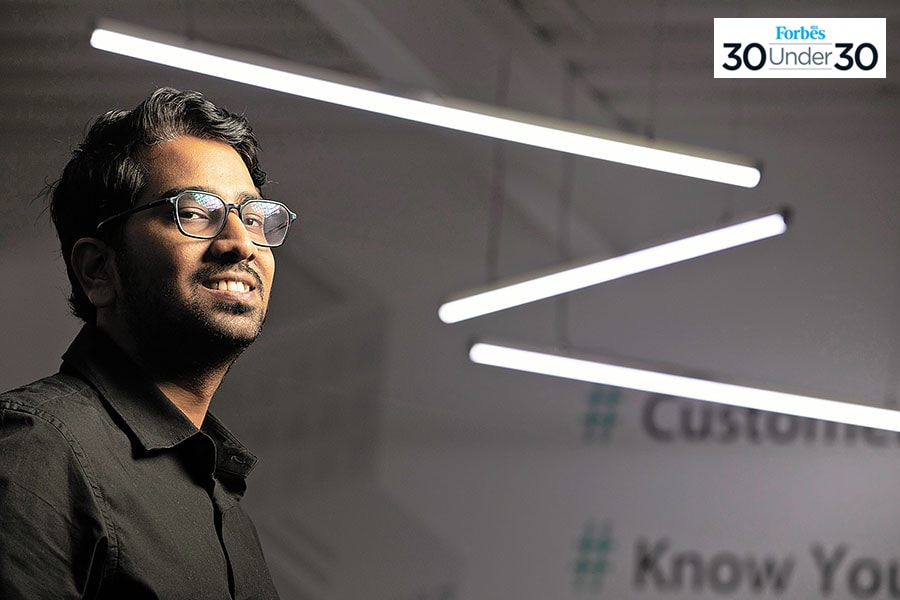

Image: Selvaprakash Lakshmanan for Forbes India [br]Akash Sinha | 29

Image: Selvaprakash Lakshmanan for Forbes India [br]Akash Sinha | 29

Co-founder, Cashfree

In 2015, Akash Sinha decided to quit his job at Amazon, and along with Reeju Datta started Cashfree, a payments and banking technology firm in Bengaluru. But what started as a payments solution for offline restaurants in the city has come a long way since then, being incubated by PayPal and being backed by Smilegate and YCombinator.

While Sinha is a software engineer, his stints at Bankbazaar.com and Amazon helped him grasp the nuances of the payments industry. He realised the scope to solve challenges faced by businesses for bulk payments and disbursals. By March 2020, Cashfree was processing over $12 billion annualised payment volumes on its platform.

The fintech firm, which has turned profitable, enables businesses to collect and send money round-the-clock, including global transfers. It works with more than 55,000 companies with solutions such as payment collections, vendor payouts, wage payouts, bulk refunds, expense reimbursements, loyalty and rewards.

“As co-founders, we have a deep sense of how to build profitable companies and it is important how much value we are creating for everyone. Due to the pandemic, there was an increase in digital transactions and our December numbers were better than February, before the pandemic,” says Sinha. In January 2021 the company has clocked $1 billion in transaction volume.

Cashfree works closely with banks such as ICICI Bank, HDFC Bank, Kotak Mahindra Bank and Yes Bank to build the core payments and banking infrastructure that powers the company’s products. Its customers include Dunzo, Xiaomi, Zomato, Cred, Club Factory.

Click here for 30Under30 full list

“As digital payments proliferate globally, the Indian market continues to represent one of the most exciting opportunities that we see in the world. Cashfree has maintained a leadership position in this space and is now going through a period of rapid growth fueled by the development of unique and innovative products that serve the needs of its customers,” says Udayan Goyal, co-founder at Apis Partners, which invested in the series B round. In November, 2020, Cashfree raised $35.3 million as part of its series B funding. With this fund raise, the company is valued around $200 million. Its existing backer YCombinator also participated in the round, demonstrating its support to the company, which is an alumnus of the YC2017 batch.

First Published: Feb 11, 2021, 12:45

Subscribe Now