Apart from these and city-wise business reports, “about 200 doctors from across the country join remotely every day—on the MedGurukul platform—to discuss different therapies such as laboratory diagnostics for tuberculosis, approach for liver biopsy and newborn screenings”, Haldar tells Forbes India.

The 40-day nationwide lockdown to contain the spread of coronavirus meant that apart from Covid-19-related issues, SRL Diagnostics, which has a presence in over 600 cities across India, had little business coming its way. “We have seen an 80 percent dip in revenues,” says Haldar.

SRL Diagnostics reported a total income of ₹1,016.75 crore in FY19, up by just 2 percent from the year before. Its B2B activity has been impacted due to lower admissions across all hospitals and B2C due to fewer home collection samples and walk-ins for tests to its laboratories. Yet, the firm appears to be better positioned to ride out of the current crisis along with a few other well-governed health care laboratories. Covid-19 has made people anxious about their health, which means wellness tests are likely to go up.

Larger rival Dr Lal PathLabs (DLPL), another authorised private lab for Covid-19 tests, is among those that stands to gain from greater awareness about health issues. Brokerage Geojit Financial Services forecasts a revenue jump of 14 percent for DLPL in FY20-22E despite the last two months and Q1FY21 being weak. With zero debt (just like SRL Diagnostics) and cash equivalent of ₹775 crore, DLPL’s balance sheet is solid.

Income vs Health

The government had no choice but to enforce the lockdown on March 24. Given India’s population—most of it low- to middle-income with limited access to diagnostic testing and quality health care services—and density, closure of public transport and commercial activity was imperative. Even when the lockdown was extended till May 3, the fragility of our health care system, including lack of sufficient hospital beds, shortage of personal protective equipment and low percentage of Covid19-testing, was apparent.![saurabh mukherjea saurabh mukherjea]() In such unprecedented and challenging times, the economy was gasping for immediate relief. Unemployment was at 21.1 percent during the week ended April 26, according to the Centre for Monitoring Indian Economy (CMIE). And the labour participation rate had fallen by 7.2 percent in the same period. The working age population in India is a little over a billion. “The drop in labour participation rate implies that over 72 million people have quit the labour market in a month [from the March 22 level],” writes Mahesh Vyas, CMIE’s managing director and CEO, on its website.

In such unprecedented and challenging times, the economy was gasping for immediate relief. Unemployment was at 21.1 percent during the week ended April 26, according to the Centre for Monitoring Indian Economy (CMIE). And the labour participation rate had fallen by 7.2 percent in the same period. The working age population in India is a little over a billion. “The drop in labour participation rate implies that over 72 million people have quit the labour market in a month [from the March 22 level],” writes Mahesh Vyas, CMIE’s managing director and CEO, on its website.

Ratings agencies, investment banks, the International Monetary Fund and World Bank have sharply lowered India’s growth forecasts to between 0 percent and 2 percent for FY21. India’s economy grew by 4.7 percent in the quarter ended December 2019, its lowest pace in seven years. Data for the March-ended quarter is due on May 29.

The revival of business for April to September can be written off, but there could be a recovery in demand for some businesses in the second half of the financial year. However, this can happen only if India can keep the coronavirus spread under check. India has seen 35,043 Covid-19 cases and 1,147 deaths because of the virus, as of May 1. At least 9 lakh people (654 individuals per million) have been tested so far, according to ICMR.

In late April, the ICMR said that the rate of infection in India was linear, not exponential. With 4.1 percent (percentage of people who test positive for Covid-19) in mid-April, India’s rate is lower than France, Spain and Italy. Also, the rate at which Covid-19 cases have doubled in India has slowed to 10 days from three prior to the lockdown. “The rate of positive cases and fatality is lower than other countries because of the early steps taken by the government,” says SRL’s Haldar.

It is in this scenario that investment manager Saurabh Mukherjea believes that once Covid-19 cases stabilise, overseas funds could start to flow back into India sooner-than-expected, as economic activity picks up in some sectors. “$15.9 billion worth of funds left India in March. Over the next 6-12 months, I expect to see that money flowing back,” he says.

Recovery in South Asia

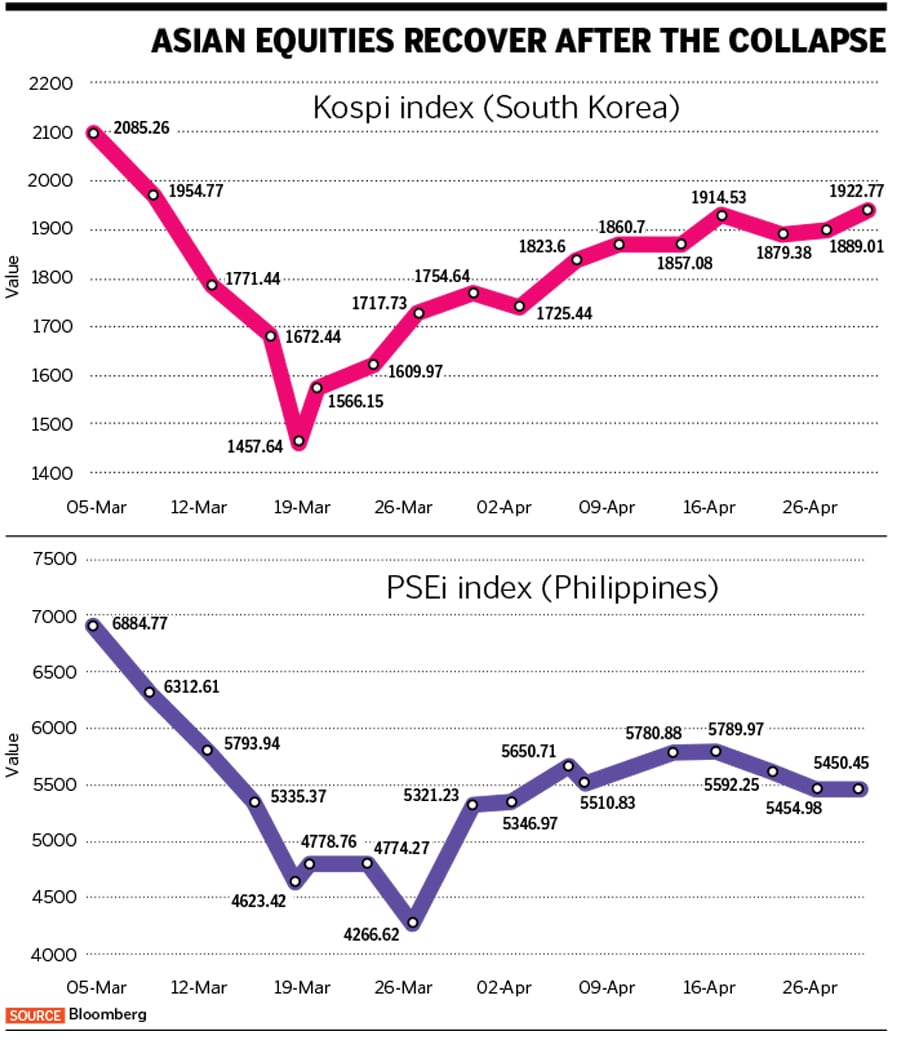

Mukherjea, founder of Marcellus Investment Managers, says the Asian economies of South Korea and the Philippines have already seen a 33 percent and 21 percent rise in their respective stock markets indices (see chart) from their 2020 low in March, aided by overseas investments.

South Korea—which has managed to flatten the curve of Covid-19 cases—went in for aggressive testing and contact tracing after a spike in coronavirus cases in February and early March. Select malls and restaurants are now open there. The Philippines, where the lockdown is expected to be partially lifted by mid-May, could see its economy contract in the second and third quarters of FY21 before gradually recovering in the fourth, its central bank governor Benjamin Diokno said, forecasting a U-shaped recovery in 2021. Emilio Aquino, chairman of the Securities and Exchange Commission, said some of the public offerings in the local capital market have been successful, which include the Bank of the Philippine Islands, SM Prime Holdings Inc and the Rizal Commercial Banking Corp.

![economic recovery economic recovery]()

As fears of a global economic recession persist, the ‘home bias’ theory—where investors pull out money from other markets to take it to their home market—has started to play out. But in a near-zero interest rate regime, US-based funds will have to eye higher returns in Asia, as Covid-19 cases stabilise here and economies recover.

Gaurav Rastogi, Singapore-based founder and chief executive officer of online mutual fund investment firm Kuvera, tells Forbes India, “Overseas funds are looking at India. There is active conversation with fund houses… they are ready and able to deploy money, but this could take another two quarters, assuming the worst is behind us.” Some pension fund houses and private equity firms will start looking to invest in startups which survive the Covid-19 crisis, he adds.

According to Rastogi, investments could be towards businesses which have almost completely digitalised themselves. “These could be fintechs, edtech, insurtech, online pharmacy, online doctor consultancy… firms which have a minimum offline presence,” says Rastogi.

Business activity has already gained speed for some of these startups. Edtech firms such as Byju’s, Vedantu and Unacademy have seen massive traffic on their platforms though there is uncertainty regarding students’ examination schedules. Individuals have even opted for Covid-19-specific or top-ups for health insurance policies. Online consultation and e-pharmacy firm Practo has partnered with private laboratory Thyrocare to provide Covid-19 home tests in Mumbai.

Over the long term, India will be a net beneficiary, with low oil prices and the political voice against China growing, post Covid-19. Rastogi, who advises and manages funds worth ₹9,000 crore, however, warns that at a global level, there might be a disconnect between the economy and stock markets. Economies might move into de-growth in the coming quarters, but asset/stock prices may not reflect realistic prices or move in tandem. “Calling the markets will be definitely harder,” he says.

Pharma, electricals in focus

With the Covid-19 crisis into its third month, salaries have been down for individuals by an average of 10 percent, but expenses have tapered off even more. Despite considering some leveraging or fixed costs such as rent, individuals would tend to save more during an economic and health emergency. Some of this will flow towards consumption in coming months, once there is more certainty over their employment.

Mukherjea estimates that demand for daily essentials from fast-moving consumer goods is likely to sustain in the coming quarters, though logistical concerns might rise, considering that several parts of the country remain under a lockdown. “The main issue is whether the money that the RBI/government is racking up through stimuli leads to a rise in consumption for the low-income people,” says Mukherjea. Will this lead to increased supplies from corporates? Mukherjea believes so, instead of raising prices of goods and services.

![arindam haldar arindam haldar]()

It is a given that the work from home model is here to stay. As a result, people will invest more in hardware—laptops, notebooks, personal computers, broadband services, flexible camera and caller visibility—in the coming months. As corporate revenues and salaries remain uncertain, wherever there is an element of discretion, such as bikes, small cars, slippers or even innerwear, we could see a demand disruption of four to six months, but it will start to recover after that, Mukherjea says.

He continues to be bullish about the future of pharma firms such as Divi’s Laboratories and diagnostics firm DLPL, in the post-Covid-19 world. Pharmaceutical companies will be sought after as western pharmaceutical giants will resort to buying more active pharmaceutical ingredients from India rather than China, says Mukherjea. Haldar of SRL Diagnostics is confident that his business will see a V-shaped recovery once normalcy returns.

“The demand for component parts for companies such as Electrolux, LG and Samsung will continue to be strong [as they would seek to reduce their dependence on China in the supply chain and look towards India],” adds Mukherjea. Just as other companies look for alternatives to sourcing from China, they will also aim to turn India into a regional manufacturing hub not just for the domestic market but also the global market. India will, however, face competition from Malaysia and Vietnam in this space.

Experts are ruling out growth for the hospitality, airlines and tourism space in 2020, where job cuts and downsizing of operations are on in a massive way.

The next few months will be the toughest for micro- and small businesses in the manufacturing space as they seek to revive business. SKV Srinivasan, former IDBI banker and mentor to SMEs, says a lot of them will find it difficult to survive. “With fixed costs and no revenues from customers, managing salaries and erratic cash flows will be extremely difficult,” he explains.

A small recovery in business in the second half of FY21 can be assumed only if Covid-19 cases start to stabilise. Dr Anup Warrier, an expert in the control of infectious diseases at Aster DM Healthcare in Kochi, Kerala, fears that as India lifts the lockdown in a phased manner, “we could see community transmission and a peak in Covid-19 cases over the next 3-6 months”. The most workable solution for hotspots, adds Warrier, is for the lockdown for containment areas to continue for an additonal 1-2 months.

Kerala has been a rare success story in managing to flatten the curve in Covid-19 cases, through aggressive contact tracking and testing. Warrier says emergency rooms at hospitals in the state are “not stretched”. In late April, new Covid-19 cases in Kerala averaged 3-6 per day compared to 15 in mid-April.

Covid-19 or not, the corporate world across the globe and in India will never be the same again. Business leaders and their decisions will become insular, promoters will continue to make their firms become leaner, more digitalized, and crisis management and business continuity plans will be common jargon.

But once they sail through the Covid-19 storm, 2021 could promise better fortunes.

Illustration: Sameer Pawar Arindam Haldar, chief executive officer of private diagnostic services firm SRL Diagnostics, starts his day at the Gurugram headquarters with a video-conferencing call with 16 others from the region and Mumbai city. Updates about the coronavirus are taken daily as it is one of the private firms approved by the Indian Council of Medical Research (ICMR) for collecting samples, conducting tests and diagnosing people for the virus.

Illustration: Sameer Pawar Arindam Haldar, chief executive officer of private diagnostic services firm SRL Diagnostics, starts his day at the Gurugram headquarters with a video-conferencing call with 16 others from the region and Mumbai city. Updates about the coronavirus are taken daily as it is one of the private firms approved by the Indian Council of Medical Research (ICMR) for collecting samples, conducting tests and diagnosing people for the virus. In such unprecedented and challenging times, the economy was gasping for immediate relief. Unemployment was at 21.1 percent during the week ended April 26, according to the Centre for Monitoring Indian Economy (CMIE). And the labour participation rate had fallen by 7.2 percent in the same period. The working age population in India is a little over a billion. “The drop in labour participation rate implies that over 72 million people have quit the labour market in a month [from the March 22 level],” writes Mahesh Vyas, CMIE’s managing director and CEO, on its website.

In such unprecedented and challenging times, the economy was gasping for immediate relief. Unemployment was at 21.1 percent during the week ended April 26, according to the Centre for Monitoring Indian Economy (CMIE). And the labour participation rate had fallen by 7.2 percent in the same period. The working age population in India is a little over a billion. “The drop in labour participation rate implies that over 72 million people have quit the labour market in a month [from the March 22 level],” writes Mahesh Vyas, CMIE’s managing director and CEO, on its website.