Future Tense, Present Perfect: A strategy for debt funds

What route bond yields and interest rates take in the long term is anybody's guess. Short-term corporate bonds, therefore, are the best debt instruments in the current scenario

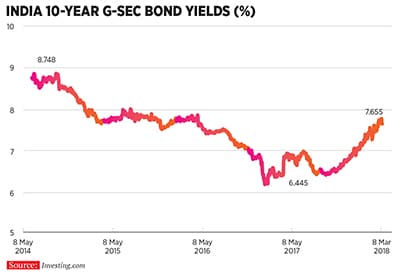

Illustration by: Chaitanya Dinesh SurpurBonds, as an asset class, have witnessed a flurry of activity in recent months: Bond prices have been falling, and India’s benchmark 10-year government security (G-Sec) bond yields have been moving up rapidly since last June, which usually signals economic uncertainty and other worrisome factors like high inflation, which also has a direct impact on debt investments. The 10-year G-Sec yield has been rising due to concerns over whether the government can manage fiscal deficit at a time when oil prices are rising, and inflation is climbing in the wake of higher domestic food prices. Minister of Finance Arun Jaitley addressed some of the concerns related to fiscal deficit slippage—now estimated at 3.5 percent of GDP for 2017-18, from an earlier 3.2 percent—calling it “statistical in character”.

Illustration by: Chaitanya Dinesh SurpurBonds, as an asset class, have witnessed a flurry of activity in recent months: Bond prices have been falling, and India’s benchmark 10-year government security (G-Sec) bond yields have been moving up rapidly since last June, which usually signals economic uncertainty and other worrisome factors like high inflation, which also has a direct impact on debt investments. The 10-year G-Sec yield has been rising due to concerns over whether the government can manage fiscal deficit at a time when oil prices are rising, and inflation is climbing in the wake of higher domestic food prices. Minister of Finance Arun Jaitley addressed some of the concerns related to fiscal deficit slippage—now estimated at 3.5 percent of GDP for 2017-18, from an earlier 3.2 percent—calling it “statistical in character”.

India’s G-Sec has risen nearly 140 basis points to 7.78 percent on March 3, 2018, against 6.41 percent on July 24, 2017. However, this is still less than the G-Sec yield of 8.76 on May 8, 2014. Globally, too, there has been a sharp sell-off in equity markets this year as US sovereign bond yields rose in February. This was triggered by the release of better-than-expected data on US wages, which heightened concerns over inflation.

“Over the past six to eight months whatever had to go wrong has gone wrong. But one cannot expect these factors to be repeated,” says R Sivakumar, head of fixed income, Axis Mutual Fund he expects G-Sec yields to drop in the coming months.

Considering that bond prices rise when interest rates fall, investors have always tried to get a handle on what the Reserve Bank of India (RBI) would do next, at a time when inflation has started to rise.Most economists expect the RBI to keep rates on hold in coming policy meetings, and only if inflation inches up further is the RBI expected to act and start raising interest rates, which realistically is a greater possibility only in the second half of 2018. “For the debt markets, however, relief might be short-lived as a strong growth picture lowers the bar for the RBI to shift from a neutral to a hawkish gear, should inflation prove sticky beyond June,” wrote Radhika Rao, DBS Bank’s India economist, in a note to clients on February 28.

But Mahendra Jajoo, head, fixed income at Mirae Asset Global Investments is of the view that the RBI may keep rates on hold for now. He adds that this being a pre-election year, there is a unique scenario where the government will need to continue spending more, while controling inflation. “Usually in this type of situation, interest rates will be compromised. The RBI can wait for things to improve. There will be no rush to try and hike rates.”

Though consumer price index (CPI) was at 5.07 percent this January and commodity prices are rising again, economists are of the view that oil prices have shown signs of stabilising and Goods and Services Tax-related concerns have diminished.

“The monsoons in 2018 will be the first crucial factor that banks and markets will watch out for, due to the obvious snowballing effect it has on farm output, rural economy and inflation,” says Jajoo. Yields, though slightly elevated at the moment, could start moving down if there is a good monsoon.

The second most critical factor will be the movement of crude oil prices. [India is a net importer of oil and rising prices will hurt its macroeconomics, including growth, inflation, fiscal deficits and currency.]

In this scenario, experts say, short-term corporate bonds are the best debt products to invest in. They add that investing in debt products should be more influenced by an investor’s own risk profile, preferences and allocation, and not by a particular string of factors or returns from other asset classes such as equities, real estate or gold.

undefined Returns from other asset classes should not influence investing in debt [/bq]

Sivakumar specifically says that he would not advise investors to apply the ‘100-minus-age’ formula (according to which individuals should hold a percentage of stocks equal to 100 minus their age) to decide how much should be invested in a debt product. “Only a part of your investment is your own, and the balance is what one would plan to leave behind for future generations,” says Sivakumar.

Outlining an investment policy for debt instruments, Jajoo says, “Investors usually try and compare debt with commodities and equities, in terms of returns. This is not the right way to go about it. Debt has always been, and should remain, a critical part of one’s portfolio, irrespective of other asset classes.”

“With bank fixed deposits also unable to offer strong returns compared to inflation, and banks themselves struggling with various other issues [read, frauds and bad loans], investors have started to look at market-related products,” Jajoo says.

Both Jajoo and Sivakumar say that in 2018, short-term corporate bonds would be the best debt option investors should look for. According to Sivakumar, these shorter-tenure bonds could provide better returns than government securities, while Jajoo says most of these instruments could offer investors 7-8 percent returns.

In recent weeks, most analysts have argued against investing in long-term debt products and income funds, as they could be more volatile in coming months. Commenting on the strategy for fixed-income portfolios, Jajoo says that if the monsoons are good this year, his fund house could add further “duration” to their funds.

So how should investors allocate the debt component of their portfolios?

In an uncertain market where yields have risen sharply and there is no immediate clarity on where they could go, “short-term funds are a more suitable debt investment option for investors with a conservative or moderate risk profile,” says Jajoo.

First Published: Mar 22, 2018, 15:17

Subscribe Now