Bad news from the markets: The bears are not done yet

The spread of the coronavirus could trigger a global recession, and India's government and RBI need to be quick, take strong action for financial stability, say economists

March 2020: Apocalyptic. This is how history will record the collapse of equity markets across the globe hurt by a precipitous fall in oil prices and the fears of a global recession, as businesses in several economies have come to a halt due to the outbreak of the deadly Coronavirus.

Economists from Morgan Stanley and Goldman Sachs warn that the spread of the virus will trigger a global recession. India is already growing at its slowest pace in seven years (4.7 percent GDP growth for the December 2019 quarter), hurt by weak domestic consumption demand.

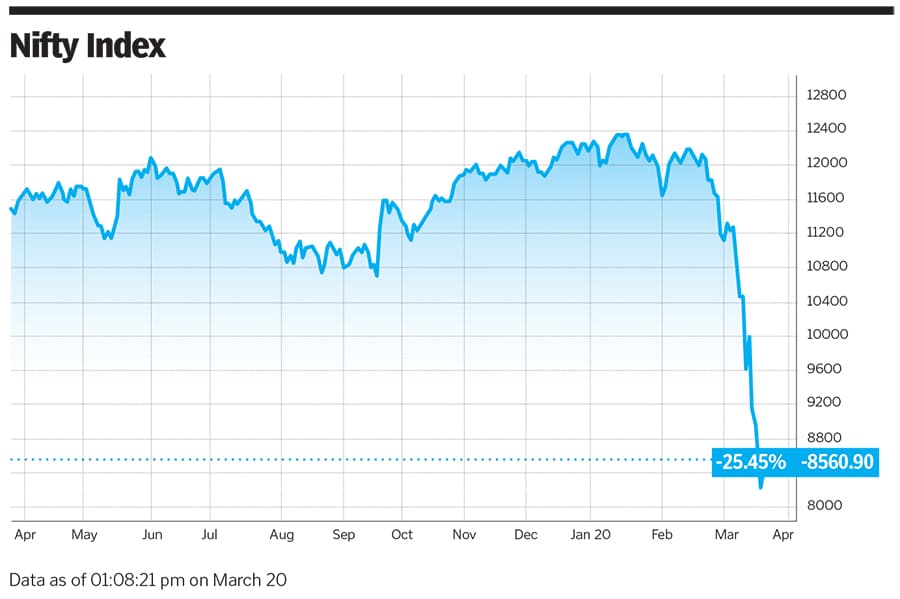

Most equity research firms have now estimated a 10 to 15 percent cut in FY21 earnings for India. The price damage and volatility to Indian stocks has been so sharp in recent weeks (see chart) that it has pushed India’s markets into a bear phase, with key indices having shed over 30 percent in 2020. The bad news is that the bears are not done yet.

For those who, from a price-perspective, find that some blue chip- and mid-cap stocks are available at throwaway prices, here is the fact: The bottom for the markets has not been found.“The intensity of the price fall is the worst ever,” says Ridham Desai, head of India equity research and India equity strategist at Morgan Stanley. For those who reported or witnessed the impact of the Lehman Brothers collapse of late 2008, or even the 1999 crash “dubbed the dot com bubble”, the panic has never been so acute.

The BSE Sensex index has shed 31 percent in 2020—including its worst ever fall of 2,919 points on March 12—and the Nifty 50, 32 percent, indicating that India is in a bear market. “The equity market could bottom out once the [Covid-19] infection numbers peak and start to recede, “says Credit Suisse’s wealth management, India head of research Jitendra Gohil. He agrees that bottom fishing “could open up” in the next few months, led by optimism of an effective cure for the virus or due to strong policy action.

Already, several central banks have, in an emergency move, lowered interest rates or provided stimulus to revive their economies. India has also created a Covid-19 taskforce to draw up measures to combat the impact of the virus. But economists feel India needs to take steps on a war footing. “The RBI needs to also provide liquidity and introduce forbearance on stressed corporate loans. This needs to be combined with a fiscal response to stressed sectors as well as acceleration in loan growth,” says Desai.

The government and the RBI, has in several cases, including the reconstruction of Yes Bank, have acted in concert to boost liquidity and lower tax rates. Almost every industry, from airlines, hospitality, tourism to small-and-medium enterprises, logistics, construction, chemicals and electronics, has been impacted. So clearly more measures are required. And swiftly.

First Published: Mar 23, 2020, 11:08

Subscribe Now