Scam-hit PNB, now deep in the red

The lender reported a loss of Rs 13,417 crore in Q4 FY18; market cap is now less than that of arm PNB Housing Finance

Image: Danish Siddiqui / ReutersOn May 16, as Punjab National Bank (PNB) announced its results for the fourth quarter of FY18—the period in which it disclosed that two jewellery groups owned by Nirav Modi and Mehul Choksi had defrauded it of around $2 billion—it became apparent that the lender had failed to meet even the low bar the market had set for it.

Image: Danish Siddiqui / ReutersOn May 16, as Punjab National Bank (PNB) announced its results for the fourth quarter of FY18—the period in which it disclosed that two jewellery groups owned by Nirav Modi and Mehul Choksi had defrauded it of around $2 billion—it became apparent that the lender had failed to meet even the low bar the market had set for it.

The bank posted a loss of ₹13,417 crore for the three-month period ended March 31, 2018, compared with a profit of ₹232 crore in the year-ago period.

The stock swiftly corrected 12 percent bringing its market capitalisation down by ₹330 crore to ₹21,000 crore. The scam-hit bank now has two ignominious distinctions. First, its market capitalisation has shrunk to late 2006 levels. Second, PNB Housing Finance, the housing finance subsidiary it founded in 1988, is now more valuable than its parent.While PNB’s case is unique on account of the Nirav Modi scam, most public sector, and few private sector, banks have resorted to kitchen sinking—aggressively declaring non-performing loans. “The situation will take at least two years to sort itself out,” says Hemandra Hazari, an independent banking analyst.

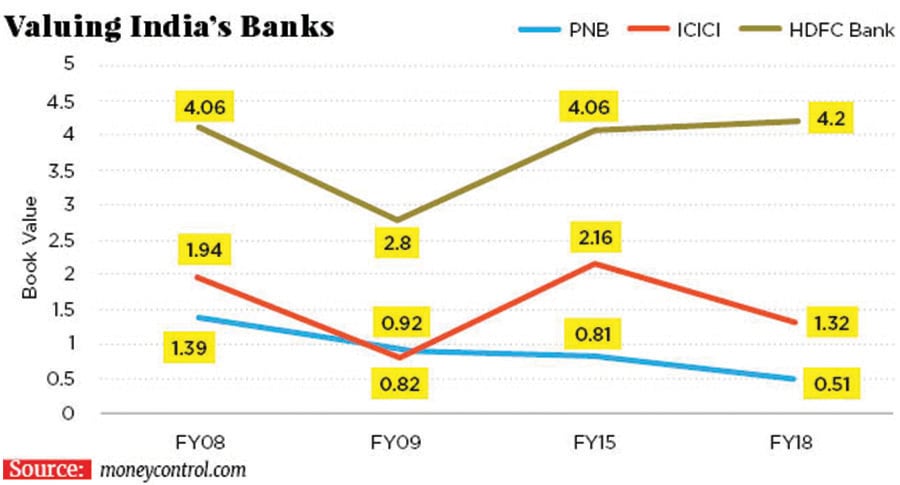

With its performance, PNB has joined its other public sector peers in becoming the largest capital destroyers in the last decade. In PNB’s case, the market has been consistently valuing it at a book value of below 1, which means below its net worth. The last time the bank was valued above its book value was in the days just before the financial crisis of 2008. Post the Nirav Modi scam, the bank’s book value has shrunk to 0.51. While assets have grown, a drop in the book value means that the market is saying it is unsure when the bank’s troubles will get resolved. (The vast majority of public sector banks are valued below their book value.)

The fortunes of India’s private banks have been equally revealing. The only bank that has stuck to its premium valuation is HDFC Bank, which quotes at above four times book. Kotak Mahindra Bank is also valued at four times book value.

First Published: May 21, 2018, 15:29

Subscribe Now