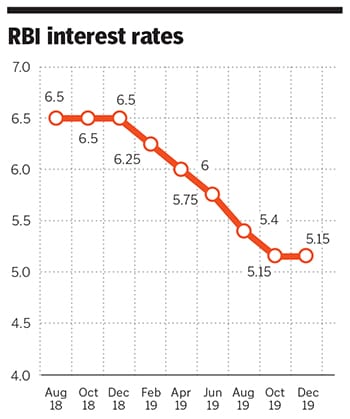

Will rising consumer inflation end RBI rate cuts?

With food prices predicted to taper off, the RBI is expected to continue with rate cuts instead of increasing them

Image: Shutterstock[br]India’s consumer Price Index (CPI) inflation was at a three-year-high—of 5.54 percent in November, led by rising food prices. Usually, to control high inflation, central banks hike interest rates, which raises the cost of borrowing and lowers the supply of money. This lowers demand for goods and services, and lowers inflation.

Image: Shutterstock[br]India’s consumer Price Index (CPI) inflation was at a three-year-high—of 5.54 percent in November, led by rising food prices. Usually, to control high inflation, central banks hike interest rates, which raises the cost of borrowing and lowers the supply of money. This lowers demand for goods and services, and lowers inflation.

It appears not. The pause in cutting interest rates further at the last monetary policy was temporary, not a long one. It is also apparent that the prices of expensive vegetables are likely to taper off soon. Their supplies are improving, while imports from Egypt and Turkey is boosting supplies and lowering wholesale prices.

This means inflationary pressures will start to ease, and CPI inflation will drop. The RBI will start to cut rates once again, for which it has clear room there could well be at least two more rate cuts in 2020. A delayed or irregular kharif harvest could prompt a rethink, but is unlikely.

Rate cuts also appear to be the more prudent move, in the short term, considering that India is in the midst of an extended slowdown.

First Published: Jan 01, 2020, 10:32

Subscribe Now