Will large cap valuations hold in 2020?

Investors will have to recalibrate expectations downwards, say experts

Image: Shutterstock [br] In 2017, large caps had four lacklustre years and were scoffed at as slow growing companies that lacked innovation. Small and mid-caps were the flavour of the season, as investors piled on at higher valuations. It was a crowded trade and was ripe to get undone.

Image: Shutterstock [br] In 2017, large caps had four lacklustre years and were scoffed at as slow growing companies that lacked innovation. Small and mid-caps were the flavour of the season, as investors piled on at higher valuations. It was a crowded trade and was ripe to get undone.

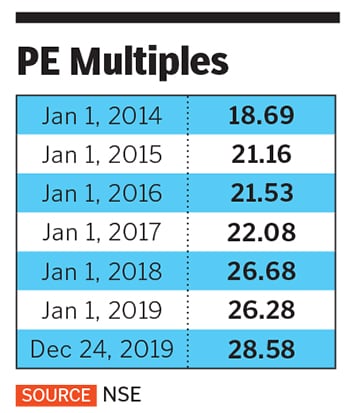

Second, global indices have had a stellar 2019 and valuations at the S&P500 at 24.6 times earnings are already stretched. Third, the divergence between the large and mid cap indices has hit a two-year high.

Also, the economy registered 4.5 percent growth in the second quarter of FY20, the worst in 26 quarters. It’s hard to see large companies growing at more than two times nominal GDP over the next year. As a result, most of the Nifty 50 will struggle to deliver double digit topline and bottom line growth. Investors will have to recalibrate expectations downwards.

First Published: Jan 01, 2020, 11:18

Subscribe Now