Tint of Mint: Impact Mints & its out-of-box play

A German confectionery brand is minting money by selling mints in tin boxes. Can Impact Mints ramp up its premium play in India?

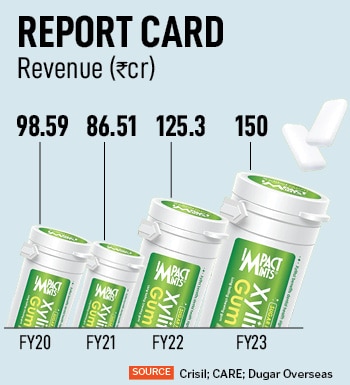

August 2016, Gurugram. “BMW bech rahe ho kya? Kaun kharedega ye? Maruti le ke aao (Are you selling a BMW? Who will buy this. Get a Maruti)…" Manoj Dugar was swamped with a flurry of not-so refreshing response from a sea of retailers across India. A German confectionery brand, Impact Mints had officially made its debut in India in 2016, and had granted exclusive distribution rights to Dugar Overseas, a Delhi-based company which has been marketing overseas FMCG brands since 1992, and also has its own range of confectionery and chocolate products and brands such as Sapphire. “Ye car nahin hai, mint hai. Nahin bikega (This is not a car but mint. It won’t sell)," there was a strong pushback from stockists, dealers, retailers and shopkeepers.

The reaction was natural, caustic, and expected. An impulse consumption item, mint has historically been a mass product in India, was sold either in tiny plastic pouches or packs, and widely carried a price tag that ranged from Re 1 to Rs 50. The organised and unorganised mint players in India followed a classic FMCG retail model to push sales. Products were made available across small kiranas, betel shops and roadside eateries, and most of them had a price sweet spot at Rs 5.

Back in 2016, Dugar was exploring a new spot, and was trying to do so in his own sweet way. Impact Mints was launched in a small tin box, the 14-gram pack was priced at Rs 100, and the option of low-priced SKUs was shunned. “It was a premium product in taste, feel and packaging," says Dugar, managing director of Dugar Overseas. Though available in India before 2016, Impact Mints was imported by a diverse bunch of retailers who sold it above Rs 200. In terms of fight from organised players, ITC’s Mint-O Ultra Mintz was the closest rival, and was priced at Rs 50. Now in 2016, with an exclusive marketing and distribution partner in the country, Dugar slashed the price to Rs 100, and thought it would find takers. “We were bringing German quality at an Indian price point," says Ayush Dugar, chief marketing officer of Dugar Overseas. “We expected it to have a brisk start," he adds.

The story, though, had a mischievous twist when Dugars added a tinge of greed to their strategy. “If people are buying a Rs 100-tin box like a hot cake," argued Manoj, “won’t they buy more if we bring down the cost." Well, the idea was logical. Impact Mints was performing exceedingly well at modern trade, airports and fancy retail stores. “What if we launch a Rs 50 pack and Rs 5 pack," he proposed to his core team. Everybody was excited. And why not? Imagine, taking a leaf from the playbook of ITC and HUL, rolling out a low-priced SKU, pushing it via paan shops, small kiranas, and democratising the product by making it hyper affordable.

There was another layer of greed, which inadvertently got added. If there are takers for a Rs 100 pack, then there would also be consumers for a bigger pack. Right? This was another argument picked up, and Dugars launched Rs 5, Rs 50 and Rs 150 packs with much fanfare. The result was dramatic. Nothing worked. If the low-priced units failed to woo users, the high-priced cousins couldn’t find a place in the family. Though the result was startling, the lesson was clear: Stick to what works.

There was another layer of greed, which inadvertently got added. If there are takers for a Rs 100 pack, then there would also be consumers for a bigger pack. Right? This was another argument picked up, and Dugars launched Rs 5, Rs 50 and Rs 150 packs with much fanfare. The result was dramatic. Nothing worked. If the low-priced units failed to woo users, the high-priced cousins couldn’t find a place in the family. Though the result was startling, the lesson was clear: Stick to what works.

Marketing and branding experts tell us what has worked for the brand. “It’s a classic case of synchronising all the three Ps of marketing: Product, pricing and promotion," reckons Ashita Aggarwal, professor of marketing at SP Jain Institute of Management and Research. While a foreign brand with a quality product easily managed to draw consumers to its fold, a neat and differentiated tin box, along with aggressive promotional push helped the brand grab eyeballs in a niche market. One needs to understand that when it comes to competition, mints are fighting with candies, gums and other confectionery products at the same time. “Having a premium play and positioning helped it stand out in a cluttered market where most of the products looked alike and tasted the same," she says. The failure of their low-cost variants, she points out, has to do with the problem of all premium and luxury brands. “A niche brand can’t become mass just by dropping the price," she says. If rising up the value ladder is a challenge for mass brands, then appealing to the masses is equally tough for premium brands.

Impact Mint, though, also has another set of challenges. Dugar Overseas, CARE Ratings points out in its credit ratings’ report, operates in a highly competitive industry, which is characterised by low-entry barriers and a large number of organised and unorganised players which results in intense competition. On one hand, the company faces stiff competition from established players such as Britannia, Parle, Nestle and Cadbury, on the other, it has to contend with local players who are price warriors. “This leads to low profitability due to aggressive pricing and high advertising cost," the report maintains. Moreover, changes in consumer behaviour around sugar and sugar-free products can also impact the confectionery market in India.

The Dugars, meanwhile, are delighted with the premium play of Impact Mints. “We don’t want to take off the premium shine," says Manoj, alluding to taking an aggressive approach in pushing the low-priced SKUs. “We have seen the minty impact, and we are gearing up to roll out more products," he says, adding that the bestselling and largest SKU of Impact Mints—14 gm Rs 100 pack—has seen a price revision and now comes for Rs 120. But was Rs 100 not the sweet spot? Manoj smiles. “McDonald’s Aloo tikki burger started with Rs 20, and is still the bestseller. But now it costs more than 20," he says. “We will continue to see a positive impact."

First Published: Aug 23, 2023, 14:59

Subscribe Now