Meet the MSD of finance: Sharechat's Manohar Singh Charan

One MSD [Mahendra Singh Dhoni] is from Harmu, Jharkhand, and the other, Sharechat's CFO, is from Harmoo, Rajasthan. Both of them are good at coming off a sticky wicket

We are not dealing with factories or inventories. Certain spends like user acquisition are now the new-age capex: Manohar Singh Charan, CFO, Sharechat

We are not dealing with factories or inventories. Certain spends like user acquisition are now the new-age capex: Manohar Singh Charan, CFO, Sharechat

Image: Amit Verma

Two wins and five losses… that’s what Chennai Super Kings (CSK) clocked midway in the Indian Premier League (IPL) in October 2020. For the three-time champion, and five times runner-up, the IPL was turning into a nightmare. From being a hot favourite to win the title to becoming a laughing stock, the morale of the team was down in the dumps. Fans were stunned, cricket pundits aghast and skipper Mahendra Singh Dhoni (MSD) had a lot to explain.

Captain cool, though, stayed calm. “I always told the players to focus more on the process," he said in one of the post-match presentations. When you start looking at the results of previous games or the next game, the wizard from Harmu in Ranchi underlined, it puts extra burden on you. With a deep understanding of the game, MSD had only one message for his team: Focus on the basics and process. From fans and experts, he wanted some time for a turnaround.

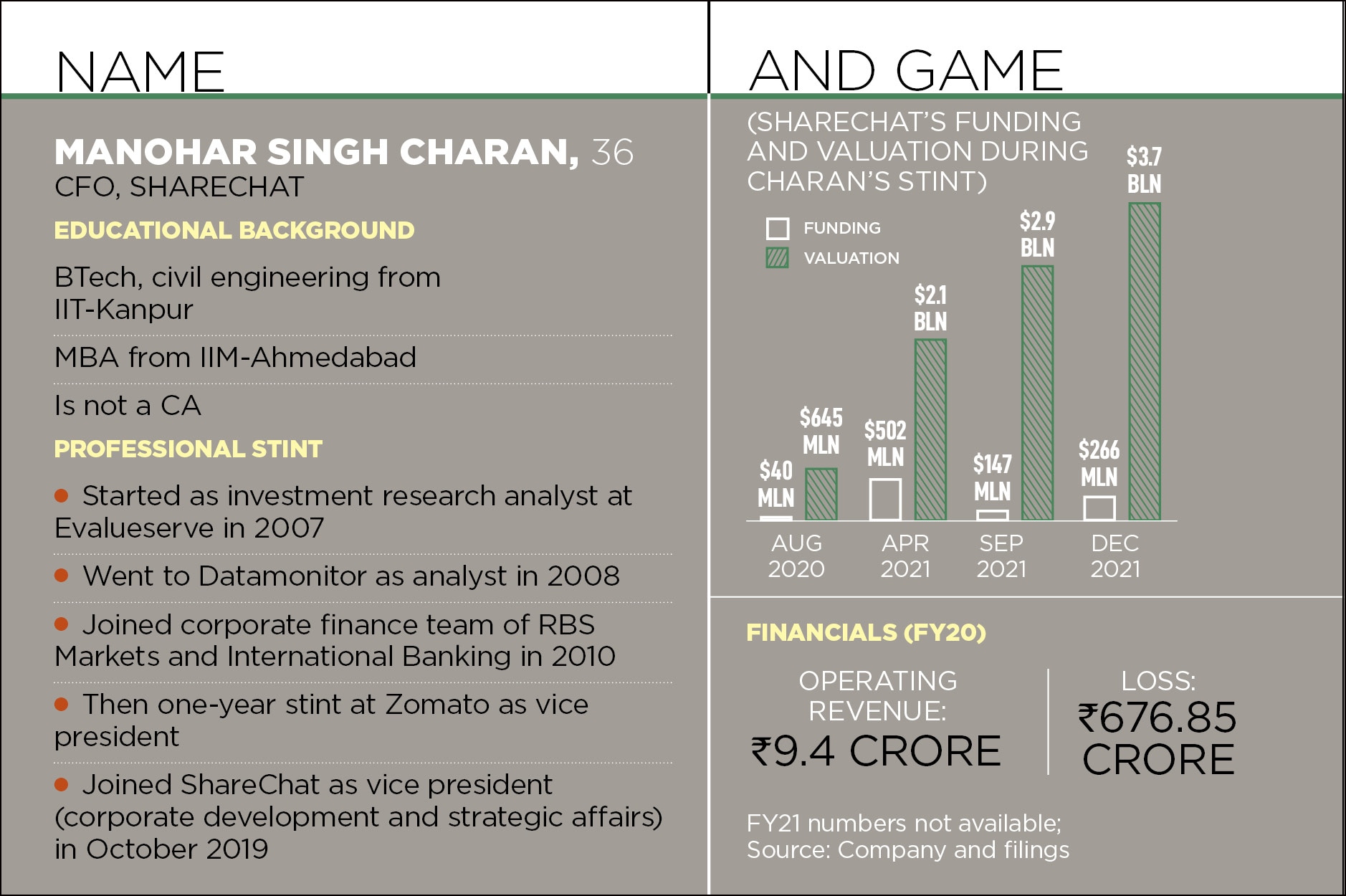

A few months later, in February 2021. ShareChat, a vernacular social media and short video entertainment platform, had posted its first operating revenue in six years: ₹9.4 crore. The loss, in a glaring contrast, stood at ₹676.85 crore. For a company which had raised $40 million in August 2020 at a valuation of $645 million, the ‘disastrous’ FY20 numbers were nothing to talk about. Understandably, Manohar Singh Charan, who joined ShareChat as CFO in October 2019, had a lot to explain.

MSC, as he is known among friends, was not jittery though. The boy from Harmoo village in Rajasthan knew how to come off the sticky wicket. “New-age consumer tech businesses require a different approach to financial management," he tried to explain. Even within new-age businesses, the CFO underlined, content and social media businesses require a longer gestation period.

The IIT-Kanpur grad and IIM-Ahmedabad alum dished out global examples to make a point. Look at Facebook it took three years to generate the first revenue dollar. Twitter took around four and a half years, and Pinterest took over five years. “We are not dealing with factories, machineries and inventories," he stressed. His one-line plea: Amassing a loyal consumer base is the capex equivalent for consumer-tech businesses. MSC was clearly buying time.

Back in April 2011, in the World Cup clash against Sri Lanka, India was struggling at 114 for 3. The team had to chase 275, and the required run rate was moving towards six an over. Enter ‘the finisher’, who had barely managed to score 150 in seven innings before the D-day. MSD scored 91 off 79 balls, not out, and took India beyond the finish line.

Meanwhile, a decade later, MSC was about to get into a finisher role of a different kind: Raising dollars. ShareChat raised a beefy $502 million in April 2021, and valuation pole-vaulted to $2.1 billion. Five months later, in September, the company closed another funding of $147 million, taking its valuation to $2.9 billion. After three months, in December, it got another $266 million and valuation touched $3.7 billion. The fund-raising spree not only made ShareChat a unicorn but it also made the social media firm the most funded among new unicorns of 2021.

MSC gets a thumbs-up from his captain Ankush Sachdeva. “Manohar has played a critical role in our journey," says the co-founder and CEO of ShareChat and Moj. From raising funds to maintaining financial discipline in a young and aggressive startup is a challenging task.

Ask Sachdeva what made him hire Charan as CFO, and he says what was going on his mind while interviewing a dozen candidates for the role. The most important attribute was that the person should be able to deeply understand the business. Given that we are creating the category of social media business in India, Sachdeva stresses, a lot of the business nuances and revenue models are new. “So we needed a smart and first-principled individual," he says.

Charan, for his part, contends that having an open mind towards understanding new-age businesses helped in his growth. CFOs, he points out, increasingly need to think beyond what goes into P&L and the balance sheet. Financial statements are an outcome of a complex interplay between operating and financial variables. To get the financial metrics to move in the desired direction, one needs to understand the operating levers, and work with teams to help them identify these levers. “It’s all about pulling the right lever at the right time," he says.

In school, it was right timing that helped him continue with his studies. “Only the name of the village sounds the same," he says, alluding to the similarity with Dhoni’s hometown. “The spelling is different."

Charan’s father studied till Class 8, but wanted his son to get the best education, and made him learn English. The young boy was sent to a boarding school in Class 5, and he fell in love with maths. His family wanted him to become a collector, but a maths teacher in Class 12 spotted his talent and urged him to prepare for IIT. The doting father sold his land to pay for IIT coaching, but Charan couldn’t make it in the first attempt. He tried again, this time without coaching, and cracked the test. He got his first job at Evalueserve, a Gurugram-based KPO, and ironically it was a finance role. “I didn’t know the F of finance," he recalls. Over the next few years, he kept changing jobs and kept adding new skills.

The learning continues at ShareChat. The biggest lesson is patience. It will take years before one can start tracking metrics like contribution margin and life time value. “But that does not mean you can close your eyes and wait for the day when critical mass will hit," he says. Over the next few years, the CFO for sure, will have his share of hits and misses. But the most important lesson would be: To stay in the game, you have to stay ahead of the game.

First Published: Feb 25, 2022, 10:49

Subscribe Now