Meesho's Dhiresh Bansal and a banker's dozen

Bansal's rich investment banking background is helping the first-time CFO stay ahead of the game at Meesho

Fundraising and M&As are important skill sets that a CFO should have: Dhiresh Bansal, CFO, Meesho

Fundraising and M&As are important skill sets that a CFO should have: Dhiresh Bansal, CFO, Meesho

Image: Nishant Ratnakar for Forbes India

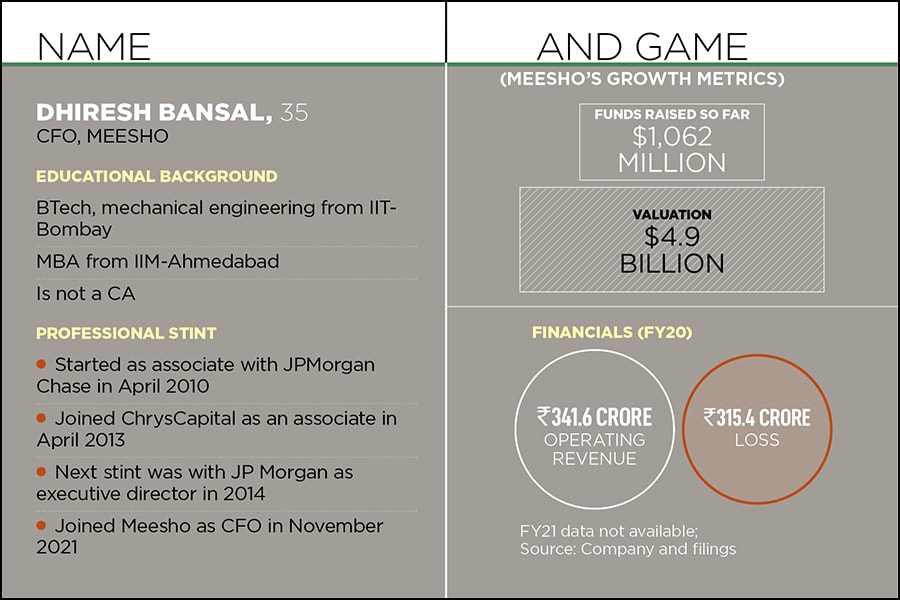

Last November in Bengaluru, the interviewer and the interviewee were taking a leap of faith. In fact, it was a first for both. Vidit Aatrey was sniffing for something extra in his next chief financial officer (CFO). The founder and chief executive officer of internet commerce platform Meesho, which had raised a staggering $570 million (around ₹4,227 crore) in its series F round in September, explained the requirement of his venture, which was then valued at $4.9 billion. As a company gets closer to milestones such as an IPO, he explained, a lot more competencies and capabilities become crucial in a CFO, which otherwise can be skipped during the early stage of growth.

Aatrey outlined his checklist. The potential candidate must be somebody with an in-depth public market experience around fundraise. The contender must also be a master in merger and acquisitions (M&A). And last, the suitor must have a deep understanding of the tech businesses. All three qualities were indispensable. “Look at the US… all late-stage tech firms have CFOs from investment banking background," he said.

Back in India, Dhiresh Bansal flaunted an impeccable background. The IIT-Bombay grad and IIM-Ahmedabad alum started his career with JPMorgan Chase in 2010. After three years, the investment banker had a year-long stint with ChrysCapital, and then went back to JP Morgan where he was executive director till last year. “As an investment banker, typically your client ends up being a CFO," he laughs. Interestingly, last November, the 35-year-old was seeking the post of CFO, a first for him, and his first interview in over seven years.

Bansal, though, didn’t show any signs of nerves. After all, he had ticked all the boxes that Aatrey was scouting for. “What about things that you have not been doing consistently?" was one of the questions, trying to test the composure of a man who was not a chartered accountant (CA). “How would you handle situations you are not exposed to?" was the follow-up query. Bansal stayed unfazed. My role as a CFO, he replied, is not just to control the financials, but also to give leverage to the CEO. There are areas where investment bankers have slightly more experience than traditional CFOs.

Back in 2017, Bansal was executing one of the things that a CA is not equipped to do. Axis Bank, the third largest private bank in India, had reportedly seen a dip in its asset quality, largely due to changes rolled out by the Reserve Bank of India in asset-quality classification. “We were advising the management team of Axis," claimed Bansal, who was then with JP Morgan. The bank, though, didn’t have much of an option: Either raise money or dispose some assets.

At the same time, Bansal was in touch with some potential key large investors. “We were able to convince Bain Capital," says Bansal, who worked on the deal as primary coverage banker. In November, Axis Bank announced it was raising equity and equity-linked capital from a clutch of marquee investors. Entities affiliated with Bain Capital Private Equity proposed to invest ₹6,854 crore.

Three years later, in 2020, Bansal was in the midst of another deal-making. He was advising Sumitomo Mitsui Financial Group, Japan’s second largest lender by assets, to buy a stake in Fullerton India. Post-Covid, the deal was put on the backburner, but was revived after a year. Last July, Sumitomo Mitsui Financial Group bought a 74.9 percent stake for $2 billion. Three months later, in October 2021, Bansal was in action again. This time, he was stitching Paytm’s insurance deal with Swiss Re in which the Zurich-based reinsurance giant bought a 23 percent stake in Paytm’s insurance unit for ₹920 crore.

Back in Bengaluru, this is what Meesho’s Aatrey wanted: A man for all reasons and all seasons. Dhiresh, he vouches, has great public markets experience around fundraise, M&A and also has a deep understanding of the tech businesses. Ask him what made him go for a CFO who doesn’t happen to be a CA, and the founder lists out three strategic roles played by CFOs. First is shaping the company’s strategy and building the shareholder base aligned to the strategy. Then comes business finance, which involves capital allocation decisions. And last, there is accounting and tax. “For late-stage companies, the first two matter a lot more than the third one," he says. In November last year, Meesho hired Bansal as its first non-CA CFO.

Bansal, for his part, reckons that the role of CFOs has evolved. “Now it’s more of a strategic role as against plain-vanilla bookkeeping," he says. But what about the age? A decade back, CFOs were not in their 30s. Bansal smiles. “It’s no longer about age," he says. It’s more about aptitude and getting things done. There might be people, he avers, who are much younger and might be better suited for the role. “It’s not about the age or degree," he adds. What makes the role more exciting for the young CFO is having a deep skin in the game. As an investment banker, he explains, one is influencing decisions rather than making them.

Apart from the role, what has also changed is the mindset, and perspective, of the new breed of executives. And a lot has to do with the nature of the industry. For example, in manufacturing industries, what would traditionally get clubbed under capex would now be under a different bucket. In the new age businesses, capex is actually within the P&L itself. “So what you’re spending on user acquisition is an investment for the future to some extent," reckons Bansal, adding that CFOs no longer take a formulaic approach to financials.

But how does one determine if an investment made now would yield results over the next few years? Does gut play a role in the life of a CFO? Bansal puts things in context. “I would be doing a lot of injustice to my role if I was only operating with gut," he smiles. In B2C businesses, one needs a lot of data to take a call. “Most of the analysis needs to be hard-core data than anything else," he signs off.

First Published: Feb 23, 2022, 18:08

Subscribe Now