GFF 2024: A regulatory window, disruptions, and ULI

The recently-concluded Global Fintech Fest saw banks, fintechs, regulators and governments speak the same language: Of building robust frameworks for fintechs, and easing access to credit

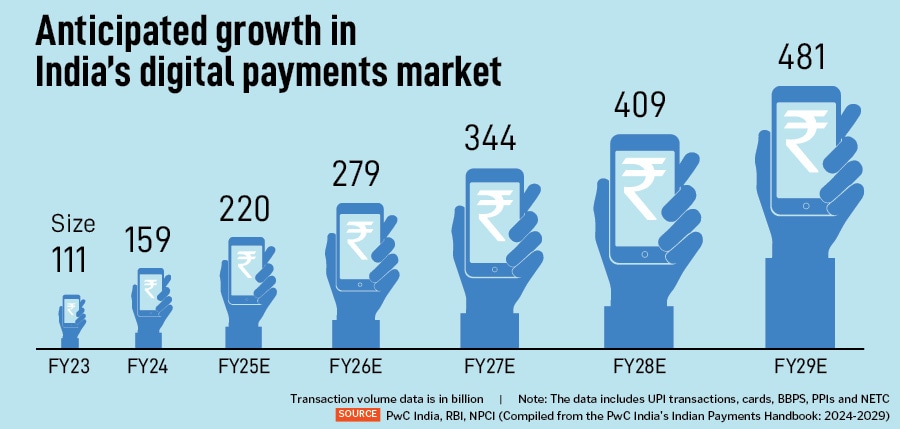

In an era of aggressive credit lending to spur economic growth, India’s fintech sector is in a space of massive overcrowding, an openness to collaborate with the old-economy lenders and a thirst to innovate. The three-day Global Fintech Fest (GFF) 2024—which ended on August 30 and was jointly organised by the National Payments Corporation of India (NPCI), the Payments Council of India (PCI) and the Fintech Convergence Council (FCC)—reflected all of this.

Over 800+ speakers, 350 sessions and delegates from over 100 countries attended GFF 2024.

There were some never before happenings: The regulator, Reserve Bank of India (RBI), had a booth of its own it had nothing to sell but there were central bank personnel ready to talk to fintechs, banks, whoever was keen.

“We were most impressed by the fact that the RBI had its innovation hub personnel present at the GFF 2024 booth, besides the department of payment systems and CBDC department personnel too. They were very proactive and ready to guide founders," GFF participant Moin Ladha, a partner at Khaitan & Co, told Forbes India. Startup founders and promoters can exercise this option to meet the regulator regularly.

“A regulator being available to listen and talk to promoters/founders of fintechs shows the commitment they bring towards the ecosystem. The success of fintechs in India has come through the collaborative approach amongst large number of players including fintechs and the regulators," he adds.

GFF 2024 is coming at a time when the global fintech world is yet to fully recover from the collapse of BaaS fintech Synapse, in April. In India, earlier this year, regulatory action against fintech Paytm and card networks Visa and Mastercard—and the rise of cyber frauds—has meant that regulation and governance of fintechs have to be real and swift. Prime Minister Narendra Modi spoke about expectations from the financial sector regulators to “take bigger steps" to curb cyber fraud and boost digital literacy.

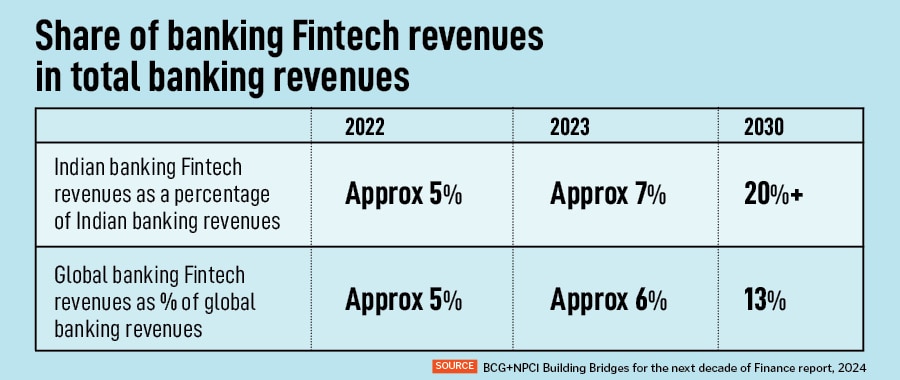

“There is no denying the fintech sector has gone through what we would call a traumatic year, especially on a global scale. The sector felt the heat of justified regulatory and market scrutiny. It lived through the freezing cold of funding winter. After being subjected to the intense heat and cold, we are seeing the emergence of a more mature and productive fintech ecosystem globally," Yashraj Erande, global leader (fintech), India leader (financial services) at BCG, said in ‘Building Bridges for the next decade of Finance,’ report, released at GFF 2024.

Globally, India ranks third in terms of the number of fintechs and fintech unicorns, with 20 unicorns in the fintech ecosystem and 17 soonicorns.

With the scope for tech-enabled lending continuing to evolve, the pressure on financial institutions and banks to alter their DNA to stay future-ready—and finally relevant and profitable—has been a challenge. The bridge (read as lines) between incumbents and fintechs “is blurring", Erande says, talking about trends emerging in shaping the next decade of finance.

Shuvi Shrivastava, partner & advisor at multi-stage venture capital Lightspeed India, says: “The excitement of the old economy (banks, financial institutions) to embrace the new economy (fintechs) was refreshing. There was an openness to learn, even possibly a desire to disrupt themselves in an effort to build a robust and vibrant ecosystem."

Prakash Sikaria, founder and CEO of Flipkart-backed super.money, which is tapping the secured and unsecured lending space with co-branded credit cards, pre-approved personal loans, FDs and more, said the focus of every player is to “be cost-effective and build for the future", instead of just expanding for growth. “Everyone is in a build phase, so that they are ready when we emerge out of the [high rate] cycle," he told Forbes India, on the sidelines of GFF 2024.

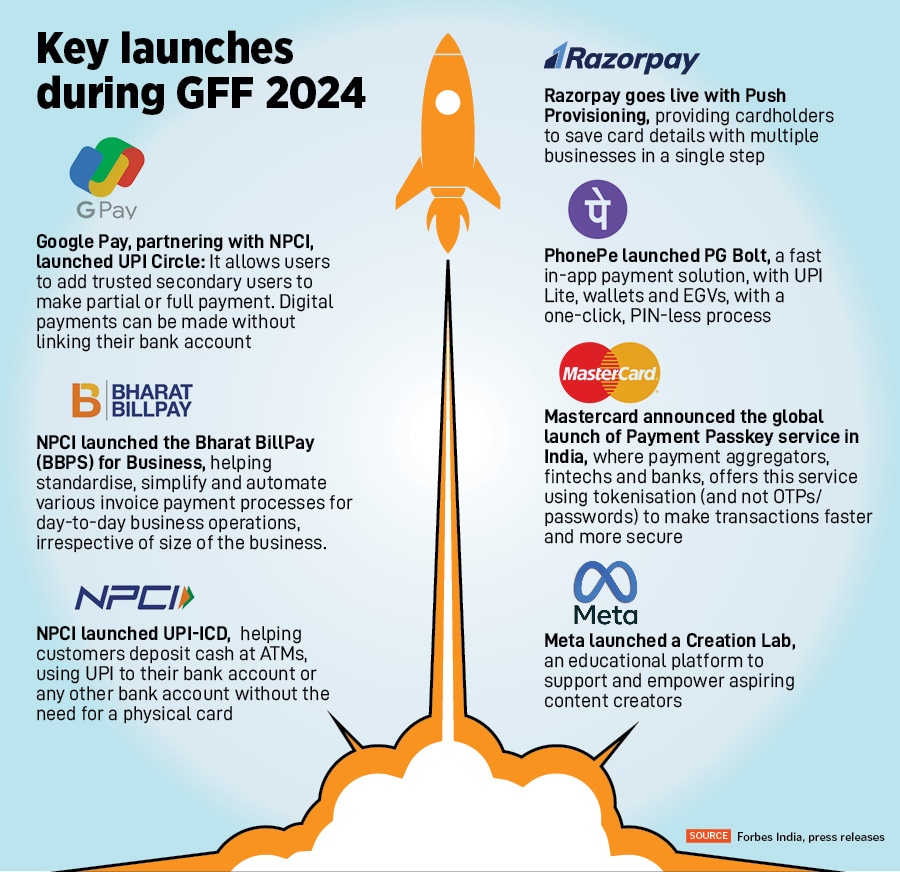

Fintech unicorn Razorpay’s co-founder and CEO Harshil Mathur said his biggest takeaway from the fintech conference was the opening up of two large opportunities: Unified Lending Interface (ULI) and the Bharat BillPay (BBPS) for Business (see GFF key launches). “ULI can democratise credit. We want to distribute credit, get merchants who want loans to connect with lenders," he told Forbes India. The second big opportunity, Mathur said, was B2B payments, which was still very manual and needed to be digitised.

Governor Shaktikanta Das reiterated the need for ULI for India at GFF, two days after announcing it at an emerging technologies conference in Bengaluru. ULI, which is in a pilot phase from 2023, will help speed up delivery of personal and business loans, since data required for credit appraisal will be centralised. Currently, such data is available separately with banks, credit information bureaus, account aggregators and state governments.

Das said ULI will allow “seamless flow of digital information", including land records of various states from multiple data service providers to lenders. It would ease credit availability for agricultural and micro, small and medium enterprise (MSME) business loans.

The entire information is based on the consent of the borrower and would help lenders provide loans quicker, based on relevant information which will be available with them.

Industry experts are also starting to talk more about tokenisation of real-world assets. “The Finternet is a new approach to global finance which is defined by the three ‘U’s—it is user-centric, unified, and universal—that it is keeping the user at the centre and it has to be universal, that is it has to cut through asset classes of all types," Infosys co-founder Nandan Nilekani said at one of the GFF sessions on how digital innovations were transforming financial services.

“The Finternet combines the best of the regulated world with the best that tokenisation technology can offer us. It uses the basic construct of tokens and then enables universal interoperability and composability," Nilekani said.

India’s GIFT City is developing the country’s first regulated platform for real estate and infrastructure assets tokenisation. Nilekani emphasised the need to amalgamate asset classifications, such as registered loan and registered financial products.

First Published: Sep 02, 2024, 10:30

Subscribe Now