IPOs and deal activity to be robust in 2024: Kotak Investment Banking

The size of public listings likely to double, corporates more optimistic of raising capital

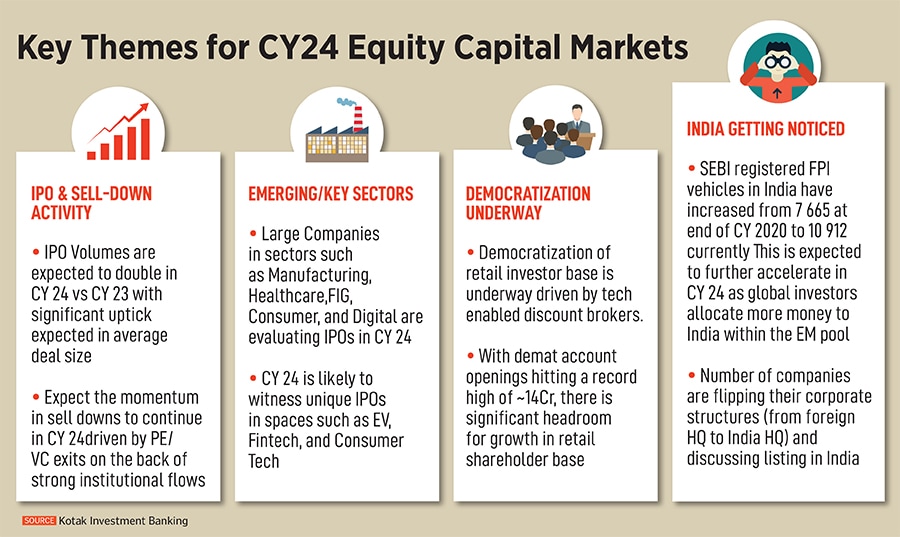

The Kotak Investment Banking leadership team is confident that India will see more robust trends in public listing activity, raising of capital and also mergers and acquisition activity in 2024.

For 2023, Bloomberg data shows that total advisory activity for India fell 57 percent to $79 billion in comparison to $185 billion struck in 2022. Global M&A trends also showed a downswing, with annual value down to $2.7 trillion—a near 10-year-low, based on data that Bloomberg has reported.

Geopolitical tensions amid three wars, still high interest rates across various economies and the sustained funding winter had all weakened the investment climate for startups and companies seeking to raise fresh capital. The high cost of financing and sponsors preferring exits via capital market routes had also impacted deal activity.

But as central banks signal a lowering of rates in 2024, investment sentiment in the New Year has started to improve.

“Corporates are finding this an exciting time. They want to undertake raising of capital where projects are good. They realise there are various options…they could look to go for private capital, or wherever relevant could do REITs or InVITs or even a QIP ," says S Ramesh, managing director and CEO of Kotak Investment banking. The advantage for corporates here is that leverage levels are “very modest", he added.

One of the other chances being witnessed in the corporate landscape is that financial sponsors are becoming quasi-investors, says Pankaj Kalra, managing director-Institutional coverage, at Kotak Investment Banking. Promoter families are now willing to cede control for value creation, and strategic decisions are being driven by financial prudence and business needs, not emotional ties, the team said in a presentation made on Tuesday.

Kotak Investment Banking, in ECM, has dominated both primary and secondary markets in 2023. The league table, based on Bloomberg data, shows that Kotak Investment Banking is ranked No. 1 in volume terms ($313 billion), ahead of rivals JP Morgan, BofA and IIFL Finance. In M&A league tables, Kotak Investment Banking was placed fourth in value terms for deals, behind Goldman Sachs, BofA and Morgan Stanley.

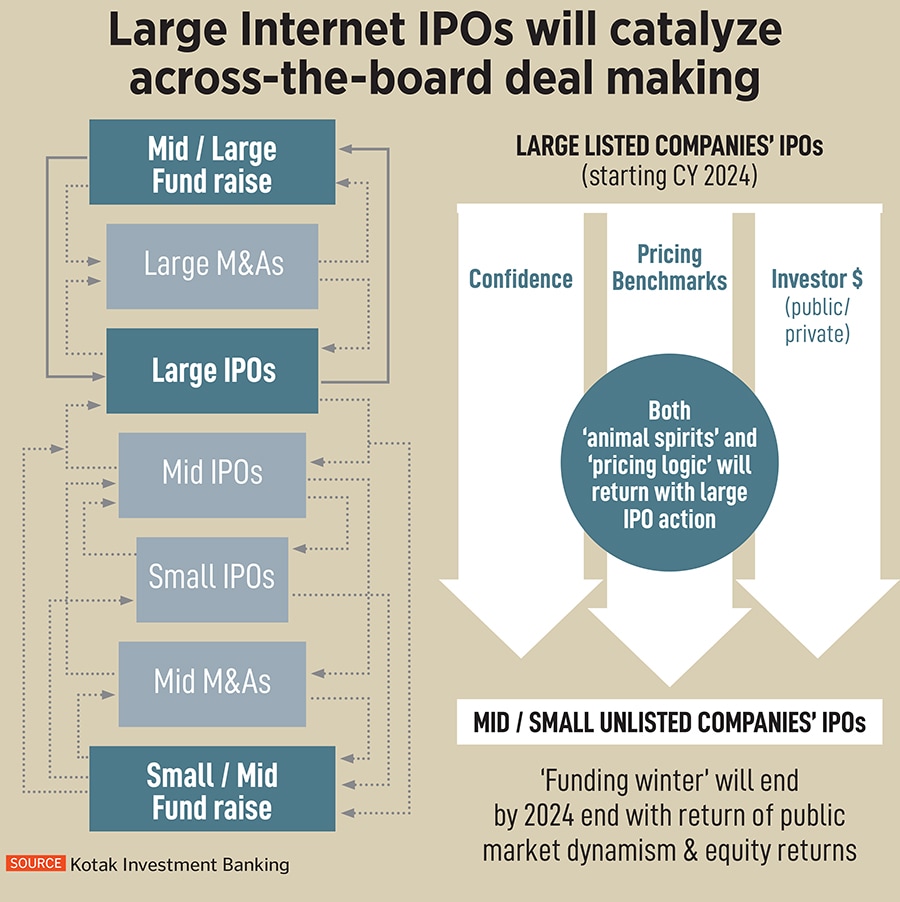

V Jayasankar, managing director and member of the board, Kotak Investment Banking, is confident that IPO volumes (size) are expected to double in 2024, with a significant uptick expected in average deal size. This trend will be driven by large IPOs. He also said that, unlike in previous years, the IPO markets are evolving beyond the traditional BFSI sector, diversifying into emerging areas such as electric vehicles, fintech, and consumer technology, showcasing a broader spectrum of investment opportunities.

Various companies such as Ola Electric, First Cry, Byju subsidiary Aakash and Mobikwik are amongst those planning for a public listing soon.

“The market should see a mix of issuers—NATCs (new-age technology companies) as well as from the traditional sectors of the economy. The positive market sentiment towards issuers with good fundamentals, as demonstrated by the last round of listings this year, is expected to gather momentum and carry on to 2024," Abhimanyu Bhattacharya, partner, Khaitan & Co had told Forbes India earlier.

First Published: Jan 10, 2024, 10:51

Subscribe Now