Reliance Industries, top banks dominate India ranking in Forbes Global 2000 larg

LIC notable newcomer, several banks and IT firms in 'Hall of Fame' companies

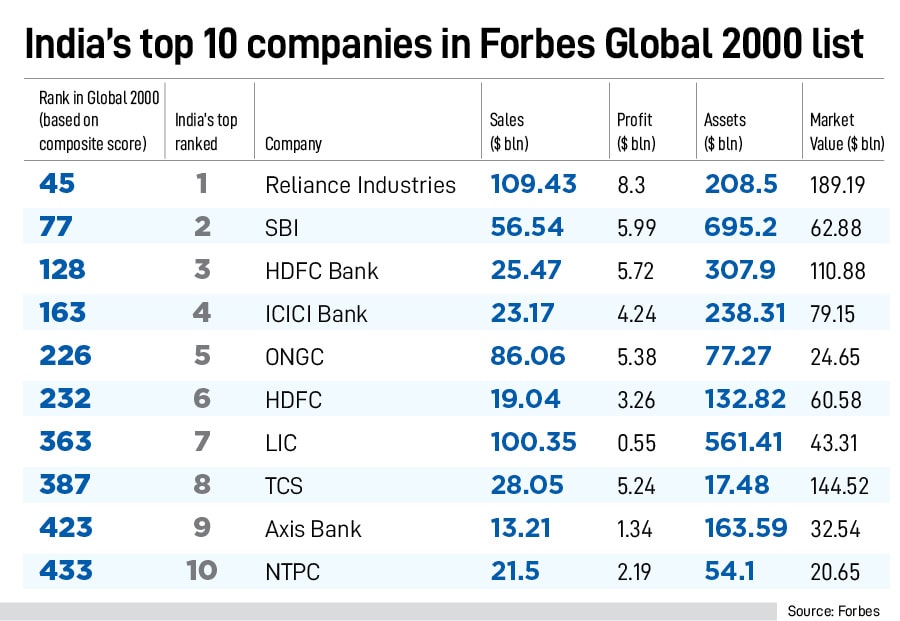

Reliance Industries drew top rank (45th) for an Indian company in the Forbes 20th annual edition of the Global 2000 list of the world’s largest publicly listed companies. It has climbed eight spots from the 2022 list, followed by State Bank of India (SBI), which jumped 28 spots from its 2022 list rank.

US’ largest bank JP Morgan, with assets of $3.74 trillion, took top position in the Global 2000 list, led by improved revenue growth and deposits. The ranking of all companies was based on four metrics: Sales, profits, assets and market value (see methodology below).

The US had 611 companies on the ranking and China second with 346 companies. In all, 55 Indian companies feature on the list, which includes 17 from the BFSI space, 10 in the manufacturing (metals and automobile) space and five from the technology space.

Reliance Industries, which has a presence in petrochemicals, retail and telecom, has started the process to unlock shareholder value. Chairman Mukesh Ambani, with a $90.4 billion net worth, is ranked 13 on the 2023 Forbes list of world billionaires (real time). Since the pandemic in March 2020, Reliance has started work on a new energy business, strengthened retail operations and broadened Jio’s subscriber base with the launch of 5G telecom services.

Disclaimer: Network18, the publisher of Forbes India, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

The second highest Indian ranked firm, SBI, India’s largest lender, continues to build on to its position. It had reported stellar growth in the March-ended quarter, led by improved interest income and margins growth, which led to an 83 percent jump in net profit for the quarter.

The India subset in the Global 2000 list shows the domination of the financial institutions, commanding half of the top ten companies. It reflects in the growth and financial performance of its most prominent banks—including HDFC Bank (ranked 3rd), ICICI Bank (4th) and Axis Bank (9th). Kotak Mahindra Bank comes in at 13th and the public sector Bank of Baroda at 16th spot. The smaller Yes Bank comes in at rank 55 and 1995 overall in the list.

India’s top banks, both private and public sector, have seen impressive growth in the past 12-18 months due to stronger balance sheets, led by capital and liquidity positions. Asset quality has considerably improved from 6-7 years ago. Despite a high interest rate regime in much of 2022, most of the banks have turned aggressive lenders, particularly in the mortgage and personal loans space.

The Forbes Global 2000 list highlights the country’s largest insurer LIC—which got listed in 2022—as a “notable newcomer" due to its mega IPO.

Some of the India’s top 10 in the Global 2000 list also feature in the Forbes “Hall of Fame" companies—648 in all—which have been on each of the annual lists for all 21 years. These include Reliance Industries, SBI, ICICI Bank, ONGC and housing finance giant HDFC (which is to be merged with HDFC Bank). The other Indian companies in the Hall of Fame include Indian Oil, Bank of Baroda, Infosys, ITC, Wipro, BPCL, PNB and Bank of India.

The comparison of the 2003 and 2023 Forbes Global 2000 lists also indicates that bigger companies have not necessarily meant better returns for investors. Giants such as Citigroup, General Electric, AIG, BP and Fannie Mae have all lost value in the two decades.

| Rank in Forbes Global 2000 | India Rank | Company |

|---|---|---|

| 45 | 1 | Reliance Industries |

| 77 | 2 | SBI |

| 128 | 3 | HDFC Bank |

| 163 | 4 | ICICI Bank |

| 226 | 5 | ONGC |

| 232 | 6 | HDFC |

| 363 | 7 | LIC |

| 387 | 8 | TCS |

| 423 | 9 | Axis Bank |

| 433 | 10 | NTPC |

Methodology: Forbes created four separate lists of the 2000 biggest companies in each of the metrics: sales, profits, assets, and market value, each having a minimum cutoff value in order for a company to qualify. A company needed to qualify for at least one of the lists to be eligible for the final ranking. It then got a separate score for each metric based on where in ranks on the metric’s 2000 list. The scores for all four metrics were added up to create a composite score for each company based on their rankings for sales, profits, assets and market value. The highest composite score gets the highest rank. The Forbes market value calculation was as of May 5, 2023, closing prices and includes all common shares outstanding."¯

First Published: Jun 14, 2023, 14:40

Subscribe Now