How Mukesh Ambani is aiming to strengthen his businesses for the next decade—fro

RIL chairman's Reliance Industries would be worth more individually than the sum of its parts. Here's why

A board meeting scheduled for May 2 promises to be the start of the value unlocking process for Reliance Industries [Disclaimer: Reliance Industries is the owner of the Network18 group, which publishes Forbes India]. Shareholders of India’s largest company, which has a presence in industries as diverse as petrochemicals, retail and telecom, will each receive shares in its financial services unit—Jio Financial Services.

User data—what consumers search for, their demographic profile as well as their likes as dislikes—are available to India’s largest telecom company with 426 million users. If it can use that data to underwrite credit for consumers, it has a winner. Jio Financial is in a unique position.

Loans to India’s middle class have grown at three percent in the last year. Compare that with credit to industry that has grown at a mere seven percent and it becomes clear why the company is keen to spin this off an independent entity and list it separately on the bourses. A successful listing could result in telecom and retail being eventually listed separately.

An analysis by Jefferies, a brokerage, shows that loans to India’s consuming class present a large market opportunity. Home loans account for about ₹25,00,000 crore, auto loans for ₹471,400 crore, consumer durable loans for ₹37,000 crore, and microfinance for ₹280,000 crore. And there is the rapidly growing personal loan segment at ₹79,000 crore. These all present a large whitespace for the company to tap into. Jeffries also points out that a key advantage of the business would be their access to low-cost capital due to the high credit rating to Reliance Industries.

The step also marks an important milestone in Chairman Mukesh Ambani’s aim to cement his position in the world’s list of billionaires. At $83.4 billion, Ambani is rank 9 on the 2023 Forbes list of world billionaires. Since the pandemic in March 2020, the second-generation entrepreneur has started work on a new energy business, strengthened his retail operations with the acquisition of Metro Cash and Carry, and broadened Jio’s subscriber base with the launch of 5G services.

As he sets out to independently grow his businesses, Ambani finds himself occupying the largest retailer spot by revenue. In the last year, store count is up 52 percent to 17,225 stores while revenues are up 17 percent to ₹67,000 crore and profit up six percent to ₹2,400 crore.

Also read: Isha Ambani: Her father"s daughter

Reliance Retail has adopted a multi-format approach. There is Ajio.com and JioMart that make up its online offering. Digital plus new commerce accounts for 18 percent of sales, according to CLSA, a brokerage. Reliance Trends is its cut price fashion format. There is the soon-to-be-launched Azorte to compete against the likes of Mango and Zara, as well as Reliance Brands that houses global names like Burberry, Armani Exchange, Canali and Jimmy Choo, among others. Add to that its private label business with brands like Campa Cola and Independence and the growth drivers for the next decade are in place. “Reliance has been clear about dominating the landscape in any sector it has entered in the last 30 years, whether it is petrochemicals, telecom or retail," says Devangshu Dutta, founder and CEO of Third Eyesight, a retail consultancy. He believes the company is getting into many sectors or formats to capture a larger share of the consumer wallet.

Add to this the synergies that could play out with Jio Financial Services. The business starts with a net worth of ₹1,07,200 crore, giving its balance sheet the strength to leverage and make loans. Even a conservative gearing of five times net worth would make its loan capacity ₹6,00,000 crore—or twice the size of Bajaj Finance—today.

In the new energy business, the company is working on plans to commence production at its new gigafactory in Jamnagar. The company is yet to share updates on progress on this front.

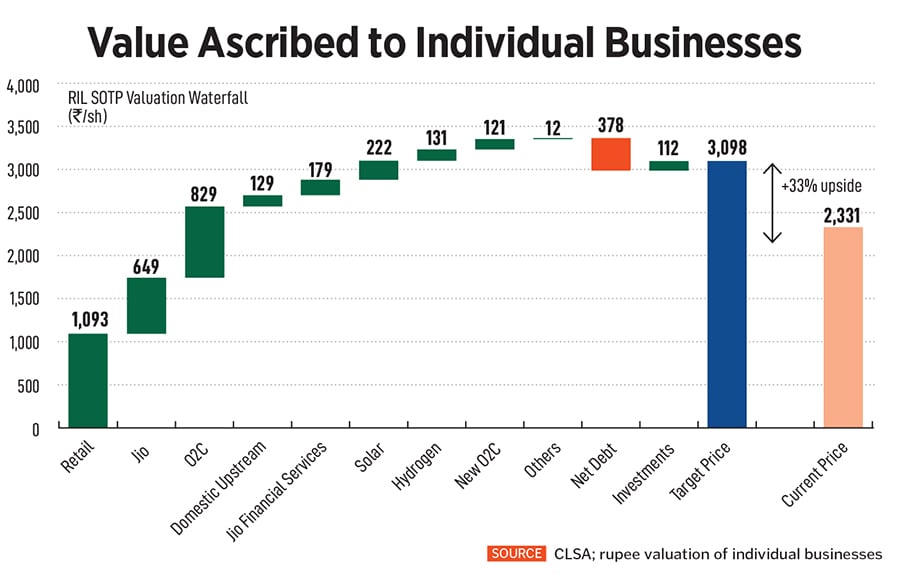

These developments have prompted upgrades by brokerages who believe Reliance Industries offers a favourable risk reward as the downside is capped on account of strong profit growth. In a recent report, CLSA termed Reliance Industries a ‘bargain buy’. In the last 12 months, sales were up 36 percent to ₹2,17,164 crore, while profits were up 16 percent to ₹70,782 crore. Still, the stock price is down eight percent to ₹2,346 per share, and its market capitalisation stands at ₹15,87,500 crore, making it the most valuable company in India.

They point to key monitorables being the rollout of its green energy ventures as well as the execution in its 5G rollout. For now, the company has a comfortable position with regard to leverage. In the quarter ended September 2022, Reliance Industries had reserves of ₹7,83,283 crore and borrowings of ₹3,16,030 crore, leaving it with scope to borrow if new business opportunities come its way. Ambani usually uses the Reliance AGM to announce new plans. Expect the next meeting in a few months to possibly come up with some.

(With inputs from Varsha Meghani)

First Published: Apr 24, 2023, 12:13

Subscribe Now