Yogesh Kothari: A chemist at heart built Alkyl Amines with worldwide competitive

Yogesh Kothari's Alkyl Amines is a reflection of his passion for chemistry

In 1979, Yogesh Kothari founded his own startup. The term startup wasn’t in vogue then, but in effect that’s what he did.

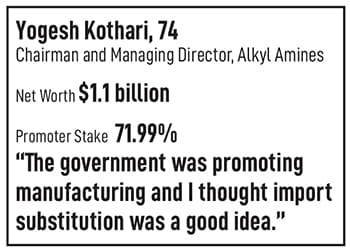

A chemical engineer—Kothari had worked for some time with elder brother Hemendra Kothari of DSP—he knew his heart always lay in a venture that made use of his skills as a chemist. “In those days, the government was promoting manufacturing, and I thought import substitution would be a good idea," says Kothari, the 74-year-old chairman and managing director of Alkyl Amines.

Back in 1979, Kothari set about identifying a gap in the market—ethyl alcohol was easily available and so his company would operate in that space. He knocked on doors to raise risk capital and IPO-ed even before his plant was up and running. Son Suneet Kothari, who is executive director, says the listing raised money only on the strength of its business plan. It had no operations and was still oversubscribed five times.

Unlike more recent listings, this one didn’t disappoint. Over the last four decades, the company has become a reputable manufacturer of aliphatic amines. These are intermediates used by a variety of industries, from pharma to agriculture and rubber. The chemist in Kothari also made sure the company has a strong research and development backbone, which allows it to develop new products.

As things stand today, Alkyl Amines is a ₹12,000 crore company with a top line of ₹1,700 crore and profitability of ₹225 crore in the 12 months ended December 2022. The company saw an operating boost during the pandemic. Operating margins that had shot up during the pandemic (the company sells about half its production to the pharma industry) to 30 percent have now settled down to 20 percent and growth is now led by volumes. Still, the market disappointed by the flat growth in profitability has derated the stock, and it is down 24 percent in the last 12 months.

As things stand today, Alkyl Amines is a ₹12,000 crore company with a top line of ₹1,700 crore and profitability of ₹225 crore in the 12 months ended December 2022. The company saw an operating boost during the pandemic. Operating margins that had shot up during the pandemic (the company sells about half its production to the pharma industry) to 30 percent have now settled down to 20 percent and growth is now led by volumes. Still, the market disappointed by the flat growth in profitability has derated the stock, and it is down 24 percent in the last 12 months.

Over the last decade, sales have compounded by 18 percent a year and profit by 29 percent, resulting in the stock compounding at 55 percent. As a result, Kothari, who owns 71.99 percent of the company, has seen wealth at $1.1 billion. The market still values the company at 54 times earnings, pointing to its belief that the business still has significant growth ahead.

Employee number one at Alkyl Amines Kirat Patel describes the early 1980s as a different era. Rashtriya Chemicals and Fertilizers (RCF) was the only manufacturer of ethyl amine, and Kothari realised that the raw material, ethyl alcohol, was easily available. So, he went about planning his business.

Initial funding was raised by the promoters with help from SICOM and IFC, which had a risk capital division to fund entrepreneurs. Add to that an IPO that raised ₹60 lakh and the business was ready to start operations in 1982.

Ethyl alcohol was reasonably priced and since no one other than RCF was making ethyl amine, a decision was made to set up operations with ethyl alcohol as the main raw material at a plant in Patalganga near Mumbai.

Admittedly the initial few years were tough, and their main competitor BASF gave them a difficult time. But Kothari persevered. There were regular trips to Delhi for a plethora of permissions as well as to ask for import duties to be raised. At the factory they set about getting manufacturing processes right. A chemist at heart, Kothari in 1986 set up an R&D operation (a larger one was set up in 2001 at Pune). By then his ‘startup’ had reached ₹10 crore in sales and about a crore in profit.

Over the years the company has used its strong R&D set up to introduce new products. Aliphatic amines are derivatives of ammonia, and their products are used in the pharma industry, agro-chemicals, water treatment and rubber chemicals. The company offers customers 112 different amine derivatives, according to a product brochure.

New products are formulated either on the basis of customer feedback or market demand. Kothari is clear that they will only make a product where they see a long demand runway. Take the case of acetonitrile, which is the company’s biggest revenue earner. The company is the world’s second largest producer through the synthetic route and has benefited due to the surge in prices for the product in 2020-21. Equally, Alkyl Amines shies away from short-term, cyclical uptick opportunities.

The last half decade has also seen the market re-rate the specialty chemical story. In the manufacturing value chain, Alkyl Amines makes intermediates that come after petrochemicals, but before, say, small-batch performance or fine chemicals.

A hallmark of Alkyl Amines has been its high standards of corporate governance. Sanjiv Shah, a value investor, recalls discovering the company in 2004-05. At that time, he had gone for the annual general meeting of a subsidiary, Diamines and Chemicals, in Vadodara. He was impressed with Alkyl Amines’ board members, including Hemendra Kothari, who by then was a doyen in broking and investment banking circles. Alkyl was a ₹40 crore market cap company when he started accumulating stock.

Over the years, Alkyl Amines has always made it a point to get a diversity of views on its board. Kothari says it helps in challenging assumptions, including the possibility that a business must always look at the possible downside instead of focusing on the upside. Shah, the investor, likes the fact that the promoters are highly transparent. “You won’t even find ₹1 crore on the balance sheet that is unaccounted for," he says. Capacity expansion like the ₹200 crore investment that the company just completed is done through internal accruals and there is always a razor-sharp focus on return on capital employed.

The last five years have seen the company benefit from operating leveraging playing out. “At some point, your volume becomes large enough and the overheads grow slower than the topline… you don’t have to worry about the overheads," says Patel. “That is when profit goes to the bottomline."

Add to it the fact that the pandemic saw prices of acetonitrile rise rapidly. It is used as an ingredient in the pharma industry, which makes up half of Alkyl’s sales. As a result, margins that were at 13 to 15 percent in the last decade moved up to 25 to 28 percent. Clearly, these were super normal profits with most of the growth coming from price increases. Going forward, Patel says most of the growth would be volume-led.

According to industry experts, when a country’s per capital income comes into the $2,000-3,000 per person range, the speciality chemical business sees growth faster than that of GDP. Over the next five years, he believes it would be fair to pencil in a doubling of topline or a growth of 10 to 15 percent a year. “Volume growth would continue, while the product range becomes more sophisticated," he says, and foresees them being used in new industries like construction and water treatment.

As the business enters its fifth decade, Kothari, who now spends his time playing poker and travelling, has a lot to be proud of. He’s kept the family flag flying high. He also remains active at his alma mater UDCT.

Unlike the startups of today, Kothari has set up a business that has a worldwide competitive edge. Also, unlike companies of today, he was very capital efficient and shunned the use of excessive leverage to gain market share. He’s also put in place an able second line of command to ensure the company stays on top of its game and grows ahead of the economy. In a world starved for growth that is all investors ask for.

First Published: Apr 20, 2023, 12:53

Subscribe Now