Cover story: Behind Britannia's record growth during lockdown

Britannia's biscuits-heavy portfolio steered the company in the lockdown phase and after, even as it stays the course to becoming a total foods company tough

Image: Nishant Ratnakar for Forbes India [br]Varun Berry came up with a cracker of an idea. After being dunked into a strict 21-day lockdown in the third week of March, and subsequent extensions till end-May, for the foods company that derives roughly 95 percent of its sales from biscuits, bakery and dairy—essential items of consumption—the road ahead was clear: A quick restart. By mid-April, Britannia was utilising 65 percent of its capacity, and Berry, its managing director (MD), had a plan: To follow “the 80:20 rule”.

Image: Nishant Ratnakar for Forbes India [br]Varun Berry came up with a cracker of an idea. After being dunked into a strict 21-day lockdown in the third week of March, and subsequent extensions till end-May, for the foods company that derives roughly 95 percent of its sales from biscuits, bakery and dairy—essential items of consumption—the road ahead was clear: A quick restart. By mid-April, Britannia was utilising 65 percent of its capacity, and Berry, its managing director (MD), had a plan: To follow “the 80:20 rule”.

The rule was simple: Twenty percent of the brands and SKUs (stock keeping units), which contribute to 80 percent of Britannia’s revenue, were put on priority list. For the biggest premium biscuit maker, it was not tough to make the shortlist: Good Day and cream variants, Milk Bikis, Marie Gold, and Nutrichoice. “These are all high throughput varieties,” underlines Berry. The 80:20 formula gave the biscuit maker an instant advantage on four fronts: It streamlined productivity gave more flexibility in manufacturing capacities resulted in ensuring efficiencies in factories and distance travelled by the products and brought laser-sharp focus in execution.

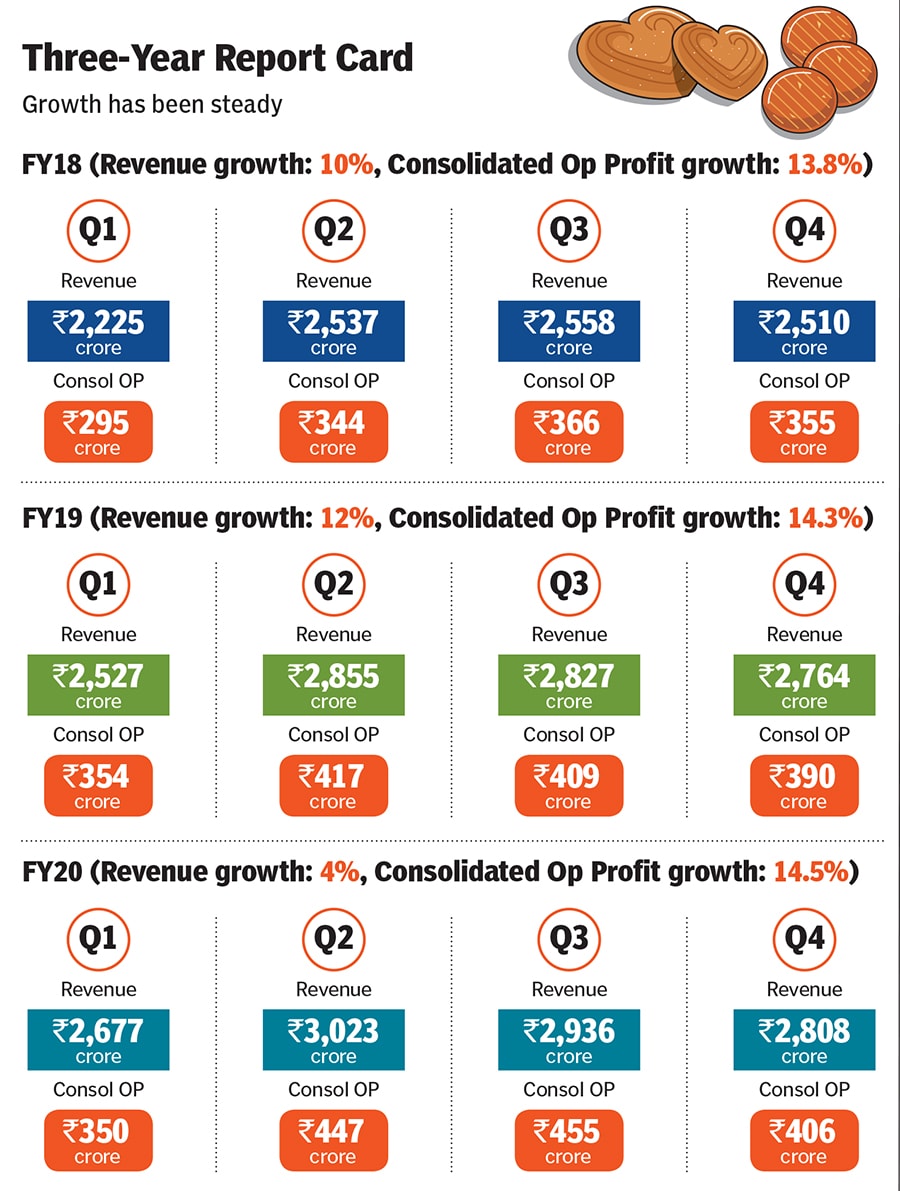

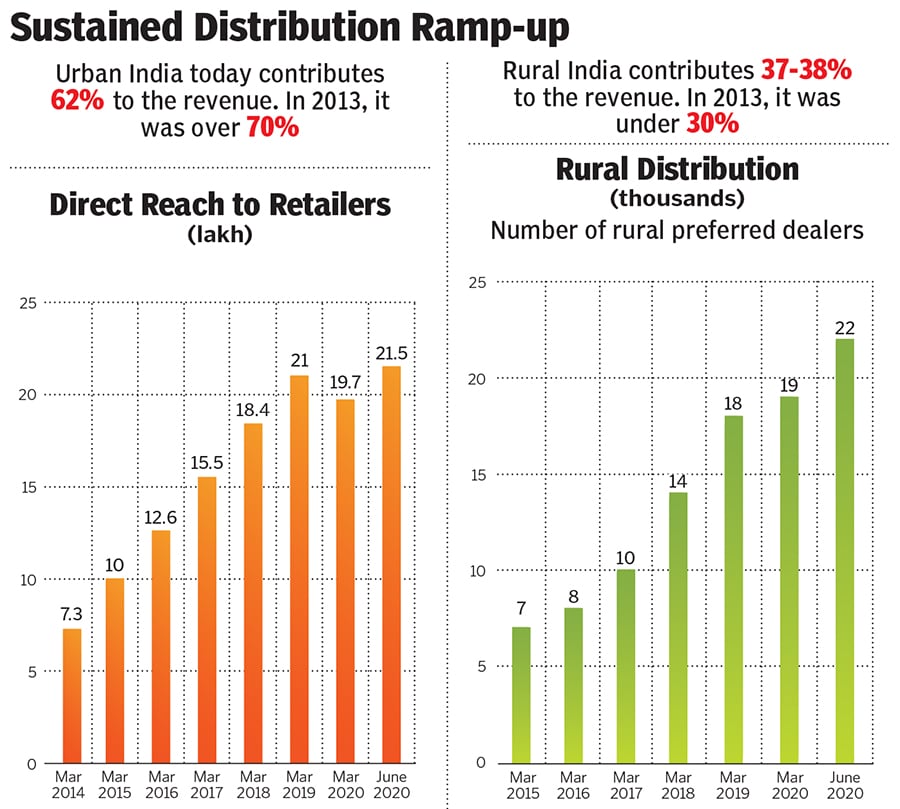

The results showed, and how. In the April-June quarter, Britannia posted revenue of ₹3,384 crore, a spike of 26 percent over a year ago. Operating profit surged to ₹669 crore, a jump of 91 percent and profit after tax (PAT) zoomed by 118 percent to ₹546 crore. Berry attributes the success to his team. “It was a big challenge, but they did a fantastic job and got us ahead of the pack,” he says, adding that bread and rusk—which come under the adjacent business of Britannia—grew faster than biscuits. “Within dairy, cheese was fantastic during this period,” he says. Rolling out a new campaign on cheese with Bollywood actor Saif Ali Khan, Berry lets on, gave the brand a good momentum. “That’s the story of the first quarter,” says the FMCG veteran, who joined Britannia in 2013 as chief operating officer.The story, though, can’t be explained only using 80:20. A lot happened behind the scenes to make it a cracking quarter. Berry decodes. The biggest part was identifying areas where the rebound would be faster. Obviously, it had to be rural, which was not as badly affected by Covid as urban during the first quarter. “We started to go after rural and expanded reach,” stresses Berry. From 19,000 rural preferred dealers (RPDs) till March, the number went up to 22,000 by June. The aggressive rural ramp-up is not surprising.

From just 7,000 RPDs in March 2015, just a year into his stint as MD, Berry took the figure to 19,000 in March 2020. Along with going deeper into the hinterland, Berry deployed a slew of other ammunition: Direct telesales, SMS blasts, distributor points’ pickup, retailer survey and digital campaigns. Expanding its footprint in urban India, which gives 62 percent of revenue to Britannia, was equally impressive. Direct reach to retailers was increased from 19.7 lakh in March to 21.5 lakh in June.

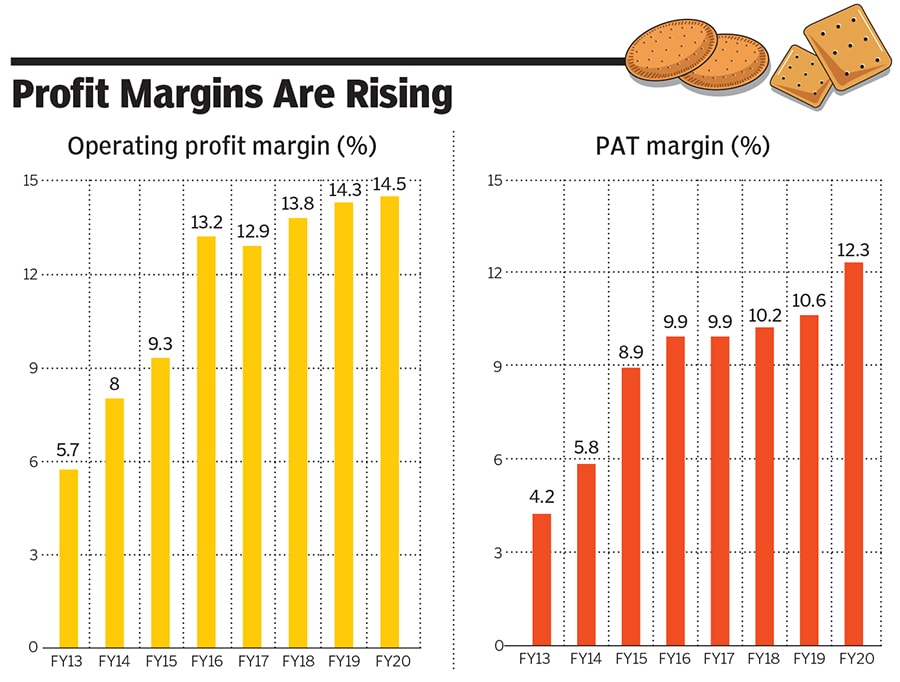

Starting factories early, even before the unlock phase began, gave Britannia a headstart. It ramped up volumes, improved productivity, and added new capacities through contract packers. In terms of distribution, it started direct sales from factories to cut the transit time. Optimising marketing efforts, Berry explains, was made possible because the company didn’t have enough products to put into the market. The company, he adds, maintained its focus on five strategic planks: Distribution, marketing, innovation, cost focus and developing adjacent businesses. But what’s most striking about Britannia under Berry is the way he has improved profitability. While operating profit margins have jumped from 5.7 percent in fiscal 2013 to 14.5 percent in fiscal 2020, PAT margins have leapfrogged from 4.2 percent to 12.3 percent during the same period.FMCG analysts are not surprised by the first quarter numbers. “Though Vinita Bali did a good job, Berry has taken Britannia to the next level,” reckons Abneesh Roy, executive vice president at Edelweiss Securities. Take, for instance, distribution. For the same outlet, now there are two salespeople who are servicing. This, underlines Roy who has been tracking Britannia for over a decade, brings in better focus, deeper connection with the shopkeeper, and a larger shelf space within the shops. The second front where Berry streamlined operations was cutting the red-tape across functions. “Earlier, it was a football match. The ball used to move from one division to another but the goal was never scored,” contends Roy.

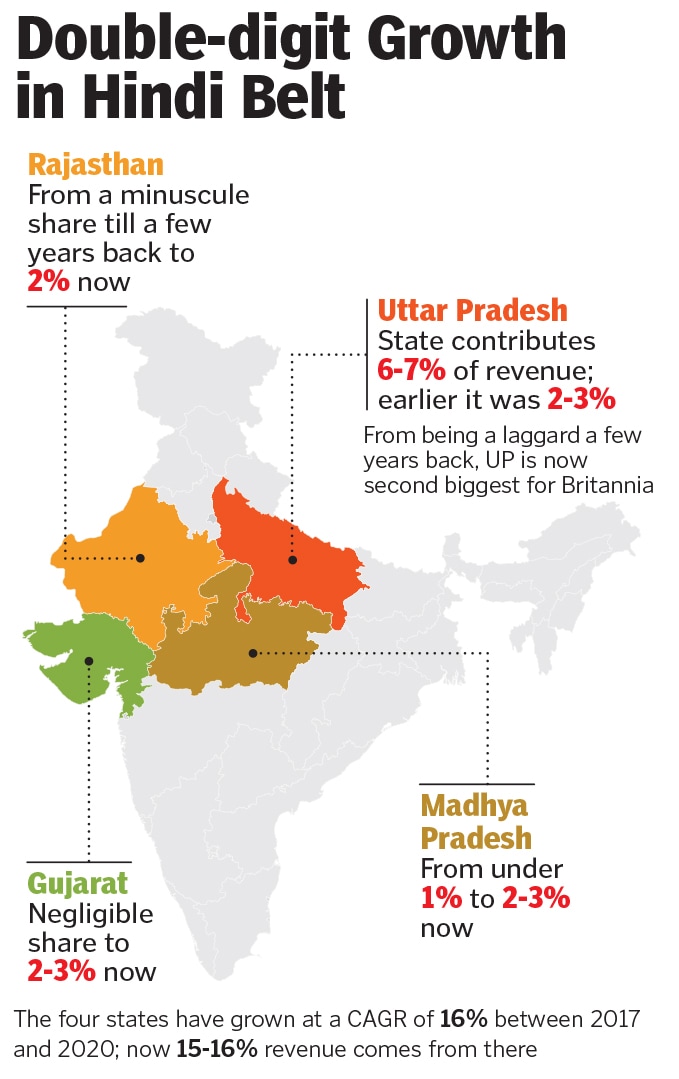

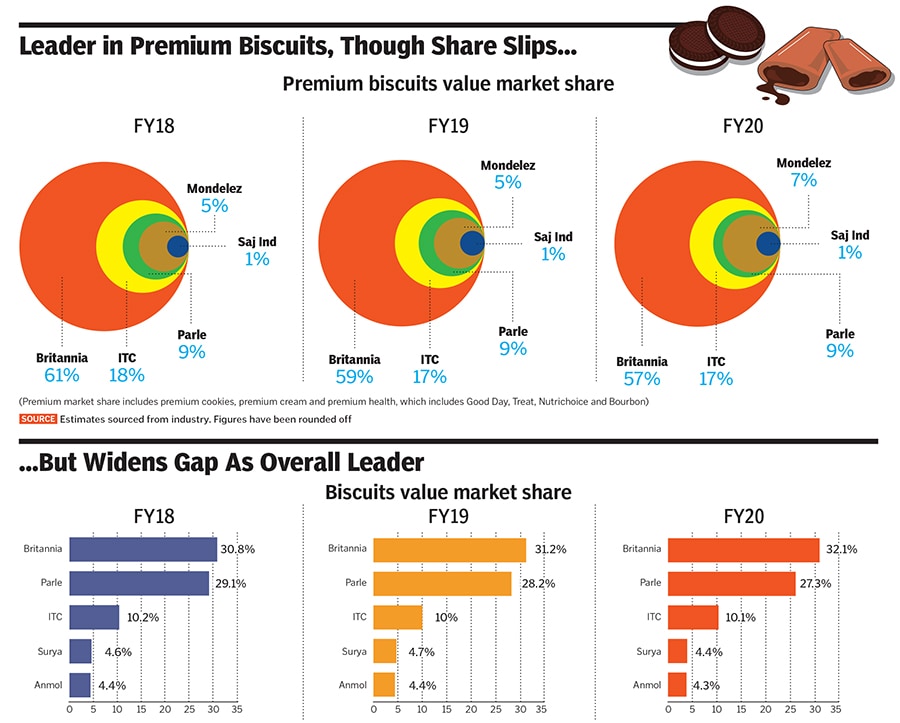

An aggressive Britannia taking on rival Parle head-on in the Hindi heartland is another area where Berry scored high. “He knew Parle was extremely strong in rural areas,” says Roy. The strategy, therefore, was to go deeper into the hinterland. The move has worked. The four hitherto weak Hindi-belt states for Britannia—Uttar Pradesh (UP), Rajasthan, Gujarat, and Madhya Pradesh—have grown at a CAGR of 16 percent between 2017 and March 2020. In fact, UP has become the second biggest state for the biscuit maker. Robust performance in the Hindi belt has resulted in Britannia increasing its overall value market share over its closest rival in the last two years. While in FY18, Britannia had a 30.8 percent share, Parle was close on its heels with 29.1 percent, according to the industry executives quoting Nielsen market numbers. In FY20, the gap has increased to five percentage points (see box). Britannia, underlines Roy, is a transformed company under Berry. Berry admits that the transformation journey was not easy. “It happened on multiple fronts,” he recalls. The first, and the biggest task, was identifying the core issue. He outlines what was missing from Britannia’s armoury. “We had lost the innovation edge,” he recounts. Alhough 25-30 years ago Britannia used to be at the front-end of innovations—products, advertising, marketing—over the years complacency set in. “We had become a little run of the mill,” says Berry. The company had a big biscuit business and the strategy was to keep pushing it. As the segment was expanding, there was a tailwind and everybody was growing. “We were happy... we stopped to look outside and we were stuck in our track,” he says. The stagnation helped rivals, who came up with differentiated products and aggression, and stole a march. ITC came up with the Dark Fantasy brand, Mondelez rolled out Oreo, and Parle came up with Hide & Seek. “We lost the innovation edge, and the crown,” he says.

Berry admits that the transformation journey was not easy. “It happened on multiple fronts,” he recalls. The first, and the biggest task, was identifying the core issue. He outlines what was missing from Britannia’s armoury. “We had lost the innovation edge,” he recounts. Alhough 25-30 years ago Britannia used to be at the front-end of innovations—products, advertising, marketing—over the years complacency set in. “We had become a little run of the mill,” says Berry. The company had a big biscuit business and the strategy was to keep pushing it. As the segment was expanding, there was a tailwind and everybody was growing. “We were happy... we stopped to look outside and we were stuck in our track,” he says. The stagnation helped rivals, who came up with differentiated products and aggression, and stole a march. ITC came up with the Dark Fantasy brand, Mondelez rolled out Oreo, and Parle came up with Hide & Seek. “We lost the innovation edge, and the crown,” he says. While ITC and Mondelez declined to comment, a Parle spokesperson didn’t reply to a request sent by Forbes India.

While ITC and Mondelez declined to comment, a Parle spokesperson didn’t reply to a request sent by Forbes India.

Meanwhile, Berry focussed on the basics. He invested in the R&D centre, doubled down on premium products and cakes, pushed direct reach and distribution, tried to understand the needs of the youth, and started venturing into new categories—rusks, croissants, milkshakes, salty snacks and wafers. Over the last two years, the contribution of new products to revenue was between 4 percent and 6.5 percent. The idea was to transform the predominantly biscuits company into an FMCG player. “Britannia has a vision of becoming a global total foods company,” says N Venkataraman, CFO at Britannia. The company entered into four new categories during 2019-20. These, along with others in the pipeline, will become the growth engines for the company in the coming years, he adds.

Two years into the journey, 80 percent of revenue still comes from biscuits. Berry, conceding that he"d like to see a better balance, explains how new categories might change the game. Take, for instance, wafers. In just nine months, Britannia has become the second biggest in the category which has been consistently dominated by small players who worked on a modus operandi of jacking up price, offering huge discounts to retailers and pushing the product. After tasting success by creating pull for the product—and ruing that it"s a late entrant into the category—Berry believes that a reasonable size business could be built with wafers. He has now pressed on the pedal by investing in the category and exploring multiple options in wafers: Layers, piped and more.

Two years into the journey, 80 percent of revenue still comes from biscuits. Berry, conceding that he"d like to see a better balance, explains how new categories might change the game. Take, for instance, wafers. In just nine months, Britannia has become the second biggest in the category which has been consistently dominated by small players who worked on a modus operandi of jacking up price, offering huge discounts to retailers and pushing the product. After tasting success by creating pull for the product—and ruing that it"s a late entrant into the category—Berry believes that a reasonable size business could be built with wafers. He has now pressed on the pedal by investing in the category and exploring multiple options in wafers: Layers, piped and more. Another category Berry is bullish on is milkshakes, and associated products. The headroom for growth is massive. While milkshakes as a market is at an estimated ₹2,200 crore, if one adds lassi and milk-based drinks to it, the size balloons to ₹10,000 crore. Britannia has launched milkshake and lassi under the Winkin Cow brand. “We have seen good traction over the last six months,” says Berry. The plan is to carve out niches in this massive category. “Dairy is a big priority for us and we are betting big on it,” he says, adding that the company is building back-end and investing in capabilities to manufacture dairy products on its own, along with its contract packers.

Another category Berry is bullish on is milkshakes, and associated products. The headroom for growth is massive. While milkshakes as a market is at an estimated ₹2,200 crore, if one adds lassi and milk-based drinks to it, the size balloons to ₹10,000 crore. Britannia has launched milkshake and lassi under the Winkin Cow brand. “We have seen good traction over the last six months,” says Berry. The plan is to carve out niches in this massive category. “Dairy is a big priority for us and we are betting big on it,” he says, adding that the company is building back-end and investing in capabilities to manufacture dairy products on its own, along with its contract packers.

The total foods transformation, reckon analysts, won’t be easy. “It won’t take some time,” says Roy of Edelweiss Securities. “It will take a hell lot of time,” he adds, alluding to 80 percent of revenue from biscuits. In FMCG, he explains, it takes years to build a sizeable presence in spite of good distribution reach. Reason: Presence of deeply entrenched players in their respective categories. In salty snacks, Britannia has to contend not only with branded majors such as ITC and PepsiCo, but also deal with formidable regional players such as Balaji. In dairy, the company is just getting into the journey of making its own product, which will help in increasing market share. “It will take time,” he says. The low-hanging fruits—cake, rusk and bread—have seen heady gains, but they are small in size, and individually don’t add much. “One shouldn’t expect Britannia to gain much in adjacent businesses and new categories in just two years,” Roy stresses. “It’s a work in progress.”

Brand strategists question the move to transform into a foods company. “The category of biscuits is huge. There is no need to become a foods company,” says Harish Bijoor, who runs an eponymous consulting firm. If one puts one head deeper into biscuits, he lets on, one will see how humungous the category is. While the branded biscuit market is an estimated ₹37,000 crore, there is a massive opportunity to eat into the large unorganised market. Britannia’s singular focus on premium cookies exposes its underbelly: Lack of gusto in the mass glucose category. Britannia, he stresses, should stick to the knitting. “Just because you have a savvy distribution system in place does not mean that you must put all kinds of things into it to carry,” he contends.

Berry is sticking to the vision and goal of transforming Britannia into a total foods company. “The dream is to keep increasing biscuits to whatever extent possible and to keep getting the icing on the cake through other categories,” he says The trick, he adds, is to ensure that biscuit growth is not hampered. Biscuits are still the fastest growing category. The contribution (of biscuits to revenue) at some stage will start to fall as the dairy and cake momentum starts to pick up, he adds.

For the time being it’s 80:20 for the maker of the 50-50 biscuit brand.

First Published: Aug 31, 2020, 10:34

Subscribe Now